Environment, Social & Governance

Noble spearheads simulation exercise to better understand well control associated with CO2 drilling

Noble spearheads simulation exercise to better understand well control associated with CO2 drilling

Noble Corp joined forces with Endeavor Technologies, as well as other industry organizations like DNV, on 5 June to conduct a simulation of the drilling of a CO2 well. Zach Bruton, Senior Business Developer for CCS at Noble, spoke with DC at the Endeavor Experience Center in Houston to explain the market drivers behind the simulation project, as well as the future of carbon storage. He also discusses the learnings that Noble anticipates to capture from the project, which could provide the industry with a better understanding of well control challenges and training needs for drilling CO2 wells – and potentially even for the development of industry standards around the certification of CO2 drilling rigs. Click here to access the video and learn more.

DNV report: China shows impressive renewables growth but will likely continue to rely on imports for oil and gas

DNV’s Energy Transition Outlook China shows the country is establishing itself as a green energy leader with an unrivaled build-out of renewable energy and export of renewable technology. However, fossil fuels will still account for 40% of its energy mix in 2050.

Energy independence is a key motivation for Chinese energy policy, but it will be only partly achieved. The power sector is decarbonizing by replacing coal with domestically sourced renewable energy, and domestically produced coal will largely be sufficient for the remaining coal demand by 2050. However, oil and gas usage will continue to rely on imports. Although oil consumption halves by 2050 from its 2027 peak, its use in petrochemicals and heavy transport will linger, and 84% of oil use will be met through imports. Natural gas consumption in 2050 will only be marginally below 2023 levels.

China’s energy use will peak by 2030 and reduce by 20% by 2050, driven by electrification and energy-efficiency improvements. This decline will also be enabled by demographic shifts, including a projected 100 million population decrease. By 2050, China’s share of the world’s energy-related CO2 emissions will have declined to a fifth, vs a third in 2023. In absolute terms, China’s emissions will reduce by 70%, following a path close to meeting its target of carbon neutrality by 2060.

Equinor gets green light to develop 2 new North Sea CO2 storage licenses

Equinor has been awarded the operatorships and 100% share for the development of two new CO2 storages in the North Sea.

The new licenses, Albondigas and Kinno, are each expected to have the capacity to store around 5 million tonnes of CO2 per year when in operation. This estimate will be further determined in the exploration phase.

Equinor said it expects 4-8% real base project returns for its early phase CO2 storage business.

The company is maturing a ship-based solution, as well as a large pipeline to connect industrial emissions in Europe with storage opportunities on the Norwegian Continental Shelf. The planned pipeline, named CO2 Highway Europe, will have the capacity to transport 25 million to 35 million tonnes of CO2 per year from Belgium and France.

Equinor is also about to complete the first phase of the Northern Lights CO2 transport and storage facility, which will be ready to receive CO2 by the second half of this year.

Separately, Equinor was also awarded its first CCS exploration permit in Denmark as operator, together with partners Ørsted and Nordsøfonden. The partnership will start surveys to assess if the onshore license in the North West Zealand can be developed into a safe CO2 storage facility.

The project, called CO2 Storage Kalundborg, has a reservoir approximately 1,400 m below ground and a potential capacity to store up to 12 million tons of CO2 per year.

If the partnership successfully develops the permit into a CO2 storage facility approved by the Danish authorities, it could start storage of CO2 at the end of this decade.

“Our first important task in the project is to ensure that environmental requirements are met before seismic and subsurface data collection can start. The exploration phase will last several years, before the Danish authorities approves the license area as suitable for safe and permanent CO2 storage,” said Grete Tveit, Senior VP for Low Carbon Solutions at Equinor.

Robert Gordon University issues report urging action to help UK achieve ‘just and fair’ transition by 2030

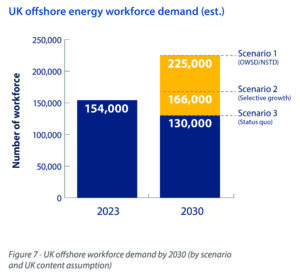

A report by Robert Gordon University (RGU) asserts that the UK will fail to achieve a “just and fair” transition by 2030 unless there is urgent alignment across the political spectrum to sustain UK offshore energy industry jobs, supply chain investments and the economic contribution of the workforce.

More than 6,560 pathways for the UK offshore energy industry between now and 2030 were analyzed, and fewer than 15 were found to meet the “just and fair” transition principles set out by the United Nations. Even these limited scenarios require success by the renewables sector in achieving higher levels of ambition through billions of pounds of additional investment in the next six years.

“The latest research reinforces the need for urgent alignment across the political spectrum to agree to the short-term actions that will deliver a just and fair transition, maintaining the workforce to 2030 to deliver a long-term net zero future and the associated economic benefits for the country,” said Professor Paul de Leeuw, Director of the RGU Energy Transition Institute.

The report notes that, in order for the pathways to a “just and fair” transition to remain open, the decline in oil and gas needs to be offset much more rapidly by greater levels of activity in renewables. Otherwise, interim steps will need to be taken to address the decline in oil and gas production, which is expected to reduce by more than 40% by 2030.

“To achieve this outcome, the UK offshore energy sector needs to deliver on spend of up to £200 billion over the remainder of this decade across offshore wind, hydrogen, carbon capture and storage, and oil and gas projects,” Mr de Leeuw said.

The report links the UN’s “just and fair” definition – “ensuring that no one is left behind in the transition to low carbon and environmentally sustainable economies and societies” – to sustaining the UK’s 154,000 direct and indirect offshore energy industry jobs and maintaining the supply chain and offshore workforce economic contribution at 2023 levels or better by the end of the decade.

Other key findings from the report:

- To sustain the UK offshore energy supply chain activities and capacity at 2023 levels, the UK must deliver around £10 billion spend by 2030.

- If the UK is unsuccessful in delivering the offshore wind ambition and UK content targets by 2030, it is unlikely to be able to retain the offshore energy workforce without progressing additional activities, including oil and gas.

- Significant levels of new operational capacity and capability will be required to deliver on the ambition of up to 40% UK CAPEX content for new offshore wind projects and up to 50% for oil and gas decommissioning activities by 2030.

- Every 10% salary differential between oil and renewables may require up to 7% more people to maintain economic contribution. Approximately one in 30 of Scotland’s working population are employed in or support the offshore energy industry, vs 1 in 220 across the UK.

- If Scotland fails to capture a significant share of future renewables activities, selective oil and gas activities may need to be sustained until 2030 to retain the Scotland-based offshore energy workforce, skills, supply chain and economic contribution.

Open Group launches draft standard to communicate, manage emissions data

The Open Group Open Footprint Forum recently released the Open Footprint Data Model Standard, Version 1.0, Snapshot 1. The standard sets out to define a common standard by which companies can effectively manage and communicate emissions information, regardless of the complexity of their global footprint and regulatory environment.

Organizations are challenged to reduce their carbon footprint across complex value chains and adapt to a growing number of emissions regulations and reporting demands. With requirements for data sharing increasing, the current patchwork approach to data recording, reporting and sharing is becoming inefficient and an obstacle in the mission to reach net zero emissions goals.

The Open Footprint data model will help companies to account, store, report and share emissions-related data across value chains, industries and international borders. Upon implementation, companies will be able to lower administrative burden and focus on reducing emissions.

The standard will be delivered with reference application programming interfaces and database schemas and will be continuously updated to support emerging emissions regulations and standards.

“Publishing the first snapshot of the Open Footprint Data Model Standard is an important milestone for the Forum,” said Jim Hietala, VP Sustainability and Market Development. “We’re excited to receive industry feedback and continue to enhance emissions data management.”

Snapshots are draft documents that provide a mechanism for The Open Group to disseminate information on its current direction and thinking to an interested audience. They represent the interim results of activities that advance the standard.

Click here to access the Open Footprint Data Model Standard, Version 1.0, Snapshot 1.