Unconventional liquids-rich plays feature unique characteristics, challenges

By Katie Mazerov, contributing editor

As the pricing differential between oil and natural gas has widened, operators are increasingly applying the technologies that were initially developed for horizontal wells in unconventional dry gas plays to the more liquids-rich formations, such as the Bakken, Eagle Ford and Niobrara plays. Various approaches in dealing with this evolving frontier were presented in a panel discussion, “Considerations for Liquids-Rich Horizontal Wells,” at the SPE Annual Technical Conference and Exhibition in Denver on 1 November. Representatives from operators, service companies and academic organizations offered their perspectives on the three regions.

Noble Energy has used an integrated approach to increase production in the 400,000-acre Wattenberg field in the Niobrara formation north of Denver, said Dennis Snow, subsurface manager for Noble’s Niobrara Integrated Team. The field, one of the largest natural gas basins in the US, also holds substantial oil reserves.

“Integration is the key to every aspect of our operation, from data to personnel,” Mr Snow said. The company places heavy reliance on data and sampling and has conducted field tests in the liquids areas, drilling infill wells and running fiber optics in laterals in three wells.

“We are currently in a growth mode,” Mr Snow said. “In the second quarter, we increased production 64% by drilling economical horizontal wells. Fluid production was 600 bbl/day on the last 12 wells we drilled. It has been very fast-paced.”

Noble’s rig count in the play has increased from one to five, and by shifting from single-pad to multi-pad drilling and from eight to 10 stimulations per week, the company expects to complete an additional 80 wells this year, with estimates of 600 million barrels of oil equivalent (BOE) per day of recoverable oil in more than 200 wells.

Four key issues

In developing liquids-rich plays, four important factors – surface area of the rocks; composition of in-situ fluids; significant penetration of stimulation fluid into the rock and variability in the surface areas – must be considered, said Dean Willberg, senior program manager of shale productivity optimization at the Schlumberger Innovation Center.

“Understanding the composition and variability of the rock is critical for developing base diagrams for these fluids,” Mr Willberg said. “In stimulating the wells, the significant penetration of fluid into the rock can result in substantial loss of the mechanical strength of the rock, in one case down to 4,800 psi unconfirmed loss of strength. Also, salts from the reservoir can move into the fracture.”

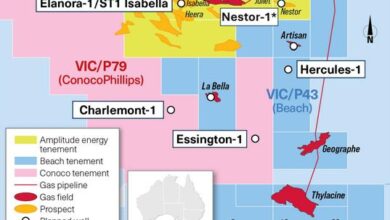

In the Bakken play, ConocoPhillips has completed wells in rock that ranges from simple to complex, the latter characterized by complicated fractures and stresses that are close to one another, said Clyde Finlay, principal completions engineer. “Weather, people, production are all challenging, and a higher number of frac stages are common,” he said. “Some wells can go as high as 80 to 100 stages.” In that regard, wells must be spaced properly with shorter frac lengths, he said. The company has found it advantageous to shift from oil-swellable to water-swellable packers, which can be easier to work with and swell more slowly.

In many cases, companies are using trial-and-error to determine if one system is better than another for maximizing production.

Whiting Petroleum Corp has tested different shut-in times in the Bakken to control post-frac flowback, an important but often overlooked phenomenon, said John Paneitz, senior operations completions engineer. “We’ve seen no negative effects by increasing shut-in times, but we have seen decreased water and higher saline dissolution,” he said. “This goes against everything we’ve been taught, but it gives time for the rock to close on the sand. Because the shut-in rock is undersaturated, it absorbs the water.”

In the Eagle Ford play, Halliburton compared the use of frac valves with plug and perforation (P&P) operations in two parallel horizontal wells, said Neil Stegent, technical manager. “Lateral placement was critical for staying in the sweet spot,” he said. The first well included a combination of frac valves and P&P; in well number two, all stages were P&P. Using an oil-based tracer and a pseudo production log to measure production, the company determined there was no significant difference in long-term production between the two methods.