HPHT completions: always a moving target

30,000 psi, 500°F on the horizon, but economics challenge solutions for HPHT deep gas wells

By Katie Mazerov, contributing editor

When it comes to pushing the envelope, the oil and gas industry has set a high bar for developing technologies that can transform seemingly unfathomable hurdles into systems and processes used every day.

Among the increasingly deep and unknown places operators are going are high-pressure, high-temperature (HPHT) gas wells, where the definitions of depth, pressure and temperature are ever expanding. While these wells can hold a wealth of resources, they are difficult and expensive to complete, especially in an environment of marginal gas prices.

HPHT wells are being discovered in onshore and offshore environments and are commonly characterized to be HPHT when anticipated shut-in pressures are above 10,000 psi (68.9 MPa) and bottomhole temperatures are higher than 302°F (150°C), said Kean Zemlak, senior staff completion engineer and technical lead HPHT/sour gas for Apache Corp.

The way in which the rock and hydrocarbon was formed ultimately dictates a well’s drilling and completion design and preparedness. Depth, pore pressure, undisturbed bottomhole temperatures and requirements for surface pressure- control equipment set the stage for a well’s complexity, said Mr Zemlak, who has had experience with both offshore and onshore HPHT wells.

“The industry is continuing to explore and develop wells in an arena called ultra-HPHT, often seen in the Gulf of Mexico, UK and overseas, characterized by temperatures over 400°F (204°C) and 20,000 psi (138 MPa),” he said. The most extreme, but rare, HPHT category, with temperatures at 500°F (260°C) or more and 35,000 psi (241 MPa), has been identified over time.

“The effects of high pressure and temperature on the wellbore result in higher drilling and completion risk and cost,” Mr Zemlak noted. “Downhole tools on the testing and completions side involve complex and expensive metallurgy. And depending on the partial pressures of CO2 and H2S (sour gas) exposed to wellbore tubulars, there is the potential for significant corrosion and cracking. The corrosive rates are higher for HPHT wells and require expensive corrosion-resistant alloys for downhole tools, wellbore construction and surface pressure-control equipment (BOPs and wellheads).

“The industry has extensive experience with producing corrosive and sour gas where a variety of detailed recommended practices have been developed for managing and ensuring strict quality control of components required for drilling and completions,” he continued. “Temperatures at HPHT levels drastically affect the stability and longevity of downhole electronics and must be properly considered to manage overall efficiency and cost.”

Technology development requirements include evaluation of alternative wellbore design and construction techniques to enable fracture stimulation at high rates and pressures, Mr Zemlak said. Consideration of interventionless HPHT technology to determine if a multistage frac completion system can be implemented and/or further developed is a priority. “This will enable less reliance on coiled-tubing and wireline intervention,” he said. “Evaluating further development of multilateral technology to satisfy HPHT requirements to reduce overall drilling and completion costs is also critical.”

In the relatively new arena of shale gas production, Encana is producing more than 300 HPHT wells in the Haynesville Shale and Deep Bossier (south of Dallas) plays, said John Dees, completion engineering advisor for Encana’s Mid-Continent region. Bottomhole temperatures range from 350°F to 380°F and between bottomhole pressures of 10,000 psi and 15,000 psi. Vertical depths are between 12,000 ft and 19,000 feet.

“We are at the limit of what our directional drilling equipment can do,” Mr Dees said. “On the really hot wells, we can get into the deeper wells vertically because we don’t need directional tools, but we can’t get into them horizontally because the temperature is too hot for the directional drilling tools.”

The wells are being designed for a life of about 30 years, but there is uncertainty about how long they actually will produce, considering shale production is a new frontier. Most wells in the region have been producing for only two to four years, Mr Dees noted.

In light of natural gas prices, the decision to complete such wells is a cost/benefit proposition. “The pressure in these HPHT wells makes them very productive because they can store more gas per cubic foot. But they are much more expensive to complete because of the technology required,” Mr Dees said. While a normal well completion cost may be around $1 million, an HPHT well can cost upwards of $4 million, he estimated.

“Due to variations in thermal gradients, wells are deeper, hotter and more pressurized in the eastern and southern areas of the Haynesville. Pressure increases roughly 0.90 psi per foot of depth. So, for every 1,000 feet of depth, the psi increases by 900.”

HPHT wells are not typically seen in the Marcellus because it is shallower and doesn’t have as high a thermal gradient as the Gulf Coast, Mr Dees noted. The Barnett is also shallower and not considered an HPHT region.

Technical challenges lie in the areas of fracture modeling and production predictions. “It is difficult to make the fracture model and production predictions match up with the microseismic work that is going on,” Mr Dees said. Frac work is expensive because of the additional hydraulic horsepower required to do the fracturing at such high pressures, again a function of pressure.

“We’re working to solve the challenge of how to complete longer horizontal wellbores, with the technology revolving around longer reaches with coiled tubing or tools that can run on casing,” he added. “Metals are being designed to handle the pressures and the corrosiveness of the gas, proppant and abrasive sands. We’re also exploring different proppant for value gained that can hold the fractures open after we release the hydraulic pressure.”

Offshore, the hot spot is the Gulf of Mexico shelf Lower Tertiary formations, where gas wells with 20,000 psi or more and temperatures of 350° and up lie in deep subsalt plays. As with onshore wells, there are limits to what the current completion tools can handle. One of the largest ultra-deep discoveries in the GOM shelf was made in January 2010, when McMoRan Exploration Company logged 200 net ft of pay in multiple subsalt Wilcox sands in the Davy Jones No. 1 well on South Marsh Island Block 230.

In March 2010, a production liner was set and the well was temporarily abandoned to prepare for completion, according to information released by the company. McMoRan has stated that it has ordered a long lead time and a number of specialty items, including a 25,000-psi production tree, safety valve and blowout preventer. The company expects to complete and flow test the well by the end of 2011.

Wells in the subsalts are being tested, and while operators believe they will be economical, they won’t really know until there is actually long-term production from them, said Rich Jones, director, completions and stimulation technology for Weatherford International.

“They always seem to be able to drill into things we can’t complete; they always seem to be a couple pressure gradients ahead of us,” Mr Jones said. “Two years ago, I had not heard of anyone wanting to complete a 25,000-psi well. Now, two or three operators a year are coming to us, saying they need completion technology for that pressure. And I think we will see interest in this space continue to grow.”

The issue is not high temperature or high pressure singularly. Rather, it is the combination of the two that poses the challenge, Mr Jones noted. “We’ve developed completion equipment to handle temperatures of 600° to 650°F for low-pressure wells, and we’ve developed high-pressure tools that can work in cases where temperatures are 300°,” he said. “But there is a lot of uncertainty when it comes to the HP and HT part of the envelope.” Among the concerns is economics, as drilling and completion costs for wells exceeding 10,000 psi are extremely high. “A well that is 32,000 feet at 25,000 psi is easily $100-plus million,” he said.

The HPHT GOM wells currently producing are typically 28,000-ft to 35,000-ft deep, sometimes in water as shallow as 30 ft, at 15,000 psi and 350°F. There are roughly 10 to 20 15,000-psi wells completed each year in the Gulf, Mr Jones estimated. “If there have been any 20,000-psi wells completed, it’s a handful.”

But the industry wants to go higher, and that translates to a need for better tools. One of the biggest issues is safety valves, which are being enhanced to handle pressures of up to 25,000 psi. “We can always handle more pressure with more thickness,” Mr Jones explained. “But then we risk having the walls so thick and the flapper so thick that we have no production room left. Then we have the added challenge of very high production rates with a safety valve that is not able to withstand the force encountered in a slam closure at extremely high rates.”

Weatherford has spent millions of dollars advancing its safety valve technology, thinning down the flapper to provide for a bigger inner diameter (ID) compared with the outer diameter (OD).

“Now, technology in the area of flapper design of safety valves has led to the ability to get stronger flappers with much thinner cross sections,” Mr Jones said. “This has led to flapper design with a cross section that would have been associated with a 10,000-psi flapper able to handle pressure ratings of 15,000 psi and higher.” The quality of the bores in the safety valves also has been enhanced. “We’ve improved the technology in getting slick finishes on our bores, which help the seals last longer and seal better,” he added.

In terms of metallurgy for extreme temperatures, service companies have addressed that issue – up to a point. “When we get into these higher pressures, we’re already using high-chrome metals, which are still stable at these temperatures,” he said. “We build our packers out of metals that are good for 600 to 650°F now.” But the industry has yet to test tools for 500°F at 20,000-plus psi. “Our main concern from a high-temperature perspective is being able to have a life-of-well operating system,” Mr Jones noted. “When we start building a 25,000-psi safety valve, we will need to test at temperature and pressure to make sure something unexpected doesn’t happen.”

The process for testing HPHT technologies can be difficult, often taking months or more than a year. If the technology being tested fails or is destroyed, it must be redesigned and rebuilt. Baker Hughes has built a facility that is capable of testing equipment at 40,000 psi and 700°F, a huge jump in what the company’s previous and standard industry test wells could handle, said Gus Weinig, packer product line manager.

“We had to reinforce the test well with significant amounts of concrete and rebar because, if a tool fails at high pressures, we have to safely contain it,” he said. “We want the equipment to fail in the test rather than in an actual operation.”

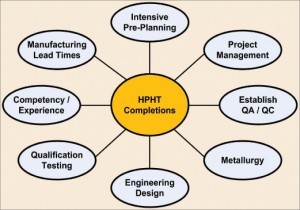

While the current HPHT well environment limit for Baker Hughes approaches 25,000 psi and 500°F, the company is being requested to push the development of tools and materials to even higher levels, to 30,000 psi. “Operators are looking to the future, so they are asking their suppliers to start exploring new technologies that aren’t needed now but may be in two, three or five years,” Mr Weinig said. “And they are asking for equipment that will be reliable for a 20-year well life.”

However, there are issues such as development of elastomer and polymer components, especially sealing components, that can withstand higher temperatures. Sealing units are particularly tricky when sealing packers against the casing inside diameter.

“It’s difficult not only because of the required materials and whether the seals can withstand the temperature and pressure, but containing those sealing elements so they don’t extrude or blow out is also a challenge,” Mr Weinig explained. “They also need to be made with materials that can withstand exposure to chemicals and downhole fluids in an HPHT environment.”

In terms of well design, customers want a large-diameter pipe to get the resources out. “Sometimes when we’re working with high pressure, metals have to get a lot thicker, so we don’t have a lot of room left over to fit the tools in the casing and still have the desired flow areas for the produced fluids,” Mr Weinig continued.

“Lead times also are challenging. We work closely with our customers to design tools, sometimes when they are still designing the wells. If they change the dimensional envelope of the casing, for example, that causes us to go back to the drawing board and redesign.”

Also, government regulations have become more stringent, especially in the Gulf of Mexico. “In some cases, if an operator wants a tool with a particular pressure grading, we have to test it to an even higher pressure,” Mr Weinig said. “The quality and reliability requirements of the design and manufacturing of these tools is another piece that must be factored into the product development time. Operators take extra steps to ensure they don’t experience any mishaps in these ultra-deep wells.”

Technologies on the horizon are HPHT intelligent well solutions that regulate the flow and pressure in the wellbore, especially in multizone completions, he said. LWD and MWD tools also will need to be advanced. “It’s an ongoing process,” Mr Weinig noted. “Fifteen years ago, a well at 10,000 psi and 350° was a challenge. Now we do it all day long. And, as we’re starting to feel comfortable with 15,000 psi pressures and 450°, the new barrier has moved to 25,000 psi and 500°.”

THIS IS A GOOD FORMATIVE REPORT. WILL APPRECIATE AADVISING ME IF YOU HAVE ANY ADDITIONAL INF RE COMPLETIONS, LOWER AND UPPER COMPLETIONS. THANKS.