Oil & Gas Markets

Texas Petro Index: Strong crude prices drive recovery of state’s E&P economy

By Stephen Whitfield, Associate Editor

After nearly two years of contraction, Texas’ E&P economy finally saw a year of recovery in 2021, driven primarily by the upward trend in crude oil prices, according to the Texas Alliance of Energy Producers’ Texas Petro Index (TPI).

“We’ve begun to recover with the oil price as demand has begun to recover and as we’ve taken a considerable amount of supply offline, certainly in Texas,” Karr Ingham, Petroleum Economist at the Texas Alliance of Energy Producers, said on 26 January. “We find ourselves in recent months with prices averaging in excess of $70, and now we’re seeing prices going over $80. We’ve had quite an uptick in price this year.”

The TPI, a monthly measure of growth rates and cycles in the Texas upstream oil and gas economy, has seen continuous growth since March 2021. From 138.3 that month, the index had risen to 172.6 by December, a nearly 25% increase. The December 2021 index, the most recent figure available as of February 2022, also represented a nearly 29% improvement over December 2020 levels. However, the December TPI still remains around 19% lower than the most recent cyclical peak (post-2015, pre-COVID) of 213.6 set in February 2019.

The TPI is calculated by assigning values to a group of E&P indicators, including crude oil and natural gas wellhead prices, rig count, drilling permits, well completions, Texas crude oil and natural gas production and employment figures.

As a main driver of the TPI, average WTI prices rose by nearly 40% in 2021: up from $35 in 2020 to nearly $50/bbl last year. Monthly average WTI peaked at $77.12 in October 2021, although average prices have since risen even higher.

Natural gas prices – which represents a combination of Waha and HSC prices – averaged $5.79/MMBtu in 2021, the highest annual average since 2008 and a 251% increase over the $1.65 average in 2020. Winter Storm Uri was an obvious factor in 2021, with both Waha and HSC seeing significant spikes that February. In fact, Waha averaged $24.28 that month while HSC averaged $36.93. If the February numbers are removed from the calculation, then natural gas prices averaged $3.53/MMBtu in 2021. Even without Uri, however, Mr Ingham said Texas was expecting an increase in gas demand as the state recovered from the COVID-19 pandemic. Average natural gas price in December 2021 was $3.53/MMBtu, a 42% increase over the December 2020 monthly average of $2.49/MMBtu.

Rig counts in Texas also improved last year, although not at the same pace as oil and gas prices. The statewide rig count averaged 216 rigs in 2021, an approximately 4% increase over the 207 rigs in 2020. The improvement is more striking when looking at average monthly rig counts, which increased from a low point of 170 in January to a high of 275 in December. That 275 is the highest the average rig count has been since April 2020, when it was 283, although it’s still well below the 533 rigs averaged during the last cyclical peak in October and November 2018.

Total oil well completions dropped by 33.8% from 2020 to 2021, while gas well completions declined by 24.8%. This drop was expected after 2020 saw operators restart a high number of drilled-but-uncompleted (DUC) wells in 2020.

“The 2020 spike in DUCs happened because production fell off a whole lot more rapidly than we expected post-COVID,” Mr Ingham said. “That’s certainly why we were able to maintain production in 2020 without adding too much to the rig count. But I think that’s played out now. We’re adding production, and we’re adding more rigs, so we don’t need to draw down DUC inventory.”

Production in Texas is also trending upwards. For the first time since April 2020, crude oil production exceeded 5 million bbl/day in December 2021, according to preliminary estimates from the Texas Railroad Commission. Assuming continued upside price support, then by the second half of this year, production is on target to exceed the previous record of 5.4 million bbl/day, set in March 2020. Meanwhile, natural gas production continues to build on the records set in 2020, moving up from 10.51 million cu ft/day in 2020 to 10.68 million cu ft/day in 2021.

Further, Texas added nearly 16,500 jobs in the upstream oil and gas sector last year, according to data from the Texas Workforce Commission. As of December 2021, an estimated 175,925 people were employed in the upstream sector, up from the post-COVID low of 157,330 in September 2020. DC

Rystad Energy: Permian is ‘entering a 3-mile lateral era’

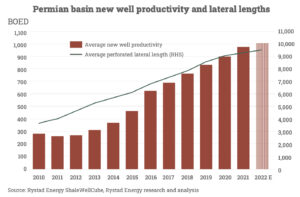

The average productivity of new wells in the Permian Basin is set to hit a record high in 2022, exceeding 1,000 bbl/day of oil equivalent (BOED) due to a surge in lateral well length, Rystad Energy research indicates. New wells are expected to break the 1,000 BOED threshold in 2022 for the first time on record, rising from the 974 BOED achieved in 2021. Average daily production levels have steadily climbed since 2010, aligned with the horizontal well length, which is expected to reach 9,500 ft in 2022.

The total completed lateral footage of wells in the Permian is expected to reach a record high of 50 million ft in 2022, beating 2021’s total of 45.8 million ft and pre-COVID-19 levels of 47.5 million ft seen in 2019. In 2020, total lateral footage in the basin dropped due to the pandemic, clocking in at only 32.5 million ft.

Operators only started using ultra-long wells, of up to 3 miles in length, in the Permian in 2014, but their popularity has quickly grown. Their market share has rocketed from 4% of completions in 2017 to 18% in 2021. However, considering total completed lateral footage in 2021, these wells accounted for as much as 23% of completions.

The average horizontal well length in the Permian increased to 9,300 ft in 2021, up from 9,000 in 2020. This increase signals a growing trend among operators to favor longer wells as they seek to increase productivity.

“The Permian is now entering a 3-mile lateral era,” said Artem Abramov, Head of Shale Research at Rystad Energy. ”Such long wells were viewed as inferior for their high finding and development costs in some deeper zones just a few years ago, but modern equipment and completion methods allow extended-reach wells to spread across the entire basin.”

However, it may be too early to view the increase in ultra-long laterals as an industrywide trend in the Permian, as some key operators contribute to this segment with a disproportionally large weightage relative to their total number of completions.

Oil and gas M&A’s increased by 16% in 2021, with highest values in upstream sector

A total of 74 billion-dollar deals were undertaken in the oil and gas industry last year, compared with only 40 in 2020, according to GlobalData. The recovery in oil price likely encouraged companies to undertake more high-value deals to push forward their growth plans. In fact, the largest deal in terms of value for 2021 was announced toward the end of the year, when prices were at multi-year highs.

Global mergers and acquisitions (M&A) activity in the oil and gas industry grew annually by 16% to reach $335 billion in 2021, considering M&As with known deal value. However, in terms of deal volume, M&A activity was largely flat at around 1,800 oil and gas deals in 2021.

The upstream sector contributed to the highest M&A transaction value of $120 billion in 2021. It also recorded the highest growth of 48% compared with 2020.

Westwood: Nearly 47,000 onshore wells to be drilled around the world this year

A new report by Westwood Global Energy Group is forecasting that approximately 46,700 onshore wells will be drilled globally in 2022, utilizing 3,960 active rigs per day. While those numbers are about 20% higher than what was seen in 2020, it’s unlikely onshore drilling activity will return to levels that used to be seen when oil prices were above $100 – unless there is a long-term return to such levels.

In the US, Westwood expects 13,000 wells to be drilled this year, with an average of 650 rigs. In 2023, 15,000 wells are expected to be drilled with 751 rigs. Independents, which account for more than 50% of shale production, are still wary of ramping activity up to where it used to be and pushing oil prices to unsustainable levels, the report noted.

In OPEC+ countries, because the pandemic-related decline in onshore drilling activity had been more muted compared with other regions, growth will be less pronounced, as well. Overall, Westwood expects OPEC+ members to drill 23,000 wells in 2022-2023. Due to the long-term nature of the infrastructural development plans ongoing in these countries, a strong ramp-up in drilling activity is not expected until late in the 2020s.

In other parts of the world, Westwood pointed to China and India as countries where high oil prices and a heavy reliance on crude oil imports will provide incentive to increase domestic production. Argentina is also likely to see a major activity boost. In January, the country’s shale oil production totaled 224,000 bbl/day and accounted for nearly 40% of total production, which is a 61% jump from the previous year.