Natural gas ranked No. 1 for providing clean, reliable and affordable electricity

Natural gas and nuclear power lead in generating clean and affordable energy, according to a new energy report card created by Northwood University in partnership with the Mackinac Center for Public Policy. Eight key energy industry sectors were ranked based on their ability to meet growing demand for affordable, reliable and clean electric generation. Grades were given based on capacity, reliability, environmental/human impact, technology/innovation and market feasibility.

Many US states are moving toward a grid that primarily relies on wind and solar, but there are serious risks that should be considered. The report found that the hurried transition from affordable and reliable energy sources to weather-dependent and expensive renewable alternatives is threatening the reliability of the North American electric grid. Rushing this systemwide transition will create an increasingly unreliable grid, putting human lives and the economy at risk.

In contrast, “the reliability and affordability of fossil and nuclear fuels cannot be ignored.” Even grid managers have warned about the dangers of rushing to close down such sources. The report’s authors acknowledged the environmental costs associated with fossil and nuclear fuels, but they also explained how advances in technology allow those costs to be addressed in a way that helps protect the environment while still allowing people to benefit from their unparalleled reliability.

The report also examines some of the routinely ignored environmental impacts caused by solar and wind. While wind and solar do not emit carbon dioxide, there are substantial environmental hazards in the production of both energy sources and their battery backups.

Transitioning a service as important as a nation’s electric grid should not be taken lightly, the report noted. Research overwhelmingly demonstrates the high environmental and economic costs of rushing the grid transition. Utility companies and lawmakers at both the state and federal levels should prioritize clean, reliable and affordable energy sources.

Upstream FIDs expected to increase this year, with focus on deepwater resources

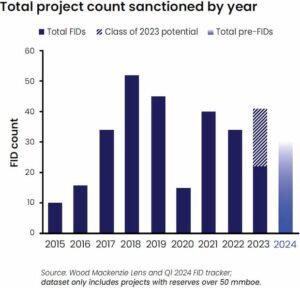

Up to 30 upstream projects larger than 50 million boe could reach FID in 2024, an increase from 22 in 2023, according to a new report from Wood Mackenzie. It states that project activity will increase this year, with a total of $125 billion in investment and the potential for 14 billion boe up for sanction.

“With many projects delayed or postponed, we expect operators to commit to more projects in 2024 than last year,” said Ross McGavin, Principal Analyst at Wood Mackenzie. “National oil companies in the Middle East will control the most projects, but the majors will be busy as well, particularly as they prioritize advantaged deepwater resources.”

Further, as the number of projects rises in 2024, project breakevens are projected to fall, with an associated bounce-back in returns (IRRs), which had dipped in 2023. The class of 2024 projects require an average of $47/bbl to generate a 15% IRR, slightly below the class of 2023’s $49/bbl. The weighted average IRR for the class of 2024 is 23%, helped by a higher liquids weighting of 57% in 2024, compared with 2023’s 46% and the five-year average of 51%.

“Most payback periods are less than eight years from FID, as operators focus on rapid execution, lower unproductive capital and higher returns,” Mr McGavin said.

With a significant emphasis on deepwater projects and advantaged barrels, the average emissions intensity for the FID class of 2024 is 13.6 kgCO2e/boe, well below the global upstream average of 21 kgCO2e/boe.

“New projects are a lever to meet emission reduction goals, especially those focused on deepwater projects that continue to deliver on low emissions intensity and economic returns,” Mr McGavin said.

Survey finds growing concerns around ROIs for transition-related investments

Survey finds growing concerns around ROIs for transition-related investments

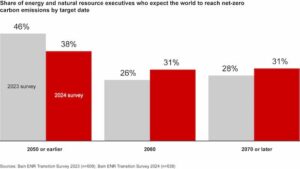

Confidence in the world’s ability to achieve net zero by 2050 looks to be eroding as it becomes even more difficult to ensure adequate investment returns and as progress diverges across a fragmenting world. Bain & Company’s fourth annual Energy & Natural Resource Executive Survey shows an increasing percentage of industry executives expect the world to reach net zero by 2060 or later — with 62% sharing this sentiment in 2024 versus 54% in 2023.

More than 600 industry executives – in oil and gas, utilities, chemicals, mining and agribusiness – were surveyed.

“Customers’ willingness to pay is a growing issue, as is the ability to generate adequate return on investment (ROI) in energy transition-oriented projects. As a result, companies are focusing on projects with a viable ROI path,” said Joe Scalise, Head of Bain & Company’s Energy and Natural Resource practice. “Clearly, the longer the executives are at the front lines of the energy transition, the more sober they are getting about the transition’s practical realities.”

The report highlighted five themes to watch:

- Fewer executives expect the world to achieve net-zero carbon emissions by 2050. This view is consistent across most regions and is most strongly held among oil and gas executives.

- At the same time, most companies are maintaining or increasing investments in their transition-oriented growth businesses, such as renewables and hydrogen. Executives in the Middle East (61%) and Asia Pacific (55%) believe those businesses will contribute to their company’s valuation and profits by 2030.

- Like last year, executives say the greatest obstacle to scaling up their transition-oriented businesses is finding enough customers willing to pay higher prices (or having equivalent policy support) to create sufficient ROI. In fact, the share of executives identifying this as a very significant roadblock jumped by 14% from 2023 to 2024, to 70% of executives.

- North America is now viewed as the most attractive region for energy transition investments, due to increasing government subsidies. However, there are concerns about policy stability over the next five to 10 years, and the availability of relatively low-cost natural gas feedstock.

- More executives believe AI and digital technologies will have a significant effect on their businesses by 2030 (65% this year vs 56% last year). The most promising AI applications include improving maintenance, production and the supply chain, with most companies focusing on applications with a clearer, shorter path to a return on investment.

Study advocates for energy security policies focusing on demand-side solutions

An international team of researchers recently published a paper concluding that demand-oriented solutions have a significantly greater potential to reduce society’s vulnerability to energy crises compared with supply measures. Governments typically rely on policies focused on energy supply to enhance energy security, ignoring demand-side options. Current indicators and indexes that measure energy security focus mostly on energy supply. This aligns with the International Energy Agency’s view, which defines energy security only in terms of security of supply. However, this approach does not fully capture the extent of vulnerability for states, businesses and individuals during an energy crisis.

“Energy security assessments also need to reflect how vulnerable countries, firms and households are to energy crises, the advantages of reducing energy demand, and the burden of energy costs,” explained Nuno Bento, a researcher at the University Institute of Lisbon and lead author of the paper. “Therefore, we have developed a more systematic approach to measure the energy security impacts of policy interventions, considering both energy supply and demand dimensions. This led us to compare interventions in energy supply along with those in energy demand from sectors such as buildings, transportation and industry.”

The researchers found that actions focusing on reducing demand would be more effective than conventional supply-side approaches in making countries less susceptible to convergent energy crises. They also proposed that future studies should compare the benefits of various energy security policies by incorporating a demand-side perspective. Instead of relying on partial assessments and problematic indicators like import dependency, they should expand their scope to include a more comprehensive evaluation of the social and environmental impacts.