US land drilling faces long road to recovery

Increase in onshore rig count is likely to be minimal next year as E&P companies will remain cash-strapped and favor conservative spending

By Stephen Whitfield, Associate Editor

Around this time a year ago, US onshore drilling appeared to be in a tough spot, with analysts projecting drops in the rig count and a slowdown in production as operators continued to prioritize cash flow. Still, no one could have predicted the events that followed.

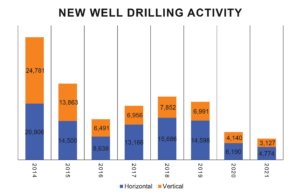

The COVID-19 pandemic and the oil price crash threw a significant wrench in nearly every facet of the industry, even more so than the 2014-2015 downturn. Onshore operators responded with massive CAPEX cuts in the first months of the year. Then, largely due to shut-ins and curtailments, Lower 48 oil production fell by 2 million bbl/day from Q1 to Q2, while drilling and completions activity dropped by more than 66%.

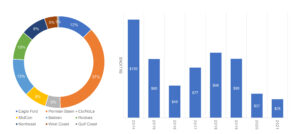

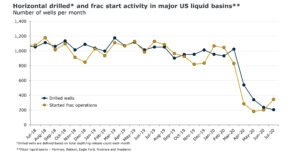

Between March and May, the US land rig count fell by 59%. In the Permian specifically, drilling activity went down by 54% in the one-year period from April 2019 to April 2020, and the Eagle Ford shale saw a 72% drop in rig count over the same time period, according to Enverus. As of 25 September, the Baker Hughes rig count showed only 246 land rigs in operation, a shocking 522-rig drop from February. Analyst sentiment is that the rig count will stay flat through the end of the year.

What happens beyond that is far from certain, but drilling activity is unlikely to reach pre-COVID levels any time in the next couple of years. John Spears, President of Spears and Associates, estimates the US rig count may rise to 300 by the end of next year. This slow rise is in part because operators will have trouble accessing the outside capital needed to fund drilling projects.

Moreover, whatever capital they secure will likely go to restoring shareholder returns. With WTI forecast to stay in the $40-50 range through the end of 2021, operator demand for land rigs is unlikely to increase, he added.

“The bucket of cash left to put into drilling is, in aggregate, not going to change very much,” Mr Spears noted. “There may be some advantaged operators who already have good balance sheets and are working in places where the breakeven points are pretty low. Maybe they can filter more money back into drilling over the next year, but that’s going to operator-specific and not an across-the-board pickup.”

In the coming year, operators will likely take advantage of the downturn to high-grade the rigs they have under contract, Mr Spears added, with an advantage going to contractors with high-spec AC or super-spec rigs versus the older rig types.

Rystad Energy is also forecasting a $40-45 range for WTI in its base-case scenario for 2021. Under that scenario, the US land rig count will increase to as much as 350 in the first half of the year, followed by a seasonal slowdown in the second half of the year. If the market recovers better than expected and WTI rises to the $60 range, then Rystad estimates the US land rig count could increase to 550 by the end of 2021; this is a high-case scenario.

Lower reinvestment by operators

Whether WTI can get to $60 is a matter of how quickly the global economy recovers from virus-related shutdowns and travel restrictions next year, according to Artem Abramov, Head of Shale Research at Rystad. While road traffic has almost completely recovered in most regions globally, jet fuel consumption is unlikely to return to pre-COVID volumes for three or four years. As of August, he said, international flights were still down by 80% compared with 2019 levels, but there should be continuous, if slow, improvement – unless there are significant rounds of new shutdowns.

“The speed of recovery for global fuel consumption wasn’t as high as expected back in April and May, but it is gradually picking up,” Mr Abramov said. “Despite all of the concerns about a second wave of COVID in multiple regions globally, it’s becoming more clear that the world is not going into a second complete lockdown. In this area, market sentiment is improving a little bit.”

Wood Mackenzie also believes that WTI needs to stay north of $50/bbl in order for most parts of US onshore to see a noticeable uptick in rig activity; only the Permian Basin could see a bit of a recovery at $45 oil. However, even if WTI reaches $50, it won’t automatically trigger pre-COVID drilling activity, according to Linda Htein, Senior Research Analyst, Lower 48 Upstream at Wood Mackenzie.

Several operators stated in their Q2 earnings reports that they will cap reinvestment at 70-80% of operating cash flow, compared with 120% in 2018, Ms Htein pointed out.

“Before COVID, operators were already starting to move to a much more conservative spending pattern, where the focus was less on growth and more on generating positive free cash flow and bringing returns to active shareholders,” Ms Htein said. “I think we’ll continue to see that, potentially to a greater extent. The price triggers that we saw before for certain activity levels will need to be higher in the future to get back to those activity levels. If we return to $60-plus WTI by the end of 2022, we could be back to near pre-COVID drilling and completions activity. But it’s a long way out.”

Capital Discipline

Further falls in dayrates, unfortunately, are also likely in 2021. It’s particularly difficult to predict future movement in dayrates at this point, Mr Abramov said, due to a lack of new contracts signed this year. However, he estimated that land rig dayrates next year will average around $15,000 to $16,000, assuming the market stays stable and doesn’t worsen. That would represent an approximately 20% reduction compared with the 2020 average.

Click here to watch an interview with John Spears on the state of the US onshore drilling sector heading into 2021, including a look at which basins could see an earlier recovery.

Click here to watch an interview with John Spears on the state of the US onshore drilling sector heading into 2021, including a look at which basins could see an earlier recovery.“As soon as new capital budgets are approved in January and February, we’ll start seeing some additional rigs contracted, and that’s when we’ll see where dayrates fall.”

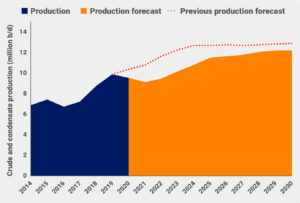

Likewise, Lower 48 onshore oil production is expected to come in well below pre-COVID projections. Rystad forecasts output to average just over 8.5 million bbl/day by December 2021; in January of this year, the company had anticipated Lower 48 production to approach 12 million bbl/day in the same time frame.

The 8.5 million bbl/day forecast comes despite hydraulic fracturing activity having rebounded sharply in the summer, with oil production increasing by 540,000 bbl/day in June, 400,000 bbl/day in July and a further 230,000 bbl/day in August. Approximately 650 frac operations started in September, doubling the 325 new frac operations that started in June.

These increases in fracking activity have primarily been driven by operators moving to bring their drilled-but-uncompleted (DUC) well inventory online, particularly in the Permian Basin. As of early September, the Permian still had more than 700 DUCs, mostly drilled in the second half of last year.

That DUC inventory will be enough to sustain the current level of frac activity, without the industry adding more rigs, through the rest of 2020 and into early 2021, Rystad estimated. As that inventory gets depleted next year, however, the basin will need at least 190 rigs working to maintain flat production; as of 25 September, the basin had only 125 active rigs.

With operators doubling down on their commitment to capital discipline, Wood Mackenzie forecast that the exploration of new Permian zones will remain stalled into next year and the region will continue to follow the 80:20 rule. This means proven commercial zones will have to carry the weight of drilling in the near future, with 20% of acreage yielding 80% of production.

Despite these challenges, Wood Mackenzie still believes the Permian offers the best chance for a quick recovery. “I think the Permian is a place where we can expect to see the fastest recovery at the lower end of the price spectrum,” Ms Htein said. “It’s got the profitability and the low breakevens, and you can scale much more easily compared to the Eagle Ford or the Bakken. Yes, those plays have some really competitive acreage, but they’re much more mature plays. There’s less of that low-cost inventory.”

Mergers on the Horizon

Moving into 2021, the drastic downturn that began this year is likely to continue reshaping the US onshore oilfield services sector (OFS), as firms cut budgets and pivot away from shale in favor of international conventional projects.

With that in mind, some consolidation among companies will be inevitable. In fact, Mr Spears said the US onshore OFS never even fully recovered from the 2014-2015 downturn and will most likely start to contract as the industry moves into a recovery phase.

M&A activity had been slow to develop in the immediate aftermath of the downturn, but conditions are now prime for organizations that are looking to expand their portfolios at low costs. Mr Spears pointed to Liberty Oilfield Services’ acquisition of Schlumberger’s frac operations in early September as an example. Schlumberger exchanged its pressure pumping, pumpdown perforating and Permian frac sand businesses in exchange for a 37% equity interest in the combined company.

Another notable deal came on 28 September, when Devon Energy and WPX Energy agreed to a $5.75 billion merger consolidation. The newly combined company, which will retain the Devon name, will hold 400,000 net acres in the Delaware Basin, giving it a dominant position in the area.

“Probably half the names in the service sector that were doing business in North America last year won’t survive, but we may see some new entrants pick up assets for pennies on the dollar,” Mr Spears said. “The absolute number of companies may not change very much, but certainly the names on the office door could change.”

When it comes to drilling contractors specifically, Mr Abramov believes there will be fewer active onshore drillers who will make it to the next market up-cycle. Small regional drillers are under the greatest threat, while larger contractors with significant market share in profitable areas will be better prepared to adapt to the changing landscape.

“The big rig companies, unlike many E&Ps, don’t have very big debts in their capital structure,” Mr Abramov said. “When they’re in a downturn, they can stack most of their equipment. Even if they don’t have much business activity right now, they can still service their debts with marginal revenues and low cash flow. They will likely not go out of business completely just because of a lack of activity.” DC