Oil & Gas Markets

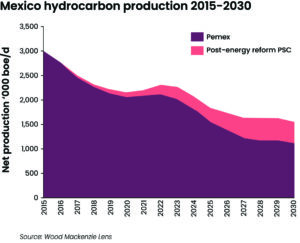

sharing contracts (PSCs) will grow by the end of the decade, this upside won’t be enough to counter the declining trend in Mexico’s production, according to Wood Mackenzie.

More private investment needed to meet expanding energy demand in Mexico

Mexico is facing several energy challenges, including declining oil and gas production, a need to increase exploration activity, a high dependence on gasoline imports, a constrained power supply and public pressure to transition to renewable energy. All this is occurring as domestic demand is expected to continue to grow through the decade, according to a report from Wood Mackenzie.

“There is a need for the new government to reassess not only the role but also the terms for increasing private investment in the energy sector,” said Adrian Lara, Principal Analyst, Upstream Latin America for Wood Mackenzie. There is a limit to how much Pemex can do, he added. Mexico just elected leftist Claudia Sheinbaum as president in June.

Mexico’s oil and gas demand is forecast to grow at 2% during the current decade. However, hydrocarbon production is set to continue to decline in the same time frame, making it difficult for the nation to meet its increasing domestic refining demands and natural gas demands in the power and industrial sectors. Further, there is risk for a steeper decline in production post-2030 if major changes are not made to the current government policy of forbidding new hydrocarbon bidding rounds or awarding exploration blocks, Mr Lara said.

According to Wood Mackenzie, about 60% of prospective resources in Mexico remain unawarded. Total prospective resources in the country are estimated at almost 113 billion BOE, of which 67.6 billion BOE correspond to 528 unawarded areas located across onshore and offshore basins. Out of the volumes discovered through exploration since 2020, only 36% have been commercially viable on average. Currently, only Pemex and three other operators have committed a budget for future exploration activities.

Equinor issues new report forecasting global energy trends through 2050

Equinor launched Energy Perspectives 2024, an independent energy scenario analysis, in June. The report contains two scenarios for the future of energy markets: Walls (current pace of the energy transition) and Bridges (accounting for radical changes needed to meet the 1.5°C reduction set by the Paris Agreement).

Key findings from the analysis include:

- Energy demand from industry and buildings will continue to stay high, but electrification will reduce the share of fossil fuels in both scenarios.

- Peak demand for fossil fuels occurs in 2025 under Walls, followed by a gentle downward trajectory. Oil demand peaks in 2027 while gas demand peaks in 2035. Under Bridges, fossil fuel demand declines at a rapid pace from 2025.

- Carbon capture, utilization and storage (CCUS) must play an essential role in the large-scale decarbonization of the power and industry sectors. In Walls, CCUS on both coal and gas starts to accelerate after 2030. In Bridges, there is a massive growth in CCUS even before 2030.

- The petrochemical sector is the only sector with continuous growth in fossil fuel demand to 2040 in both scenarios. In Walls, petrochemical feedstock demand accounts for 10% of total gas demand and 23% of total oil demand in 2050. In Bridges, petrochemical feedstock demand peaks in 2040 and plateaus toward 2050.

- Geopolitical tensions, wars and economic development are drawing focus away from energy transition goals. “Despite some regions’ adamant push on energy transition efforts… the global development over the past few years has made the challenges of delivering on the 1.5°C ambition larger,” said Eirik Wærness, Chief Economist at Equinor.

Wood Mackenzie: European gas storage levels could hit 100% by end of September amid low demand

European gas storage is forecast to reach 100% by the end of September and remain full until the end of October, with an additional 4 million tonnes per annum (mmtpa) of floating storage also accumulated, according to a new report by Wood Mackenzie.

The report states that low European demand for gas has kept storage levels at record highs this year. This is despite Europe importing 11 mmtpa less LNG through May, compared with the same period in 2023.

Lucy Cullen, Research Director, EMEA Gas & LNG Research at Wood Mackenzie, noted that lower European demand has pushed more LNG into Asia; imports to China alone has jumped by 22%. “Looking ahead, high prices are likely to provide some headwinds to near-term Asian demand growth. As a result, European storage levels remain on track to reach full capacity by the end of September and stay that way through October.”

Still, increased Asian demand, alongside risks to Russian supply and maintenance at Norwegian fields, has pushed European gas prices higher in recent months. Further, a return to normal weather dynamics over the winter of 2024/2025 and a strengthening macroeconomic outlook is set to drive increased heating requirements, industrial activity and electricity demand across Europe. Overall, an increase in gas demand of 7 billion cu m (bcm) is anticipated in 2025, compared with 2024.

Meanwhile, rising Asian demand will absorb most of the yet-limited new LNG coming online, but Europe should manage to import an extra 4.2 mmtpa compared with 2024.

However, the report adds that Europe will most likely lose more Russian volumes, up to 12 bcm per year, as the transit agreement via Ukraine expires on 1 January 2025. Central European markets will look for alternatives, including boosting use of LNG regasification capacity in Southeast Europe.

With more than 40 mmtpa of LNG supply growth expected in 2026, prices will undergo a structural shift. Asian LNG demand will absorb significant additional LNG supply, but Europe will have to absorb almost 20 Mt additional LNG, putting downward pressure on prices.

“European storage levels will once again reach record levels, despite resilient gas demand and reduction in pipe imports from Norway,” Ms Cullen added. “But with the level of LNG imports in Europe only marginally higher than peak 2022 import levels, our view is that the coming wave of LNG supply will somehow be absorbed, with European prices holding close to US$8/mmbtu. The risk that US LNG cancellation will be needed to balance the market remains limited.”