Northwest Europe: Chance of recovery may depend on small operators’ access to funding

By Jeremy Cresswell, contributing editor

It’s money that makes the bit go around.

When I was asked to prepare this outlook piece covering Northwest Europe a few weeks ago, the picture at first sight looked rather bleak. I thought, crikey, this is a tough call.

If I had sat down immediately to write, the tenor of this review would probably have been a lot less positive than the picture that is emerging now (mid-October), despite the ravages of recession, the oil price mega-wobble, the paucity of money to finance corporate ambitions – not least in upstream oil and gas, and mounting climate-change pressures.

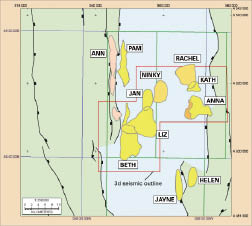

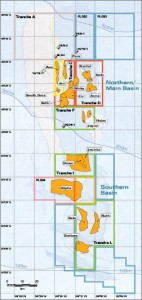

Just in the last four weeks, for example, there have been two significant UK Atlantic Frontier gas discoveries made West of Shetland, while Providence Resources has reinforced significantly with fresh 3D data the view that the twice successfully drilled Spanish Point licence area 125 miles west of Ireland has considerable potential.

Add to the relative oil price stability at around $70/bbl hints that green shoots of economic recovery are sprouting on both sides of the Atlantic, plus signs of a slight easing of money supply, and there are clear grounds for measured optimism.

But it is a tough market out there, with drilling analysts Hannon Westwood plus Deloitte data suggesting that the tough times will continue, even though there has been a partial recovery of North Sea E&A drilling activity, especially during Q3 this year.

While such a recovery suggests that 2010 can only get better, this is contingent on credit lines to cash-strapped small E&A players being restored and perhaps on rig rates dropping a modest amount.

However, given that Transocean has pulled high-specification jackup tonnage off the North Sea market for the time being, with Galaxy I and Galaxy II stacked and, with the imminent departure of the semisubmersible Ocean Guardian for the South Atlantic, is it not the case that rig rates will prevail at a higher level than some hopeful explorers with near-empty wallets would like?

Yes. However, with further rigs expected to go into stack, perhaps rates will indeed ease significantly.

Make no mistake: Times are tough, even if there are glimmers of light coming down the tunnel. The North Sea has in 2009 alone witnessed the demise of Oilexco; an apparently close-call for Ithaca; what amounts to a fire sale of the large Breagh gas discovery in the North Sea’s Southern Gas Basin to OMV; Venture Production being taken out by Centrica; and StatoilHydro becoming quietly concerned about ballooning rig rates because of its decision not to take up a couple of drilling contract options.

On the flip side, the region has also witnessed small company success stories, notably Norwegian E&A player Noreco. It was launched in 2005, has seen 11 out of the 15 exploration wells in which it has participated come in positive, has production to generate cash flow, and has eight wells in its 2009-2010 exploration schedule, plus three appraisals, including the UK sector Huntington discovery made originally by Oilexco.

Think conventionally and, for 2010, it would appear that there are a clutch of exciting UK Atlantic Frontier finds to pursue – Glenlivet and Tornado especially, not forgetting Chevron’s ongoing appraisal of Rosebank/Lochnagar.

Then there is a string of more than 20 useful to very good discoveries made during the first nine months this year by StatoilHydro on its home ground, some of which will undoubtedly be further evaluated by the company during 2010.

There is even an oil discovery made west of Ireland by Burren to perhaps revisit.

On top of this, there is a backlog of discoveries racked up in the UK and Norwegian sectors that need developing.

However, as Jim Hannon of Hannon Westwood puts it, finding the stuff is relatively low cost, certainly compared with the money needed for development, which invariably means significant further work for rigs.

Mr Hannon said that, just for the UKCS, there is a shortfall of $70 billion over and above the money currently being spent hunting for and developing new resources.

He says the UK sector’s biggest challenge in 2010 is exploring for and tapping money supply, not arguing over rig rates or counting the numbers of jackups, semisubmersibles or drillships that may or may not be available.

Hannon Westwood has developed a software program that plugs all key factors relevant to its North Sea crystal ball, and Mr Hannon says the answer comes out the same every time the numbers are crunched. Money … the lack of.

“What you end up with is a very underfunded scene. To get the UK North Sea back on track? I see a shortfall of at least $70 billion over the next three to four years.”

Despite the gyrations, Mr Hannon agrees that the current oil price of around $70 is a decent number as a catalyst to activity just about anywhere. But the big players mostly remain disinterested in small finds unless it suits their purpose while, at the other end of the scale, cash-strapped small players can’t raise the money to develop the very thing that will generate cash flow – new resources.

“The real story is that we have to go searching for finance. Even for E&A, whereas in the past about one-third of wells were underfunded, now it’s more than half,” said Mr Hannon.

“But don’t forget, chasing E&A is a relatively small part of the cost.

“Next year is going to be a field day for finance companies that want to help fund development and for contractors prepared to create solutions with upfront equity or similar participation based perhaps on some sort of joint venture arrangement. There are 3-4 billion barrels in that waiting room.”

FOCUS IS ON 2010

One of the hardest-hit players on the North Sea drilling stage during 2009 has been AGR Petroleum Services, though this is largely a UK North Sea rather than Norwegian sector issue, where business remains buoyant.

Ian Burdis, VP well management, had about a third of the UK E&A market in 2008, but nowhere near that this year. However, he is optimistic that there will be at least a partial rebound in 2010.

“Going from 2008 into 2009, around about September it became apparent that all of the aspirations and planned activities for 2009 were rapidly being taken off the table,” Mr Burdis said.

“People who had commitments were trying to pull out of them. Those that had expressed interest in carrying out work were suddenly not interested any more, postponing to 2010 at the earliest.

“Whether or not these well commitments actually materialise in 2010 is still a piece that’s yet to crystallise.

“In 2008 the company had one-third of the UK market … we did 27 projects here in the UK, 32 if you include sidetracks based on the Rushmore categorisation.

“This year we’re down to two executed projects; we’re doing the second on behalf of OMV using the Stena Carron, drilling the Tornado prospect,” which is a gas discovery declared on 14 October.

However, Mr Burdis says that preparatory work for a string of future wells has continued. In Norway it is more or less business as usual, and an exciting programme is about to kick off in the Falklands, drilling four exploration wells minimum for Desire Petroleum with the option on a further four.

Mr Burdis doesn’t see AGR managing the drilling of any further UKCS wells in 2009; everyone is instead now focused on 2010.

But why did AGR’s share of the 2009 E&A market shrink so dramatically, even allowing for the overall E&A well count being significantly less than 2008?

The answer is simple … the nature of their clients, many of which have tended to be small, new-generation players that are dependent on access to debt for their survival.

His view is that even a large company could tend toward using well management contractors, perhaps for non-strategic work or because they drill only a few E&A wells annually and cannot justify the cost of setting up an in-house capability. Six wells a years is the estimated threshold for that.

“The vast majority of people who we have been working with … and I include the other well management contractors … are the small to mid-cap new entrants or sporadic activity by other, larger outfits.”

Mr Burdis chimes with Mr Hannon about the banks’ role in the current mess and tight cash liquidity outlook, with the exception of Norway. He agrees that many small Northwest Europe players are starving.

“What we’re seeing is that there is a lot of enthusiasm to move forward, but there is an inability to get the cash with which to do it,” says Mr Burdis, adding that even AGR had been asked if it was willing to take commercial risk on drilling new wells; something that the company will not contemplate.

Mr Burdis is cautious about 2010. “I think the chances are that the North Sea is going to be one of the last areas to pick up because the UK banking system has been hit probably harder than anywhere.

“In fact, the whole house of cards … promote licences, new entrants, eased terms and conditions for licences, extended commitments and so on … is potentially at risk because of the money thing.

“Last year and the year before, the North Sea was potentially at risk because people couldn’t get rig capacity to meet their commitments. Some were even looking at relinquishing licences. Now you’ve got people who literally cannot afford to drill at all, even if rigs were available.”

Mr Burdis says “elements of the supply chain” aren’t helping to make the current situation better.

Mr Burdis says “elements of the supply chain” aren’t helping to make the current situation better.

“Let’s take the drilling contractors. Some are now demanding escrow accounts of tens of millions of dollars before they will turn up to do the work. And for rigs in stack, they’re looking for longer-term contracts before being prepared to bring them out.”

Mr Burdis is perfectly clear as to why such action has been taken … rig owners have been burned and are taking understandable precautions, at least in the UK sector.

“If it were me, would I be doing the same thing? Probably,” he adds.

One of the ironies of the Northwest Europe picture is that this is a story of two North Seas. The picture for Norway remains as different as it has ever been when compared with the rest of the region.

“There’s little adverse effect in Norway. The problems are on the UKCS, in Holland and Denmark and Germany. For example, in Denmark, we’re seeing some contracts that are not being extended and options not being honoured. OK, we are seeing that to some extent in Norway as well, and a couple of StatoilHydro option contracts have not been exercised. So you have the likes of the Ocean Vanguard becoming available over the next year, and you’ve got the Stena Don potentially available in February.

“Statoil is now looking to push down the whole cost base on the NCS. I don’t know if they’re reacting to a lack of success elsewhere (in the word) that is leading them to retrench somewhat. There does seem to be a change in behaviour.

“In truth, however, what that does in Norway is free up rig capacity for the companies that have been unable to secure it. Remember, the barriers of entry for rigs into Norway are substantially higher than anywhere else.

“For us, what we have seen in terms of demand this year was sufficient to warrant taking another semi and another big jackup into Norway. That demand remains, but I think that will now be satisfied by rigs already in Norway.

“Looking to 2010, my gut feel is that we’re not going to see much of a net change in terms of activity for Norway.”

Mr Burdis sees a significant number of rigs going into stack around the North Sea in 2010. He reckons there are around 60 E&A wells that ought to be drilled, plus a couple in Irish waters. “So let’s say 70 wells. That’s an average of eight wells for the year per rig … roughly. Rounded up, that’s seven rig years.

“By the end of this year, there will be 14-15 rigs stacked in European waters. I believe there will be an oversupply of both semisubmersible and jackup capacity in the North Sea next year. The drilling contractors will seek to tighten the market; effectively matching supply and demand.

“So what does that do for AGR? We’re actually looking to expand activities and have set ourselves up with a core staff to run two rig strings while the rest of our activity would be handled through our consultancy group; so we would bring in contractors as required.

“We downscaled towards the back end of last year, and we’re cautiously scaling back up now. We have a full team working on the Desire contract for the Falklands (Ocean Guardian).

“We’ve had the contract to manage the Desire program since 2008 and have been working with them since on well design and procurement for about the last four or five years. The program is for four wells, with the option of four more depending on results.

“There is a strong desire among companies to do stuff next year. Next year could be the same as 2008 in terms of wells managed by us as a company, although it’s not strictly speaking all UKCS.

“It might take a bit of innovation, but I’m reasonably optimistic about 2010.”

The Irish bailout, like the Greece bailout and the looming Portugal bailout, isn’t about saving the Irish people, it’s about preserving the privately-owned banking system that acts like a parasite on those same people. Soon there’ll be a Spanish bailout, perhaps French, German & UK bailouts too – when are people universally going to turn round and say NO to this nonsense?