With recovery of global economy still uncertain, oilfield services must stay agile, seek new ways to adapt

Forecast for gradual increase in oil demand signals potential for comeback in 2021, but low spending levels likely to plague OFS for at least 3-4 years

By Stephen Whitfield, Associate Editor

The global economy has been devastated since the World Health Organization (WHO) declared COVID-19 as a global pandemic in March. Financial markets crashed. Governments around the world locked down their countries. Millions of people lost their jobs, and many others have had to deal with disruptions at their work place. The International Monetary Fund (IMF) estimates that the global economy will shrink by 4.9% this year, the worst decline since the Great Depression. Next year, IMF expects the world’s GDP to grow by just 5.4%. That projection is 6.5% lower than IMF’s pre-COVID numbers released in January.

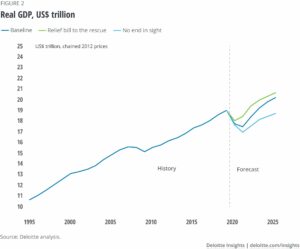

In the US, GDP growth will be dependent on factors such as the passage of an additional coronavirus relief bill in the US Congress, the successful deployment of a vaccine and whether work-from-home will continue to be the norm. In its Q3 Economic Forecast released 14 September, Deloitte projected that US GDP would drop by 6.4% in 2020 and by an additional 1.7% in 2021, before seeing a 5.2% increase in 2022.

Under this baseline scenario, the lack of an additional relief package in Q3 will lead to substantial drops in consumer spending in the fall and winter months. It also assumes that a vaccine will be deployed starting in early 2021 but that it does not become widespread until later in the year.

If the number of COVID cases remains high and states are forced to limit economic activity through additional lockdowns, then the US will see bigger GDP declines – by 7.1% in 2020 and 3.8% in 2021.

Looking at the oil and gas industry specifically, it appears that the business was already in a precarious spot, even prior to COVID. In November 2019, Deloitte released a report highlighting the low levels of external investment in the oil and gas industry. Investments were low even though operators – particularly those in the US shales – had grown their oil production and were providing high dividend yields of more than 4%. The industry’s market capitalization share had actually fallen to an all-time low of 4.5%, according to the report.

Nearly a year since that report, the pandemic has not improved matters for the industry. Over the course of 2020, the industry has seen a price war between Russia and Saudi Arabia, followed by the WTI oil price plummeting by 79.8% in a five-month span, reaching a year-low mark of $12.78 on 27 April. Most analysts appear to agree that oil prices next year will hover between $40 and $45 and not reach pre-COVID levels until 2022.

Oil Demand Recovery

In 2020, with many countries imposing strict travel and tourism restrictions, fuel usage dropped significantly. In the span of just a few months, total liquid fuels consumption globally fell from 94.92 million bbl/day in Q1 to 85.05 million bbl/day in Q2, according to the US Energy Information Administration (EIA). That’s by far the lowest total seen over the past five years.

Consumption rebounded to 95.3 million bbl/day by September, but the overall average for this year of 92.8 million bbl/day will reflect an 8.6 million-bbl/day drop compared with 2019. In 2021, liquid fuels consumption is forecast to rise to 99.1 million bbl/day, according to the EIA’s October 2020 Short-Term Energy Outlook.

In terms of the outlook for oil specifically, the International Energy Agency (IEA) is projecting demand this year to go back to 2013 levels: 91.7 million bbl/day. That would be a decline of 8.4 million bbl/day from 2019.

A recovery is in the cards for 2021 – up to 97.2 million bbl/day – but the IEA is pointing to a lag in jet fuel demand as a notable weak spot. Consumption of jet fuel is expected to drop by 39% this year compared with 2019 – dropping to 4.8 million bbl/day then rising to only 5.8 million bbl/day next year. Last year, jet fuel demand averaged 7.9 million bbl/day, approximately 8% of total oil consumption.

Rystad Energy, at its Annual Summit held in late September, agreed that the recovery in oil demand will be gradual next year, and it is contingent on not having a second wave of COVID-19 lockdowns. Otherwise, recovery will get pushed back later into 2022 or even 2023. In such a “second wave scenario,” oil demand could drop by an additional 4 million bbl/day, Bjørnar Tonhaugen, Partner and Head of Oil Market Research, said.

“Even more regional and targeted lockdowns – not the global lockdowns we saw in April, May and June this year – could prolong recovery by at least a couple of years and be devastating for short-term oil pricing implications,” Mr Tonhaugen said.

In fact, a full recovery in the oil and gas industry will require not only for the number of new COVID-19 cases to drop substantially but also for global economic activity to climb back to pre-pandemic levels, Deloitte said in a June report. That encompasses GDP growth, transportation demand and demand for consumer goods.

Until then, companies in the oil and gas space will need to remain agile, streamlining their asset portfolios to improve operational flexibility. That may be easier said than done, however, according to Duane Dickson, Vice Chairman and Deloitte’s US Oil, Gas & Chemicals Leader.

“Oil and gas is a very asset-intensive business, so there’s only a certain amount of agility you can attain,” Mr Dickson said. “But the more asset-light, the more agile you can become, whether you’re supplying oilfield services or you’re a drilling contractor, the better off you’re going to be.”

Operator Spending and Oilfield Services Forecast

Across the board, operators responded to the oil price downturn this year with sharp cuts to their 2020 investment plans. In just the first two months following the 11 March pandemic declaration, operators slashed their E&P CAPEX levels by an average of 25%, according to the IEA.

By the end of this year, 2020 global E&P CAPEX will likely settle around $383 billion – a 15-year low and a 29% drop from 2019 levels, according to Rystad. These cuts have directly translated to activity reductions. In fact, the firm estimates that global project sanctioning this year will decline by a whopping 75% from 2019 levels.

And for 2021, 105 projects are expected to be sanctioned – a level on par with 2017 and 2018 but far below the 197 projects sanctioned in 2019. Beyond that, oilfield services (OFS) staffing levels have also fallen to the lowest levels seen in more than a decade, Rystad said.

Recovery back to 2019 spending levels will likely take three or four years, said Audun Martinsen, Partner and Head of Energy Service for Rystad. A major reason is that operators lack the cash flow to invest in major capital projects, especially if oil prices stay lower for longer.

Even if they do have cash to spend, they’re likely to put them toward “green” energy initiatives that can help them meet carbon emissions targets.

“More and more oil and gas companies that have been traditionally exposed to greenfield projects will start to focus their big capital spending programs into renewable energy infrastructure, rather than greenfield oil and gas projects,” Mr Martinsen said. “This will lock in resources and investments. As a result, it will make it harder for the oilfield services market to exceed 2019 levels anytime soon. It will be a long journey to recovery.”

A Sustainable Future

Sustainability and profitability will be critical to shaping investor sentiment in the coming years. Some investors that have traditionally funded oil and gas operations are now focusing increasingly on decarbonization – even more so since the onset of the pandemic – said Kate Hardin, Executive Director of the Deloitte Research Center for Energy and Industrials. As an example, the Oil and Gas Climate Initiative, a CEO-led consortium that includes BP, Equinor, ExxonMobil and Occidental Petroleum, announced in July a plan to cut carbon emissions from upstream oil and gas operations by 36 million to 52 million tonnes per year by 2025.

“Oil and gas companies may have shifted priorities toward critical issues right now – like the health and safety of employees on rigs and platforms and managing their balance sheets – but the longer-term focus regarding greenhouse gas emissions is very much still in play,” Ms Hardin said.

OFS companies will likely need to seek new ways to adapt to a lower-carbon future. One potential avenue for drillers is geothermal development. There will be 25 GW installed capacity of geothermal wells drilled from 2020-2029, compared with 15 GW installed capacity from 2010-2019, according to Rystad’s forecast. That’s roughly the equivalent of drilling 800 new geothermal wells over the next decade, Mr Martinsen said.

Digitization and automation technologies may also provide long-term value for companies trying to survive until the next upturn. Mr Martinsen cited two examples from 2019 as templates for useful partnerships – the collaboration among Schlumberger, Chevron and Microsoft to build applications in a cloud-based environment, and Baker Hughes’ collaboration with AI software provider C3.ai on deep learning platforms.

Over the next decade, digitization and automation initiatives could provide more than $100 billion of value creation, Rystad estimates. DC