Environment, Social and Governance

DNV report: UK emissions to drop 82% by 2050 but still fall short of net zero target

The UK will miss its net zero target by 18%, but its emissions in 2050 will still have dropped by 82% from 1990 levels, according to DNV’s 2025 UK Energy Transition Outlook report. That amounts to remaining annual emissions of 145 million tons of CO2 equivalent (MtCO2e).

DNV assessed the UK’s trajectory against key government targets: Clean Power 2030, 2035 Nationally Determined Contribution (NDC) and the net zero by 2050 goal.

The Clean Power 2030 target sets an ambition to decarbonize the electricity system by decade’s end, but DNV forecasts that unabated gas will still generate 12% of UK electricity in 2030. Full decarbonization is expected by 2035.

Renewables is forecast to see strong growth, with solar and wind capacity nearly doubling to 90 GW by 2030. However, this remains 45 GW short of government targets to double onshore wind, triple solar, and quadruple offshore wind.

Under the new NDC, the UK has committed to reducing economy-wide greenhouse gas emissions by 81% by 2035, compared with 1990 levels. DNV’s projections suggest it will reach only 68%, requiring steeper reductions to meet its pledge.

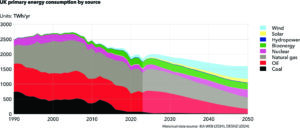

When it comes to fossil fuels, its share in the UK’s primary energy mix is expected to fall slowly from 75% today to 71% in 2030. After that, the transition is expected to accelerate, falling to 34% by 2050.

However, oil and gas will remain dominant across the next decade, with significant amounts still required to balance energy demand and ensure security of supply. The report noted that there are still a number of oil and gas projects in concept or front-end engineering stage and working toward final investment decision. Around 30 projects are looking to start up within the next five years, and recoverable reserves for those projects are estimated at approximately 2 billion barrels of oil equivalent over the life of the fields.

In 2023, oil accounted for 35% of overall primary energy, largely driven by the transport sector. That is forecast to decline by two-thirds by mid-century, due to the phase-out of combustion engine vehicles from UK roads. Aviation will replace road transport as the single largest consumer of oil products, doubling its share from around 20% to 42% by mid-century – although in absolute terms, oil demand for aviation will decrease by 58% in the same period.

Natural gas is likely to remain dominant for the foreseeable future. Especially for home heating, more than half of homes will still use natural gas by 2050, with adoption of heat pumps limited by cost and insulation requirements. The use of natural gas will also increase in the production of hydrogen and derivatives, growing from almost nothing today to 60 TWh per year in 2045. That would account for 15% of total natural gas demand in the 2040s.

2024 safety results show positive trends in Equinor’s SIF to 0.3, TRIF to 2.3

Equinor recently released its 2024 safety results showing an overall positive trend. Its serious incident frequency per million hours worked (SIF) was 0.3, down from 0.4 at the end of 2023. Its total recordable injury frequency per million hours worked (TRIF) was 2.3, down from 2.4 in 2023.

“We see that the overall safety results are improving, the positive trend demonstrating that systematic efforts over time are paying off,” said Jannicke Nilsson, Executive VP for Safety, Security and Sustainability.

However, Ms Nilsson noted that the deadly helicopter incident that occurred on 28 February 2024 means more work is needed to continuously improve safety.

Equinor also reported seven oil and gas leaks in 2024, a decrease from 10 at the end of 2023. Oil and gas leaks are classified according to the severity of the leak rate.

Delayed energy transition would necessitate 30% rise in upstream spending

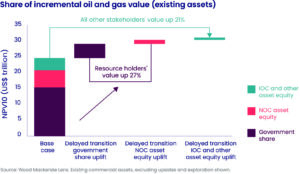

With the possibility increasing for a delayed energy transition, a new Wood Mackenzie report looked at how the upstream sector would be impacted. The report (“Taking the Strain: How Upstream Could Meet the Demands of a Delayed Energy Transition”) noted that a variety of external pressures have weakened government and corporate resolve to spend the estimated $3.5 trillion required to restructure energy systems to limit hydrocarbon demand and global warming.

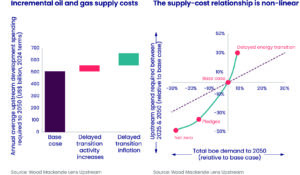

If the upstream sector needs to meet higher-for-longer oil and gas demand, it’s estimated that 5% more oil and gas supply would be needed. Compared with the base case, liquids demand would average 6 million barrels per day higher, while gas demand would average 15 billion cu ft/day higher. The base case incorporates the evolution of current policies and technology advancement.

The report posits that “a five-year transition delay would require incremental volumes equal to a new US Permian Basin for oil and a Haynesville Shale or Australia for gas,” said Angus Rodger, Head of Upstream Analysis for Asia Pacific and the Middle East.

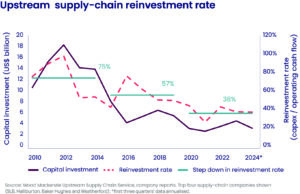

Wood Mackenzie also estimates that upstream spending would have to rise by 30% compared with the base case, up to $659 billion annually.

“We have calculated the sector’s cost elasticity by integrating our field-by-field annual supply models with our global supply chain analysis,” said Fraser McKay, Head of Upstream Analysis. “This includes an assumption for continued operational efficiency improvements, which the industry could very well outperform, mitigating some of the inflationary impact.”

However, more activity would put significant pressure on the supply chain, parts of which are already running near capacity.

“The industry’s current strict capital discipline edict would also have to change or, at least, what defines capital discipline would have to evolve,” Mr Rodger said.

With the higher cost of supply, oil and gas prices would be pushed higher, as well. Wood Mackenzie forecasts Brent price would rise to over $100/bbl during the 2030s in a delayed transition scenario before falling toward $90/bbl by 2050.