The case for non-OEM repairs: a missed cost reduction opportunity?

Non-OEM makes case for reexamining engrained beliefs about equipment repairs, urges industry to gain knowledge of alternatives in supply chain

By Craig Fraser and Paul Naysmith, RigQuip

Non-original equipment manufacturer (non-OEM) repair of drilling equipment is an often-controversial subject, with the drilling industry seemingly split down the middle. For various reasons, some do, and some don’t. This article will discuss and explore the differences between OEM and non-OEM repairs and present one company’s view, along with two case studies where an operator and drilling contractor chose to go non-OEM. The latest API repair standards, API Q2 and API 16AR, will also be discussed and presented.

Introduction

One cost reduction opportunity that is sometimes overlooked in the oil industry supply chain is using non-OEM service providers.

Traditionally, the oil industry is built on well-established methods and technologies. The way that hydrocarbons are extracted, controlled and processed has not changed significantly for nearly a century. As a result, within the oil industry, there are major brands that have been established for decades, recognized in their name, limited to a particular field or technology. In this article, these are regarded as OEMs.

As time has passed, along with the patents expiring and the movement of expertise or knowledge, a sub-industry of businesses has been created that provides equivalent equipment and services to the OEMs. In this article, these are regarded as non-OEM. Two other terms used here are original component manufacturer (OCM) and current equipment manufacturer (CEM).

Challenging the Perception

In an industry that has experienced catastrophic events over the past four decades, there is a conservative approach to the supply chain and to going non-OEM.

Companies that are reluctant to change from using OEMs have provided a variety of reasons, presented below. This article will review them.

‘API states to use the OEM’

API is the technical body for the oil and gas industry. Established in 1919, API today supports 650 member companies in the industry and produces technical standards to assist in achieving global consistency to ensure the integrity of equipment, processes and services.

It is the author’s view that API does not state the OEM should be used. The group actively engages all stakeholders, including non-OEMs, to develop its specifications and standards.

A summary is provided below of two API specifications and standards applicable to the debate.

• API 16AR (API, 2017)

This is an updated version of the API 16A standard specifically for repair and remanufacture of drill-through pressure control/containing equipment built under the API 16A and API 6A standards, where equipment will have typically been API monogrammed. API 16AR is the first “AR” version of any standard published by the API.

Key points of the API 16AR standard include:

1. The addition of the term CEM;

2. It allows for a non-OEM to take ownership and become the CEM.

3. The “manufacturer” is the OEM or the CEM as per the standard.

4. There is no stated requirement that the OEM is the “remanufacturer” and/or the company carrying out “repair,” according to API 16AR.

It is the author’s contention that this new standard is driven in part by stakeholders with a desire to explore alternatives to the OEM.

• API Q2 (API, 2016)

The API Q2 Specification defines the quality management system requirements for service supply organizations for the petroleum and natural gas industries. It is intended to apply to the execution of upstream services during exploration, development and production in the oil and gas industry. This document applies to activities associated with well servicing, equipment repair/maintenance and inspection activities.

The API Q2 specification was established in 2011 and designed for companies servicing oilfield equipment. It was developed as a direct result of Macondo by an API subcommittee that currently includes operators, drilling contractors and key service companies. API Q2 is similar to the API Q1 quality management standard but with additional sections to cover service and repair aspects.

RigQuip is certified to API Q2 and was among the first service companies in Europe to obtain this certification.

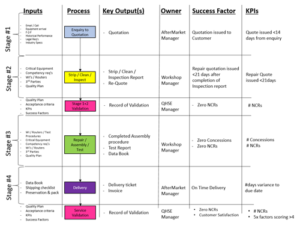

In summary, through improving quality in the business by using the framework of API Q2, RigQuip has increased its performance based on competency, process and risk mitigation. The client focus throughout maintains the course of direction in the customer’s interest. It has been observed that through the structure of the business and process discipline, financial savings come as a result of improving quality and are shared with the customer.

‘Less risks associated with the OEM’

The definition of risk is “a probability or threat of damage, injury, liability, loss or any other negative occurrence that is caused by external or internal vulnerabilities, and that may be avoided through preemptive action,” (BusinessDictionary, 2018). Therefore, it is to be viewed as the risk with the non-OEM in context. The company looking to select a vendor for work may have an established relationship with the OEM and have a working understanding regarding the quality of prior work to base a presumption of future performance. Taking this into consideration with the risks of moving from the OEM to a non-OEM – such as internal barriers, administration controls or strategic policy – a level of complacency or conditioning of the system to using the OEM may occur.

Any business looking at the supply chain should question what are their actual risks in moving from an OEM? A process of risk appreciation or mitigation can be established, and these can be in the form of First Article Inspection, audits, or testing services on a small scale. From these examples, risk is to be considered by the company.

In some cases, risk may be reduced using a non-OEM. There are several cases where, for example, a non-OEM has further developed and enhanced OEM products or parts to increase safety, quality or reliability.

‘Our management dictate this’ and ‘Our technical standards state we have to’

Every organization has rules, many written as standards. Then there are unwritten rules, which become a business’ culture. For most businesses, there is a basis to establish these rules through lessons learned from past mistakes or from a risk assessment. For many organizations, these rules were created in the past, and it is possible that the justification of these have been forgotten or never fully investigated.

Taking the lessons from the five monkeys experiment (Franz, 2014), the statement above could be rephrased as “we have always done it this way.” In many ways, this has been viewed as a “culture killer, an innovation killer, an employee experience killer and a customer experience killer. Companies change. Employees change. Customers change. We need to regularly revisit rules, policies, processes and approaches to ensure that they are still relevant and that we deliver a great experience for both employees and customers.” (Franz, 2014).

It is, therefore, recognized that without good understanding of these rules, they could be harming the decision to go for a non-OEM option to the benefit of the organization or the ultimate customer. It is necessary to challenge these established requirements or rules by weighing all risks to the business, including the risk of maintaining the status quo.

‘Our customers (operators) demand this in the contract’

This is like the previous statement of having company standards or management stated requirements. It is recognized that the customer can specify their expectations in the contract. However, as recognized in good supply chain practices (Christopher, 2016), providing options based on improved quality, lead time or cost would not be realized. Again, in the previous example, this should be challenged as there may be a continued risk to safety, quality or delivery through specifying a particular company to provide OEM services or parts as part of contract.

‘OEMs supply own equipment’

In many examples, OEMs have their in-house manufacturing functions. However, for some more specialized and common components, they will be sourced through the lower tiers of the supply chain and from OCMs. Therefore, equipment or parts sometime only become OEM when “badged” as such.

In some cases, the OEM will focus more on newer products, where knowledge of older products may be lost as personnel move on or have been retired, often due to the cyclic nature of the oil industry. With older equipment, it is not uncommon for the non-OEM to have more knowledge than the OEM.

Case Study 1

In December 2017, a major drilling contractor requested RigQuip to support the company in providing the overhaul of an E-3000 drawworks manufactured by a major OEM.

This was one of the first major projects conducted under the company’s newest API Q2 processes, including the aftermarket process for design of service. The overhaul progressed as follows:

25 January 2018: initial inspection on rig;

30 January 2018: remove drumshaft assembly and order parts;

2 February 2018: drumshaft assembly arrives at RigQuip’s workshop for strip down, inspection and overhaul;

9 February 2018: drumshaft assembly delivered back to rig;

10 February 2018: rebuild on the rig commenced;

21 February 2018: drawworks commissioned and signed off; and

1 March 2018: final report and documentation pack issued.

Areas of significant success include a turnaround of less than one month between initial inspection and final commissioning, which enabled the rig to start on schedule. Further, the equipment has been in operation since, with zero service calls and no reported downtime.

Case Study 2

In early 2018, RigQuip was engaged to overhaul equipment, including two 12P160 mud pumps, 1320UE drawworks, iron roughneck and choke manifold for an offshore platform operator. The equipment was manufactured and previously serviced by three OEMs. The work scope included initial offshore inspection, removal of assemblies and parts, workshop disassembly, repair and re-assembly, and offshore installation and commissioning. RigQuip procedures were updated to reflect working to API Q2.

Equipment removal had its challenges due to structural and piping additions to the rig over the years, which made working on the equipment difficult and removal of one of the mud pump crankshaft assemblies almost impossible. A detailed plan was developed, which included skidding one of the pumps forward to allow access to the crankshaft assembly.

A decision was made early on for RigQuip to supply a complete set of major parts, as there would be not enough time to wait for onshore strip down and inspection before ordering parts and have them delivered in time to meet deadlines. The operator requested that RigQuip provide all required parts, including new bull gears, pinion gears and, for one of the pumps, a complete set of conrods. For the drawworks, major parts included a new main shaft and Lebus grooving. Around 80% of the parts were non-OEM or OCM and 20% OEM. All parts arrived on time, and the equipment was commissioned in time to meet the operator’s drilling schedule.

Conclusion

This article makes the point, from a non-OEM perspective, of the potential gains that can be made by doing non-OEM drilling equipment repairs.

It is crucial to gain knowledge of alternatives in the supply chain, as the engrained beliefs in the oil and gas sector about choosing non-OEM over OEM may be preventing the industry from achieving greater levels of performance.

The article provided case studies from a non-OEM, which has provided efficient equipment repairs and costs savings yet not sacrificed the quality of service. Through attaining API Q2 certification, the non-OEM has tackled the common risks and addressed the misplaced beliefs in the drilling sector of an alternative to the OEM. DC