A seismic shift in the subsurface

Although still a niche technology, microseismic monitoring is upending old production theories by providing a deeper understanding of the reservoir to optimize unconventional development

By Katie Mazerov, Contributing Editor

In the 15 or so years since the unconventional oil and gas boom began, the industry has learned that unlocking the secrets of the subsurface is the key to tapping additional resources. Operators now know that the complexity, heterogeneity and unpredictability of unconventional plays and tight oil and gas formations require a deeper characterization of the geology and an understanding of the effects of hydraulic fracturing on the rock. Today, models can provide a 3D view of the formation and simulate hydraulic fractures, with the capability of making real-time adjustments. They have become essential in designing completion strategies that enhance production. A pivotal piece of that process involves listening to the rock and detecting subsurface stress – microseismic monitoring.

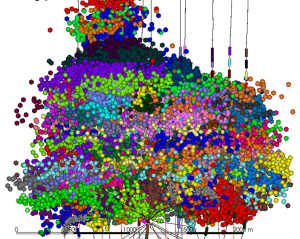

Microseismic events induced by hydraulic fracturing are so tiny and seemingly insignificant that they register a moment magnitude of zero or less. They do, however, have a significant impact on oil and gas production. Microseismic monitoring, whereby an array of geophone or other acoustic devices is placed in the borehole or on the surface to passively observe these minute emissions, provides valuable information on how the rock is behaving during hydraulic fracturing. Seismic moment tensor depictions of rock changes and deformations enhance understanding of fracture propagation and networks and which fractures contribute to production.

The technology is most commonly used to monitor hydraulic fractures. More recently, it is being used for long-term reservoir monitoring of various processes, including injection wells, and detecting events created when the reservoir drains. With the growing focus on refracturing, microseismic monitoring is seeing yet another venue of application.

“The unconventional market, specifically the need for subsurface data to effectively develop these variable fields, has been the key driver for the evolution of microseismic monitoring,” said Dick Zinno, Chief Geophysicist, Global Wireline business unit for Weatherford. “A lot of the current technology would not have gotten off the shelf were it not for the production irregularities operators in these plays have experienced. To a great degree, microseismic monitoring has changed the paradigm, providing solutions that go against the grain of what was assumed to be a viable theory for production.”

Although less common, the technology can be useful in conventional wells, especially for avoiding aquifers, faults or traps. Cost and installation challenges remain barriers for the subsea market. In the unconventional sector, however, development of microseismic monitoring of hydraulic fractures has been instrumental in the industry’s shift from geometric completions, with evenly spaced stages and the same pumping protocols, to a tailored placement and pumping approach that takes into account the varying properties and geology of the reservoir

Oil and gas production company Nexen, a wholly owned subsidiary of China National Offshore Oil Corp (CNOOC), and ESG Solutions, a provider of microseismic monitoring services, have been developing and applying microseismic technology for shale gas development in the Horn River Basin in northeast British Columbia, Canada since 2010.

Nexen has now targeted several unconventional plays internationally for applying the technology, and CNOOC has adopted microseismic as part of its corporate strategy, according to Eric von Lunen, Senior Geophysical Advisor. “If we continue to have success, microseismic technology will be a major game-changer for us.”

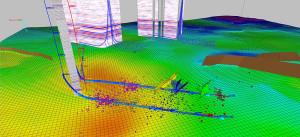

The impetus for implementation in the Horn River Basin centered on monitoring and quality control of hydraulic fracturing operations. “The microseismic applications we’ve developed have led to greater understanding of how hydraulic fracturing changes the stress field in the vicinity of the wellbore and how fluid moves during the fracturing process,” Mr von Lunen explained. “The data set we’ve acquired on stimulated reservoir volume (SRV) show a good picture of what fracturing and the fractured reservoir characterization process really look like.”

Exploiting the sweet spot

Nexen is using FRACMAP, ESG’s fracture mapping service, for real-time hydraulic fracture monitoring and to conduct post-acquisition reviews on how the fracturing process has progressed. Ongoing microseismic applications will be aimed at “sweet spot exploitation that involves rejecting large areas and targeting selective areas within our scope of interest economically and developing drilling and completion styles that favor the best 20% of the reservoir. We expect the technology to change our strategies going forward, especially if natural gas prices stay low,” he said, noting that prices and knowledge of the tremendous variation of shales vertically and laterally have rendered the “drilling-it-all” approach obsolete.

Based on the volume of learning that has come from rock properties and stress fields, Nexen is looking at using microseismic monitoring post-fracturing to observe how productive the reservoir is or how the stress fields change, Mr von Lunen said. “Most events we see after production are likely related to the stress field readjusting itself. The stress field is important because it determines whether fractures are open or closed. Depending on how we pump the job, we end up with certain sections of the subsurface closing up, and others opening up.”

A subsurface stress, or 3D geomechanical, model and rock properties are critical for successful reservoir development, but using too simplistic a model won’t optimize the reservoir, he said. “The goal is to understand the seismic data in terms of the rock properties and stress geomechanics, use that to enhance reservoir characterization and then use microseismic data to confirm the data in more detail. Certain patterns of rock properties and stress will be more productive than others.”

Production results in the Horn River Basin have been encouraging and show statistically credible correlations with the use of microseismic technology, Mr von Lunen noted. “When booking reserves, we must use industry-accepted, or reliable, concepts. Today, the reliability of microseismic monitoring is much more apparent, and when drilling ramps up again, there will be more focus on how to use the technology successfully. The work we’ve done with ESG has led us to believe microseismic is no longer a one-off concept but one that has its place in unconventional resource development.”

ESG was on the ground floor of microseismic monitoring for oil and gas development in the late 1990s, after the technology was already being used successfully by the mining industry. “The understanding we now have about the complexity of the fracturing process and stimulation comes from microseismic monitoring,” said Dr Ted Urbancic, Chief Technology Officer for ESG. “Microseismic monitoring is still not widely embraced by the industry, with only 5% of wells drilled today being monitored. As we get into the complexities of refracturing and infill drilling, microseismic will play an increasingly important role in how best to develop these mature fields and maximize the output that remains.”

ESG’s hydraulic fracture mapping technology, which has been used in the US since 2000, provides an understanding of fracture behavior and stimulation effectiveness, optimizes fracture injection strategies and staging and observes fault behavior and interaction. “By integrating surface downhole measurements of seismicity, ESG is positioned to assess SRV, define a discrete fracture network, calibrate reservoir models and understand failure mechanisms,” Dr Urbancic explained. “By combining surface and downhole measurements, we can monitor a fracture with dimensions ranging from a few meters to hundreds of meters.”

The company’s RESMAP service provides life-of-field reservoir monitoring, including injection and production cycles, for enhanced oil recovery operations and underground storage projects globally. In some cases, an operator will start with either surface or downhole hydraulic fracture monitoring, then transition to reservoir monitoring. Induced seismicity monitoring of disposal wells over extended time periods uses the same technology as hydraulic fracturing monitoring, Dr Urbancic said.

ESG’s new SMTI Production Suite, providing Seismic Moment Tensor inversion, uses advanced microseismic analysis to detect reservoir response to stimulation and examine fracture growth and pumping program effectiveness. The data is incorporated into a geomechanical model that helps determine areas of enhanced fluid flow and future production.

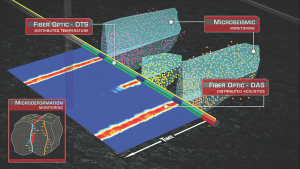

“A burgeoning application involves integration of microseismic monitoring with other downhole technologies, such as fiber optic sensing, that can provide temperature and pressure measurements over the entire wellbore,” Dr Urbancic said. “The next five years will see more integration of various technologies for developing more sophisticated 3D models.”

An early microseismic event

The evolution of microseismic monitoring in the petroleum industry began in the mid-1990s in the East Texas Carthage gas field, where the need to understand the drainage patterns of tight-gas wells led to what became known as the Cotton Valley Hydraulic Fracture Imaging Project. A consortium of operators and service companies led by Union Pacific Resources (later purchased by Anadarko), designed a one-shot system focused on determining the height, length and azimuth of hydraulic fractures, explained Weatherford’s Mr Zinno, who served as geophysical operations manager for the project.

The system included 96 sondes of three channels each, deployed in two monitor wells and cemented in the annulus between the casing and the borehole. Despite persistent technical difficulties with the custom electronics, the system created a viable data set with significant redundancy. The findings revealed that hydraulic fracture lengths were much longer and narrower than previously modeled, with fracture growth also inconsistent with what had been predicted, he said. “We made some very astonishing conclusions about the way the field was being produced, its drainage area, the impact of hydraulic fracturing and what factors were actually affecting outcomes.”

Further study shifted to the Barnett Shale to prove that microseismic monitoring was reliable for making important economic decisions. By this time, Mitchell Energy, the company that pioneered unconventional development (later purchased by Devon Energy), had joined the project.

“With advances in borehole seismic technology, we were able to record enough data channels, at high sample rates, and stream it up a commercial wireline to the surface without interruption, which was key,” Mr Zinno said. “We watched the fracture start to grow and immediately branch out in large parallel fractures with branches connecting in between, not achieving predicted lengths and with a high degree of zonal containment. These were complex checkerboard patterns that matched the pre-existing jointing in the formation. This had big implications for how to stimulate the reservoir, what proppant and gel to use and, most importantly, the direction to drill the wells.”

The cigar-shaped drainage patterns that Mitchell had anticipated were replaced with a drainage pattern that looked like a brick wall. “Microseismic monitoring provided the empirical evidence supporting the idea that we were fracturing complex drainage patterns,” he continued. “These early applications of microseismic monitoring became the basis of understanding for where to set surface locations, drilling azimuth, where to land the well and where to perforate, parameters that have profound economic impact. The trump card is understanding the pre-existing natural fractures.”

Advances in microseismic monitoring have led to more sophisticated geomechanical modeling and forward simulation. “We can predict fracture results and do a comprehensive conductivity map of the drainage area around the well to model production,” Mr Zinno noted. “From that, we can predict estimated ultimate recovery. Far away from trial and error, this takes a lot of the subjectivity out of the process of understanding and applying what we observe and the data we collect.”

Weatherford provides real-time in-treatment well microseismic monitoring with its patented Spear tool, technology developed by ExxonMobil Upstream Research Technology Corp, for regions where it is difficult to conduct offset well downhole or surface monitoring. These include coalbed methane wells, vertical wells in stacked pays drilled off pads with closely spaced wells, and deep wells spaced far apart, Mr Zinno said. Weatherford also has developed borehole tools with temperature ratings up to 392°F (200°C) for places where successful monitoring had not been possible previously, such as the Haynesville, deep Eagle Ford, the deeper Montney in Canada and other high-temperature plays.

Surface microseismic monitoring

An important step-change in the evolution of microseismic technology was the introduction of surface microseismic monitoring, a technique that acquires data without the need for downhole sensors. “Prior to 2003, all microseismic monitoring was done with sensors in the borehole, no more than 1,000 ft from the well being fractured,” explained Sudhendu Kashikar, Vice President, Completions Evaluation for MicroSeismic Inc, which pioneered surface microseismic monitoring for completions evaluation and real-time monitoring and mapping of hydraulic fracturing operations.

“With surface microseismic, we’re putting sensors 8,000 to 10,000 ft away from the well that is being fractured,” he said. “In high-temperature areas like the Haynesville, where downhole tools don’t work as well, it makes perfect sense to acquire data from the surface.”

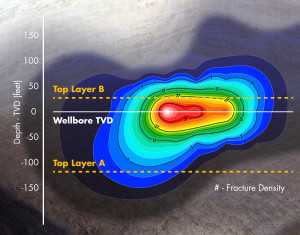

MicroSeismic Inc uses surface, near-surface and downhole arrays to quantify fracture length and height. “Ideally, operators like fractures to extend 500 ft in length depending on wellbore spacing, and cover the height of the target formation,” Mr Kashikar explained. “By locating, monitoring and measuring microseismic events in real time, we can do real-time analysis to determine if that objective has been achieved and chart the fracture growth. Then, we can advise operators on adjustments, such as pumping schedule changes, to optimize treatment programs.”

In October 2014, the company launched PermIndex, a microseismic-based permeability tool designed to take data analysis beyond simply calculating fracture dimensions. The tool estimates permeability using radial pressure fronts of microseismic events during hydraulic fracturing to help operators improve production forecasting and estimated ultimate recovery.

An enhanced version of the tool, scheduled for launch this year, will generate 3D volumes to quantify permeability on a much more granular scale than a stage or well. “The advantage is that we will be able to map permeability volumes and historical data directly into a reservoir simulation to history-match and forecast what production will look like six months or a year from now,” he said.

In recent years, MicroSeismic Inc has seen growth of the injection (disposal) well business segment in Canada and the US due to concerns that these wells lead to seismic activity. Regulations in Alberta and British Columbia require that wells be monitored for seismicity before, during and after hydraulic fracturing and during injection. “If enough fluid is pumped over an extended time period, it eventually seeps into natural faults or fractures and causes the pore pressure of the rock to change, resulting in slippage,” Mr Kashikar explained. “By monitoring minute earthquakes, with magnitudes as low as negative 2 or 3, we can advise companies to reduce the pumping rate or volume of the injection fluid to prevent these small events from becoming significant earthquakes.”

AlertArray, a high-resolution, real-time 24/7 sensor introduced this year, establishes three thresholds of seismic events and magnitudes for alerting customers to take corrective action.

Nice-to-have vs must-have

Although a direct correlation between microseismic monitoring and production has yet to be established, the technology is the only proven far-field tool for understanding how fracture treatments affect the reservoir and planning future fracture treatments, explained Jeremy Dumoit, Chief Operating Officer for Magnitude, a Baker Hughes company that provides microseismic monitoring services.

“To a great degree, microseismic is still a nice-to-have rather than a must-have technology that is most often used in the initial development phase of a reservoir,” he said. “Once we establish a quantifiable correlation between the technology and production, microseismic monitoring will become much more valuable in estimating production on every single well. Until then, it provides an overall idea of reservoir geometry and serves as a valuable piece of the puzzle that can be plugged into reservoir or fracture models to provide an idea of how a treatment worked compared to how it was anticipated to work.”

Since the first commercial applications in 2000, microseismic has primarily been used to measure how far fractures extend from the wellbore and determine basic fracture geometry to establish a fracture network and avoid fault hazards, Mr Dumoit explained. Early applications involved downhole array tools; since the emergence of surface seismic array, both are widely used.

“A key industry focus has been how to better interpret microseismic data and integrate data sets,” Mr Dumoit noted. In June, Magnitude introduced Joint Inversion, a system that uses downhole and surface arrays simultaneously to make a single calculation. “With borehole arrays, we can see up to 5,000 ft and gain very good depth resolution and good sensitivity to detect smaller-magnitude events,” he explained. “With surface arrays, which can be placed several thousand feet from the well, we can get very good horizontal resolution on the X/Y plane and measure moment tensor, or how the rock cracked, and the size and direction the rock slipped.” The system is being used in the Eagle Ford and Woodford plays, among others.

Early skepticism about the capabilities of microseismic technology has seen a steady shift to adoption. With hydraulic fracturing now accounting for 50% of well development costs, however, production companies are increasingly seeing the benefits of microseismic as they continually strive to optimize their fracturing operations, said Juan Garcia, Product Line Manager, Downhole Microseismic at Pinnacle, a Halliburton service. Adoption also is growing for use of real-time microseismic monitoring while fracturing to enhance understanding of where and how the fracture is growing.

Integrating the data

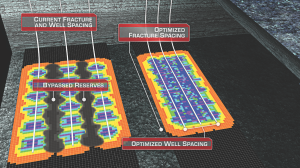

“Some companies drill dedicated wells for microseismic monitoring because they know how important the information is in understanding and developing the field,” Mr Garcia said. “Based on reservoir volumes obtained from microseismic measurements, operators can better plan their wells in terms of the number of stages, stage and fracture spacing, how long the wells need to be and the appropriate stimulation treatment to use. Later, those wells can be very beneficial while monitoring refrac operations, where it is vital to make sure treatment fluids affect bypassed reserves missed during previous treatments. Microseismic monitoring not only tells us where rock is being broken but provides information on diversion effectiveness.”

Integration of data is an important objective. Pinnacle’s integrated sensor diagnostics (ISD) service combines far-field subsurface data, obtained using downhole microseismic sensors, surface microseismic imaging and micro-deformation monitoring, with near-wellbore measurements gained using fiber optics. Fiber optics typically uses distributed temperature sensing or distributed acoustic surveys to determine if fluid is going into the formation. “Combining these two results allows us to produce a fracture calibration model that can determine if a given completion design needs to be adjusted,” Mr Garcia said. “The fiber optics monitor production for several months. We then input that production data into a reservoir model that tells a larger story about the field.”

In an unconventional play in Latin America, an operator used the ISD service to adjust the downhole microseismic service to adjust the treatment method after observing a fracture was growing downward, instead of up, as initially anticipated. “Use of microseismic data and real-time microseismic analysis and interpretation resulted in treatment changes for the remaining stages, and we were able to get the fractures going in the direction the operator needed,” Mr Garcia said. “The ultimate goal is not to fracture poor-quality sections of the reservoir.” ISD also can be used to change the completion style by adjusting the spacing between perforations or stages.

FracHeight service, a hybrid tool introduced in 2014, combines downhole sensors that measure miniscule changes with microseismic receivers deployed downhole on a fiber optic wireline to detect fracture deformation and ultimately improve accuracy in predicting fracture height.

FRACMAP and RESMAP are registered trademarks of ESG Solutions; SMTI Production Suite is a trademarked term of ESG Solutions. AlertArray and PermIndex are trademarked terms of MicroSeismic Inc. FracHeight is a registered trademark of Halliburton.