Australia embarks on coal seam gas, the next E&P frontier Down Under

By Katie Mazerov, contributing editor

Down under and far away, Australia is a land unto itself. From its vast outback to verdant farmland to a bustling coastline, it is a place defined by great distances and differences that pose a unique set of challenges for the country’s energy market. A longtime and steady producer of oil and gas in conventional onshore and offshore fields that remain significant, Australia is looking to new and unconventional resources to chart its future.

On the east side of this expansive and geologically diverse country, coal seam gas (CSG) drilling is ushering in a new era of hydrocarbon development and bringing in a wave of contractors and service companies that have not traditionally had a presence in the region.

A world away, the North West Coast of Australia is seeing a new stabilization in the offshore market, bolstered by large and promising natural gas developments. Onshore in the state of Western Australia, extensive shale and tight-gas deposits are poised to bring on yet another frontier of development.

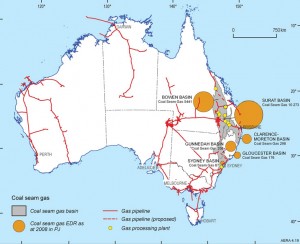

But the big story for now is the CSG market, centered in Queensland. Proven and probable reserves of CSG in Australia as of December 2009 were estimated at 26,132 petajoules (PJ), or close to 26 trillion cu ft (TCF), according to the Australian Atlas of Minerals Resources, Mines and Processing Centres, published by Geoscience Australia, a division of the Australian government. The figure was a 61.5% increase over the previous year’s estimate. Queensland has close to 90% of the reserves, in the Surat and Bowen basins, with the remainder in New South Wales.

The prospects hold a wealth of opportunity but also bring a host of challenges for a region unaccustomed to this level of activity. CSG is shallow and fast to recover, and most wells are vertical and require simple completions. They are brittle and partially fractured, but they can be extremely unstable due to formation stresses. Saline water production associated with the wells presents an environmental challenge to the industry.

Residents in the region, which includes agricultural farmland, are fearful about the effects of drilling on local aquifers, and both the Queensland and Australian governments have imposed strict regulations on a number of aspects of the process, including well design and hydraulic fracturing fluid chemistry.

Production of CSG in Queensland began around 15 years ago, but the game-changer occurred in 2007 when a number of Australian operators saw an opportunity to commercialize CSG by liquefying it for export to markets in Southeast Asia, said Simon Hann, manager, CSG Drilling and Completions for Santos. The company, one of the oldest and largest in Australia, is one of the Big Four Australian operators that have formed partnerships with major oil and gas companies in the venture. Santos is also the largest producer in the Cooper Basin, a conventional basin that has been producing oil and gas since the mid-1960s.

“Up until this year, the companies were progressing with their plans for CSG production independently,” Dr Hann said. “Now we have our final investment decision based on a defined scope. On the drilling and completions side of the business, we are starting to collaborate to establish standardization for training, competencies and contracting.”

Santos, in partnership with PETRONAS, Malaysia’s national oil and gas company; French energy major Total; and Korean company KOGAS, the world’s largest LNG importer; will develop approximately 2,650 exploration and production wells in the region. The company is anticipating drilling approximately 200 CSG wells this year in Queensland for its multibillion-dollar Gladstone LNG project, with a fleet of 14 drilling and completion rigs, two frac spreads and workover equipment.

In an effort to minimize the footprint and reduce surface facility and infrastructure costs, Santos is doing directional pad drilling. “We have 30 different well designs – open- and cased-hole fracturing, fracturing in deviated wells, open-hole completions and multilateral designs – depending on where we are in the field and the depth of pay,” Dr Hann said. “We are going as deep as 5,900 ft, with step-outs of up to 6,500 ft.”

While CSG reserves often are considered easy to produce in light of today’s drilling environments, there are difficulties. “Deviated drilling through unstable, underpressured coals increases the complexity of both the drilling and the completions, especially where fracture stimulation is required in deviated wells,” Dr Hann said. “We have losses, hole-instability issues and structural stresses in the formations. Reservoir pressures are 5 and 6 ppg, and if we drill with any fluid system, we have total losses.”

Santos is developing systems for managed pressure drilling on air for drilling in highly depleted, structurally stressed formations to maintain reservoir pressure during drilling intervals, and is deploying electromagnetic tools for geosteering.

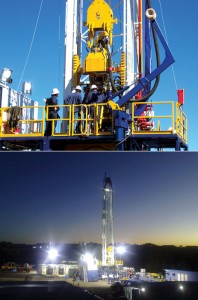

The fleet consists of relatively small and mobile rigs, primarily hydraulic or AC-driven, that are suitable for pad drilling, Dr Hann continued. They range from high-speed, light, truck-mounted coring rigs that can spin bits at 800 or 1,000 rpm to rigs with pipe-handlers with mast ratings up to 300,000 lbs and one or two mud pumps.

While the outlook for the CSG market in Australia is bullish, it is also a “moving feast and a tricky thing to balance,” Dr Hann noted. Santos plans to keep its rig count at 14 for the next three or four years. “We’re trying to balance the resources to the demand in a sustainable way,” he said. “Historically, Australia has not been an active spot market. We have not had the luxury of picking up and dropping off rigs on an ad hoc basis, so the minimum contracting period is 12 months.”

In response to environmental concerns, operators are engaged in a massive education effort to reassure landowners that the chemicals used in hydraulic fracturing, as regulated by federal and state governments, are not contaminating ground water and that CSG water production is not depleting aquifers used by farmers.

“We are operating in the backyards of the landowners, and we want to have a respectful and harmonious relationship with them,” Dr Hann said. The government requires risk assessment before hydraulic fracturing is undertaken, baseline assessments of all wellbores, a re-baseline after hydraulic fracturing activity and water testing before and after fracturing, he added.

The CSG market has attracted a number of outside contractors, thanks in part to Canadian government incentives for Australian companies to invest in Canadian rigs. Calgary-based Savanna Energy Services entered the Australian CSG market in January, bringing the technically advanced hybrid rigs the company has used successfully for similar drilling programs in western Canada. By the end of 2011, the company will have four drilling rigs and three completion rigs deployed in Queensland.

The rigs are particularly suited for the shallow, vertical CSG wells in many areas of Queensland, said Mike Bill, general manager. “Most of the wells we are drilling are shallower than 3,300 ft, normally around 2,600 ft,” he said. The company uses coiled tubing, which delivers high ROP, to drill a vertical well, then deploys drill pipe for the horizontal section.

“What makes CSG attractive is that in a world where drilling is becoming more complex, this is very simple,” Mr Bill said. “On the flip side, people are concerned about the water production that comes with CSG, and that a lot wells must be drilled to get the gas production.” Horizontal production typically goes to 1,640 ft, but some operators are looking to push that number to 4,900 ft, he noted.

Saxon Energy Services, also based in Calgary, has four drilling rigs and five completion rigs going into a Queensland field that is operated by Queensland Gas Company, a division of British Gas (QGC/BG). These will be Advanced Technology Single (ATS) rigs, a design for shallow to medium depths that the company introduced in 2006 and hopes will bring about a step-change in rig design for the Australian market. “We produce highly efficient, advanced-technology style rigs for the wells these companies need to drill,” said Jim Thorn, vice president, business development.

However, Australian government regulations on load sizes, rig-moving characteristics and electrical specifications are having a significant impact on the kind of rigs that can be brought in, Mr Thorn said.

“By thoroughly researching a jurisdiction’s permitting requirements, Saxon can structure its rig loads to move with the least number of permits required, thereby decreasing inter-well times and the proportion of time spent drilling,” he continued. “A collaborative approach with the operator ensures that the rigs deliver superior operational performance and lower per-well costs.”

The ATS rigs will be highly mobile, with remote monitoring, advanced instrumentation for data acquisition, and a pipe-handling system designed to reduce crew contact and promote safety and efficiency. “With the land access issues and hilly farmland terrain, the moving aspects of the rigs become extremely important in looking at the life of the project,” Mr Thorn said.

Earlier this year, Saxon brought in three conventional rigs that are working for Santos in the Cooper Basin, drilling 9,800-ft gas wells. Primarily a desert region, the Cooper Basin stretches from South Australia and touches the northwest tip of New South Wales and Queensland. The Jackson Oilfield, discovered in 1981, is the basin’s largest oil-producing area.

“Cooper Basin is the most important onshore oil and gas field in Australia and is where the majority of the supply still comes from,” Mr Thorn said. “Between 30 and 50 wells per year are drilled in the basin. It’s a fairly mature market, but it’s a huge region, and there is still plenty of opportunity. Relatively speaking, Australia is still a fairly new market and in the past has been consistent with conventional oil and gas production.”

Easternwell, operating since 1976, has well-servicing and drilling rigs operating predominantly in the Cooper Basin and on Barrow Island, off the coast of Western Australia, where the Gorgon Gas Project is under construction and expected to produce 40 TCF of gas.

However, the bulk of the company’s operations are in Queensland, the hub of the CSG activity. “The coal seam gas market in Eastern Queensland is experiencing its most significant growth ever previously encountered in Australia,” said Luke Smith, general manager, operations, at Easternwell Energy and vice chairman of the IADC Australasia Chapter.

The company’s Advantage Series rigs, designed for the CSG market, are capable of drilling 4,900-ft directional wells. They feature automated pipe handling and can move quickly and efficiently for either pad drilling or short-distance rig moves. Easternwell, an experienced CSG drilling contractor, has three drilling rigs and four well-servicing rigs contracted in the Surat Basin in Queensland, with another four or five well-servicing rigs expected to be deployed later this year.

Thousands of miles to the west, Australia’s offshore market is set to move into a development phase following recent exploration and appraisal activity off the country’s northwest coast. Much of the production will involve gas reserves that are close to the Asian markets. “We have a healthy, steady rig market underpinned by some large gas development projects,” said Brett Darley, vice president drilling and completions for Woodside Petroleum.

Australia’s offshore rig market is set to move into a gas development phase following recent exploration and appraisal activity off the country’s northwest coast. Much of the production will involve gas reserves that are close to the Asian markets. “We have a healthy, steady rig market underpinned by some large gas development projects,” Mr Darley said.

A key region is the North West Shelf, which has been producing for more than 25 years and continues to provide 40% of Australia’s oil and gas. Woodside, together with its joint venture participants BHP Billiton, BP, Chevron, MIMI and Shell, owns the North West Shelf Venture. Woodside also operates the North West Shelf Project, one of the world’s largest LNG projects.

“The wells we have executed to date in the North West Shelf are prolific producers, with most wells capable of flowing 300 million cu ft of gas per day,” Mr Darley said. “Recently, we have seen exploration moving into the deeper, outboard areas of the North West Shelf, where last year Woodside drilled a well in a record water depth of 6,200 ft.” Woodside’s deepest production wells to date are in 2,600 ft of water in the Pluto gas field, which is planned for startup next year, he added.

Woodside is active in other areas of Australia, including the Browse Basin off of the Kimberley coast, the Exmouth Sub Basin off the North West Cape and the Bonaparte Basin in the Timor Sea.

“Australia is a unique market, with our distance from the rest of the world having a large influence on our business,” Mr Darley said. “It is a relatively difficult market to enter as mobilization costs are significant, the regulatory environment is rigorous, and the business costs are comparatively high. As a result, companies look for long-term opportunities before committing people or equipment into the country.”

Other challenges include the sheer size of the state of Western Australia – 1 million sq miles – and the fact that the operating bases are 1,000 or more miles from Perth, the corporate center of the country’s offshore E&P industry. “The logistics of moving people and equipment can be challenging,” Mr Darley said. “And with the coal seam gas activity on the east coast of Australia ramping up, it is putting pressure on an already limited pool of expertise and equipment.

“But the current market stability has done a lot to give confidence to the major service companies to invest in facilities and bring experienced people in on a long-term basis,” he continued. “For example, we now have more local servicing of specialized downhole tools, wellheads and trees that historically was done in Singapore, which has been a positive change.”

Australia’s current offshore rig count includes 11 semi-submersibles and two jackups. Of those, Woodside has three semis, two for deepwater and one for shallow water. “This is a relatively steady market; we haven’t seen a large change in rig numbers in the past few years,” Mr Darley said, indicating that the stable activity level is a positive change from the boom-and-bust cycles of yesteryear.

The future of Australia’s market may include yet another unconventional resource, with the government of Western Australia issuing permits for development of extensive onshore unconventional tight gas and shale reserves. The move is one of several initiatives intended to supply natural gas to the domestic iron ore mining industry and wider economy and to avert a “predicted gap” in domestic gas supply. It also signals the government’s desire to promote production of cleaner natural gas over coal and diesel.

“The unconventional tight-gas and shale-gas market in Western Australia is in its infancy, but there is a golden opportunity for companies with solutions to tap into this promising region,” said Duncan MacNiven, a partner in Warrego Energy, a private UK company that has been awarded an unconditional permit (EP469) to develop an 86-sq-mile block in the North Perth Basin. The block contains the West Erregulla tight-gas field, which underlies the Kockatea shale play recently mapped by the US Energy Information Administration (EIA). Other operators also are moving into the region.

The company plans to drill an appraisal well in 2012 and begin commercial tight-gas production in 2014, with 10 to 12 wells planned. The Kockatea shale also will be appraised as part of the 2012 appraisal program. “There has been conventional oil and gas production in the region for decades, but most of that is depleted, so the focus has shifted to unconventional resources,” Mr MacNiven said. “If the EIA assessment of the still-to-be-appraised Kockatea shale is correct, and we have no reason to believe it isn’t, preliminary estimates for gas-in-place resources in Warrego’s block may be of the order of 9 TCF.”

Mr MacNiven and his partner in the venture, Dennis Donald, previously owned an independent drilling engineering firm, with an office in Perth, Western Australia, that specialized in the applications of advanced drilling techniques such as coiled tubing, underbalanced drilling and managed pressure drilling.

While government regulations on hydraulic fracturing are expected to become more stringent, Mr Donald said that unlike CSG, fracturing will be done 10,000 ft below the water table. Furthermore, Western Australia has a population of just 2.4 million, with most of that centered around the Perth metropolitan area on the coast.

“The scope of opportunity and type of operation we are envisioning is going to require the introduction of a number of cutting-edge technologies not currently available in Western Australia,” he added. “There is not a single drilling rig in all of Western Australia that can drill to the depths we need, more than 13,000 ft. The service infrastructure needs to expand to keep pace with developments in the unconventional gas sector.

“But,” he continued, “we think a blend of local knowledge about the logistics and geology of the region, and customization of the technologies available in Canada, the United States and the UK will provide the key to unlocking these massive reserves and meet the country’s predicted domestic energy shortfall.”

ATS is a registered trademark of Saxon Energy Services.

Trying to find a comprehensive list of drilling companies operating in QLD. We service all the major miners with our technology and are looking to shift into the gas and petrochemical sector. Your assistance greatly appreciated.

Phil Goulding