North American land drilling market moving up, but at a gradual pace

Amid slow recovery, operators are still hedging against potential oversupply in 2022, while strong natural gas prices may lead to some reallocation of resources

By Stephen Whitfield, Associate Editor

Heading into 2022, the North American shale market appears to be in the early stages of a recovery from the COVID-fueled oil price downturn.

A gradual increase seen in this year’s US rig count, driven mostly by activity in the Permian Basin, is likely to continue into next year, according to Rystad Energy. The number of wells drilled in US shales is also likely to see an uptick in 2022. Overall, Lower 48 oil production is expected to increase from 9.4 million bbl/day in Q4 2021 to 10.0 million bbl/day by Q4 2022. Outlook for Canada is also positive, with unconventional oil production expected to reach 4.37 million bbl/day, up from 4.23 million bbl/day in 2021.

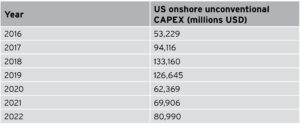

However, despite these signs of optimism and with WTI staying in the low to mid-$70s for much of Q3, operators are not expected to open the spending floodgates next year. In fact, operators are mostly planning for $60-65 WTI in their FY2022 budgets, according to Artem Abramov, Head of Shale Research at Rystad. The firm projects 2022 North American CAPEX will reach $119.9 billion in 2022, up from $98.7 billion in 2021 but still well below the $171.8 billion operators spent in 2019.

Overall, operators still appear to be hedging against potential oversupply, Mr Abramov said. While energy demand has picked up as countries lift COVID-19 travel restrictions, other factors – such as the possibility of further disruptions affecting freedom of movement and a slower-than-expected return to normal – have led to caution about raising activity to pre-COVID levels.

“The supply potential, especially in the second half of next year, looks much stronger now than it did three or four months ago. We’re seeing more production,” Mr Abramov said. “But if we get any disappointments on the demand side – for example, if jet fuel consumption recovers more slowly than most people think due to travel restrictions – we may actually see oversupplied markets in 2022.”

Statistical outlook – US

Rystad currently projects the US land horizontal rig count to average 427 for 2021, and Mr Abramov said he expects that number to rise going into 2022, averaging around 589 for next year. While that would signal an improvement over the 385-rig average in 2020, it would still be well below the 2019 average of 826 rigs.

Potential roadblocks to the market’s continued recovery next year include cost inflation and labor shortages. Rystad said it has already seen both of these bottlenecks pop up in several areas this year, and the labor shortage may continue to exacerbate in 2022 if drilling activity picks up too quickly.

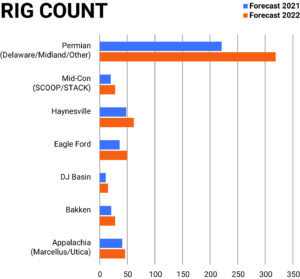

The Permian, which is still expected to make up the lion’s share of the US land rig count as it has in recent years, is forecast to see the average number of active rigs rise from 221 this year to 319 next year. Unsurprisingly, most of the increase will occur in the Delaware and Midland basins: Delaware will go from 125 to 183 rigs, while the Midland will go from 85 to 122 rigs.

Rig counts for other major US basins are going to be more muted:

• Haynesville: 48 in 2021, 62 in 2022;

• Eagle Ford: 36 in 2021, 50 in 2022;

• Marcellus: 33 in 2021, 37 in 2022;

• SCOOP/STACK: 20 in 2021, 28 in 2022;

• Bakken: 21 in 2021, 28 in 2022;

• Denver-Julesburg: 11 in 2021, 15 in 2022.

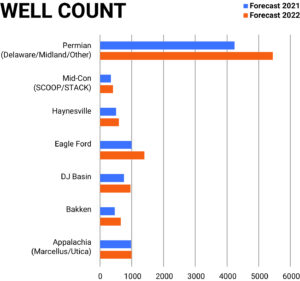

When it comes to the well count, Rystad expects US land to drill 11,324 wells in 2022. That would be a nearly 27% increase over the 8,945 wells drilled in 2021 but 22% below the 14,572 wells drilled in 2019. Looking at specific basins, a breakdown shows:

• Permian: Rising from 4,236 total wells (2,119 in the Delaware, 1,877 in the Midland, 240 in other basins) to 5,446 wells in 2022 (2,630 in the Delaware, 2,533 in the Midland, 283 in other basins);

• Eagle Ford: a 393-well increase from 1,000 in 2021 to 1,393 in 2022;

• Appalachia (Marcellus-Utica): up from 980 to 999;

• Denver-Julesburg: up from 753 to 960;

• Bakken: up from 463 to 648;

• Haynesville: up from 501 to 593;

• SCOOP/STACK: up from 338 to 408.

While dayrates have not seen much movement this year, Rystad anticipates they will rise by approximately 10-15% in 2022. If such increases pan out, average dayrates would be back to pre-COVID levels in most major US basins.

Rystad estimates average all-in revenue per rig day to reach $26,000 in 2022, with the raw rig rate making up 70-80% ($18,200-$20,800) of that figure. However, drilling contractors likely will not actually see these rate hikes until late Q1 or early Q2 of next year. This is because most of the currently active rig contracts are based on rates from early 2021, before the onshore market began to see a noticeable recovery.

Mr Abramov also emphasized that dayrates have become much harder to forecast in the current market.

“Talking with the drilling contractors, we’re seeing that the pricing model for them has changed quite dramatically. You don’t see as many dayrate-based contracts. It’s more like a fixed-term agreement in a good share of the market – a fixed fee the operator pays to get several projects drilled, and the rates may vary based on different logistical constraints.” He believes this trend is likely to continue into next year.

Statistical outlook – Canada

Except for 2020, Canada’s onshore production has been rising steadily but gradually over the past five years, and that upward trend is expected to continue next year. The 4.37 million bbl/day forecasted for 2022 would mark a full recovery to pre-pandemic levels, at 150,000 bbl/day above 2019’s production.

Much of the growth is expected to come from Alberta’s oil sands, which is forecast to contribute up to 72.4% of unconventional oil production in 2022. This year, oil sands production reached 3.02 million bbl/day, surpassing the pre-COVID record set in 2019 by nearly 200,000 bbl/day. Next year will see even more of a jump, to 3.16 million bbl/day.

Looking beyond next year, there are already major oil sands projects on the horizon to keep production growing into the 2020s. Phase H of Cenovus’ Foster Creek project, in northeastern Alberta, is expected to add 40,000 bbl/day of production capacity by 2024. Phase H is the eighth of nine expansions planned for the project. Syncrude’s Mildred Lake Extension project, targeting 490 million bbl of reserves in northeastern Alberta, should begin production in 2028.

Shale gas and tight oil reservoirs in western Canada are also catching up from the drops seen during the downturn. Tight oil production had hit 399,000 bbl/day in 2019 before dropping to 356,000 in 2020 and staying flat in 2021. That number is expected to rise to 372,000 bbl/day next year, according to Rystad. Light oil and condensate production from shale gas reservoirs is forecasted to increase from 207,000 bbl/day in 2021 to 221,000 bbl/day in 2022.

Horizontal rig counts are also in the midst of a recovery, estimated to jump from 75 rigs in 2021 to 94 in 2022. If that forecast pans out, it would mark the highest level since the 108 rigs seen in 2017. Looking at specific basins, a breakdown shows:

• Montney: up from 38 rigs in 2021 to 49 rigs in 2022;

• Duvernay: up from seven rigs in 2021 to 10 rigs in 2022;

• Viking: up from four rigs in 2021 to six rigs in 2022;

• Cardium: up from five rigs in 2021 to six rigs in 2022.

Horizontal wells drilled will also see a jump, from 1,744 this year to 2,142 next year:

• Montney: rising from 783 wells in 2021 to 1,033 in 2022;

• Duvernay: 119 wells in 2021, 172 wells in 2022;

• Viking: 142 wells in 2021, 163 wells in 2022;

• Cardium: 231 wells in 2021, 271 wells in 2022.

Natural gas market

Gas production in the US Lower 48 is expected to grow from 92.6 billion cu ft/day in Q4 2021 to 96.8 billion cu/ft day by Q4 2022, according to Rystad. Around 74% of that 4.2 billion cu ft/day increase will come from the Permian and the Haynesville, making them particular areas of note in 2022.

While the bulk of the Permian’s gas production will come from associated gas, Rystad said it’s also seeing more operators reallocate portions of their rigs and CAPEX to the more gas-rich parts of the basin as gas prices have improved. This year, Henry Hub spot prices have already hit their two highest monthly averages in the past seven years: $5.35/mcf in February and $5.16/mcf in September. If prices stay in that range, Rystad expects the reallocation trend to continue in 2022.

In fact, gas production now makes up around 25% of total Permian operator revenue and could reach 30% next year. Pre-downturn, this figure typically fell at 10% or less.

Looking out to 2035, Rystad expects the Midland and Delaware regions to account for more than 5 billion cu ft/day of gas production growth.

The Haynesville is set to become the largest source of gas output growth in the US, forecast to add about 10 billion cu ft/day to US onshore gas production by 2035. Just within the next five years, the region is expected to see production growth of 5 billion cu/ft day, amid robust permitting activity and an expanding inventory of commercial locations.

The region is forecast to have the second-highest horizontal rig count among major US basins in 2022, but it will only have the fifth-highest wells count. Mr Abramov said this discrepancy is partially because Haynesville wells are among the deepest in the US onshore, and the average pad size is also much smaller. This has significant implications for metrics like wells per rig-month – while the Haynesville has more rigs, those rigs will typically drill fewer wells than rigs in other basins.

Another key factor in the Haynesville’s growth is the relative ease with which operators can transport gas from wellheads to Gulf Coast markets, Mr Abramov said. Producers in other gas-heavy basins such as the Marcellus face more frequent infrastructural bottlenecks caused by the delays and cancellations of pipeline projects.

“The Haynesville is the most economic gas basin in the US, if you factor in transportation costs,” he explained. “And with the current Henry Hub prices, most Haynesville projects deliver triple-digit rates of returns before you take into account overhead costs. It will remain the most significant driver of nationwide gas production recovery in the medium term.”

Operator activity

The months immediately following the beginning of the downturn in early 2020 were characterized by mergers and acquisitions among US shale operators, particularly in the Permian Basin. However, those opportunities are now few and far between. Outside of three or four smaller public E&P companies in the Permian, the merger market will be all but dead in 2022, Mr Abramov said.

As operators seek other routes to optimize their portfolios, asset deals have become a particular area of focus. The most notable asset deal this year came on 20 September, when Shell announced an agreement to sell its Permian business to ConocoPhillips for $9.5 billion in cash. Shell’s Permian holdings included ownership in approximately 225,000 net acres.

This deal is also indicative of a split in the corporate strategies of major US shale operators, Mr Abramov added. One group – European supermajors like Shell, BP and Equinor, as well as non-American large independents – is focused on exiting shale and strengthening other parts of their portfolios, while another group – ConocoPhillips, ExxonMobil and Chevron – is intensifying its focus on tight oil production.

Mr Abramov said the former group is motivated primarily by two factors: either they have never been able to achieve competitive performance in US land, or they no longer view tight oil as a good fit in their corporate greenhouse gas (GHG) intensity reduction strategies. The latter group will likely seek to divest their less economic and more GHG-intensive assets in the next few months to optimize their shale portfolios, Mr Abramov predicted.

For instance, he said he “wouldn’t be surprised” to see ConocoPhillips and ExxonMobil sell their Bakken assets next year, as they currently cannot compete with Permian assets in terms of achieving lower GHG intensity.

The market is also watching for anticipated activity from private companies next year. Private shale operators’ share of total tight oil output has increased rapidly since Q4 2020, peaking at a record-high 27.2% in February 2021. In its base-case price forecast, which assume $60 WTI, Rystad estimates private operators’ share of the US onshore market will reach 28-29% in 2022.

However, because private operators often rate lower on drilling efficiency and well productivity metrics than public companies, Mr Abramov said it is unlikely this trend will lead to a significant production increase, beyond what has been forecasted. “Private operators, on average, are simply more likely to keep doing everything the way they did it in the past if the returns are acceptable,” he explained. Public companies just can’t afford that kind of approach, since their investors are pushing them towards the best practices adapted by their competitors.” DC