NOV rig census shows pandemic’s historic impact on drilling industry

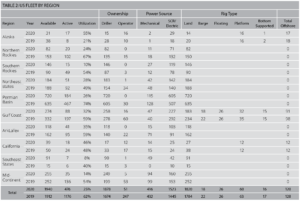

Global rig demand has fallen to lowest point in census history, dating to 1955; North America has been hardest-hit, with Permian utilization at just 26%

By Tarjei “TJ” Myklebust, Karl Appleton and Kevin Scherm, National Oilwell Varco

The start of any 2020 census, in any industry or any part of the world, must begin with the impact of COVID-19. For oil and gas, the impact was a drastic drop in demand. Oil and gas drilling has been one of the most negatively impacted industries during the pandemic, and recovery appears to be slower than everyone had hoped.

Early in the pandemic, the industry was further impacted by the market share war between Saudi Arabia and Russia that led to oversupply at a very low price, and an associated build in oil inventories that poor demand is slow to draw down. Operators quickly cut CAPEX budgets by 20-30%.

As of late October, oil price was still slowly regaining to a level at which operations can be stable and still some time away from a level that will stimulate growth in rig demand.

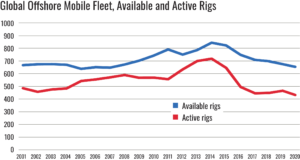

Global rig demand in the census period has fallen by 82% from its peak in 2014. It now sits at the lowest point in census history, dating back to 1955.

The North America land market has been the hardest-hit, with its active rig count dropping to 398. This is a two-thirds decline compared with the 2019 census, and it may fall even further before year-end. Within this market, the decrease was felt the most in the Permian Basin, where utilization dropped from 74% to a grim 26%.

Offshore has not been spared either, although the effects of the pandemic is taking longer to play out in this market due to the longer-term nature of projects and contracts. Operators were quick to cancel or suspend any contracts that did not penalize early termination harshly. Many contracts were also renegotiated with lower dayrates.

Offshore utilization is expected to continue its decline for the rest of the year, with a possible recovery beginning in the latter parts of 2021.

Census Highlights

Key statistics from the 2020 census include:

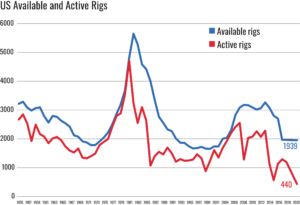

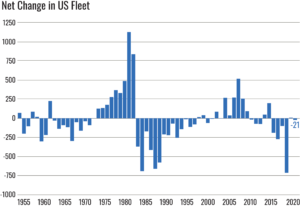

- The US fleet, both land and offshore, decreased slightly by 21 rigs to a total of 1,939 rigs. This change is the result of 27 rig deletions offset by a total of six rig additions.

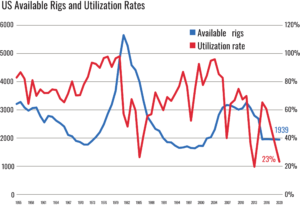

- Active rigs in the US fleet fell to its lowest number ever recorded, at 440 rigs. This represents a 23% utilization, which is the second lowest in census history dating back to 1955. 2016 was the year with the lowest utilization rate, at 20%. Only one other time – in 1986 when the utilization rate was 26% – has the utilization been in the 20% range.

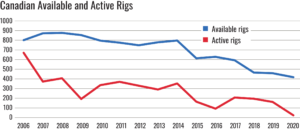

- The Canadian fleet experienced record lows, with utilization at just 7%.

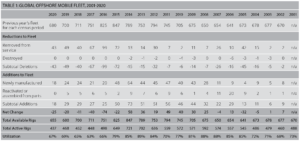

- The global offshore mobile rig fleet decreased by approximately 4%. The utilization rate dropped by 2% to 67% and is still falling. The total number of active offshore mobile rigs was 437, which is the lowest it has been in this century.

- In response to market pressures, the international land rig count was starting to drop at the time of the census and has declined further since then, reaching historic lows in some countries in South America.

US Fleet

An available rig is one that is currently active or ready to drill without significant capital expenditure. To be considered available, a land rig must not have been stacked for longer than three years. For offshore rigs, that criteria is five years. This year, the US fleet totaled 1,939 rigs: 120 offshore and 1,819 onshore. This is the smallest the fleet has been in the past decade and 40% lower than the peak of 3,254 rigs seen in 2014.

US Rig Additions & Attrition

Only six new land rigs were manufactured and delivered to the US market since the previous census. There were no additions to the offshore mobile rig fleet in the US. A total of 27 rigs were removed since the previous census, 16 of which were scrapped and the other 11 removed according to census rules.

Canadian Fleet

The Canadian rig fleet decreased by 7% to 427 units since the 2019 census. It is now at its lowest level in 15 years. Only 29 of the 427 units in Canada were active.

Global Offshore Mobile Fleet

The global offshore mobile fleet decreased by 4% compared with the 2019 census, bringing the total number of available rigs down from 680 to 655. A total of 43 rigs were removed this year. Only 33 of those were scrapped, which is six fewer than 2019 and 19 fewer than the average number of rigs removed per year since 2014. Semisubmersible rigs were hardest hit, with 15 scrapped, followed by 10 jackups, seven drillships and one platform rig.

The removals were offset by 18 newbuilds, of which 17 were jackups. However, most of these jackups remain hot stacked at the yards without contracts. The one new semisubmersible also remains hot stacked without a contract. This was the first year since 2006 that not a single new drillship entered the fleet.

While 17 drillships remain under construction, deliveries from shipyards in 2021 and beyond will continue to see delays, as has been the trend the past couple of years. Some rigs will end up being owned by the shipyards due to contractual disputes.

Looking regionally, the Middle East continues to have the largest share of the global offshore fleet, with 26% of the fleet. The rigs there are almost exclusively jackups.

The Far East now makes up 13% of the global offshore fleet, also mostly jackups. It has overtaken Northwest Europe, which holds 10%.

However, Northwest Europe has a more even split of jackup vs. harsh-environment semisubmersibles and is the region with the most semisubmersibles.

Drillships dominate the US Gulf of Mexico, with 22 such rigs there even though the region holds just over 5% of the total global offshore mobile fleet.

International Land Rigs

Since the recent low in drilling experienced in 2016, the international industry had been steadily recovering each year to a much-improved state by the end of 2019. However, this has unraveled in the first half of 2020. The international fleet is now at an estimated 1,954 active units and a utilization rate of 62%. This effectively erases the recovery seen since 2016.

Latin America, which had seen steady activity but not the uptick toward 2019 that was seen elsewhere, has now experienced a brutal fall to a utilization rate of only 18% during the 2020 census period. Active rig count fell hard in Argentina and Colombia and reached almost zero in Venezuela.

Most of Europe saw active rig counts comparable with 2019. However, Ukraine – which was included in the census for the first time last year and had almost 90 active rigs – dropped into the 30s at the end of 2019 and has remained there.

In the Middle East, most countries’ active rig counts have held steady in recent years; however, a distinct drop could be seen starting in April that may coincide with OPEC+ production cut agreements. During the census period, utilization dropped to 80%.

US Industry Trends

The number of individual rig owners holding available rigs dropped sharply to 188 in 2020, from 236 identified in the 2019 census. This results from a combination of rig owner consolidation and bankruptcies. Compared with the past decade’s peak, seen in 2011, 188 represents a 42% drop.

Approximately 3% of the rigs in the US were owned by operators, with the rest being owned by drilling contractors. Changes in contracting scenarios are taking place in the region. While straight dayrate is still most prevalent, there is a shift to performance-based or index-linked contracts.

US Forecast for Next Year

The famous Danish proverb says, “It is difficult to make predictions, especially about the future,” and forecasting amid an unprecedented global pandemic seems like a precarious effort. Nonetheless, it’s believed that the bottom of rig activity will be reached around Q3 2020. After that, there should be either stable activity or slow growth in 2021. No substantial growth is expected before 2022, as recovery in the rig count will lag recovery in oil demand due to easy barrels coming out of storage and relaxation of production cuts to fill the gap, before more difficult barrels and new wells are needed.

US land will remain depressed. The oversupply – caused by the massive drop in demand combined with a large number of drilled but uncompleted wells (DUCs) that can be brought online quickly – is likely to keep drilling activity to a minimum for the next 12 to 18 months. The Permian Basin will be the first to see any increase in activity.

While well activity may be slow, it would not be surprising to see an increase in mergers and acquisitions amongst the operators as they look to refine their portfolios.

It is expected that high-spec land rigs will be the first to return as rig count recovers. There is a high likelihood that older and/or under-spec rigs will never return. The same principal applies offshore, but perhaps even more so. It will not just be old rigs that face attrition.

While things had started to look better for rigs working in the Gulf of Mexico in the 2019 census, with dayrates and utilization both trending up, everything has now been turned upside down. The region has already experienced some contract cancellations, and there are very few new contracts being awarded at the moment, a trend which will continue into the first half of 2021. This means that the focus for rig owners will be to get new work for the rigs that are rolling off contracts.

One bright spot in the region could be the handful of 20k projects in the Gulf of Mexico over the next several years, requiring higher-capacity hookload and pressure control capabilities. DC

To view the full version of this article with additional census data, click here.

IHS Markit and Enverus are the primary sources used for the global offshore and North American rig fleets. Information for the international land fleet was found using both Baker Hughes data and information collected and analyzed by NOV.