Fracturing innovations target improved equipment durability, optimized proppant placement

New technologies also aim to lower maintenance costs, reduce environmental footprints even as operators seek cost-efficient production boosts

By Karen Boman, Associate Editor

The oil and gas industry’s goals of reducing nonproductive time (NPT) and increasing production of unconventional resources are driving the evolution of hydraulic fracturing technologies. Especially as operators start to hit the natural physical limits of unconventional production, the need to optimize the fracking process has grown stronger, James West, Senior Managing Director for Oil Services, Equipment and Drilling with EvercoreISI, said. The optimization process differs by play, but overall, companies are looking for better well and fracture placement, as well as different sizing and staging of frac clusters.

Efforts have also focused on improving equipment durability to handle more intense fracking operations, Mr West said. This includes advances in engine technology and transmission technology. More companies are also implementing predictive analytics in their equipment to better align maintenance schedules. The next round of technology advancement, he added, is expected to address frac pumps, which wear out the fastest due to the corrosive materials pumped through them.

“Average equipment life has gone from a cycle of seven or so years to an average of four to five years,” Mr West explained. On top of that, current pricing levels do not yet support a return on equipment above most companies’ cost of capital, primarily due to the heavy maintenance expenses.

In this article, Drilling Contractor speaks with several companies about their recent fracking technology developments, which also include innovations in proppant and diverter technologies.

Simplicity and durability

In 2018, companies are looking for a simpler, lower-cost means of creating fractures that leaves no doubt as to what well stages have been treated, Ian Bryant, President of stimulation hardware provider PackersPlus, said. The company is field-testing completion systems that will deliver high stage counts in both cemented and open hole without the need to mill out plugs or ball seats.

The company’s TREX QuickPORT IV sleeve – released commercially in January 2016 – seeks to address what Mr Bryant believes is industry’s realization that perforation clusters actually cause inefficient reservoir stimulation. In recent years, oil and gas companies had turned to multiple perforation clusters in each well stage, hoping that they would get even fluid distribution by varying the size or density of the perforations. “Although, on paper, you have 120 to 150 entry points or fractures, that really isn’t the case,” he explained. The inefficiency in perforation clusters – which creates multiple entry points in a stage to create fractures – results in perforations towards a well’s heel getting most of the treatment, he said.

Using squeeze technology – a combination of completion engineering and material science – to play within the tools’ elastic limits, the QuickPORT IV sleeve can open up multiple entry points in a wellbore with one ball, allowing for more even distribution of fluids in a wellbore. Its jets are reinforced with tungsten carbide to ensure that entry points aren’t washed out during stimulation. “If you have casing with just regular steel, perforations that initially take fluid tend to wash out during stimulation, so perforations further down the well don’t take further treatment,” Mr Bryant said.

The technology was deployed in the Permian Basin in November 2017. An operator was experiencing difficulties using wireline and coiled tubings for plug setting and perforating operations in laterals with measured depths over 20,000 ft. Beyond that length, the operator was concerned about providing sufficient weight on the drilling bit to mill out plugs, as well as getting wireline and coiled tubing to bottom to set plugs, to mill out and to clean out in longer laterals. The operator also had lost expensive perforating equipment downhole on three occasions.

By running four stages of QuickPORT IV limited-entry cement sleeves at the toe of a well – right next to plug-and-perf stages – the operator saved approximately 14 hours on location, according to PackersPlus. The sleeves also allowed the operator to cut time and cost spent to deploy and mill plugs through long lateral distances.

Lower cost, greater durability

One of the key drivers Weir Oil & Gas sees for future fracking technology developments is reducing the total equipment maintenance cost. “The big thing we see changing today is the harshness of the cycle,” Bryan Wagner, Director of Engineering and Product Management for Weir’s pressure pumping team, said. “They’re pumping more sand now and at higher pressures for longer. That takes its toll on equipment.”

At the same time, there’s been a strong push across the board to reduce cost during this downturn. “But the push was not just about paying less for equipment but really about finding more efficient ways to do the job they’ve always done,” Mr Wagner said. “The downturn forced the industry to spend a lot of time understanding how uptime and reliability of equipment and efficiency affect their bottom line and ability to weather oil price downturns.”

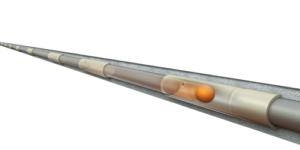

Seeking to meet this need, Weir announced at the 2017 Offshore Technology Conference (OTC) the Simplified Frac Iron System, designed to reduce the amount of iron and equipment at a fracking site. The system includes preassembled components on a modular skid design. At the end of each skid is a single connection, which reduces assembly time and the number of field technicians needed. It also features redundant 7-in. SPM isolation and directional valves, one of which includes a hydraulic actuator for safe, remote operations. By reducing the amount of pipe connections from 100 to 12, the potential for leak paths was eliminated by 88%. An internal 2017 computational fluid dynamics analysis of the Weir configuration concluded that the system could achieve approximately 70% less pipe erosion compared with other designs. This year, the company is releasing the first 7-in. plug valve and 7-in. check valve for the system. Mr Wagner said these valves are the very first fit-for-purpose 7-in. 15,000-psi frac application valves for the main line.

“It is a true 7-in. valve running traditional iron up into the frac stack. The current solution is 3- or 4-in., which means you have to have multiple lines that convert down to smaller valves in order to consolidate down to the main line,” Mr Wagner said. “The 7-in. allows you to truly consolidate down to one line. The benefit to the customer is less equipment onsite, reduced footprint, less potential leak points and reduced NPT.”

On the pressure control side of its business, Weir is designing products around the need to reduce NPT onsite and prevent potential leaks. This includes a one straight line (OSL) frac system, Russell Hamilton, Director of Engineering and Product Management, Pressure Control, said. The company introduced this technology in Canada last year and is now launching it in the US market.

The system, which consists of a vertical zipper manifold, OSL frac connection and a frac stack, reduces the number of connections required at the manifold to just one, from the three to six that are typically required. The frac connection complements the vertical zipper manifold by making the connection from zipper manifold to frac tree in one large-bore connection, reducing equipment footprint, NPT and labor costs while improving safety, Mr Hamilton said.

This year, the company plans to release several new sealing and plug valve technologies to prevent leaks, allowing for safer and longer operations, and an updated version of its legacy 2250 XL pump, along with new fluid end technology. The firm will also release an EXL swivel seal for its swivel product line, as well as proprietary elastometers for plug valve seals, union seals and safety iron seals to address produced water and chemicals in fluid.

Further, Weir is working with its customers to help them use their data more effectively, by allowing customers to interface with Weir’s algorithms to make their current systems smarter, Mr Wagner said. “We are working with our customers and using our advance knowledge of vibrations and what goes on during component failures to enable our customers’ existing systems to perform significantly more functions than they could previously.”

Optimizing proppant placement

Still struggling to understand how much proppant is enough to optimally deplete or drain a reservoir, the oil and gas industry now must focus on the long-term productivity of unconventional wells, Terry Palisch, Global Engineering Director for CARBO, said. With cost-cutting still king in this environment, the company saw a massive shift among its customers toward sand-based products. However, this shift raises questions around the sustainability and logistics of putting 20 million to 30 million pounds of sand in a well. For example, there are challenges around the shortage of sufficient-quality sand in some areas and the use of chemicals used in frac treatment. The disposal of flowback water also poses challenges, as do the number of trains and trucks required to transport sand to worksites.

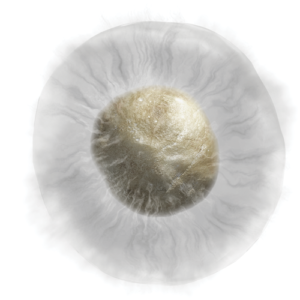

By substituting sand volume with a low-density ceramic proppant, CARBOAIR, the company believes that operators can transport proppants further in the wellbore with 25% to 30% less water than typically used, reducing a fracking operation’s environmental footprint. The release of the new proppant began last year with two initial field trials; it has also been deployed in another field trial earlier this year, Mr Palisch said. CARBOAIR is an ultra-low density ceramic proppant with chemically engineered internal porosity and 2.0 specific gravity that offers 30% to 40% slower settling rates compared with sand. According to CARBO, the technology reduces the amount of proppant needed to keep fractures open versus conventional proppant, reducing water consumption and flowback treatment costs.

In early 2017 in Eddy County, New Mexico, an operator was able to stimulate a wildcat well with thin gross pay in the second Bone Springs formation by pumping in the low-density proppant as a tail-in to promote greater propped frac half-length. A total of 26 frac stages were pumped using a smaller amount by weight of CARBOAIR – 2.5 million to 3 million lb total, or around 100,000 lb per stage – to achieve the equivalent volume as 40/70 conventional sand. As a result, the well experienced a shallower production decline than other nearby wells, according to the CARBO study.

In another case study, an Eagle Ford operator had planned to drill two parallel offset horizontal wells. In one well, 20% of the final proppant in each stage – 100 mesh and 40/70 sand – was replaced with 40/70 mesh CARBOAIR. As a result, a 20% productivity increase was seen in the well, according to the company.

To help oil and gas companies understand where proppants are flowing in the subsurface, CARBO has been working to develop proppants that do more than just prop open the fracture. It plans to commercialize in the second half of 2018 its new product, QUANTUM, which allows an operator to detect proppants in the subsurface from hundreds of feet away.

Technology currently available for detecting proppants can see specialty proppant that contains either radioactive or non-radioactive-based tracers using gamma ray or neutron logs run in the wellbore. However, such technology can only detect the proppant location within 18 to 24 in. of the wellbore. It is measured using a log run in the wellbore, and this can be done basically at any depth reservoir, Mr Palisch explained.

The QUANTUM technology is meant to see electrically conductive proppant – or standard proppant with a metal coating – from hundreds of feet away from the wellbore. “To date, the proppant has been at depths up to 10,000 ft, although we do not know what the limit will be. It is measured using sensors located on the surface around the wellhead and pad,” Mr Palisch said.

Using electromagnetic methods, surface electric and magnetic field sensors and a specially formulated proppant, the technology has been tested in field trials in West Texas, the Marcellus and STACK plays. CARBO is currently holding its fifth and hopefully last field trial of the product, Mr Palisch said.

Tackling produced water

Proppant provider Fairmount Santrol sees the need for fracking technologies that not only boost production and require a lower upfront investment but are simpler to deploy and more environmentally friendly.

Sid Banerjee, Product Manager for Self-Suspending Sand at Fairmount Santrol, said he is excited about applying the company’s self-suspending sand production line, Propel SSP, to reduce the use of fresh water in fracking operations. Propel SSP 350 can tolerate water with up to 350,000 parts per million total dissolved solids. The product had a soft launch in January 2017; the company continues to revise the technology for various applications, including refractures.

“Water has been one of the biggest waste streams in hydraulic fracturing in North America, as water types used had to be relatively clean. This put the oil and gas industry in competition with farms, ranches, cities and other entities that consume fresh water. Water shortages in some areas have heightened concerns over available supply,” Mr Banerjee said.

In terms of future technology development, Fairmount Santrol is looking at well refracture technology as E&P firms seek to boost production at the lowest cost possible. For the tenth of the cost of drilling a new well, production can be boosted or regenerated from an underperforming well or old well. Refracking an old well could pay off if the well’s problem is solved. But companies short on time have often opted to drill a new well in a new area with a design they can understand, rather than reengineer an old one. “There’s considerable interest in the space, but not a lot of understanding about what makes a well a good refracture candidate,” Mr Banerjee said.

Reduced number of plugs

This year, Oklahoma City-based Thru Tubing Solutions is expanding its SlicFrac intra-wellbore diverter product to projects in Saudi Arabia and the North Sea. The technology – released in January 2016 – utilizes proprietary plug devices of differing material strength and shape – known as perf pods – which enhance production from understimulated perforations by sealing dominant ones. The product is being used in all North American shale plays and has been utilized in a project in Australia.

Used primarily in mid-stage diversions, SlicFrac Perf Pods follow the dominant flow path and plug perforations, allowing a higher frac gradient to be reached and additional clusters to be stimulated, Jenna Robertson, SlicFrac Product Line Manager, said.

The product addresses the shortcomings of particulates and ball seal diverter products. Particulate, which is pumped with proppant or flush, may not dissolve when it goes out into the formation and may stay there. Ball seal diverters, which are round, may not fit into perforations that shift shape and will fall off without annular pressure, Ms Robertson said.

In Carter County, Okla., an operator was able to eliminate 89% of plugs by utilizing SlicFrac POD ’n Perf, according to a 2017 company case study. A typical plug and perf completion uses a single wireline run to set a bridge plug and then perforate the next interval prior to frac stimulation. The number of bridge plugs used in a single wellbore depends on the lateral length, number of clusters and stage spacing. After the well is fractured, bridge plugs are removed from the wellbore with a milling assembly deployed on either coiled tubing or jointed pipe. By replacing bridge plugs with the SlicFrac POD ’n Perf system, the total number of plugs in the wellbore was reduced from 19 to two, while maintaining the customer’s planned stage spacing and cluster volume. DC

Click here to view a video about Fairmount Santrol’s Propel SSP 350.

Click here to watch a video on Thru Tubing Solutions’ SlicFrac technology.