Mediterranean drilling looks to promising recovery on the horizon

By Katie Mazerov, contributing editor

Situated at the crossroads of Europe, Africa and Asia, the Mediterranean is a microcosm of how geopolitical and economic events can impact oil and gas recovery. From North Africa to Central Europe, the resource-rich but politically evolving region has seen its share of political tension over the decades.

This year, the story has been the Arab Spring, with the uprisings in Egypt and Libya resulting in drilling and production disruptions. In Libya, especially, the impact of the prolonged political unrest on production was immediate and profound as drilling came to a standstill.

Looking ahead to 2012, operators and drilling contractors are anticipating a market rebound in these two pivotal North African countries. Egypt is returning to production, and the expected stabilization in Libya has raised hopes there for renewed activity. Those developments, along with increased activity in some of the region’s growing markets such as Tunisia and Central Europe, are putting a generally positive spin on the near-term drilling outlook.

“The political situation is stabilizing, and we are very optimistic going forward,” said Jens Byrialsen, managing director of Egyptian Drilling Company(EDC).

“Onshore, we are seeing dayrates increasing slightly, and utilization is firming up. Egypt has seen some very significant oil and gas discoveries recently that will strengthen that market and attract more companies.

“In Libya, depending on how quickly the political situation is resolved, the potential is there, and we are hopeful we can get our rigs up and running,” Mr Byrialsen continued. EDC shut down and evacuated all three of its onshore rigs in Libya. The company also has one land rig operating in Syria, and while operations have remained steady, Mr Byrialsen is concerned about potential political unrest in that country as well.

Egypt and Libya will be key growth areas for the Mediterranean, along with some emerging smaller markets, he said.

The company has a fleet of 70 rigs, most of them operating onshore Egypt. The offshore rigs include eight jackups, five of which are EDC-owned, and three are under management contracts for Maersk Oil and the Egyptian Natural Gas Holding Company (EGAS). Six jackups are operating in Egypt; the other two are in Gabon and Qatar.

Offshore, dayrates have struggled to keep up, in part because the region remains oversupplied with jackups, Mr Byrialsen said. “Even some reasonably high-spec jackups are sitting idly in the Mediterranean. In the Gulf of Suez, dayrates have softened in recent years, and they remain soft with no indication of an increase.” At the same time, the market will likely have to phase out a significant number of older jackups, he noted.

Complicating the jackup picture is the shrinking shallow-water opportunities in Egypt. “The Egyptian part of the Mediterranean is where we expect to see a serious increase in activity,” Mr Byrialsen said. EDC has no plans to move into the deepwater sector or to add any newbuilds to the jackup fleet.

Another company preparing for an uptick in the wake of Arab Spring is Croatia-based CROSCO, an onshore and offshore integrated drilling and well services contractor. “The return of the North African markets to full capacity will be the biggest development for us over the next 48 months,” said George Kovacic, a consultant for the company.

“Events have happened quickly on both sides of the disruption,” he said. “Within a two-week period, there was an oversupply of jackups in the region, and now, in another two-week period, we have seen that oversupply balance out. The planned, ongoing projects will be the first operations back on track.”

The company, with its subsidiary Rotary Drilling Company, has more than 50 land drilling, working and geoservices rigs, one jackup and one semisubmersible. Several are working in the Mediterranean region.

Those include three drilling rigs under contract in Libya. All three were shut down in March. CROSCO also has two owned and one managed rig in Egypt and has plans to move into Tunisia. The first of the drilling rigs in Egypt, the EMSCO 605, is already being mobilized back to work following the disruption in that country. The company also has an ongoing operation in Turkey.

The North African market is rich in oil but also exports a large amount of natural gas to Europe, Mr Kovacic said. Italy has long-term natural gas contracts with both Libya and Algeria.

“We’re feeling very positive about the future,” Mr Kovacic said. “A healthy market in the region is in everyone’s best interest. Everyone needs the revenue that will be generated.”

Adriatic and the Balkans

CROSCO has extensive operations along Adriatic coastal and Balkan nations, with ongoing drilling and well services operations in Croatia, Hungary, Bosnia-Herzegovina and Slovenia, and a jackup in Italy, where the company held, and may still hold, the record for the deepest offshore well drilled in Europe, at nearly 24,000 ft.

ZAGREB 1, a semisubmersible that has been active in the Mediterranean region, is undergoing a five-year survey and maintenance program and will be available in January 2012. CROSCO also anticipates an increase in operational activities in Croatia.

The company’s most prolific Central European operation is in Albania, where it has two rigs operating – and will be deploying a third – for Bankers Petroleum in the Patos-Marinza field, the largest onshore oilfield in continental Europe, with an estimated 7.5 billion barrels of oil in place.

The field produces primarily medium- to heavy-grade oil with an average API of 8° to 10°, said Gregor Schoenberg, senior staff drilling engineer for Bankers Petroleum. Since the company entered the Albanian market in 2004, production has gone from 600 bbl/day to 14,000 bbl/day. Production, most of it for export, has increased by approximately 75% in the past 18 months.

“We’re bringing Western technology and expertise into an area that was initially drilled and produced using very rudimentary methods” Mr Schoenberg said. “We are much more efficient because we have science on our side; we are also much more environmentally conscious.”

Vertical drilling has been done in the field since the 1920s, but production had declined to very low levels prior to Bankers’ commencement of operations in the country. The Albanian government has been very receptive to the influx of Western technology, and the ramped-up production has been good for the local economy, Mr Schoenberg added.

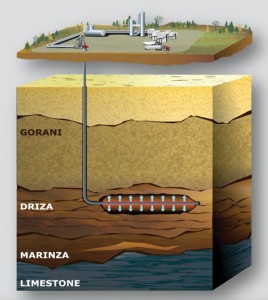

Bankers, using older rigs that have been modernized, now has four rigs operating in the field, drilling eight horizontal wells per month. A fifth rig, which is being supplied by CROSCO, will begin service in November and will help push the number of new horizontal producers per month to 10. Measured drilling depths are typically 2,500 meters, with 500- to 700-meter horizontal legs. The reservoirs feature multiple layers in three zones – the upper Gorani zone, middle Driza zone and Marinza – each with several sub-sections.

Thermal drilling pilot

“These are not cookie-cutter wells,” Mr Schoenberg said. “The region is geologically very complex, with layers that come and go throughout the field, making it technically challenging to navigate. One of the biggest challenges for us is avoiding the existing vertical wells that were drilled in the past.”

The company recently embarked on a thermal pilot drilling program for some of the heavy oil in place. “We believe there is huge potential in this play for heavy oil production,” Mr Schoenberg said. While the initial pilot uses a “huff and puff” process of alternating steam injection with production, future plans could include a typical steam-assisted gravity draining (SAGD) process.

This involves drilling parallel holes on legs within a few meters of each other and injecting steam into the upper leg. Gravity then pushes the steam down into the production leg to make the fluid flow more easily.

Bankers also has a fleet of 12 service rigs – with plans to bring in two more – for well cleanout, workovers and water shut-off work and is bringing in additional coiled-tubing units. The company also has retained assets in the heavy-oil Kucova field in Albania, which holds an estimated 296 million bbls of oil in place.

KCA DEUTAG, headquartered in Aberdeen, is anticipating strong growth in its onshore business in North Africa following the Arab Spring uprisings, Rodrigo Rendon, head of business development, said. The company owns and operates 16 of the 54 rigs that were working in Libya before the shutdown.

“We successfully and safely evacuated our employees and have kept local security to oversee our rigs in-country, which are located in the desert, somehow away from the main areas of unrest,” Mr Rendon said. “The timetable is difficult to pin down, but we anticipate a return to some kind of activity in 2012.”

Algerian market growing

The company also has three rigs active in Algeria that are working, among others, for Dublin-based Petroceltic International, and plans to double the count next year with the introduction of three additional newbuild rigs. “We see Algeria as a growing market,” Mr Rendon said. “The country has large proven oil and gas reserves and is a major supplier to Europe. We are also working at further enhancing our relationship with Sonatrach, the Algerian-owned oil and gas company.”

The increase in activity will involve deployment of the SPEED RIG, primarily 1,500 hp, manufactured by KCA DEUTAG subsidiary BENTEC. The AC-driven, lightweight, compact rig was designed to be highly efficient in desert conditions. It features a 36-hr move time between wells and a top drive with 25% higher torque than equivalent models, according to the company.

KCA DEUTAG also is exploring the possibilities of entering the other markets and countries and regions in Africa where it currently does not have a footprint, for example, in East Africa and Tunisia. The company has appointed Stuart Anderson as business development manager for Africa. “We are offering a proposition of quality and performance to ensure that our clients are able to drill their wells safer, quicker and in a cost-effective manner,” Mr Anderson said.

The main challenges in the region include security and limited rig capacity, meaning the demand is far greater than the supply. Also of top priority is ongoing development of relationships with the national oil companies and international players, he noted.

In the offshore arena, Grup Servicii Petroliere (GSP), a subsidiary of Romania-based Upetrom Group, provides drilling and construction services in the Black Sea and Mediterranean Sea. The company owns a fleet of seven jackups that have been modernized in the last three years, Bruno Siefken, senior vice president of Upetrom Group, said.

Black Sea challenges

“Most of the drilling we do is conventional, but the Black Sea has some deepwater high-pressure, high-temperature (HPHT) wells, and we have future plans to add a semisubmersible to the fleet to move into deeper waters,” Mr Siefken continued.

GSP was the general contractor for the Engineering, Procurement, Installation and Commissioning (EPIC) project for TPAO, Turkey’s national oil and gas company. The company recently completed drilling four wells with a platform rig in the Akcakoca gas field of the Black Sea, about 150 km from Istanbul.

GSP hopes to relocate that rig to Greece to drill and work on 10 exploratory wells for Energean Oil Company in the Kavala oil and gas field, pending the resolution of that country’s financial debt crisis, Mr Siefken said. In addition, Energean is planning several exploration wells.

GSP has two jackups in the Black Sea, one that is being refurbished and another that is set to begin drilling an exploration well in offshore European Turkey. GSP Saturn, another jackup that was rebuilt in 2009, has been deployed to Kaboudia field in Tunisia for Numhyd.

“We have established a base in Tunisia and from there plan to expand into other North African countries, mainly Libya, as soon as that market comes back online,” Mr Siefken said. “We feel that with the formation of new governments in Egypt and Libya, offshore drilling activity will rebound stronger than before.” Prior to the Arab Spring, GSP had one rig operating in Libya for Japanese oil company JAPEX.

GSP’s jackup design allows for easy mobility between the Black Sea and Mediterranean Sea through the Bosphorus Strait. “Our rigs have leg extensions that can be mechanically disconnected to clear the bridges in Istanbul, that are only 58 meters high,” Mr Siefken said. “We can take 15 meters off our rig height. This technology gives us the advantage of moving between the two seas in a cost-effective way, providing us a high rig occupation rate.”

Ensco has had jackups operating in shallow water off Tunisia for some time, said Steven Brady, vice president, Europe and Mediterranean. The ENSCO 85, a 300-ft MLT 116-C jackup, is working for PA Resources, a Swedish oil and gas operator. Through its acquisition of Pride International earlier this year, Ensco also has a deepwater semisubmersible working for Noble Energy offshore Israel.

“Some world-class gas reserves have been found in the region, and there is optimism that this trend will bring significant drilling opportunities,” Mr Brady said. Ensco has not been significantly impacted by the events of the Arab Spring. “We were careful to quickly institute safety measures when some of the uprisings began several months to protect our people and assets,” he added.

“But for some of the uprisings and the Greek debt crisis, we might have had more demand for offshore rigs in Libya and also Greece, where we have contracted some of our jackups for Aegean Energy; however, that is hard to quantify,” he continued. “As the situation in Libya and the broader region stabilizes, we hope to see more opportunities with customers.”

Deep and HPHT environments are among the technical challenges in the region. “There are some unique drilling challenges in the Nile Delta area where Egyptian operators have some deep, high-pressure gas work requiring HPHT-capable and experienced rigs with two million-lb hookload capacity,” Mr Brady said. “Also, we are seeing increasing demand for a deepwater-moored semi with 6,000-ft capability such as the ENSCO 5006 in the Eastern Mediterranean, in offshore Egypt, Israel and Cyprus.”

SPEED RIG is a trademark of KCA DEUTAG/Bentec.