UK rig market turns a corner as E&A, development activities rally

Dayrate, utilization, contract lengths all trending upward in both UK and Norway

By Linda Hsieh, Editor & Publisher, and Sarah Junek, Associate Editor

After several years of strained cash flows and dim outlooks, things are finally starting to brighten up for drilling contractors in the UK and Norway. They can take comfort in the fact that several key metrics – number of wells drilled, utilization, contract lengths, and perhaps most importantly, dayrates – all indicate the market is heating up.

“This time last year, we were already witnessing a steady upward movement in dayrates for the Norwegian semi and jackup markets. However, the UK sector was still weak due to higher supply and less long-term demand,” said Teresa Wilkie, Senior Rig Market Analyst with Westwood Global Energy. “It was not until last quarter that this segment turned a corner. We have witnessed a rally in UK exploration and appraisal (E&A) and development activity, which has spurred on utilization and subsequently kickstarted dayrates.”

She pointed to the most recent award from Premier Oil for the Transocean Leader as an example. The semi, which was built in 1987 and can drill in up to 4,500 ft of water, recently received a contract with a dayrate between $240,000 to $250,000.

“This dayrate is a stark comparison to its past four contract awards fixed between January 2018 and September 2018, which ranged from $120,000 to $160,000,” Ms Wilkie said. “The Premier Oil campaign doesn’t begin until Q2 2020, but North Sea drilling contractors are now able to command higher rates for work that will begin next year or beyond as supply is starting to disappear.”

In general, dayrates for semis in the UK had stayed in the $135,000 to $180,000 range last year, with the low end representing a standard-spec or older unit and the higher end for a modern, high-spec rig, according to Westwood. Since then, that range has shifted upward to between $160,000 and $250,000. Semis in Norway are getting between $180,000 and $320,000. In that market, newbuilds like the Transocean Norge and Seadrill’s West Bollsta typify the premium, harsh-environment rigs are commanding some of the highest dayrates that can be found anywhere in the world.

In the jackup segment, Ms Wilkie noted that “rates are also on the rise as the market continues to sell out,” especially for high-spec, heavy-duty jackups. “It is now one of the tightest markets in the North Sea.” In the UK, fixtures for high-spec rigs have already been rising to between $85,000 and $90,000, then up to mid-$90,000 to $110,000 for drilling campaigns that won’t begin until next year. Even standard jackups working in shallower waters are getting up to $70,000/day.

New contract fixtures are going up in Norway too, where there is a more limited pool of certified rigs. While drilling contractors have been reluctant to share dayrate information, Ms Wilkie estimates that current benchmarks are between $150,000 and $200,000 for 2019 work, while 2020 work is “rumored to be coming in between $200,000 and $300,000 per day.”

Some contractors are also mobilizing jackups into the North Sea from other parts of the world “because the market is already becoming so tight in certain sub-segments… We expect to see rig owners continue to test pricing going forward.”

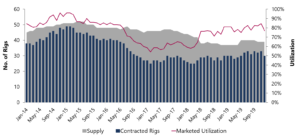

With dayrates moving upward, it’s no surprise that rig utilization is getting stronger, as well. Not counting 10 cold-stacked and non-marketed rigs, North Sea semis were seeing a 75% utilization rate as of May, according to Westwood’s RigLogix database. By August to October this year, that number is expected to surpass 84%, once five additional rigs commence their planned campaigns.

“We saw utilization hit the same mark for only one month last year during June, but prior to this, a figure this high has not been recorded since July 2015,” Ms Wilkie said. The only reason utilization hasn’t reached 90%, she added, is there are four older rigs in the market that have no work prospects.

Further, because semi supplies are tightening, it’s expected that more operators will be forced to drill during the winter months going forward, even if that means more weather-related downtime and higher costs, Ms Wilkie said. “Our forecast shows that utilization of floaters will sit above 70% through this coming winter, a level not recorded since the winter of 2014 and 2015.” This compares with 50-60% utilization rates in the winters between 2016 and early 2019.

Over on the jackup side, utilization had crossed over the 80% threshold in late 2018 when 10 rigs were taken out of the fleet. While that utilization number has since gone down to 75% as of May, it’s expected to rise again to 84% later this year. “Most of the excess supply will be in the standard and older jackup segments, with the high-specification market expected to remain very tight,” Ms Wilkie said. In fact, high-spec jackup utilization is likely to hit 92% by September – a level not seen since July 2015.

Trends in contract lengths being awarded are also positive, according to Ms Wilkie, driven by operators now approving development and redevelopment campaigns that they had shelved during the downturn. Contract terms had hit their low points in 2016 for both semis and jackups, according to RigLogix data. That year, semis received only 17 awards with an average duration of 148 days, and jackups received 26 awards averaging 174 days. Last year, semis logged 38 new contracts with an average duration of 197 days. Jackups in 2017 received 28 new awards for an average of 540 days, bolstered by two 10-year contract awards. So far this year, jackups have already seen 11 awards with an average of 199 days.

Another reason for increasing contract lengths is that Norwegian operators, including Aker BP and Lundin, have been securing rigs for multi-year campaigns with additional options so they can move premium assets around for a mix of development, E&A or plug and abandonment work. “In certain segments, such as the high-specification jackups and premium semis, there is definitely a higher sense of urgency in securing rig time as availability of these units slips away,” Ms Wilkie said.

These operators aren’t concerned with having idle rigs on a long contract as the asset can be sublet to another operator, she explained. One recent example is OKEA and PGNiG subletting Odfjell Drilling’s Deepsea Nordkapp semi from Aker BP.

Other smaller independent operators impacting the North Sea drilling market include Alpha Petroleum and Bridge Petroleum; both companies have acquired older assets from large operators for redevelopment. “These two operators alone will drill a combined total of 35 wells at the initial phases of their planned UK Cheviot and Galapagos redevelopments, which could equate up to five years of rig time if the projects come to fruition,” Ms Wilkie said.

She also referenced other companies like Siccar Point, Hurricane Energy, Azinor Catalyst and Zennor Petroleum, all of which have undertaken E&A campaigns in the UK and Norway. They are either already having or will have substantial impact on the North Sea rig market, even if some of these companies’ drilling campaigns only translate into 30-60 days of work at a time right now. For example, Siccar has announced a large discovery “that will ultimately turn into longer-term demand down the road.”

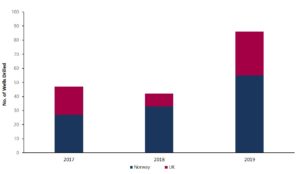

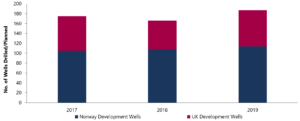

Yet another encouraging metric that can be found in the North Sea is in the number of E&A wells to be drilled this year. That number is expected to jump by 53% this year over last year, from 40 to 86, according to Westwood’s Atlas database. The company’s Sectors database shows a much smaller increase for development wells – just 11%, from 2018’s 166 wells to 2019’s 187 wells. “Although the rise is not the same extent as the E&A well predictions, it does show that this side of the market is also moving in the right direction,” Ms Wilkie said.

Despite all the activity increases that are either being tracked or planned, Ms Wilkie cautioned that operators are likely to continue exercising an abundance of CAPEX discipline over the next few years. “In general, the supply chain has been squeezed since the oil price downturn to improve project economics, and that is expected to continue going forward.” DC