Oil & Gas Markets

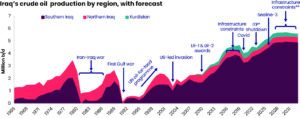

Output set to grow from Iraq’s upstream sector

Iraq’s natural gas output could more than double by 2030 to reach 4.4 billion cu ft/day (bcfd) and its oil output could hit 5.5 million barrels/day (bpd) in the same time frame, according to a new report from Wood Mackenzie. The majority of potential growth will be from large oil fields in the south, such as Rumaila, West Qurna, Zubair and Majnoon.

“Iraq’s upstream industry is changing dramatically, and it has the resources to increase both oil and gas output considerably,” said Alexandre Araman, Director at Wood Mackenzie. “Corporate interest is increasing as there are multiple entry opportunities of scale. Many of the majors are reevaluating their presence – given the low returns on offer from historically punitive fiscal terms – with willing buyers in Southeast Asian NOCs and China’s state-backed players.”

Further, harsh fiscal terms have discouraged both foreign investment and exploration activity. According to Wood Mackenzie, despite more than 150 billion barrels of oil resources, only five exploration wells have been drilled in Federal Iraq since 2013.

However, recent licensing rounds in 2024 showed considerable interest from Chinese firms. This also highlights how Iraq’s corporate ecosystem has diversified and expanded over time, although more of this attention has been to discovered resources than exploration potential.

“Iraq’s fiscal terms are still among the least competitive in the Middle East,” Mr Araman said. “If that is addressed, it is likely we will see more activity from Asian players as the corporate landscape in Iraq is shifting from West to East.”

US oil and gas workforce report finds steady growth followed by stabilization

The 2024 Workforce Report from the Energy Workforce & Technology Council (EWTC) indicates there was a gradual recovery within the US energy services workforce in 2023, with steady job growth early in the year followed by a period of stabilization. The top six energy-producing states accounted for 76% of jobs in the sector (495,685 total jobs), with Texas taking a significant lead at 317,199 positions, followed by Louisiana, Oklahoma, Colorado, New Mexico and California.

The report analyzed data from approximately 346,598 employees globally, with nearly 189,000 based in the United States.

It found that female representation in the US oil and gas workforce had decreased, at only 15% in this report versus 19% from the 2021 report. Those numbers compare with 47% women in the overall US workforce.

The underrepresentation of women was especially pronounced in technical roles (13% women). In fact, less than 1% of the highest-ranking executives in technical/operating functions were filled by women – down from 9% in 2021.

The representation of women was more balanced in business support functions, with 46% women (up from 34% in 2021). However, less than 20% of the highest-ranking executives in business support functions were women.

Ethnic diversity was found to have risen, with minorities making up 35% of the US oil and gas workforce – up from 28% in 2021. Ethnic minorities still represented less than 2% of the highest-ranking executive roles in technical/operating functions, however; that’s down from 9% in 2021.

The report underscored the need for merit-based recruitment, targeted skill and leadership development, and flexible work options to attract retain top talent. Also, there is opportunity to improve the inflow of women into the industry, considering that 29% of entry-level recruits within STEM are women. Further, the report noted that more than half of companies do not track talent outflows, which limits feedback in retention strategies.