Environment, Social and Governance

Energy-related emissions to peak this year, according to DNV’s forecast

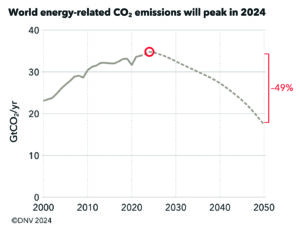

2024 will go down as the year of peak energy emissions – from the combustion of coal, oil and gas – according to DNV’s Energy Transition Outlook. Energy-related emissions are at the cusp of a prolonged period of decline for the first time since the industrial revolution, and are set to almost halve by 2050. However, this is short of requirements of the Paris Agreement, and DNV forecasts the planet will warm by 2.2°C by end of the century.

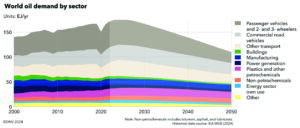

The peaking of emissions is largely due to plunging costs of solar and batteries, which are accelerating the exit of coal from the energy mix and stunting the growth of oil. Annual solar installations increased by 80% last year as it beat coal on cost in many regions. Cheaper batteries, which dropped 14% in cost last year, are also making the 24-hour delivery of solar power and electric vehicles more affordable. The uptake of oil was limited as electrical vehicles sales grew by 50%.

In China, where both of these trends were especially pronounced, peak gasoline is in the past. China is dominating much of the global action on decarbonization, particularly in the production and export of clean technology. It accounted for 58% of global solar installations and 63% of new electrical vehicle purchases last year. And while it remains the world’s largest consumer of coal and emitter of CO2, its dependence on fossil fuels is set to fall as it continues to install solar and wind.

“Solar PV and batteries are driving the energy transition, growing even faster than we previously forecasted,” said Remi Eriksen, Group President and CEO of DNV.

Progressing despite challenges

The success of solar and batteries is not replicated in the hard-to-abate sectors, where essential technologies are scaling slowly. DNV has revised the long-term forecast for hydrogen and its derivatives down by 20% (from 5% to 4% of final energy demand in 2050) since last year. And although DNV has revised up its carbon capture and storage forecast, only 2% of global emissions will be captured by CCS in 2040 and 6% in 2050. A global carbon price would accelerate the uptake of these technologies.

Wind is expected to contribute 28% of electricity generation by 2050. In the same timeframe, offshore wind will experience 12% annual growth rate although the current challenges impacting the industry are weighing on growth.

Still, the peaking of emissions is a sign that the energy transition is progressing. The energy mix is moving from a roughly 80/20 mix in favor of fossil fuels today to one that will be split equally between fossil and non-fossil fuels by 2050. In the same timeframe, electricity use will double.

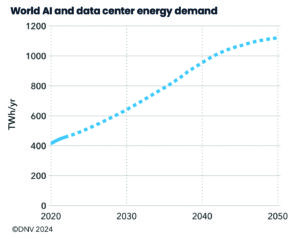

The outlook also examines the impact that AI is expected to have on the energy transition, particularly for the transmission and distribution of power. Although data points are currently sparse, DNV projects that AI will see a tripling of the energy consumption of data centers between now and 2050, equating to 2% of global electricity demand by then. However, the use of AI is also enabling significant advancements in areas like power grid management, material science and energy storage.