McKinsey warns Europe may need to reduce gas demand by 55 bcm

Europe could be at substantial risk if it fails to immediately reduce its gas demand by 55 billion cu m (bcm), according to new analysis by McKinsey & Co.

In the wake of the war in Ukraine, McKinsey research finds that a total cessation of Russian imports could reduce Europe’s supply by 25 bcm and renewed Asian LNG demand could soak up 35 bcm of supply, while a colder winter in 2023 could push demand up by 15 bcm. The analysis shows that 57% of EU manufacturers would not be able to further reduce gas consumption while maintaining output over the next two years, indicating that further gas rationing measures could substantially impact the EU economy.

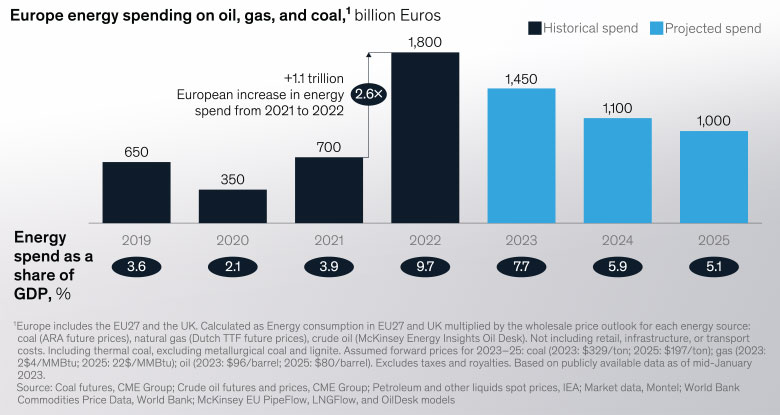

The analysis reveals that even if Europe meets its RePowerEU targets to reduce gas consumption and improves energy efficiency across buildings and industry, volatile gas prices and potential supply disruptions still pose a risk to many economic sectors. McKinsey projects that Europe may need to delay the phase-out of coal, extend the lifetime of nuclear plants and accelerate the expansion of renewable energy sources to reduce reliance on gas as a baseload.

“Our analysis shows there is little bandwidth to further reduce Europe’s gas demand without substantial economic damage,” said Namit Sharma, Senior Partner at McKinsey. “If the EU achieves all its gas-savings measures, this could see a 24% reduction in consumption, yet other potential factors such as more competition from Asia could reduce Europe’s supply by an even greater amount. The many variables at play will produce significant uncertainty and Europe’s businesses may need to prepare to mitigate these risks. This may require businesses to consider diversifying their energy sourcing and managing demand, investing in natural gas substitutes or storage and closely monitoring movements in the energy market.”

Thomas Vahlenkamp, Senior Partner at McKinsey, added: “If Europe can sustain and accelerate several gas-demand reduction measures, the market is likely to remain balanced without significant price spikes in the coming years. Europe could drive substantial gas demand reduction by accelerating industrial-electrification measures like fuel-switching and build-out of RES (renewable energy sources) and through longer lifetime extensions of nuclear and coal.”

McKinsey identified several actions that businesses can utilize to help navigate energy market volatility and disruption:

- Energy procurement and energy management – Diversifying energy sourcing and demand-side management could allow businesses to manage costs and stay competitive in an increasingly volatile energy market.

- Risk management and security of supply – investment in storage or in natural gas substitutes, such as biomethane, could hedge against potential energy supply disruption while higher gas prices could boost the business case for longer-term fuel switching or electrification.

- Signpost monitoring – Monitoring of key signposts in the energy market may allow businesses to respond to changing supply and demand dynamics, while scenario planning could help pivot between different levels of demand response.