In search of equilibrium in the North Sea

Shrinking CAPEX leads to substantial rig oversupply as industry seeks cost-cutting measures that can be ‘win-win’ for both operators, drilling contractors

By Linda Hsieh, Managing Editor, and Alex Endress, Editorial Coordinator

-

Unfavorably low oil prices have exacerbated pre-existing problems associated with the North Sea’s high-cost structure.

-

Drilling contractors are lowering dayrates, stacking rigs and, in some cases, scrapping rigs in effort to rebalance the market and position themselves for the next upturn.

-

Increasing collaboration is being seen among industry, governments and regulators to facilitate cost reductions

and to improve the future economic viability of North Sea E&P.

The North Sea – once bursting with demand for drilling rigs due to favorable oil prices – is now in the midst of an oversupply. As operators adjust their budgets to accommodate $50-60 oil by cutting overall CAPEX and drilling spend, these companies have also begun to cancel rig contracts, sublet rigs or simply stop hiring them altogether. Drilling contractors have responded by lowering dayrates, stacking older rigs and moving them to other markets around the world. However, as more rigs come off contract and fail to find new work, some are increasingly looking at rig decommissions as a strategy to rebalance the market.

Commenting on the health of the UK oil and gas industry, Oonagh Werngren, Oil & Gas UK’s Operations Director, explained that while production has stabilized over the past two years, it decreased slightly by 1.1% between 2013 and 2014, from 524 million BOED to 519 million BOED.

“Oil and gas production has gradually been declining, which is affecting production revenues, which were £24.46 billion in 2014,” said Ms Werngren, who added that together with rising operating costs, the UK upstream industry is facing the challenge of operating within a business environment that is unsustainable. Its key priority is to tackle cost and improve efficiency to make the UK Continental Shelf (UKCS) more economically competitive and attract fresh investment into the North Sea basin.

“If the industry can get to grips with this challenge, it has the opportunity to regain its international competitiveness. There are certainly more discoveries to be made in the basin, especially when there’s still somewhere between 14-23 billion barrels of oil equivalent remaining on the UKCS – a prize well worth chasing,” Ms Werngren said.

One important step that Oil & Gas UK took in 2014 was to launch several pan-industry initiatives to tackle its cost base and improve efficiency. As part of that work, it established a project to help make sure that offshore resources and equipment were used more efficiently across the North Sea basin.

An aspect of this work includes the concept of a “rig club,” which consists of an online database that participating companies operating on the UKCS can share as a central resource. Oil & Gas UK helps facilitate this tool, which helps to connect operators and drilling contractors located in the same UKCS sector by providing information on the availability of drilling rigs and wells that require drilling in the same vicinity. “By using this information, companies can plan and optimize well operations more efficiently by sharing drilling rigs and associated services,” Ms Werngren explained.

Standardization and simplification is another key theme on the industry’s cost and efficiency agenda. “The theme of standardization focuses on removing costs that currently exist in offshore operations. For example, there has been a trend toward overspecification and complexity in contracts, which are sometimes described as ‘bespoke.’ Instead of producing complex versions of items such as valves and pipes, there is scope for adopting common standards, which would help reduce unit costs in design and maintenance,” Ms Werngren said.

Both the UK and Scottish governments recognize the oil and gas industry as a national asset and have made it a priority in their respective industrial strategies. In the past year, the UK government has introduced a number of changes in its tax regime to help encourage investment on the UKCS. As a result of the findings of a ground-breaking report reviewing the status of the industry, known as the “Wood Review into Maximizing Economic Recovery,” from the UKCS, the government has also established a new “arm’s length” regulator known as the Oil and Gas Authority (OGA). The OGA will have the power to wield more rigorous stewardship of the North Sea oil and gas industry.

In March 2015, the UK announced three changes to the way it taxes oil and gas producing companies. First, the supplementary charge rate has been reduced from 30% to 20% from 1 January 2015, following a 2% cut at the end of 2014. Second, the petroleum revenue tax (PRT), which is levied on fields that were given consent for development before March 1993, will be reduced from 50% to 35%, with effect from 1 January 2016. The headline tax rates are now 50% (75% for PRT-paying fields, which will fall to 67.5% from 1 January 2016) compared with 62% (81% for PRT-paying fields) for 2014.

Thirdly, an investment allowance has been introduced, replacing the range of field allowances. The investment allowance reduces the marginal tax rate on new investments to 30% (which would be the corporation tax charge, as the investment allowance removes the supplementary charge) based on the capital expenditure incurred by the company after 1 April 2015. The allowance is worth 62.5% of capital investment, subject to the field being invested in generating sufficient production income.

While these and other similar efforts will contribute to creating a better business environment in the medium and longer term, it is unlikely that they will have an immediate short-term impact because the majority of companies operating on the UKCS are currently in a tax loss position, given their historic investments, according to Ms Werngren.

It will also take time for the OGA to get fully established. As part of a comprehensive range of work aimed at maximizing economic recovery from the UKCS, the OGA is working with the industry to revitalize exploration. In the UK government’s March budget, it announced that it would make £20 million available to fund new seismic surveys of underexplored areas in the North Sea. The OGA aims to facilitate the sharing of this data to the industry from March 2016.

In terms of how the future looks for the industry, Oil & Gas UK’s Activity Survey forecasts that capital investment in upstream developments will fall from £14.8 billion in 2014 to between £9.5 billion and £11.3 billion in 2015. The number of wells drilled is also expected to fall. In 2014, just 14 exploration wells and 18 appraisal wells were drilled.

“This year, Oil & Gas UK expects that approximately eight to 13 exploration wells will be drilled, with a maximum of five appraisal wells, so concerted effort from industry and government is required to turn this situation around,” Ms Werngren said.

The outlook for the UK oil and gas industry and associated sectors remains uncertain, as new investment in the basin is expected to amount to less than £3.5 billion over the next three years, she added.

However, along with efforts to revitalize exploration and increase production efficiency, there is growing evidence that the industry is steadily implementing cost-efficiency initiatives to help the sector regain its competitiveness in the global market.

Rig counts drop

As capital investment shrinks, so do rig counts across the North Sea. Total utilization for semisubmersibles across the North Sea dropped from 96% in June 2014 to 88% in June 2015, according to IHS Senior Manager Rod Hutton. Total utilization for jackups dropped from 100% in June 2014 to 87% in June 2015, he said.

IHS projects rig utilization will keep falling through next year, with semisubmersibles seeing an average rate of 78.5% in 2015 and 69.1% in 2016. Total utilization for jackups will fall from 85.3% this year to 75.1% next year, according to Mr Hutton.

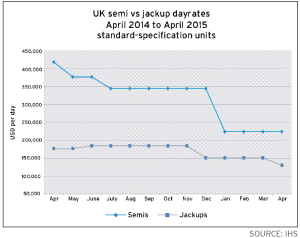

For rigs in the UK, IHS reports that semisubmersibles saw an 80.1% total utilization rate in June 2015, while jackups saw a 78.7% total utilization rate. These numbers are accompanied by sharply falling dayrates. Fixture rates for standard semis – those built before 1983 with a water depth capability of up to 3,000 ft – have decreased from the low $400,000s in April 2014 to around $200,000-$220,000 in April 2015, IHS indicated. Rates have also dropped for standard jackups, from a range of $170,000-$185,000 in April 2014 to $110,000-$151,300 in April 2015.

In Norway, the historically strong market is also slumping. Upstream capital investment is expected to fall from NOK 187 billion ($28.8 billion) in 2014 to NOK 136 billion ($22 billion) in 2015, according to an investment forecast released online by Wood Mackenzie early this year. The Norwegian Petroleum Directorate also released a forecast stating that it expects the number of exploration wells drilled offshore Norway to be cut back from 56 in 2014 to 40 in 2015.

For rigs in Norway, IHS is reporting total utilization rates for June 2015 of 96% for semis and 100% for jackups. The single drillship located offshore Norway – the West Navigator – was stacked after Rosneft canceled a five-year contract with North Atlantic Drilling that had been set to commence in July. Two semis – Transocean Spitsbergen and COSLPioneer – are now off contract, but as 2015 progresses an additional five semis and two jackups will roll off charter

with no work lined up, according to IHS.

Supply, demand imbalance

As operators cut drilling spend, contractors are pruning their own fleets in response. Cold-stacking rigs is one obvious option. However, in the face of significant uncertainty as to the length and severity of this downturn, some contractors have also turned to rig scrapping. “We have to take a longer-term view and position ourselves to take advantage of the next cycle,” Terry Bonno, Transocean’s Senior Vice President of Marketing, said.

Since Q4 2014, Transocean has announced the company will scrap 20 floaters and will either scrap or sell another floater for use in a non-drilling capacity, leaving 63 units in its global fleet. One of the 20 floaters was located in the North Sea – the GSF Arctic III, built in 1984. “We don’t consider these rigs part of our core fleet going forward,” Ms Bonno said of the decision to scrap the rigs. “In order to rebalance the market and play the role that attrition needs to play, the industry simply has to take a lot of these older rigs out of the overall fleet and cut them up.”

According to IHS, only two rigs in the North Sea have been announced to be scrapped since Q4 2014. However, the industry is very likely to see more such announcements, Mr Hutton said. “A lot of these 30-plus-year-old units are prime targets for scrapping,” he said. “Whether a rig is scrapped or not will come down to the internal reviews of the drilling contractor involved, and whether they think the cost of keeping it going will be recouped once the market picks up again.”

For Transocean, the decommissioning of these 20 floaters will allow the company to better market its remaining fleet of higher-spec units. The contractor currently has 14 rigs working in the North Sea region – four in Norway and 10 offshore UK. Some are enjoying relatively high dayrates, such as $550,000 for the Transocean Barents and $379,000 for the Transocean Arctic.

Offshore UK, the contractor has eight floaters and two high-specification jackups. The Transocean Leader and the Paul B. Loyd Jr, both floaters, will stay busy through 2019 and 2017, respectively.

Jackups, not surprisingly, are seeing shorter-duration contracts. “We are in a market circumstance where there is a lot of availability on the jackup side,” Ms Bonno said. For Transocean’s two jackups working offshore UK, the GSF Galaxy I is contracted to TOTAL until at least May 2017, while the GSF Galaxy II was recently awarded a two-month extension with GDF Suez at a dayrate of $190,000. The Galaxy II is completing a three-well project that began in September 2014 and will be free in August.

Ms Bonno said she believes that the higher barrier of entry to the North Sea market is affording contractors in this region a degree of protection as the standard floater fleet does not have the specifications required to operate in the region. “You don’t have a major influx of rigs that can easily come in and take over your market share… but still there’s going to be availability. There’s certainly not enough demand in the near term to keep the entire fleet going.”

In this type of market, she said, Transocean is putting a heavy emphasis on working with operators to make sure that concerns are addressed. She cited the “blend and extend” approach as one option, where term is added at the end of a contract at a market rate, and that rate is then blended over the entire contract period. “We are certainly working with our customers to come up with creative solutions that will keep our rigs working and get their wells drilled.”

Collaboration with operators also sits at the top of the agenda for Rowan Companies. Ralph Whelan, VP of International Sales and Marketing for Rowan, explained that drilling contractors are well aware of operator expectations – and yet both parties realize that the solution doesn’t simply lie in slashing dayrates. “Our customers are under tremendous pressure to cut costs, which translates to pressure on drilling contractors to reduce rates,” he acknowledged. “But we must work with our customers to find win-win situations.”

Mr Whelan also cited as a “win-win situation” the option to reduce rates in exchange for additional length of contract term. “At Rowan, we have had some opportunities to extend our drilling contracts, providing more stability for the company in this uncertain time, in exchange for a reduction in dayrate under an existing contract,” he said.

This type of cooperation was seen recently on the Rowan Gorilla V jackup contract extension. TOTAL awarded the rig a two-well extension that will keep it busy for another year. The dayrate was brought down to $170,000 from $274,000 in January 2015 and will increase to $175,000 in January 2016 until the projected contract termination in August 2016. “We have held similar discussions with Apache for the Rowan Gorilla VII,” Mr Whelan said.

“Without a doubt, this is a difficult time for many companies,” he continued. “Like most other contractors, we are reducing our costs and working with our customers to keep our rigs working through this downturn.” Besides the Gorilla V and Gorilla VII, Rowan has four other jackups working in the region – one more in the UK and three in the Norwegian market. “High performance and efficiency is critical for our success in the North Sea – and in all our operating regions,” he said.

Compared with contractors who have a concentration of rigs in the oil-heavy areas such as the UK’s Northern North Sea and Norway, contractors with a focus on the gas-prone Southern North Sea appear to be holding steadier in terms of activity levels. “Gas prices have not dropped as significantly as the oil price. As a result of that, we’ve seen the drilling activity in the Southern sector actually hold up quite well,” Peter de Bruijne, Director of Marketing and Contracts for Paragon Offshore, said. He added that 65% of Paragon’s well activity is gas related. “Indications also show that next year we will still see a fair amount of activity in the Southern sector.”

Paragon currently has nine jackups and one semi working in the North Sea region. Two of the nine jackups came from Paragon’s acquisition of Prospector Offshore last year and are contracted to TOTAL through the latter parts of 2016 and 2017. “Obviously, activity levels have slowed down… but we are actually in a good position and have rigs working on fairly long-term contracts,” Mr de Bruijne said.

Even for rigs that are not under long-term contracts, he expressed confidence in maintaining long-term relationships with operators through the downturn. “One of our rigs has been on contract with the same oil company for more than 20 years, but they’ve never signed any one contract for more than one year,” Mr de Bruijne said. “In this environment, there’s always concern about being able to renew contracts, but we think the North Sea is actually one of our stronger areas.”

Adding to that optimism are Paragon’s expectations for a growing well abandonment market. This is driven by an increasingly strong focus by regulators on integrity of aging wells. “Many companies don’t like thinking about this part of the market because it is not very productive from an oil recovery standpoint, but it is one of those areas where we need to work cooperatively as an industry – to abandon these wells as safely and efficiently as possible,” Mr de Bruijne said.

Older rigs are particularly well-suited for these applications because these projects are about minimizing costs, said Lee Ahlstrom, Senior VP of Investor Relations, Strategy and Planning for Paragon. “If we’re able to get the cost in line to still generate good margins, that could be a very strong business going forward,” Mr Ahlstrom said. Paragon currently has two standard jackups – the Paragon B391 and Paragon C20051 – completing well abandonment procedures. The B391 is on contract with Centrica offshore UK, while the C20051 is working in The Netherlands with TOTAL.

“There are at least a couple thousand wells that need to be abandoned in the North Sea,” Mr de Bruijne continued. “The abandonment market could necessitate a large number of rigs for a period of 10 years if you look at the sheer amount of old wells.”

Finding ways to ‘smarten’ drilling operations

From an operator’s perspective, re-adjusting to the new upstream landscape means making crucial and often tough decisions on CAPEX deployment. Many North Sea assets that were already economically challenging at higher oil prices have simply become uneconomic at $50-60 oil. For Apache, however, the company said it doesn’t plan to significantly reduce the number of wells drilled in 2015 compared with 2014. Apache VP of North Sea Jim House said he expects 22-24 wells to be drilled this year; last year the operator drilled 20.

“The number of wells being drilled is obviously driven from a CAPEX allocation basis, and there is less CAPEX to go around,” Mr House said. “But we’re not planning anything dramatically different. Some companies are in relatively good shape from a free cash flow standpoint, and fortunately we’re one of those companies.”

Apache’s success with the Forties Field is well known in the industry – an independent operator acquiring from a supermajor what was then already a 28-year-old asset and adding at least 20 years of life to the field. This year, Apache is celebrating the field’s 40-year anniversary of oil production. “The field has far exceeded the expectations of the initial development plans,” Mr House said. Apache has produced more than 230 million BOE from the field since acquiring it in 2003. “That’s our keystone asset that got us here.”

Including the Forties, Apache has interest in approximately 1 million gross acres offshore UK. The company invested more than $1 billion in the North Sea last year and was rewarded with a record quarter of production in Q4 2014, at 80,806 BOED. “We came out of the year with a fair amount of momentum,” Mr House said.

Another major asset for Apache in the North Sea is the Beryl complex, where the operator recently completed the area’s first 3D seismic acquisition survey since 1997. Two semis – Diamond Offshore’s Ocean Patriot and Awilco Drilling’s WilPhoenix – have been brought in to drill two to three development wells in this area over the next 12-18 months. Apache is also working on additional drilling plans for more than a dozen exploration targets that were imaged in the recent survey.

How many of those targets actually get drilled will depend on the price of oil and availability of CAPEX, of course. Mr House noted that Apache’s operating costs have already dropped by approximately 12% over the past year, and the company is working on further reductions. He agrees with contractors, though, that reducing dayrates is not the only way to go. “Yes, we are looking to structurally reduce the cost of doing our business, but we’re really working with all of our service providers to look at how we can continue to smarten our operations up,” Mr House said. “There are some straight cost reductions that can be made, but there are other ways to approach this area that will provide lasting improvements.”

The company recently re-adopted an equal time rotation for crews on offshore production platforms, instead of using a two weeks on/three weeks off rotation. Mr House cited the latter as a contributing factor for efficiency losses across the North Sea over the past seven to 10 years. “There was a loss of continuity which also impacted people’s focus in delivering the work objectives,” he said. Going to the three on/three off rotation is now significantly reducing Apache’s offshore logistics requirements. So far this year, several other operators have also announced changes to the three on/three off rotation.

Lower breakevens lead to more opportunities

At Statoil, efforts to enhance efficiency have been formalized under the Statoil Technical Efficiency Program (STEP). “What we have seen is that we drill more wells with the same rig capacity,” said Per Haaland, Process Owner, Drilling and Well for Statoil. Simpler well designs have been a key driver behind STEP, “which means that we are not trying to do the complicated wells that try to drain everything in a reservoir,” he explained.

As of mid-June, Statoil was planning to drill 86 wells on the Norwegian Continental Shelf (NCS) and two in the UK North Sea in 2015. These numbers compare with 85 wells drilled on the NCS and zero in the UK in 2014. “We’re trying to position our company in a place where wells in the future can be drilled cheaper, which means the breakeven price for new field developments will be lower. That means we can open opportunities for more field developments,” Mr Haaland said.

Another critical part of STEP has been execution efficiency, which entails working much more closely with drilling contractors. “We integrate them and fit them into our process so they fully contribute with their skills,” Mr Haaland said. “They also need to be integrated into our planning so we can get the most capacity out of technologies. In Norway, we use relatively high-tech equipment, but we weren’t necessarily realizing the true potential of those technologies. Now, we’ve been able to increase our drilling speed by approximately 16% with existing technology and existing rigs.” The goal is to eventually reduce drilling time per well by 25%, he said.

Statoil expects that such efficiency gains will eventually pay off in the Barents Sea. Earlier this year, Statoil and its partners decided to postpone development of John Castberg until the second half of 2016, with expectation for an investment decision in 2017. “We have made significant progress in reducing costs for Johan Castberg,” Ivar Aasheim, Statoil Senior VP for Field Development on the NCS, stated as part of the announcement in March. “However, current challenges in relation to costs and oil prices require us to spend more time to ensure that we extract the full benefit of the implemented measures.”

One project that has not been postponed is Johan Sverdrup in the Norwegian North Sea. It is estimated to hold between 1.7 billion to 3 billion barrels of recoverable oil. In June, Statoil announced that it had awarded contracts to Odfjell Drilling, valued at more than NOK 4.35 billion, for work to be done on the Johan Sverdrup field. Under a three-year contract, the Deepsea Atlantic semi will drill a minimum of 13 pilot wells starting in March 2016; there are six 6-month options. Another contract calls for Odfjell to provide drilling services on the fixed drilling unit to be installed on the field. This four-year contract will start in December 2018 and includes six 1-year options.

Uncertain future

While the industry has no direct control over commodity pricing, companies continue to show that it can drive improvements through better operator/contractor collaboration, through innovative technologies and through simplification and standardization of processes.

Perhaps next up is a more fundamental reexamination of the way the industry structures its business. “As an industry, we need to look at how to dampen the cyclic nature of the drilling business,” Mr House said. “Perhaps there’s a better way to structure and engineer drilling contracts. Perhaps there’s a way to gear rig pricing around either oil and/or gas prices. If the industry can find a way to manage contracts so they reflect the current state of affairs, it would be very healthy in the long term.”

- Total utilization for semisubmersibles across the North Sea dropped from 96% in June 2014 to 88% in June 2015.

-

Total utilization for North Sea jackups dropped from 100% in June 2014 to 87% in June 2015.

-

Upstream capital investment in Norway is expected to fall from NOK 187 billion ($28.8 billion) in 2014 to NOK 136 billion ($22 billion) in 2015.

-

Oil & Gas UK’s Activity Survey forecasts that capital investment in UK upstream developments will fall from £14.8 billion in 2014 to between £9.5 billion and £11.3 billion in 2015. The group also forecast 8 to 13 exploration wells will be drilled in 2015, compared with 14 last year.