Push/pull dynamic with rig efficiency and pricing likely to lead to stagnation in dayrates

As improved efficiencies allow operators to grow production with fewer rigs, contractors seek price escalations to maintain margins

By Stephen Whitfield, Senior Editor

After hitting their peak in 2023, Lower 48 well costs are expected to fall this year and next – Wood Mackenzie forecasts a 10% year-on-year decline in well costs in 2024 and a 1% year-on-year decline in 2025. In a July 2024 report (“2024 tight oil costs: the push and pull between efficiency and OFS rates”), the consultancy attributed the cost reduction primarily to substantial drilling and completion efficiency gains, along with declining oil country tubular goods (OCTG) pricing.

Operators have been looking for step-change cost savings, in both drilling and completions, that are sustainable through market cycles. For completions, the deployment of “simul-frac” and “trimul-frac” systems, which allow pressure pumpers to complete two or three wells at once, are increasing the number of pressure-pumping hours per day, reducing NPT and fuel costs. On the drilling side, AI, machine learning and downhole monitoring systems on the bottomhole assembly (BHA) are technologies that could have a notable effect on efficiencies moving forward.

“The big thing we’ve seen with technologies, particularly on the rig, is just that we’ve been able to reduce downtime,” said Nathan Nemeth, Principal Analyst at Wood Mackenzie and a co-author of the report. “We’re seeing improvements with technologies and the super-spec rigs that are more advanced than what we would’ve been using even five years ago. We’re seeing operators really talk about big data that could unlock further efficiency improvements.”

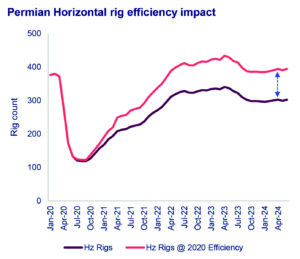

Such improvements in efficiencies will reduce the need for more rigs, however. Mr Nemeth posited that, for every 5% improvement in drilling efficiency, approximately 28 fewer rigs will be needed in the market. This calculation was based on Wood Mackenzie’s current measure of 550 active horizontal rigs in the Lower 48.

As an example, Mr Nemeth pointed to Diamondback Energy’s Q2 earnings report, which stated that the company decreased its active rig count in the Permian to 10 (compared with 12 in Q1) and its frac fleet count to three simulfracs (from three), while still increasing its full-year production guidance. In the report, the company pointed out how it was doing more with less and becoming more operationally efficient each quarter. At the beginning of the year, it anticipated that a rig would drill 24 wells a year, and by Q2 it was modeling that one rig could drill 26 wells per year. On average, the company was drilling wells approximately 10% faster in Q2 than it was at the beginning of the year.

“That earnings report really caught our eyes,” he said. “You’ve got an operator saying that, because of the efficiency improvements that they’re seeing, they don’t need to have as many rigs to deliver the same amount of wells. The way we would think about this is, the operators have their production targets and their well targets, and their priority is not so much about keeping rig activity flat. They really are targeting 5% production growth and backing into whatever rig count they need in order to deliver that. Any excess cost savings from dropping some rigs is just going to go to the shareholders via buybacks or dividends.”

The increase in efficiency is one reason why Wood Mackenzie anticipates Permian rig count to stay flat next year, but the rise in M&A activity serves as another push for greater efficiencies. Wood Mackenzie reported a total Permian M&A spend of $100 billion in 2023, and the $26 billion merger of Diamondback and Endeavor Energy has only continued that streak.

“We’ve seen a wave of high-growth Permian private operators getting acquired. And when those were done, the public E&Ps that acquired them were very clear about reducing rig counts while still bringing that high growth in line with the rest of their companies. That’s going to continue to be a driver in activity,” Mr Nemeth said.

However, despite the anticipated focus on efficiency, Wood Mackenzie still expects Lower 48 onshore rig count to increase by 40 units from 2024 to 2025.

Mr Nemeth said this forecast was primarily due to a more certain pricing market. While Wood Mackenzie does not publish a specific WTI forecast, he said it expects the price to stay fairly close to, if not slightly improve upon, the $70-80 range it has presided within for much of 2024. While that price would be far from the triple-digit figures seen in 2022, it would indicate a level of stability that would encourage operators in non-Permian areas to invest in more rigs.

“When you go back to the start of the rig count decline that we saw in 2023, we saw the roots of that coming out of the non-Permian oil plays like the Bakken, the Eagle Ford and the Mid-Con. As Russia invaded Ukraine, you saw oil prices go up over $100. But prices came down and we saw some of those higher-cost, higher-breakeven areas see a rig count reduction as prices softened. While we think the rig count’s going to stay flat in the Permian, we believe there will be rigs returning to some of those other oil plays as prices stabilize and maybe even potentially move a bit higher next year,” he said.

Gas-heavy basins are also expected to drive an increase in the Lower 48 year-on-year rig count as Henry Hub price rebounds from the sub-$2.00 levels it saw at the beginning of this year. “Gas prices just got decimated over the last couple of years, so we’ve seen rigs getting slashed in plays like the Haynesville. We think prices are going to be a little bit better in 2025, and so that would lead to more gas rigs coming back,” he said.

Lower 48 rig rates are expected to see a modest decrease from 2024 to 2025 – Wood Mackenzie forecasts 2025 rates to average $34,000, down from the $35,000 average anticipated for 2024. Mr Nemeth pointed to a proportional relationship between rig rates and the increased priority on drilling efficiency from E&Ps. He said that the E&Ps have used efficiency gains as a means to push for lower well costs, while rig contractors cite those same gains as the reason for higher dayrates. “What they’re highlighting is, we’re X percent more efficient, and for that reason, prices need to be at this level. You can’t have more efficiency and price concessions at the same time, because that’s going to be a double-win for the E&Ps.”

This push-pull dynamic with efficiency will likely lead to stasis in dayrates in the near-term future, barring an unexpected market shock. More efficient operations are helping E&Ps drill and complete wells faster, which leads them to push for lower costs. However, by using more efficient equipment and workflows, drilling contractors are pushing to sustain elevated prices.

“You’re going to continue to see efficiency improvements,” Mr Nemeth said. “Is that enough to offset some modest price escalation as rig contractors want to maintain their margins and have healthy businesses as well? That’s why we think efficiency is so important for the E&Ps, because it’s going to be like a structural game. Obviously if you see a downturn you can see rig rates decline materially, but if we see service cost inflation from a commodity price increase, those efficiency gains are going to help make that inflation sustainable through those periods. It’s one way the E&Ps are going to prevent the sorts of swings you could see in rig costs over time. Generally, the efficiency gains are going to offset any increase in prices.”

In its report, Wood Mackenzie forecast that the E&Ps with enough scale to commit to longer-term contracts for new equipment will help push greater efficiency gains and keep their costs lower. The most in-demand equipment will be high-spec, efficient and enable lower emissions. As E&Ps continue to push for these efficiency gains, the question of who pays for the software and equipment upgrades will come up more frequently in discussions with drilling contractors. Mr Nemeth said a stable dayrate environment will actually help in this regard.

“It’s almost like putting a floor in terms of pricing – if you don’t see stability, you aren’t going to see new equipment. The larger E&Ps want more equipment. But what we’re seeing right now is a trade-off with some of the lower-spec equipment being discounted. The smaller producers who can’t find longer-term contracts for the high-spec stuff are picking up some cheap equipment on the spot market and seeing some efficiency gains, but maybe not seeing all of the efficiency gains that we’re seeing from some of the bigger producers. But going forward, if the E&Ps want to see new, efficient equipment getting built, rates are going to have to be somewhat sustained.” DC