2022 NOV rig census shows a welcome recovery period, but challenges loom ahead

Active US rig count up by 40% since last year, while Middle East continues to drive jackup demand and ultra-deepwater segment is tight

By Tarjei “TJ” Myklebust, Karl Appleton and Kevin Scherm, NOV

Rig counts, dayrates and operator earnings paint an even healthier picture this census than last. Cold-stacked rigs have been reactivated, and some stranded rigs have found homes.

From the start of the year to census time, US land saw dayrates increase by 30% in some regions, as well as longer terms. Offshore, for the first time since 2014, new contract rate averages are better than the old ones when contracts roll off. Due to elevated oil prices, operators have announced some of the best profits ever.

However, the austerity caused by oil prices averaging less than $20/bbl only two years ago is being felt today, as the industry struggles to achieve its full potential due to difficulty finding experienced crews and resilient supply chains.

The war in Ukraine has led to anxiety over energy and food availability as the year progressed, and associated inflationary and recessionary pressures may stymie future rig growth even as increased long-term energy needs are predicted. Energy security concerns, however, have put oil and, especially, gas back at the forefront of planning for future needs alongside the energy transition.

2022 census highlights

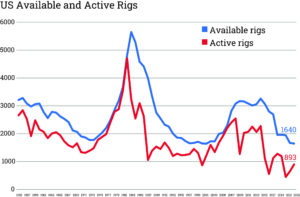

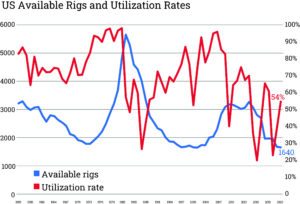

- The US available fleet, including land and offshore rigs, decreased by 23 rigs to 1,640 due to a combination of scrapping and removal according to census rules for prolonged inactivity.

- The active rig fleet in the US increased by 40% to 893 rigs. This is just over double the record low of 440 active rigs in 2020.

- The Canadian rig utilization hit 51% in 2022, the highest during the census period since 2006.

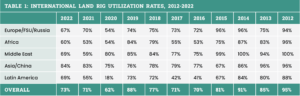

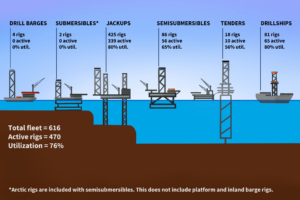

- The global offshore rig fleet is gaining traction again after the false start in 2019. Utilization has increased this year to 76%, the highest since 2015.

- Global offshore rig activity will continue to increase as jackups are put to work by national oil companies (NOCs) in the Middle East, and the ultra-deepwater drillship segment continues to be tight due to demand in Guyana and the Golden Triangle of West Africa, Brazil, and the US Gulf of Mexico (GOM).

- Every region saw an increase in land activity and utilization except Europe, where the effects of the war in Ukraine were felt.

US fleet and activity

The US rig fleet totaled 1,640, reflecting a decrease of 23 rigs compared with the previous year. Additionally, it almost matches the record low of 1,636 rigs set in 2000. During this year’s census, 30 rigs were scrapped, and 31 rigs were removed due to census rules. A total of 38 rigs were added to the fleet – six newbuilds and 32 reactivations of rigs that had been inactive for more than three years.

US rig additions

A total of 38 rigs were added to the US fleet since the last census. Six are newbuilds, while 32 are reactivated cold-stacked rigs that had previously been removed per the census rules. While still less than the number of reactivations in 2019, it is a sharp increase compared with the number of rigs added to the fleet in 2020 and 2021. More reactivations would likely have occurred had it not been for inflation and supply constraints on things like frac sand and crews. Four offshore rigs were added to the US fleet: One drillship, one jackup and two semisubmersibles entered the US GOM. This number is likely to increase further this year after the census period as the drillship market in the US GOM is basically sold out and will soon see the first eighth-generation unit.

US rig attrition

A total of 61 rigs were removed from the available fleet in the 2022 census, partly offset by the addition of 38 rigs that were either newbuilds, reactivated or moved into the region. Therefore, the total fleet size was reduced by 23 rigs. This is a much smaller number than what was seen in the previous census, when 276 rigs were removed. It is also well below the average fleet reduction of 210 rigs per year seen over the past five years, mainly due to large reductions in 2018 and 2021. Of the 61 rigs removed, 30 were scrapped, including 25 land rigs and five old jackups from the ’70s and ’80s, and 31 were removed per census rules.

US drilling activity

There were 893 active rigs in the US in the census period – 851 land and 42 offshore. This reflects an increase of 40% compared with 2021 but is still 61% fewer than the 2,269 active rigs in 2014 before the start of the global downturn. Overall, land saw 55% utilization while offshore had 43% utilization.

Not surprisingly, the Permian led with 370 active rigs, representing 56% utilization for the region’s fleet. The Permian fleet decreased from 759 to 656 available rigs, likely due to stacked rigs now hitting their third year not working compared with high-spec rigs quickly returning to work. Although having a smaller fleet of 114 rigs, the ArkLaTex region saw the highest utilization rate of 75%.

This year, land rigs capable of drilling 20,000 ft or more (839 rigs) led with 61% utilization. Rigs rated between 16,000 and 19,999 ft (312 rigs) increased to 184 active, or 59% utilization. Rigs with drilling depth capacities between 6,000 and 9,999 ft saw 52% utilization. It should be noted that there are only 135 rigs in this segment.

Offshore, jackup utilization increased from 33% in 2021 to 46%, with six rigs active out of 13 total. Semisubmersibles had no active rigs last year but had two active rigs this year, representing 67% utilization. Finally, drillships are nearly tapped out with 95% utilization of the 20 available rigs.

Canadian fleet and activity

The Canadian rig fleet decreased by approximately 12% to 358, a historical low. The offshore fleet remained at seven rigs: three platforms, three semisubmersibles and one drill barge. Although one drillship left the region, it was offset by the entrance of a semisubmersible. As for the land rig fleet, six were added, while 54 were removed according to census rules, netting 351 available land rigs.

Fleet utilization hit 51%, the highest since 2006, although the available fleet now is less than half the size of what it was in 2006. Still, 51% is a healthy utilization rate as the census period often coincides with the spring breakup. The number of active rigs increased for the second consecutive year, reaching 184 in 2022. This is up from 140 active rigs in 2021 and far more than the 2020 low of 29. Drilling contractors have indicated that more rigs could be active if they were able to staff them adequately, highlighting crew availability and retention challenges.

Offshore saw four active rigs: three platforms and one semisubmersible. This is up from just one drillship and one platform active during the last census period.

International land rig utilization

The number of active international land rigs is estimated at 2,254, with a 73% utilization rate, including Russia and China. In every region except Europe, the active rig count rose. The Ukraine count dropped following the Russian invasion, declining from 39 active rigs in January to only five rigs three months after the war began. Elsewhere in Europe, Turkey has remained flat since before the pandemic, with roughly 20 active rigs.

South American leaders Argentina and Colombia have reached pre-pandemic levels of activity, with approximately 50 and 30 rigs, respectively, in June 2022. Mexico has also recovered with 25 active rigs.

In the Asia Pacific, India’s rig count has been consistently in the 60s since mid-2020. Indonesia and Australia each saw a 50% bump in active rigs since last year and ended the 2022 census period with 29 and 18 rigs, respectively. China continues to dominate the active count in the region by a huge margin.

The highest active rig counts in Africa were previously Algeria and Libya, but 2022 sees Libya down to two rigs, while Algeria is up from 25 rigs to 33. Nigeria now takes second place with eight rigs.

The Middle East reached its bottom in November 2020, after which the rig count rose as restrictions were intentionally relaxed. Of note is the acceleration of active Iraqi rigs to almost match Saudi levels, at 55 and 56, respectively, in June 2022. Oman sits in the third position with 48.

Global offshore mobile fleet

The global mobile offshore drilling unit (MODU) fleet is finally seeing positivity, as eight years of attrition and the recent uptick in activity has created a tight market for drillships and jackups. Several stacked rigs were reactivated, including some that had been cold stacked for more than five years. The trend of stranded rigs finally being delivered from shipyards continued in 2022 and should continue in 2023. NOCs like Saudi Aramco and ADNOC are driving up jackup demand in the Middle East, while the tight Golden Triangle drillship markets seek to add incremental rigs, especially in Brazil.

A total of 22 offshore mobile rigs – nine semisubmersibles and 13 jackups – were removed from the fleet. This was partly offset by 17 rigs entering the fleet, including nine reactivations and eight newbuilds, six of which were jackups and two were stranded drillships. This brings the total number of available MODUs to 616.

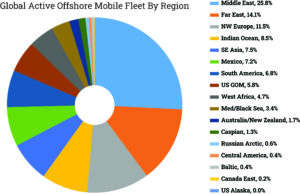

The largest MODU region was the Middle East, with just over one-quarter of the fleet – all jackups. The Middle East is expected to add incremental rigs, with several jackups already preparing to move into the region to begin contracts in late 2022 and early 2023.

The Far East was the second-largest region, with 14.1% of the fleet, mostly jackups. Northwest Europe had 11.5% of the fleet, with a more even split between harsh-environment jackups and semisubmersibles. This is the largest region for semisubmersibles in the world. The US GOM remains the largest region for the drillship segment, with 20 drillships counted during the census period, or 5.8% of the global MODU fleet.

Global offshore mobile activity

In the 2021 census, utilization had increased mainly due to attrition. This year, the 6% increase in utilization – to 76% – can be attributed to more rigs going to work. Active MODUs went from 436 in the 2021 census to 470 this year, the highest level of activity since 2016, when most rigs were still working on contracts handed out before the downturn began.

With increased activity, drilling contractors are regaining some much-needed pricing power, especially in the drillship market. Several drillships have been awarded contracts with dayrates of more than $400,000. The US GOM leads in dayrate increases as the drillship market is essentially sold out. Brazil and West Africa are looking to increase activity and see dayrates grow.

The jackup segment has also seen dayrate increases as Middle Eastern NOCs, most notably Saudi Aramco and ADNOC, are increasing production and bringing in jackups from outside the Middle East. This includes rigs that had been cold stacked for years and rigs that had been stranded in shipyards.

While utilization for semisubmersibles is improving year over year, it is not increasing at the same pace as the other MODU segments. The Norwegian Continental Shelf, normally a driver for dayrates in the semisubmersible segment, had a slower year. This market is expected to stay soft until mid-2023.

Offshore industry trends

While current dayrate levels do not yet support ordering newbuilds, more rigs are being reactivated, including cold-stacked and stranded rigs. Drilling contractors are waiting for firm contracts before considering reactivation. This discipline is likely to continue, but with fewer rigs available, operators will likely have to pay for partial or all reactivation and mobilization costs.

The increase in tendering activity in the Middle East has resulted in several jackups being picked up from shipyards through bareboat agreements as seen in the past couple of years and outright sales. Despite this, there are still 26 jackups waiting for delivery, although most of these are not of the designs currently favored by rig contractors. Twenty of the 26 jackups waiting for delivery have a scheduled date in 2022 or 2023, but many will likely be postponed.

The drillship segment has 15 rigs still waiting for delivery, all ordered pre-downturn. Of these, 13 have scheduled delivery dates for this year or next; however, several of these are likely to be postponed. With a tight market in some regions, a few deliveries will come over the next two years as the preference for reactivations over newbuilds will not be enough to cover the demand. Supply chain issues and inflation have increased the time to reactivate a cold-stacked drillship from 9-12 months to 12-18 months, and prices for reactivation are likely to exceed $100 million in many cases.

The semisubmersible segment is different as only seven semisubmersibles are currently under construction, three of which are scheduled for delivery this year, another three next year and one in 2024. However, most of these will likely be pushed out further, and there were no new deliveries last year. Comparatively, more semisubmersibles were scrapped relative to its fleet size since the downturn began than the other two MODU segments.

US industry trends

The number of individual rig owners holding available rigs barely changed this year, dropping to 171 from 172. The wave of bankruptcies has ended, and high asking prices have stifled mergers. A total of 77 rigs are considered operator-owned, or roughly 4.7% of the US available fleet of 1,640 rigs.

Increasing dayrates was the primary trend for the year, a welcome change for drilling contractors that have faced financial hardships for some time. Tier 1 rigs have reached the mid-$30,000 dayrate range. The struggle to crew rigs going back to work has also been a common thread. Drilling contractors have indicated that some operators are choosing to wait to contract a hot Tier 1 rig with an experienced crew versus being forced to use green drilling crews with a reactivated rig. Operators continue to ask for technology that can lower carbon emissions and meet growing ESG demands.

Forecast for next year

As generally expected, the world has now learned to live with the impacts of a global pandemic. Except for inflation fears and the effects of the Russia-Ukraine conflict creating an increase in potential volatility in the oil price, things have settled down. The oil price should average high enough that forecasting rig activity with a bit more confidence is possible.

Oil prices are expected to average just under $91 in 2023, and countries worldwide have taken steps to counteract the spike seen earlier in 2022. Rig count and utilization are likely to increase, but the availability of qualified personnel, supply chain constraints and minimal spare capacity will keep this at a muted pace. Consequently, drilling contractors, service providers and OEMs will likely have more pricing power in negotiations.

The world needs sustainable, affordable and secure energy, and all projections predict a growing need for energy. While the world works on transitioning to more sustainable energy sources, the oil and gas industry continues to take tremendous steps to reduce carbon emissions. Oil and gas remain two of the most affordable and transferable forms of energy and are subsequently critical to any country’s energy security. The Russia-Ukraine conflict has shown the vital importance of energy security, which adds up to favorable times ahead for oil and gas. DC

IHS Markit is the primary source for the global offshore fleet, while Enverus provided the source material for the US and Canadian onshore fleets. Information for the international land fleet came from NOV analysis of data from Baker Hughes and Spears and Associates.

Scan me to view the full version of the NOV Rig Census article with additional data.