Steady but flat outlook forecast for the global onshore market in 2025

Rig and well counts set to rise slightly, but E&Ps’ spending caution, continued M&A activity and OPEC+ cuts will likely limit growth

By Stephen Whitfield, Senior Editor

Today’s global onshore drilling market is in a holding pattern. With activity expected to go up in some regions and down in others, the end result is a market that will not look that much different from 2024 to 2025.

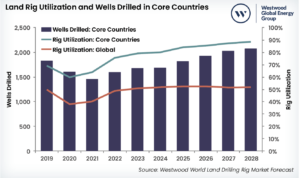

Westwood Global Energy Group expects to see a slight increase in the total number of onshore drilling rigs operating around the world, from 4,384 in 2024 to 4,617 in 2028, which is the end of its most recent forecast period. The number of wells spud will also increase, from 49,300 this year to around 51,000 in 2028. The US will see very little movement in activity, Russia may see a decline, countries like China and India will see an increase to counterbalance that decline in Russia, and the Middle East remains a wildcard.

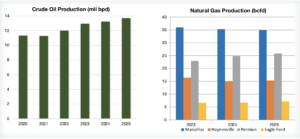

Global liquids and gas production are expected to go up over the forecast period, as well. Liquids production could rise from 102.4 million bbl/day in 2024 to 108.4 million bbl/day in 2028, though demand and the actions of the OPEC+ group will play a major determining factor in this. Gas production, meanwhile, will rise from 68.1 million bbl/day in 2024 to 73.4 million bbl/day in 2028.

Ben Wilby, Senior Analyst at Westwood, said it was fair to describe the global onshore market as “middle of the road” in the near-term future.

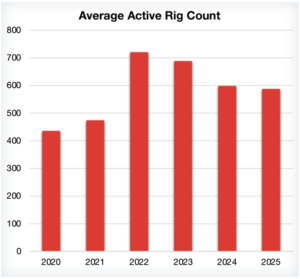

“Over the coming years, global rig demand is likely to be relatively flat, with limited year-on-year change. It will be interesting to see what happens in the US and how that will impact the global picture, and what that will mean for US-centric land rig contractors. We’re definitely not at that stage in 2022 where rig demand suddenly jumped up. We’ve retreated from those kinds of glory days there and in a number of other markets,” he said.

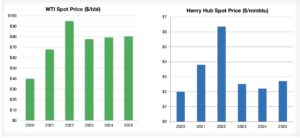

Right: The Henry Hub price will show slight recovery from its $2.21/mmBtu average in 2024, moving up to $2.71/mmBtu in 2025, according to Spears and Associates. That is still well below the 2022 average of $6.35.

The US drilling market largely mirrors the pricing environment experts are expecting to see heading into next year. WTI is expected to hit $80.38 next year, though Spears & Associates President John Spears said he wouldn’t be surprised if it falls within a $75-85 range, same as what he had forecast for 2024. Mr Spears also projects Henry Hub gas prices to reach $2.71/mmBtu in 2025. While that would be a year-on-year increase over the average $2.21/mmBtu in 2024, it would still be well below the $7-8 prices that the industry saw for much of 2022.

“The industry’s trying to reduce gas injections so that we can bring inventories back to normal, and that can take several months to get done. We’ll be pretty close to normal by the end of the year, but there’s still going to be a lot of gas looking for a home,” Mr Spears said.

With gas prices not expected to see a major upswing, rig activity will also not see much of an upswing. US Lower 48 rig count and wells drilled are also expected to stay largely at the same level over the coming year – from 598 rigs and 16,500 wells in 2024 to 587 rigs and 16,500 wells in 2025. Total Lower 48 oil production is also going to stay stagnant – from approximately 13.23 million bbl/day in 2024 to 13.69 million bbl/day in 2025. Gas production will move from 110 billion cu ft/day in 2024 to 113 billion cu ft/day in 2025.

“The focus right now is clearly on achieving profitability goals,” Mr Spears said. “I think that’s just a feature of the market that is going to be with us moving forward. That means the market’s not going to be responsive to changing commodity prices like it used to be, at least in terms of rig activity and CAPEX. All the numbers we’re looking at today are showing little correlation between the change in oil or gas prices and a change in rig activity. It’s more about setting a standard – here’s our program for the year, now let’s try to figure out ways to get things done a little bit better so that we can operate in this fashion over the next 10 years and not just live quarter-to-quarter making Wall Street happy.”

US Lower 48 and Canada

In the US Lower 48, the Permian Basin remains the main story. Mr Spears estimates the region will account for approximately 60% of the US onshore rig count both this year and next year – rigs in this basin are expected to average 300 in 2024 and 2025. The number of wells drilled is expected to hit 8,000 this year and 7,800 next year. This activity level remains below what the Permian saw in 2023 – 335 rigs and 8,600 wells.

This lack of movement in the Permian year-on-year is partially a byproduct of the merger & acquisition activity seen among US operators over the past few years, he added. Notable deals include Chevron’s $6.3 billion acquisition of PDC Energy in 2023 and ExxonMobil’s $60 billion acquisition of Pioneer Natural Resources, which was completed last May.

“Generally speaking, the mergers have always been a bit disruptive for service firms. The operators hit pause for a little bit and try to reconfigure the wells they’re going to drill. Then there’s reconfiguring the supply chain because the acquirer always brings their guys into the discussion, which can be very disruptive. We’ve seen rig count fall 5% since these mergers really began to hit the news,” Mr Spears said.

Moreover, the M&A activity in US onshore has given operators significant amounts of acreage, and instead of investing in more rigs, they are choosing to boost production by increasing lateral length. Mr Spears said he expects Permian lateral lengths to average 11,000 ft this year and increase to 11,500 ft next year.

“When we look at the bigger measures of activity, it’s more about those longer laterals that we’re seeing being drilled,” he said. “It’s not so much the things you measure on the ground, like rigs running, where you’ll see movement in the market. It’s going to be the total footage drilled and the wellbore exposure from longer laterals. Operators have enough acreage on their hands now that they can drill more of these 15,000-ft laterals in the Permian, for instance. We don’t see much push coming from commodity prices, so the industry is going to be left to work on finding a little bit better way to get things done.”

Right: Gas production in the US Lower 48 will also see a slight increase, although growth will be limited with gas prices remaining relatively muted.

Apart from the Permian, other US onshore basins are also not expected to see a lot of change. One exception to this trend is the Haynesville, as it is a heavily gas-producing basin in a sensitive gas market. Gas storage operators are still dealing with the aftereffects of a warmer-than-expected winter in 2023-2024, holding 450 billion cu ft of surplus gas as of August. Spears and Associates estimates that gas storage operators bought 20% less gas in summer 2024 compared with summer 2023.

As long as storage operators are looking to reduce gas injections and drive down the gas surplus, the gas price will remain low, Mr Spears explained. Then, as long as the gas price remains low, the need for drilling in gas-heavy basins will not grow. Rig count in the Haynesville is expected to fall to 30 rigs this year, from 52 in 2023. If gas inventory returns to normal levels by early 2025 as Mr Spears expects, then rig activity should pick up slightly in next year, moving up to 35 rigs.

“The Haynesville is the poster child for all the issues with the gas market. It’s the swing producer,” he said. While the Marcellus has takeaway requirements and will deliver a certain amount of gas no matter the price, in the Permian all the associated gas coming with the oil will also come out of West Texas regardless of the price. “However, the Haynesville is sensitive to price. That’s where the most pain is being felt among the operators and the service firms.”

The story in Canada is all about pipelines and LNG. The Trans Mountain pipeline expansion started up in May 2024, shipping 590,000 bbl/day of oil from Alberta to the Pacific Coast. Three significant LNG projects are set to start up over the next three years, starting with the Shell-led LNG Canada in mid-2025, while Woodfibre LNG and Cedar LNG are expected to begin operations in 2027 and 2028, respectively. Mr Spears estimated that those terminals will bring 2.5 billon cu ft/day combined in LNG exports.

The pipeline and upcoming LNG terminal are going to have a trickle-down effect on drilling in the country – Spears & Associates estimates a 4-5% annual growth rate in rig activity over the next three years as these midstream projects come online. Even with the same middling price environment in the US, rig count is still expected to see a 6% increase from 2023 levels. Year on year, he said, Canada should see 188 rigs running in 2024 and 196 in 2025; those numbers compare with 179 in 2023. Wells drilled will move from 6,800 in 2024 to 6,950 in 2025.

“I think we’re going to see things pick up next year. Just opening up that new oil pipeline was enough to send rig activity up, even though Canada has the same commodity price environment that we’re dealing with in the US – fairly steady oil prices and terrible gas prices. Operators in Canada have gotten busy developing their oilfields so they can supply that pipeline. That’s really picked things up on the oil side, and then the gas side is going to really pick up next year.”

India

Outside of North America, 2025 will be dominated by the same major onshore markets as in the past few years, such as the Middle East and Argentina. However, Mr Wilby noted India as an emerging market that could evolve into a major player in the onshore space fairly soon. Westwood forecasts both rigs and wells drilled in India will see a jump over the course of its forecast period – 111 rigs and 553 wells in 2024 vs 142 rigs and 670 wells in 2028. A big reason for this is the increase in oil demand the country is expected to see over the course of the decade.

In February, the International Energy Agency said it expects India – currently the third-largest oil-importing country in the world – to be the largest driver of global oil demand growth through 2030. It’s expected to account for more than one-third of the projected 2.3 million bbl/day of global increases from 2023 to 2030. The agency forecast India’s demand will reach 6.6 million bbl/day in 2030, up from 5.5 million bbl/day in 2023. To meet this growth in domestic demand while decreasing its reliance on foreign imports, India is expected to boost its drilling activity, both onshore and offshore, Mr Wilby said. India imported 232.5 million tonnes of crude oil in the 2023-2024 fiscal year, according to the Oil Ministry’s Petroleum Planning and Analysis Cell.

“I think the story for a lot of these emerging superpowers is in reducing the need for imports,” Mr Wilby said. “It’s such a huge drain on the economy to import the product needed to meet that demand. India is notorious for missing its production targets, but I do think it’s a market where we can see demand and rig activity creeping up quite steadily.”

While the bulk of ONGC’s contract awards over the past couple of years have been in the offshore space, the company has also been active in building a portfolio of onshore projects. In 2021, under the Indian government’s “Make in India” initiative, ONGC contracted Megha Engineering and Infrastructures (MEIL), an Indian fabrication company, to deliver 27 land drilling rigs and 20 workover rigs for $860 million. So far, three land drilling rigs have been deployed at the Rajahmundry field in the state of Andhra Pradesh. Further rigs are planned to be deployed to seven other ONGC fields – Sibsagar, Jorahat, Ahmedabad, Ankaleshwar, Mehasana and Cambay, Agartala, and Karaikal.

ONGC also announced an onshore discovery in August at the PURN-1 exploration well in the Olpad Formation of the Cambay Basin, located in northwestern India. The discovery opened up a new area for exploration in and around OALP block CB-ONHP-2019-1.

Middle East

Generally, there is a positive outlook on the short-term future of the Middle East onshore drilling market. Westwood forecasts that rigs will increase from 412 in 2024 to 618 in 2028, while wells will go up from 2,882 in 2024 to 3,427 in 2028.

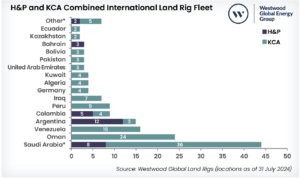

Mr Wilby pointed to Helmerich & Payne’s (H&P) acquisition of KCA Deutag, announced in July 2024 and expected to close by the end of the year, as a signal of the direction in which the Middle East market is heading. KCA Deutag’s Middle East contracts were the “real prize” of the deal for H&P – 71% of the company’s EBITDA in 2023 came from land drilling countries in the three core countries – Saudi Arabia, Kuwait and Oman. All three of those countries are expected to see notable growth over Westwood’s forecast period.

Westwood expects utilization in those countries to grow from 79% in 2024 to 89% in 2028, even as major regional players like ADNOC Drilling, Arabian Drilling and SANAD undertake newbuild land rig additions.

“With H&P, their purchase of KCA Deutag was a huge signal of how they see the Middle East being an important part of their future. KCA Deutag has rigs all over the world, but it’s their Saudi Arabian rig fleet and the Middle East rig contracts that are the real prize of the $2 billion deal. It’s the kind of hot place where people want to bring their rigs,” he said.

Saudi Arabia will be a highlight for global rig demand over Westwood’s forecast period. Eight H&P rigs have had tenders announced in 2023 and 2024, with each rig being sourced from the company’s idle US rig fleet. KCA Deutag also operated 36 rigs in Saudi Arabia. Demand is expected to grow year on year – likely offering further opportunities for H&P to move more rigs from North America into the country.

However, the optimism surround the Saudi Arabian market comes with caveats. Mr Wilby noted the recent spate of jackup contract cancellations as evidence of how things can change quickly in that country, especially given the monopolistic contracting environment with Saudi Aramco. He also noted that the recent extension of the full 2.2mmbpd of OPEC+ voluntary production cuts until December is a sign that global oil demand is not as high as expected. The production cuts had commenced in April 2023 and were set to slowly be reduced from September.

With huge projects offshore Guyana and Brazil expected to bring additional structural supply into the crude oil market, he said “there’s a question about whether the world needs more oil from those big Middle Eastern players.” If global demand drops lower than expected and supply gets boosted from other regions, he said oil-rich countries in the Middle East could continue to curb production. This could have a residual impact on drilling activity in these countries and elsewhere in the region.

“If oil demand doesn’t grow at the expected rate, I think we could see some retreat in the Middle Eastern places where they produce a lot of oil,” he added. “We might see some contracts getting canceled. We might see rigs getting stacked rather than kept running.”

Several Middle East players have been making moves in the gas space to offset any potential drop in oil demand. For instance, Saudi Arabia has turned to gas as the key driver for its onshore activity. In June, Saudi Aramco signed $25 billion worth of contracts for the second phase of expansion of its Jafurah gas field and the third phase of expanding its main gas network. Jafurah is Saudi Arabia’s largest unconventional non-oil associated gas field, with reserves reaching 229 trillion cu ft of gas and 75 billion bbl of condensate. Saudi Aramco is also expecting to increase its gas production by more than 60% by 2030, compared with 2021 levels of 10.1 billion standard cu ft/day.

Outside of Saudi Arabia, ADNOC Gas signed a 10-year agreement in January to supply 0.5 million tonnes/year to GAIL, India’s largest natural gas company. This agreement came on the heels of an LNG supply agreement the company signed with PetroChina in September 2023. Additionally, in March 2024, ADNOC Gas agreed to provide 1 million tonnes/year to German company SEFE starting in 2028. In April of this year, Oman LNG signed a 10-year deal to supply 1 million tonnes/year of LNG to Turkey’s Botas Petroleum Pipeline Corp starting in 2025.

“These deals are really setting themselves up for that extra phase of their oil and gas journey,” Mr Wilby said. “Gas has been relatively neglected in the past by many Middle Eastern players. They see an opportunity to bring it more to the forefront and start monetizing it more. That’s going to require a lot of onshore drilling. So, if we see oil start to retreat, we think gas will help fill that gap.”

China

China is expected to be among the leaders in driving global rig demand, accounting for almost 30% of the global rig count by 2028, boosted by a drive to increase domestic production. That drive to push production will lead to an increase in drilling deeper wells in shale gas plays and an increase in drilling in mature fields. Rig count will go up in China over Westwood’s forecast period – from 1,300 rigs in 2024 to 1,340 rigs in 2028.

“China is really setting themselves up to try and raise domestic production. That’s a long-term goal of the government, and they’re starting to put things into action. They’re showing they’ve got the technical capabilities to drill really deep – it’s uncertain how economic that drilling will be for them, but broadly I’d say it’s been positive.”

One thing that will help drive activity in China is the country’s move to ease exploration regulations in the Sichuan Basin, home to some of the world’s largest natural gas reserves. This year, China began awarding relinquished onshore hydrocarbon exploration blocks to businesses outside of central government control, a move the government hopes will diversify investment and boost production.

In September, the Ministry of Natural Resources granted Sichuan Energy Investment Tianfu Oil and Gas Exploration and Development, an E&P company established by the regional Sichuan government, the rights to explore two onshore gas blocks in the Sichuan Basin, marking a significant departure from its previous practice – in the past, local Sichuan companies had to partner with state-owned operators like CNPC and Sinopec in order to explore the basin.

“They’re putting a lot in place to allow more production, and they’re easing some of the regulations in the Sichuan province. By making it so that local companies don’t need a national company to drill projects, you might see more projects approved quicker. These are the kinds of things that are helping the industry progress at greater speed,” he said.

South America

Mr Wilby described South America’s outlook as “quite bleak outside of Argentina, compared to historical levels.” Argentina – and specifically, the Vaca Muerta shale – is by far the continent’s brightest spot when it comes to onshore activity. In the first half of 2024, Argentina saw 546 development wells drilled compared with 493 in the same period last year. Westwood expects the country to increase from 106 rigs and 1,080 wells in 2024 to 139 rigs and 1,279 wells in 2028.

Like in Canada, pipeline projects are what’s fueling the optimism in the Argentinian land drilling market. Last year, the government brought online the first stage of a major pipeline delivering gas from the Vaca Muerta to Buenos Aires, adding 22 million cu m/day in capacity. In May, state energy firm YPF began construction on an additional pipeline (Vaca Muerta Sur) that will run from Anelo in the Neuquén province to Allen, in the province of Rio Negro. This pipeline is expected to transport up to 390,000 bbl/day of oil. A potential second stage of that pipeline and an export terminal are still in the development stage.

“Argentina’s got a lot of wells being drilled, and it’s going to require a lot of land rigs. They’re putting in the infrastructure to help with offtake capacity, which has been one of the limiters on increasing production and drilling in the past. They needed more pipelines to be built for both oil and gas, and it looks like those are being built. Argentina looks like a really promising market for the foreseeable future,” Mr Wilby said.

Outside of Argentina, there is still significant drilling expected in countries such as Colombia. However, this activity will be well below historic levels. Venezuela, which has seen rig demand fall from a high of 161 rigs in 2010 to an average of around 10 in recent years, could see activity improve. But this is largely dependent on how the US proceeds with ongoing sanctions against the country.

In October 2023, Venezuelan President Nicolás Maduro and his opposition signed the Barbados Agreement, which included a roadmap toward holding competitive elections. Following that agreement, the US Treasury issued a six-month general license (GL 44) temporarily authorizing transactions involving the oil and gas sector in Venezuela. However, US officials warned that licenses could be revoked if the Maduro government did not create a process to allow all candidates to run, as well as release wrongfully detained Americans and Venezuelan political prisoners.

In January 2024, Venezuela’s supreme court upheld a ban on the candidacy of the opposition’s chosen nominee, María Corina Machado. As a response, in April, the US did not renew the oil sector license. The US Department of the Treasury’s Office of Foreign Assets Control stated that companies may seek specific licenses to work in Venezuela and that projects under way before GL 44 took effect may continue, but companies may not start new work in the country.

Should the sanctions loosen, Westwood anticipates onshore activity to pick up, given that the country has one of the largest proven crude oil reserves in the world. However, that is a big what-if.

“We’re holding a ‘wait-and-see’ approach with Venezuela,” Mr Wilby said. “You just don’t know which way sanctions will go. If they get tightened up, the market won’t be able to go up that much.”

Russia

Russia’s position in the global onshore market is a tricky one to explore, partly because of the lack of transparency in numbers coming out of the country – official oil and gas statistics from Russia are classified. The ongoing sanctions affecting the country in the wake of its 2022 invasion of Ukraine also makes analysis difficult.

While Russia’s gas production dropped 15% from 2021 to 2023, it appears to be on the rebound this year: In July, the International Energy Agency (IEA) forecast 6% year-on-year growth for the country’s gas production from 2023 to 2024, going from 638 billion cu m in 2023 to 675 billion cu m this year. That forecast was higher than the agency’s previous estimate of 670 billion cu m in 2024. According to the agency’s estimates, gas production in Russia had already increased by more than 7% from H1 2023 to H1 2024. Almost 40% of this year-on-year growth was achieved through increased exports. Particularly, Russia increased gas exports to China through the Power of Siberia pipeline, and it has increased LNG exports to Europe.

Oil production is another story. Since June, Russia has been trimming crude production in line with a new quota from OPEC+. In addition, the Russian government has pledged further cuts to compensate for exceeding its quota in April and May, a pledge that would likely force additional cuts into 2025.

Overall, Westwood foresees a decline in the Russian onshore market over its forecast period. The country will drop from 1,137 rigs in 2024 to 1,014 rigs in 2028. Mr Wilby said this will be a residual impact of the OPEC+ crude production cuts, the sanctions – which banned the import of Russian oil, LNG and coal to the US – and the exit from the region of US-based IOCs.

“Certainly, with Russia being part of OPEC+, it doesn’t make economic sense to keep drilling at the rate they’ve been drilling previously, producing all those liquids that they theoretically can’t export because you’ve got quota agreements,” he said. “They overproduced in the first half of the year and will be reducing production to compensate in late 2024 and into 2025, further reducing the need to keep drilling at these levels. They’ve also lost some expertise due to the sanctions. The rigs from international companies were probably quite high-spec, but they were cold stacked. If Russia is not able to use them, they might have to use lower-quality rigs and do more drilling just to maintain their production levels, whereas before they could do more innovative things to get more returns per well drilled.” DC