Report urges hydrogen exporters, developers to consider emissions scope from full value chain

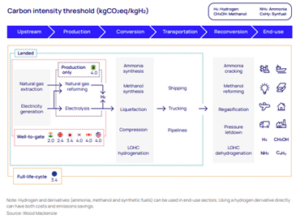

Regulations and subsidies should focus on the carbon intensity of different sources of hydrogen produced, rather than its color, Wood Mackenzie said in a new report. While green hydrogen is generating high interest as it is almost carbon free, the full value chain must be considered.

For green (electrolytic) hydrogen, nearly all emissions are attributable to the electricity used by the electrolyzer. In principle, it should only be called green if it uses 100% renewable power. However, the variability of renewables means that multiple electrolytic hydrogen projects are planning grid connection to maximize the utilization of electrolyzers and lower hydrogen unit costs. However, if the availability of renewable power is limited, there is a high risk that green hydrogen projects will need to connect to grids with high carbon intensity.

Wood Mackenzie estimates emissions from green hydrogen produced from 100% grid power could be as high as 50 kg of CO2 equivalent per kg of hydrogen (kgCO2e/kgH2) if the electrolyzer is connected to a grid powered by fossil fuels.

In the case of blue hydrogen, emissions can come from upstream natural gas production, transportation, reforming and energy use. In principle, almost all these emissions can be captured and stored. However, capturing more than 60% of the carbon dioxide from hydrogen production is costly and has yet to be proven at scale.

Hydrogen’s carbon intensity is also related to transportation. For example, any future trade in hydrogen between Australia and Northeast Asia or the Middle East and Europe requires hydrogen to be shipped across significant distances. Many countries have already established carbon-intensity thresholds for low-carbon hydrogen. But most, including future importers such as Japan and South Korea, only count production or well-to-gate emissions. For future developers and buyers of blue and green hydrogen, emissions abatement strategies across each step of the value chain should be considered.

Currently, only the EU defines carbon intensity as including emissions across the full life cycle.

NSTA launches new plan for emissions reductions from North Sea oil and gas assets

The North Sea Transition Authority (NSTA) published a new emissions reduction plan in March with strong emphasis on electrification and low-carbon power. The plan asserts that electrification alone could, under the best-case scenario, deliver emissions savings of 1-2 million tonnes in 2030. That would be equal to taking 1 million cars off the road for a year, and a total of up to 22 million tonnes by 2050, according to the NSTA.

The plan makes it clear that, where the NSTA considers electrification reasonable but is not done, field development plans and similar decisions to give access to future hydrocarbon resources on that asset will not be approved.

Other forms of low-carbon power will also be considered if operators can provide evidence of near-equivalent emissions reduction. If electrification of an existing asset is not reasonable, other low-carbon power emissions reduction strategies must be undertaken.

The plan also highlights three other emission reduction pathways: investment and efficiency, focus on inventory as a whole, with increased scrutiny of assets with high emissions intensity, and action on flaring and venting.

In relation to inventory, there will be increased scrutiny of assets with high emissions intensity and their cessation of production dates. The plan emphasizes that operators should take action and budget to reduce flaring and venting, with the latter focused on methane. The plan also sets out a clear requirement that operators monitor and reduce fugitive emissions.

The NSTA emphasized that it will apply the plan in a reasonable manner and will not pursue actions that could bring about significant unintended consequences simply because of specific wording in the plan.

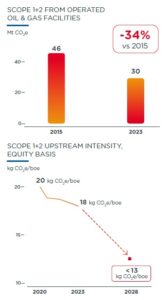

TotalEnergies reports 34% reduction in its Scope 1+2 emissions from operated oil/gas facilities since 2015

TotalEnergies published its Sustain-ability & Climate 2024 Progress Report in March. Key achievements that have been made with emissions include:

A 34% reduction in Scope 1+2 emissions from the company’s operated oil and gas facilities compared with 2015. This supports the company’s objective to reach a 40% net reduction by 2030;

Scope 1+2 emission intensity of upstream oil and gas activities on an equity basis decreased to 18 kg CO2e/boe;

A 47% reduction in methane emissions on operated facilities in 2023 vs 2020. The company says it is on track to reduce its methane emissions by 50% a year ahead of its 2025 target. Further, TotalEnergies is extending its objective to reduce its methane intensity to <0.1% by 2030 to the entirety of its operated upstream oil and gas facilities, not just its gas facilities.

The company also estimates that its LNG sales contributed to avoiding about 70 Mt of CO2e emissions worldwide in 2023.

In March, the company also launched Care Together by TotalEnergies. The program reflects the company’s social responsibility toward its employees and revolves around the four pillars of social protection, health, the family sphere and working conditions.

Technology allows BP to step up flares emission tracking

Baker Hughes announced a breakthrough in flare emissions monitoring following a collaboration with BP. Using Baker Hughes’ emissions abatement technology, flare.IQ, BP is quantifying methane emissions from its flares, a new application for the upstream oil and gas sector.

With no universally accepted solution to quantify methane emissions from flares, BP and Baker Hughes conducted one of the largest ever full-scale studies of flare combustion, including testing a range of flares under challenging conditions and verifying the accuracy of the flare.IQ technology.

Now, acting on real-time data at 65 flares across seven regions, BP can carry out early interventions and reduce emissions from flaring.

flare.IQ builds on four decades of ultrasonic flare metering technology experience. Its advanced analytics platform enables operators to pull critical information from their flare systems, including temperature, pressure, vent gas velocities and gas composition, helping maximize combustion efficiency. It is part of Baker Hughes’ Panametrics product line and enables emissions reporting based on real-time measurement, in compliance with OGMP 2.0 level 4.

Studies look at how existing infrastructure can be used to transport hydrogen

DNV is executing hydrogen blending feasibility studies for Enbridge and FortisBC Energy. The two individual studies will determine the percentage of hydrogen that can be safely transported through existing natural gas pipeline infrastructure, including Enbridge’s transmission system and FortisBC’s distribution system, both located in British Columbia, Canada. These studies, which are the largest blending studies undertaken in North America, will be used to develop the codes and standards required to safely transport hydrogen as the first step in forming a sustainable commercial hydrogen market.

The project is part of British Columbia’s work to reduce greenhouse gas emissions by decarbonizing FortisBC’s and Enbridge’s natural gas systems while maintaining safety, reliability and affordability. Individual studies will be undertaken for both sets of assets, recognizing the unique components and systems in place. Collectively, the studies will build a knowledge base to establish the safety, technical and economic requirements needed to identify and introduce the best and safest hydrogen concentration levels for the system. The entire gas supply value chain will be examined, from hydrogen injection points to end-user delivery points on the pipeline systems.

When injected into the natural gas grid or distributed into new or converted infrastructure, hydrogen can be a renewable and low-carbon fuel to reduce greenhouse gas emissions and develop a low carbon-energy economy.

“This important study will play a critical role in determining how existing energy infrastructure can be used to transport hydrogen,” said Cynthia Hansen, Enbridge Executive Vice President and President, Gas Transmission and Midstream.