Oil & Gas Markets

5 levers UK can pull to increase oil and gas production

High commodity prices and Russia’s invasion of Ukraine have called into question the UK’s reliance on energy imports. In response, the UK government is set to unveil a energy security strategy. In a new report, Wood Mackenzie examined the levers the North Sea can pull to increase production and argues indigenous oil and gas still has a major role to play.

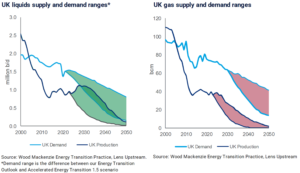

While UK demand for oil and gas will continue to outstrip supply, there are wide ranges of uncertainty, the report stated. In 2030, production will be between 0.6 million and 1.6 million bbl/day of oil equivalent (BOED); the range for demand is even wider.

“By 2050, UK North Sea production will have largely ceased. But even in a net-zero scenario, demand will persist, with emissions being offset by carbon capture and storage and nature-based solutions,” said Neivan Boroujerdi, Research Director, North Sea Upstream for Wood Mackenzie. “Current levels of production could be maintained for the next decade, underpinning energy security and safeguarding jobs. But the UK is sorely lacking in gas and will be heavily reliant on imports in all scenarios.”

The report sets out five levers to boost production: execution, new greenfield projects, increasing recovery from existing assets, exploration and the development of contingent resource. If all economically viable resources were to be produced, this could deliver 5 billion BOE of new volumes and $60 billion of investment, according to the report. Greenfield projects like Cambo and Rosebank offer the most immediate upside, but some require finance or a change in ownership.

Wood Mackenzie also asserts that UK shale is not the answer. “In-place volumes may appear big, but public opposition, population density, infrastructure, land access, flow rates and low recovery rates all limit its commercial impact,” Mr Boroujerdi said.

Energy talent survey finds potential for skills exodus to renewables sector

A whopping 82% of oil and gas professionals would consider leaving for another energy sector within three years, according to findings from the sixth annual Global Energy Talent Index (GETI). The report by Airswift and Energy Jobline also found that 54% would choose renewables.

Moreover, the talent migration is already under way, with 28% of those who joined the renewables sector in the past 18 months transitioning from oil and gas.

This is partly driven by rising concerns over climate change, with ESG factors now the second-biggest driver behind cross-sector career moves.

A total 85% of those in the sector say ESG concerns are now a factor in whether to join or leave a company. Those oil and gas majors that are slowest to adopt clean energy could, therefore, be most at risk of mass resignations, with 28% of survey respondents reporting that their organization has not changed direction to adapt to the energy transition. With investors increasingly spurning fossil fuels, professionals now rank the transition to clean energy second only to COVID-19 as the biggest challenge to oil and gas over the next three years.

On the other hand, oil and gas workers awarded their companies an average 3.53 out of 5 stars for performance on environmental issues, and 18% of people who joined from another sector in the last 18 months came from renewables. Further, 89% of all professionals would consider moving within the sector, indicating that companies with strong ESG credentials could attract workers from both within and outside the industry.

Renewables salaries are also increasingly attractive. A total 40% of renewable professionals received a pay rise last year, compared with 31% in oil and gas. And only 11% of those in renewables saw salaries fall, compared with 21% in oil and gas.

“The (oil and gas) sector should continue to promote its role in global development efforts and as a bridge to clean energy,” said Janette Marx, CEO at Airswift.

Airswift and Energy Jobline interviewed sector experts and surveyed 10,000 energy professionals and hiring managers in 161 countries across five industry sub-sectors: oil and gas, renewables, power, nuclear and petrochemicals.

Ukraine war will not derail Europe’s energy transition, DNV analysis shows

Europe’s energy transition will be accelerated – with less fossil fuels in the energy mix and lower greenhouse gas emissions – because of its pivot away from Russian gas, according to new analysis from DNV’s Energy Transition Research.

Their findings show that 34% of the energy mix in Europe will come from non-fossil fuels in 2024, 2% more than the pre-war forecast. Overall gas use will drop by 9% in 2024 compared with DNV’s pre-war model run. The biggest percentage increase is in solar, which is expected to be up 20% by 2026. The delayed retirement of some of the continent’s nuclear power plants is also an important component of filling the gap.

Although some coal is needed in the very short term to meet Europe’s energy demand, by 2024 postponed retirements and higher nuclear utilization will be important to cover the shortfall of natural gas. Emissions from energy will be 2.3% lower in Europe from 2022-2030, compared with a pathway without the Ukraine war. This is due to the increased prominence of low-carbon energy (renewables and nuclear), more energy efficiency and, in the short to medium term, lower economic growth.

Russia’s pivot East will not fully compensate for reduced gas exports to Europe because of limited infrastructure. In contrast, DNV estimates that Europe itself will produce 12% more gas in 2030, reflecting industry’s reaction to higher oil and gas prices in the short term and response to the pledge from EU to deliver more gas. The role of imported LNG is limited by regasification capacity, with extra infrastructure expected to take years to build.

Global oil/gas contracts up by 9% from 2020 to 2021, while contract value rose by 51%

Annual oil and gas contracts activity increased by 9% in 2021 in terms of the number of contracts and by 51% in terms of disclosed contract value, according to GlobalData. The number of contracts increased from 5,750 in 2020 to 6,263 in 2021, and the disclosed contract value rose from $115.42 billion in 2020 to $174.21 billion in 2021. The analysis cites improved crude oil prices and COVID-19 subsiding as key factors that boosted activity.

Notable contracts include those for an LNG project by Qatar Petroleum for the North Field East Project, as well as Saudi Aramco’s 16 contracts, with a combined worth of $10 billion, for the subsurface and EPC works for the development of the Jafurah shale gas field.

Operation and maintenance represented 44% of the total contracts, followed by contracts with procurement scope with 20%.

Wood Mackenzie: Russian-Ukraine war may slow global economic growth in 2022-2023

Global economic growth could slow to 2.5% year-on-year in 2022 and 0.7% in 2023 due to the Russia-Ukraine war, according to Wood Mackenzie.

The company has produced a downside scenario for the global economy, assuming large spill-over effects from the Russia-Ukraine conflict through transmission channels and markets, some interruption of energy and commodity flows, an energy price shock causing recessions in the EU and US, and pro-cyclical policy missteps exacerbating matters.

“Energy and commodity prices could fall as the global economic downturn takes hold and the EU and US recessions bottom out after four to six quarters when consumption hits its nadir,” said Peter Martin, Research Director. “The lag in reaching the bottom of the economic cycle sees the global economy take a bigger hit, relative to the base case, in 2023 compared to 2022.”

In the scenario, Russia partially defaults on sovereign debt worth $480 billion, with contagion effects for the European banking system. However, this pales in comparison to the Euro crisis in 2011-2012, and banks are now better capitalized to weather losses.

Conversely, a sharp rise in energy and food prices hurts industry, destroys demand and erodes consumer purchasing power. Global business confidence deteriorates and investment contracts. Wages are frozen before unemployment eventually rises and consumption falls further. Concerned about inflation, major central banks persist with monetary policy tightening into the recession and fiscal support is inadequate.

“We think a 15% decline in Russia’s GDP this year is possible,” Mr Martin said. “Over the medium term, however, Russia’s economy will be forced to rebalance and restructure.”

He added: “More importantly, the global economy could be looking at more permanent changes. If the COVID-19 pandemic highlighted a need to shorten supply chains, the war in Ukraine underscores the importance to have reliable trading partners. These forces could lead to a lasting realignment of global trade. The global economy becomes more regionalized — shorter supply chains with ‘reliable’ partners.”