Oil & Gas Markets

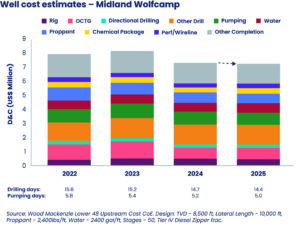

Wood Mackenzie: Lower 48 well costs set to fall by 10% in 2024, but future cost reductions will have to come from efficiency gains, not oilfield service pricing

After peaking in 2023, Lower 48 well costs are expected to decline by 10% in 2024 and 1% in 2025, according to a recent report from Wood Mackenzie.

According to the report, “2024 tight oil costs: the push and pull between efficiency and OFS rates,” lower pricing for OCTG, proppant and diesel, combined with substantial drilling and completion efficiency gains, have helped reduce E&P costs. However, additional reduction will be difficult in this environment, as oilfield equipment and services companies (OFS) seek to keep margins high.

“Both E&Ps and service providers are emphasizing significant efficiency improvements, albeit for different reasons,” said Nathan Nemeth, Principal Analyst for Wood Mackenzie. “More efficient operations are helping E&Ps drill and complete wells faster, cutting costs. At the same time, OFS firms are utilizing more efficient kit and workflows to sustain elevated prices. If E&Ps look to reduce costs more, it must come from additional efficiency improvements, as OFS pricing is unlikely to fall.”

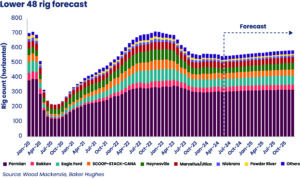

Wood Mackenzie forecasts that by the end of 2025, an additional 40 rigs will be active relative to current levels, led by gas plays and the Permian. However, faster drilling operations will mute the need for more rigs. Wood Mackenzie estimates a 5% improvement in drilling efficiency equates to approximately 28 fewer rigs needed in the market.

“With Lower 48 activity relatively flat, rig operators will look to keep utilization rates high to preserve prices and margin,” Mr Nemeth said.

Small producers exposed

According to the report, future cost trends depend on the outcome of the battle between efficiency and gradually rising unit pricing, meaning price trends will be operator-dependent based on the technology and equipment used.

For example, the deployment of “simul-frac” and the adoption of new electric pumping units have accelerated the trend of faster, cheaper and more reliable operations with less emissions. Since 2020, pumping efficiency has increased by between 30% and 100%, depending on the technology used.

“The largest producers with the scale to commit to longer-term contracts (one to three years) for new equipment and technologies will realize additional efficiency gains and keep costs lower,” Mr Nemeth said. “Smaller producers will be most exposed to inflation headwinds — arguably motivating even more M&A activity in the region.”

International M&A spend by NOCs falls to 20-year low, but trend is set to shift under current market drivers

While the mergers and acquisitions (M&A) market has been supercharged by international oil companies (IOCs), national oil companies (NOCs) have largely sat on the sidelines, according to Wood Mackenzie. Its analysis shows that international M&A spend from NOCs has collapsed from more than $30 billion per year (2009-2013) to less than $5 billion (2019-2023). The peer group’s share of global spend has fallen from nearly 50% at peak to less than 5% today.

“However, with M&A valuations attractive and NOCs’ financial ratings at all-time highs, the drivers for NOCs to fill strategic gaps through international business development have never been stronger,” said Neivan Boroujerdi, Director, Corporate Research at Wood Mackenzie.

“With (some) NOCs becoming increasingly privatized, motivations for foreign expansion have moved towards those shared by IOCs in terms of portfolio competitiveness and sustainability,” he added. “We could see several NOCs take advantage of international opportunities to expand, especially those from Asia and the Middle East.”

Middle East NOCs are growing capacity and – as a group – will be producing more in 2050 than they are today.

“Middle East NOCs are well-placed to outlast other producers, but they do have areas of relative weakness, with portfolios overwhelmingly concentrated towards either domestic oil or gas,” Mr Boroujerdi said. “Several have kickstarted internationalization efforts in search of more diversity. We have already seen Saudi Aramco and ADNOC fast-track entry into LNG and QatarEnergy look to grow via exploration.”

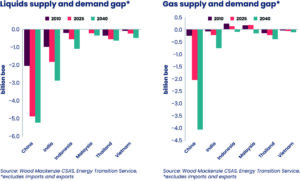

In Asia, booming populations, expanding economies and coal-to-gas switching will see national energy demand increasingly outstrip local supply. While these countries are committed to net zero in one form or another, Wood Mackenzie forecasts an aggregate oil and gas supply shortfall of 13 billion barrels of oil equivalent (boe) by 2030 – up from 9 billion boe today.

Wood Mackenzie’s Head of Upstream M&A Greig Aitken also noted that there’s still room for NOCs to acquire. “Outside of North America, where there’s been a consolidation frenzy, the upstream M&A market is uncrowded. There were only 200 transactions globally in 2023, that’s the second-fewest number of deals in the last 20 years. But there are still a number of material, high-quality opportunities available internationally.”

Energy supply chain looks to client-facing services for growth, EIC report shows

The UK-based Energy Industries Council (EIC) has released its eighth annual Survive and Thrive report, highlighting challenges faced by the global energy supply chain.

“While opportunities abound, the lack of clarity on financial incentives and regulations makes navigating these waters increasingly complex,” said Stuart Broadley, CEO of the EIC.

“What our members are telling us is that the energy supply chain needs to be listened to by policymakers,” Mr Broadley said. “Clear and consistent policies, financial incentives and an understanding of the entire and largely integrated supply chain’s needs are crucial. Policymakers should de-silo energy policy, ensure an overarching target with contributions from all stakeholders, and recognize the impact of increased taxes on operators. Upgrading capabilities to meet net-zero demands, reassessing local content regulations, and providing a clear roadmap for energy projects are essential steps to support and nurture the energy supply chain.”

For the eighth consecutive year, the report notes that the development of new export or international regions remains the least-used growth strategy, with only 7% of companies venturing into new markets. The majority focus instead on domestic or well-trodden overseas markets like North America, Europe and the Middle East. High costs and insufficient government support, such as lack of financial support and unfavorable tax environments, are major deterrents.

On the other hand, developing client-facing services and solutions has emerged as the most popular growth strategy this year, with 82% of supply chain companies now working directly with operators. This means they are increasingly sidestepping the traditional model of contracting via Tier 1 EPC contractors. This shift allows companies to forge deeper relationships with end-user clients and increases the chances of having their technology pre-specified.