CCS shows great promise, but scaling up requires collaboration, investment

Some drilling contractors already looking at ways to repurpose existing rigs to economically drill carbon injection wells, as well as contributing to production of natural gas-based blue hydrogen

By Stephen Whitfield, Associate Editor

While the world is still exploring and developing solutions to reduce carbon emissions, with no clear consensus on what is the best pathway, both policymakers and energy industry leaders do all appear to be convinced about one thing: Carbon capture and storage (CCS) will have to play a critical role if the world is to meet its net-zero goals in the coming decades. That means drilling contractors will have a critical role to play, as well, since drilling rigs will be needed to drill CO2 injection wells.

CCS involves the capture of CO2 emissions from industrial processes, such as steel or cement production, or from the burning of fossil fuels in power generation. The captured carbon is then transported and stored underground in geological formations via injection wells.

While some environmental groups do still oppose CCS, support from policymakers and governmental groups has so far been consistent. Last year, the UN International Panel on Climate Change specifically cited CCS in a report as an enabler to reduce global climate-related risks and estimated that CCS could help to remove up to 11.19 Gt/year of carbon dioxide globally by 2050, if the world follows the modeled pathways in which global warming is limited to 1.5°C.

In 2021, the US White House Council on Environmental Quality (CEQ) also voiced its support for CCS, saying the US will likely need to capture, transport and permanently sequester significant quantities of CO2 in order to meet its climate goal of net-zero emissions by 2050. In February this year, the CEQ also formed two task forces focused on making the permitting process for carbon capture, utilization and sequestration more efficient.

“There is no scenario where you get to the goals of the Paris Agreement without CCS unless you see an unrealistic reduction in energy demand,” said Torbjørg Klara Fossum, VP, Global CCS Solutions at Equinor. “To reach the necessary emission reduction targets in 2050, CCS needs to be the same size as the oil business is today in terms of the volumes that need to be managed. But for that to happen, we’re really going to have to scale up.”

Work is already ongoing in many parts of the world to build CCS infrastructure. While there were only 51 large-scale CCS facilities either operating or under development in 2019, that number had increased to 194 by 2022, according to the Global CCS Institute, an Australia-based think tank.

Hurdles to scaling up CCS include the significant investments required for equipment, primarily the ones that separate the CO2 from the emissions stream. Transportation of the captured oxides can also be costly, as it requires a pipeline and related infrastructure from the plant where the carbon is captured and processed to a secure underground geological structure for injection. Additionally, current regulatory approval processes for CCS projects are time consuming.

“There’s also a larger aspect of collaboration among all stakeholders that we’re going to need with CCS,” said Pat Garcia, Energy Transition Director at Parker Wellbore. “If we’re going to create this huge market for injecting CO2, everyone’s going to have to work together. There is a strong value proposition for CCS, but when factoring in all the associated costs for capture, removal, transport, storage and everything else that goes on with a CCS project, the cost structure needs to improve to reach scalability. We’re going to need incentives to enable more CCS.”

Reducing well costs in CCS

Even though the design and drilling of CO2 injection wells is similar to that of conventional oil and gas wells, there are still some differences driving higher costs for CCS wells. Finding ways to lower these costs will be critical to the continued long-term growth of CCS, said Rolf Arne Thom, Drilling and Wells Manager for the Northern Lights CCS joint venture (JV).

“CCS is basically in the waste industry, which means that the return on investment is not comparable to oil and gas right now,” Mr Thom said. “For those of us looking to deliver these wells, this translates into one thing: We need to provide cheaper wells. This can be challenging when you’re competing in the same market as oil and gas, but it can be done if we simplify, standardize and industrialize.”

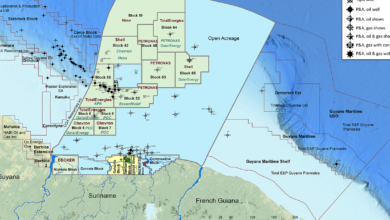

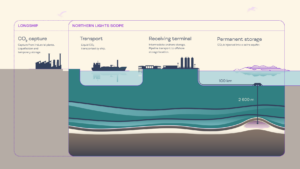

The Norway-based Northern Lights project – a partnership among the Norwegian government, Equinor, Shell and TotalEnergies – aims to build the first cross-border CO2 transport and storage infrastructure network. Two CO2 carrier ships are being built to take captured CO2 to an onshore receiving terminal at Øygarden on the Norwegian west coast before being transported by pipeline for permanent storage in a reservoir 2,600 m below the seabed in the North Sea. Northern Lights is the transport and storage component of Longship, the Norwegian government’s full-scale CCS project.

In Phase 1 of the project, the Transocean Enabler semisubmersible drilled a CO2 injection well and a contingency well. The wells were drilled from August to November last year at 2,600-m depth in the Johansen formation, within the EL001 license awarded to the Northern Lights JV owners in 2019. Together, the two wells will provide CO2 storage capacity of 1.5 million tonnes/yr.

Phase 1 is expected to be complete in 2024, once the receiving terminal, transport ships and offshore pipeline for transporting the CO2 are completed. In Phase 2, the JV hopes to expand CO2 storage capacity by up to 3.5 million tonnes with three additional wells, although this will depend on market demand and being able to build a viable commercial business case acceptable for the owners.

The wells drilled for the project highlighted some of the areas where marginal costs could have an impact on scaling CCS. For one, Mr Thom noted that it is important to ensure that CO2 does not leak back into the atmosphere, whether it’s through seepage from the injection well itself or from the dedicated subsurface storage complex in which it is injected. In the two initial wells, Equinor installed downhole pressure and temperature gauges and an annulus pressure monitoring system to monitor the integrity of the tubing and casing. A CO2-resistent cement also had to be developed for the two wells.

Corrosion poses another challenge. With CCS, CO2 is injected in liquid form at low temperatures and high pressure. The mix of formation water and the liquid CO2 down in the reservoir where the CO2 is stored can be highly corrosive. Both the reservoir liner/sand screen and the injection tubing below the injection packer need to be a high-grade material – either 13CR or 25CR stainless steel, depending on the conditions downhole. This can add to the overall well costs, as those materials are more expensive than the traditional carbon steel material used in oil and gas drilling and have a longer lead time. For the Northern Lights project, 25CR material was utilized.

Also, subsea CO2 injection wells with flowlines directly from shore cannot be flowed back toward an offshore installation for clean-up. An effective clean-up of the drilling and completion fluid particles is important to avoid hurting the injectivity of the formation/plugging of pores at injection start-up. Fluid design and fluid testing, including testing of particle breaker chemicals that can dissolve unwanted particles, must be performed to ensure the well is as clean as possible when starting up injection.

These costs can all add up, and government funding has so far been critical to continuing the Northern Lights project. However, to scale CCS in the long term, the market cannot count on continued significant funding from governments, Mr Thom said. Identifying industries and companies that are willing to pay for storing carbon will be key to building a viable CCS market.

In August 2022, the JV signed an agreement with a Netherlands-based fertilizer manufacturer to transport and store their CO2. According to the JV, this was the CCS industry’s first commercial agreement on cross-border CO2 transport and storage.

“Setting up a commercial business without being dependent on government subsidies is challenging, as there is not yet a market for trading CO2” Mr Thom said. “The industry in general has a social responsibility of reducing CO2 emissions to fulfill global climate goals, but we’re going to need customers who will be willing to pay a price to transport and store the CO2 instead of paying taxes to the relevant authorities for emitting CO2 into the atmosphere.”

Noble Resolve jackup during a CO2 injection pilot conducted as part of Project Greensand in the Danish North Sea. The CO2 injection project was conducted at the Nini West field from January to April 2023. Source: INEOS

Exploring the CCS value chain for drilling contractors

In January, Noble Corp’s Noble Resolve jackup began injecting CO2 into an injection well for Project Greensand, the Danish North Sea’s first CO2 storage project. It encompasses a consortium of 23 companies, including producers INEOS and Wintershall DEA, and aims to store up to 8 million tonnes/yr of CO2, or approximately 13% of Denmark’s annual CO2 emissions, by 2030. Noble’s involvement as a Project Greensand consortium partner was originally initiated by Maersk Drilling, which merged with Noble last year.

“We had been monitoring the CCS market for a while, looking for where we could get a foot in the door and test out our place in the value chain, maybe put our assets and capabilities into play,” said Rune Loftager, Head of Technology and Decarbonization at Noble. “Project Greensand met a lot of our criteria. We see the high business potential of CCS and an opportunity to potentially get a profitable market share.”

The pilot phase, which was conducted at the Nini West field, took approximately 90 days, concluding in April. It proved the viability of CO2 injection in the Danish North Sea – that the CO2 could be safely treated and injected with minimal rig modifications, Mr Loftager said. In addition to the CO2 injection and bunkering arrangement installed onboard, the modifications required included an increased capability to monitor CO2 gas releases.

The Greensand consortium is now analyzing the potential to begin full-scale CO2 storage by 2025. The initial storage target is 0.5-1.5 million tonnes/yr of CO2 in 2025, which can increase to a potential of up to 8 million tonnes/yr by 2030. Noble holds the rights to all drilling work involved with the project until the end of 2027.

Mr Loftager noted that, while he is optimistic about the growth potential for the CCS market, the Greensand pilot highlighted several hurdles that drilling contractors will have to address before they will be able to achieve widescale profitability. For example, CCS OPEX will need to be reduced, which can be achieved by converting existing rigs or constructing newbuilds that are purpose-built for CCS, Mr Loftager suggested. While the latter option is less likely given current rig market conditions, it could become feasible if demand for CCS grows to such a level to support newbuilds.

“We probably need to find some alternative ways to do CCS on a larger scale,” he said. “There is no such thing as a CO2-certified rig right now, but it could be an opportunity. We aren’t building anything, but we’re spending some energy on looking into exactly how such a rig would be specified.”

“I believe we, within a relatively short time, will see an increased interest for offshore carbon storage due to better social acceptance compared to onshore projects,” he continued. “This is also a solution to repurpose existing infrastructures in a region like the North Sea. We certainly believe that we are well prepared to support the market using our capabilities. This does not mean that everything is clarified from the drilling contractor perspective, since there are still some unanswered questions with regards to steel embrittlement, hypothermia and so on.”

Mr Loftager also added that he believes carbon pricing could help drive CCS market growth – if heavy industry is required by regulators to pay high prices for emitting carbon, it will make CO2 injection a more attractive financial option.

The European Union already uses an emissions trading system (ETS) where manufacturers, power companies and other heavy industries are required to pay for each tonne of CO2 it emits. On 21 February, the EU allowance contract, or the price of permits on the ETS, rose above €100/tonne for the first time, trading at €101.29/tonne. Although that price has since dropped to €94.34 as of 13 April, it has still been on a general upward trend over the past seven months.

“The cost of carbon will add momentum to this market,” Mr Loftager said. “The carbon price is likely to increase, and as that happens the business case for CCS is only going to get better. Right now, there are a lot of discussions about CO2 storage, but I’m confident it’s going to become one of the options for decarbonization of energy-intensive industries.”

Regulations and the US CCS market

The North Sea and Europe are not the only hotbeds for CCS development in recent years; the US is arguably an even bigger market. Of the 30 operational CCS facilities in the world, 14 are located in the US, 10 more than any other country, according to the Global CCS Institute’s 2022 status report. In particular, the geological nature of US onshore shale plays and the regulatory environment have made the country an attractive location for companies looking to expand their CCS portfolios.

Equinor, for example, has been involved in carbon capture since 1996, when it began CO2 injection at the Sleipner gas field in the North Sea, and it is a partner in the Northern Lights Project. Recently, Ms Fossum said the operator has begun looking to expand its CCS initiatives to the US. One reason for this is because US shale basins have a favorable geology for storing CO2, similar to the offshore basins in the North Sea.

“You have the sand layers where you can inject CO2 and a lot of caprock to prevent it from leaking. The sand layers have really good injectivity, so you can store a lot of CO2. The US is a growth area for us – we’re incentivized by the good conditions there.”

The favorable tax regime fostered by the US Inflation Reduction Act (IRA), which went into law last year, is another incentive. The IRA increased the tax credit given for every tonne of CO2 captured and permanently stored in geological formations from $50/tonne to $85/tonne. This will give additional incentive for industrial sectors to participate in the carbon capture, removal, transport and storage ecosystem.

The IRA also boosted incentives for the use of direct air capture (DAC) as a carbon dioxide removal technology, from $35/tonne to $180/tonne. In addition, many CCS projects that qualify for federal 45Q tax credits can earn state-level tax and economic incentives, making them even more viable.

“We find both Europe and the US important for CCS,” Ms Fossum said. “We’re maturing several early-phase low-carbon solutions projects in the US, and that is incentivized by the Inflation Reduction Act. In Europe, with the carbon pricing, that’s kind of like the stick – we’re getting to the point where it costs more to emit CO2 than it costs to implement CCS – but with the US, you have the carrot.”

Permitting issues and carbon pricing

Parker Wellbore, which has eight barge rigs in its fleet specifically designed to serve customers along the US Gulf Coast for CCS, is eager to expand its stake in the CCS market. The company has discussions ongoing with companies interested in capturing point source industrial CO2 emissions in the Gulf Coast CCS hub, where the natural subsurface geology provides opportunities for long-term storage of carbon dioxide, Mr Garcia said.

At the heart of its efforts is the production of blue hydrogen, or hydrogen produced from natural gas, as a renewable fuel. Hydrogen, which produces only water as a byproduct, has been cited by several US and international agencies as a potential low-carbon fuel source and is critical to helping decarbonize the energy mix. Because it is generated from a widely available source and has lower production costs compared with green hydrogen, having more blue hydrogen can help to scale up the production of hydrogen as a fuel source, Mr Garcia said.

Consequently, the CO2 emissions generated from the natural gas burned to create blue hydrogen is a prime candidate for storage in CO2 injection wells.

“When you’re creating hydrogen from natural gas with a process of steam-methane reforming, you’ve got carbon dioxide emissions. Capturing the emissions from blue hydrogen is critical. If the emissions are captured and stored underground, then you cancel out the emissions and create a carbon-neutral process. We are uniquely positioned to help our customers with storage of CO2 deep underground in the US Gulf Coast, where there is a cluster of industries, pipeline infrastructure and geological formations close enough to the concentration of industrial emissions that makes economic sense for storage,” Mr Garcia said.

For the past few years, Parker has been working on a project that involves CCS along the US Gulf Coast. The ultimate goal is to store the CO2 captured from blue hydrogen projects. The CO2 would then be transported along a pipeline network, which stretches from Galveston, Texas, to New Orleans, La., and drilled into reservoirs offshore Louisiana.

Mr Garcia said that Parker has been in discussions with hydrogen and ammonia producers, including other customers and operators, looking to offer CCS-as-a-service on drilling exploratory, appraisal, stratigraphic, monitoring and injection wells in shallow waters along the US Gulf Coast as part of the CCS value chain. However, most plans for CO2 storage projects are on hold because of the lag time in obtaining adequate permitting to store the CO2.

The US Environmental Protection Agency (EPA) already has minimum federal requirements for six classes of injection wells (Class I to Class VI). Each well class is based on the type and depth of the injection activity and the potential for that injection activity to impact underground sources of drinking water. For instance, Class II wells are used only to inject fluids associated with oil and natural gas production for the purposes of disposal, enhanced oil recovery (EOR) or hydrocarbon storage. Class VI wells are used to inject CO2 into deep subsurface geologic formations for long-term underground storage. Currently, there are approximately 180,000 active Class II wells in the US, many of which are used for EOR, where fluids containing CO2 are injected underground. However, there are only two active Class VI wells in the US.

Beyond delaying Parker’s CCS efforts, Mr Garcia said the length of the Class VI permitting process has been a major hurdle to scaling CCS development in the US. EPA’s review of the Class VI permit application is an iterative process, which requires frequent communication between the companies submitting the application and the EPA. Overall, the process can take three to six years to complete, he noted. “This is why some states are seeking primacy or primary enforcement authority, which is the ability of a state to step into the shoes of the federal regulators and oversee at the state level the permitting of wells used to inject CO2 into deep subsurface geologic formations for long-term underground storage,” he stated.

“In my view, the biggest challenge for the entire industry is permitting reform. Just getting the Class VI license is such a challenge – as an example, we’re pretty much ready to go on our projects, but we can’t move because the permitting process is taking so long. Commercializing CCS requires significant upfront capital investment to deploy technology. If you are trying to commercialize a CCS project and are focused on profitability and bringing a CCS business to market, imagine lining everything up and being ready to start on a project only to end up waiting for years to get what you need from the federal regulators. A lot of the issues we’re seeing with CCS can relate back to that,” Mr Garcia said.

The US White House Council CEQ appears to be aware of current inefficiencies and in 2021 identified opportunities for “clarifications and improvements” in the permitting process. These opportunities included implementation training for EPA staff, as well as the development of a planning document to support EPA regional permit writers as they evaluate Class VI applications.

Another challenge Mr Garcia cited in scaling CCS in the US is the lack of sufficient carbon pricing. Currently, the US does not have a federal carbon pricing system like the EU allowance contract; California’s Cap and Trade Program is the only statewide pricing system. Implementing a carbon trading market could give heavy industry, operators and drillers more financial certainty with regards to CCS projects.

“A carbon price along with cross-border pricing for emissions to be captured in one country and transported to a different region to be stored elsewhere will attract capital toward CCS, drive costs out of the process as more projects are launched, and create efficiencies in the market,” he said. “We need to have carbon markets – a free market system – where everybody can have a transparent price on it, so everyone is operating from the same playing field and so we know the economic value of the carbon we have.

“Right now, you get the 45Q tax credit, but how do you split up that credit between the operator and the emitter and the other stakeholders in the value chain? We still need to work all of that out,” Mr Garcia continued. “I’m not a proponent of taxes, because that’s not going to achieve what we want to see, but you need a mechanism to help the industry build up to do this stuff.”

Identifying gaps in international standards

The International Organization of Oil and Gas Producers (IOGP) has also been exploring ways to bolster the global regulatory environment to better aid operators and service companies looking to get into CCS development. While several international standards have already been passed by organizations such as DNV and the International Organization for Standardization, there is room to improve on those standards to better account for the ongoing expansion of the CCS industry, said Caterina De Matteis, an IOGP Policy Manager focused on EU policy, energy and climate.

“The CO2 storage operators have decades of knowledge in the subsoil. They know how to operate it,” Ms De Matteis said. “However, the development of a CO2 storage project is a complex operation that requires a significant upfront capital expenditure. There is a need to put in place long-term contracts between the emitters, the storage operators, and the entities along the value chain that help transport. The biggest challenge to this is the policy framework. We need to put in place an overall framework which removes potential barriers for CO2 storage.”

In November 2022, IOGP released a report analyzing the gaps in standards for carbon capture and making recommendations to address those gaps.

The report identified 13 standards, recommended practices and guides that provide a framework for storing CO2 in subsurface formations. Of those 13, only one of them actually covers the management of the CO2 injection well itself. That document, DNV 2011-0448, provides guidelines for the risk assessment and management of well integrity aspects for active and legacy wells that are exposed to the effects of CO2 storage, such as pressure, temperature and CO2 exposure, during site selection work.

The report stated that, while well integrity characterization is defined in DNV 2011-0448, it does not provide specific criteria on the acceptable amount of leakage of CO2 from the storage site, which IOGP identified as a critical aspect of CO2 storage. Instead, the document aimed to help reduce leakage risk through risk-reducing measures and analysis. To address this, IOGP said, countries should adopt regulations covering the mitigation of and response to CO2 leakage. For the EU specifically, it also recommended that member states check local regulations to ensure consistency when defining acceptable limits for CO2 leakage.

Lifecycle risk management of the CO2 injection well and storage facility was another gap the IOGP identified in existing standards on CO2 storage. It noted one document (ISO/TR 27918) that is a resource for development of a future standard on overall risk management.

The IOGP report also acknowledged that most companies will have their own overarching standards that cover the risk management of projects in general. However, hvaving a single standard specifically covering CCS would be easier to follow, given the number of stakeholders that can be involved in a CCS project. DC