E&P briefs: Statoil assumes operatorship in Eagle Ford, Chesapeake selling shale assets

Statoil takes over operatorship in Eagle Ford

Statoil has assumed operatorship for all activities in the eastern part of its Eagle Ford assets in Texas. “This is an important milestone for Statoil’s development as an operator in the US,” Torstein Hole, senior vice president for US onshore, said. “We now have operational activities in all of our onshore assets – Bakken, Marcellus and Eagle Ford. Our organization in Houston is eager to further develop our Eagle Ford holding as operator, and we look forward to engaging with communities and landowners in the eastern part of our joint venture acreage.”

Statoil entered the Eagle Ford shale in 2010 through a 50/50 joint venture with Talisman Energy where Talisman initially acted as operator. Last year, the companies agreed that Statoil, through a phased transition, would take responsibility for operations in the eastern half of the asset. This acreage falls mainly within Live Oak, Karnes, DeWitt and Bee counties.

Talisman will continue with operational responsibility for the western acreage, which is principally in McMullen, La Salle and Dimmit counties. The splitting of operational responsibilities does not impact joint ownership for the total acreage.

Statoil has taken over operations on three drilling rigs in the Eagle Ford, as well as assumed responsibility for producing wells, processing facilities, pipelines and infrastructure and a field office in Runge, Karnes County.

Statoil holds approximately 73,000 net acres in the Eagle Ford. Its production share stands at 20,200 bbl of oil equivalent per day (boed) from approximately 300 producing wells.

Elsewhere in US shale plays, Statoil also holds significant positions in the Marcellus and Bakken. Production from these positions contributes significantly to Statoil’s North American growth strategy, where the goal is to produce more than 500,000 boed in 2020. Globally, the company aims to produce 2.5 million boed in 2020.

Chesapeake to sell northern Eagle Ford, Haynesville assets for $1 billion

Chesapeake Energy Corp is selling assets in the northern Eagle Ford Shale and Haynesville Shale to EXCO Operating Co, a subsidiary of EXCO Resources, for aggregate proceeds of approximately $1 billion. The transactions are expected to close in Q3 2013, contingent on certain closing conditions, according to the announcement made last week.

In the northern Eagle Ford Shale, EXCO has agreed to acquire approximately 55,000 net acres in Texas’ Zavala, Dimmit, La Salle and Frio counties, including approximately 120 producing wells with average net daily production of approximately 6,100 bbl of oil equivalent during May.

In the Haynesville Shale, EXCO has agreed to acquire Chesapeake’s operated and non-operated interests in approximately 9,600 net acres in Desoto and Caddo parishes, Louisiana. Included in the transaction are 11 units operated by Chesapeake and 42 units operated by EXCO. Average net daily production from the Haynesville properties to be sold was approximately 114 million cu ft of natural gas equivalent during May.

“Today’s announcement brings our year-to-date asset sales signed or closed to approximately $3.6 billion, which, combined with forecasted net operating cash flow, enables Chesapeake to fully fund its 2013 capital expenditure budget. Additional asset sales contemplated for later this year may reduce long-term debt and further enhance our financial liquidity,” Chesapeake CEO Doug Lawler said.

Shell Vicksburg “A” may hold more than 100 million bbl of oil equivalent

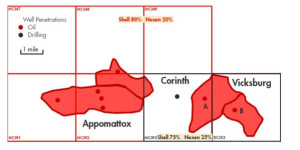

Shell has announced a successful exploratory well at Vicksburg in the deepwater Gulf of Mexico. The well is located 75 miles (120 km) offshore in the Mississippi Canyon Block 393 in 7,446 ft (2,269 meters) of water. It was drilled to a total depth of 26,385 ft (8,042 meters) and encountered more than 500 ft (152 meters) of net oil pay.

In total, the Vicksburg “A” discovery is estimated to hold potentially recoverable resources of more than 100 million bbl of oil equivalent (mmboe). It adds to the more than 500 mmboe of potentially recoverable resources that have already been discovered and appraised at the nearby Appomattox discovery. Vicksburg “A” is a separate accumulation from both Appomattox and the 2007 Vicksburg “B” discovery.

“The results of the Vicksburg well strengthen our existing deepwater Gulf of Mexico exploration portfolio and should contribute to the nearby Appomattox discovery,” said Mark Shuster, executive vice president of Shell Upstream Americas Exploration. The discovery well will be followed up with a sidetrack well to test the Corinth prospect, a separate fault block from the Vicksburg discovery. Shell, which is the operator with 75% interest, expects to conduct further exploration drilling targeting tie-backs to Appomattox. Nexen, a subsidiary of CNOOC, is Shell’s partner with 25% interest.

Eni, Rosneft begin seismic operations in Russian Barents Sea

Eni and Rosneft have begun seismic operations in the Fedynsky and Central Barents license areas in the ice-free part of the Russian Barents Sea. The 2D seismic survey, during which an environmental monitoring program will be implemented, is planned for 9,950 km over the two areas.

The project is part of a wider cooperation between Eni and Rosneft sanctioned under the Strategic Cooperation Agreement approved in April 2012.