Offshore drilling industry must cooperate to ‘recalibrate’ market

Rig demand stalling as contractors continue stacking rigs, attrition lags supply growth

By Alex Endress, Editorial Coordinator

Cutthroat competition for offshore rig contracts became an unfortunate reality for drilling contractors worldwide this year. Without a significant decrease in the global offshore rig supply, these woes will likely persist into 2016. According to the US Energy Information Administration (EIA), the active offshore rig count declined by almost 20% between August 2014 and August 2015, no doubt the result of big declines in crude oil prices and, subsequently, operator CAPEX. “Basically everybody is scrambling to get contracts for their rigs, whether big or small,” IHS Energy Offshore Rig Consultant Tom Kellock said in a presentation at the 2015 IADC Asset Integrity and Reliability Conference on 17 September in Houston. “This is an insanely competitive market.”

Although rig oversupply seems to be the main hurdle for drilling contractors to overcome in 2016, there has still been little meaningful attrition to the world’s rig fleet, according to Mr Kellock. “Scrapping of independent cantilever jackups, which are the basic type, is still negligible,” he said. “It’s quite honestly not really happening at the moment. Unless something happens, the situation is going to get worse before it gets better.”

Contractors are understandably reluctant to give up on their core assets, however. “Those who are largely reliant on older rigs – they cannot just scrap that fleet because maybe the industry needs it… That’s their lifeblood,” he acknowledged. Still, as competition increases for contracts, Mr Kellock said he expects to see increasing M&A activity among drilling contractors in 2016.

The industry is not sitting around waiting for the next upturn, however. Capital discipline has become a necessity for survival, and all companies from operators to contractors to service companies are seeking ways to reduce costs responsibly. While collaborative efforts have always been ongoing to bring down the overall cost of well construction, the industry is realizing that it must work harder at this in order to yield longer-lasting results. “There needs to be a different sort of focus and shift toward more of a partnership and integrated solutions in order for this to be sustainable,” said Kjell Evensgaard, Maersk Drilling’s Head of Strategic Business Partnering.

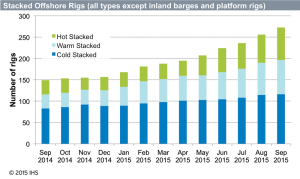

Saturated offshore rig market continues

Utilization of the global offshore rig fleet, which totals around 850 units, declined from 85% in September 2014 to 71% in September 2015, according to IHS. “The last 12 months, there was surprisingly little change in supply (but) consistent decrease in demand and utilization across the board. Correspondingly, there were rapidly increasing numbers of stacked rigs but, so far, fairly limited scrapping,” Mr Kellock said. Currently, more than 100 rigs remain in cold stack globally.

“The big question for a lot of the drilling contractors today is what are we going to do? Are we going to stack our rigs? Are we going to scrap our rigs? Or are we going to fold the tents and just get out of the business?” He advised against further cold-stacking of rigs, however, citing the costs that will be required to bring them back to working condition, as well as the risk that they will never be needed again due to the current oversupply, which is still growing. Over the past year, the total number of stacked rigs has already increased by approximately 125, from about 150 to 275. More than half of these are either warm or hot stacks, as drilling contractors are choosing to keep their assets work-ready in case rig demand suddenly rises.

Most rigs that have been scrapped so far have been floating rigs – 38 since October 2014, IHS reported. Mr Kellock said he believes that it was through the scrapping of these rigs that contractors were able to maintain floater utilization rates around a respectable 85% until March of this year. Thereafter, the significant decline in rig demand took over, pushing utilization rates down to the low-70s. But “it goes to show that by controlling supply, you can have some kind of effect on demand,” he said.

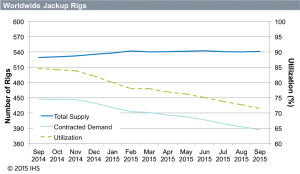

On the jackup side, while demand has declined, the total supply of jackups has grown, with 20 newbuilds entering service in 2015. “The jackup rig supply has been increasing slightly, but it’s been a similar pattern on utilization and demand as the global fleet – basically, both going down,” Mr Kellock commented. As of September 2015, the number of jackups on contract had decreased to 390, down from 450 a year ago.

Although IHS data shows that 11 jackups have been scrapped in 2015, Mr Kellock said only three of them could be considered competitive standard jackups. Six others were workover rigs, and two were independent slot units, which he said have little to no effect on the overall drilling market. “It hasn’t really helped very much. Nobody is building those, and nobody is planning to build those.”

Further, there are still more than 200 rigs being constructed. Although contracts are likely to be hard to come by for most, IHS doesn’t expect many cancellations for these newbuilds. “We have endless supply coming,” he said.

Drilling contractors look to help ‘recalibrate’ cost level

For drilling contractors, without a doubt there’s a critical need to focus on cost reduction. However, compared with the 1980s, there appears to be a heavier focus this time on seeking sustainable approaches to cost reduction. At Maersk Drilling, Mr Evensgaard believes the best strategy is to focus on value creation for operators.

“As a collective industry, we basically have to recalibrate and adjust,” he said. Instead of simply squeezing dayrates in reaction to market declines, companies should look for and even create opportunities to partner together and work out contracts that benefit both the operator and drilling contractor.

“The most obvious (value driver) is how you deal with waste,” Mr Evensgaard said, adding that bringing NPT down to the lowest possible level is a top priority for operators. One project that illustrates Maersk Drilling’s approach to value creation is the Atoll-1 well that was drilled earlier this year offshore Egypt. It became one of Egypt’s deepest wells ever drilled – reaching a depth of 21,000 ft in early 2015 – and was completed two months ahead of schedule. The Maersk Discoverer semi drilled the well in just 234 days – 62 days ahead of BP’s AFE target, ultimately saving $34 million.

To achieve these results, Mr Evensgaard pointed to efficiency improvements, in particular with BHA handling. Maersk Drilling implemented a key performance indicator (KPI) test to evaluate a new BHA handling process inside the rig’s auxiliary well center. By separating the task into a series of simpler steps, the new handling process provided an average 45-min time saving for each assembly and testing of the BHA.

Maersk Drilling is now seeking additional ways to make more drilling projects, including deepwater projects, economically viable. “A lot of the projects that were borderline economical last year are certainly on the wrong side of the line now,” Mr Evensgaard said. Making them feasible again will require more than short-term cost cuts, he continued, and the industry may simply have to wait until fundamental market drivers are sorted out organically.

In July, Maersk Drilling sold one standard jackup – the 31-year-old Maersk Endurer – to a Chinese recycling yard, but there are no plans to sell or recycle any additional rigs. The company does have one rig, the XL Enhanced 4, under construction that is scheduled for delivery in 2016. It already has a five-year contract with BP for work in the Norwegian North Sea.

“We don’t foresee any (other) newbuilds next year, certainly not unless it is against a firm contract,” Mr Evensgaard said.

Hope for rig market rebalance in 2016

Despite continued declines in overall rig utilization and dayrates, there’s still an air of optimism among some drilling contractors. “If you have a general belief in energy use and consumption, coupled with the current decline of new wells being drilled, you know that sooner or later the decline curve is going to meet the demand curve. Although they are not in sync now, it will soon happen,” Northern Offshore President and CEO Gary W. Casswell said. “Our belief is that the current decline of production, lack of drilling and increased consumption will lead demand to be greater than the supply sooner than some are currently forecasting.”

Mr Casswell said Northern Offshore is targeting Q4 2016 or Q1 2017 as possible recovery periods for rig demand, which means its newbuild rigs will be delivered during an improved period. Northern Offshore currently has six jackups under construction. Two are in the Cosco Dalian shipyard and four in the SWS shipyard, all in China. The rigs are scheduled for delivery in late 2016 through early 2018. Although none of the new units currently has contracts in place, Mr Casswell said he is confident about the competitive edge these new units bring to the market. “The fact is that our clients want new rigs with new technology, and most prefer the new over the older equipment, which is why our strategy is to continue to add new units to our fleet.”

The contractor’s six newbuilds encompass two LeTourneau Super 116Es, the Energy Engager and Energy Encounter; two CJ46s, the Energy Emerger and Energy Embracer; and two CJ50s, the Energy Enticer and Energy Edge.

Mr Casswell said he believes there will be more scrapping of older units, especially ones that have been cold-stacked, going forward. “I believe that basic drilling contract economics will force the market to rationalize the number of older units that actually come back into the market as the capital investment required in the older units with a limited life will be too great to justify. In addition, contractors will be challenged by our clients to provide new rigs and technology,” he said.

Previously traded on the Oslo Bors stock exchange, Northern Offshore has been acquired by a subsidiary of Shandong Ocean Investment, which also owns Blue Ocean Drilling. Through an amalgamation that was completed in August, Blue Ocean Drilling has now been merged into Northern Offshore. The company remains Bermuda based and is privately held. It has four existing drilling units, one floating production facility and the six new rigs under construction.

“I think we are near the bottom of this down cycle, and there is a little light at the end of the tunnel as operators will soon begin to drill and replace produced reserves and increase production to meet the future demand of consumption,” Mr Casswell commented.

“We are in a commodity business which has seen its fair share of up and down cycles. In my many years, we have always said, ‘it’s chicken one day and feathers the next.’ Although today we have feathers on our plate, we are building for the future and the demand for new equipment. It will soon turn, and we will have our rigs ready to go,” Mr Casswell said.

Inspiring new thinking

For some oilfield service companies and equipment providers, the downturn has forged a new perspective on cost reduction and collaboration with operators. This will be especially critical to the high-cost deepwater and subsea sectors.

For GE Oil & Gas, this approach is all about shifting its partnerships with oil companies to focus on long-term goals instead of on single-project sales, said Federico Noera, GE Global Engineering & Technology Leader for Subsea Systems and Drilling. “We’re seeing a paradigm shift in the industry these days which is opening up to long-term collaboration for optimized business cooperation more than a single-shot kind of engagement,” he said.

This means that rather than the operator giving the manufacturer thousands of pages of technical specifications for a subsea field development, for example, the two parties will engage in discussions on the customer’s core requirements. “Let’s open up and have a meaningful discussion on what your key requirements really are, then I’ll come back with ideas from a field configuration perspective. Then we can sit down and select the best concept that fits your requirements,” Mr Noera said.

This won’t happen overnight, he acknowledged, but the time is right to pursue this type of partnership. With the downturn in the global market, “operators are much more open to new thinking and new ideas,” he said. “The market is the market, but it’s up to us to think and behave differently so we can make the whole industry profitable.”

Capital discipline

Looking to the future beyond current difficult times, some experts are advocating that the offshore drilling industry practice more capital discipline, not just during a bust but also during the boom. “We’ve seen reduction in capital for all businesses. Everybody’s capital budgets have been slashed,” said Neeraj Nandurdikar, Oil and Gas Practice Director at consulting firm Independent Project Analysis (IPA). Initiatives such as reducing training, delaying equipment maintenance or staff layoffs may save money in the short term, but they won’t help in the long term.

Instead, Mr Nandurdikar urged operators to find the root causes that lead to cost inflation. “If we want to survive and benefit in the future, we’ve got to think about the long run,” he said at during a panel session at the 2015 SPE Annual Technical Conference and Exhibition on 29 September in Houston.

For offshore operators especially, he suggested that they choose E&P projects from a more conservative standpoint, maximizing the value that can be gained rather than risking capital on high-cost projects. “One thing we need is really robust but lean portfolios. Does every project really make sense?” Mr Nandurdikar asked.

Companies that overextend themselves during the boom years put themselves in a position to need short-term fixes – such as significant layoffs – during the inevitable downturn. “Yes, there may be barrels in the ground, but does it really make sense for me as a company to do everything that comes along?”

Short-term fixes also inevitably lead to long-term challenges. “I think we are going to see in the long run that we are sacrificing our future with these short-term decisions to preserve cash,” Mr Nandurdikar said. The combination of cutting both older, more experienced workers and young workers, along with training, could put companies in a competency hole once activity picks up again. “Who is going to train these young engineers? Maybe we need an apprenticeship model where somebody learns, but we won’t have people to (teach them).”

He also echoed the point that operators should collaborate with service providers to make more projects possible. This can help to prevent short-term project cancellations that result in large staff cuts. “We actually need to do something different if we want to have different results.” DC

DC Managing Editor Linda Hsieh contributed to this report.