With economic recovery uncertain, drilling contractors must remain flexible, industry CEOs say

By Stephen Whitfield, Associate Editor

The COVID-19 pandemic and oil price downturn have added new challenges that the industry, and drilling contractors at large, have had to handle. With a full recovery from the pandemic and a full recovery of the global economy still off in the future, contractors will have to rely even more on their experience and show a willingness to be flexible to stay afloat.

Reduced energy demand stemming from the pandemic, as well as the subsequent reduction in drilling activity, have led to an “upheaval” in rig crew management. At Patterson-UTI, with fewer crews working, the company has prioritized keeping its most experienced people on its rigs, President and CEO Andy Hendricks said during the Drillers Outlook panel at the 2020 IADC Annual General Meeting on 5 November. This has meant often having to move people to new positions.

In the early stages of the pandemic, Patterson-UTI launched a Risk Mitigation and Business Continuity Plan to address its possible effects on personnel and operations. Any threat of exposure among its personnel has necessitated further reshuffling, Mr Hendricks said, with potentially exposed workers being moved off of rigs and other workers taking on new responsibilities to make up for the absence.

“We’ve all been dealing with this, whether you’re onshore or offshore,” Mr Hendricks said. “We’ve got our most experienced people out on the rig, but those people are, in some cases, performing different roles than they may have in the past. We’ve reassigned roles to fill crews. This is a safety challenge we’re dealing with now that we haven’t had to deal with in the past. We still have to be careful in minimizing exposure while still performing the jobs that we need to do.”

At Enterprise Offshore Drilling, crew change rotations have been adjusted from 14-day hitches to 21-day hitches, President and CEO W. Brad James said during the panel session. The company has employed additional personnel to disinfect its facilities and worked to prioritize creating a work environment where personnel recognize and reduce exposure risks through personal accountability. As part of its COVID-19 response, the company educates its workers and their families on risk mitigation, and workers have to complete questionnaires prior to rig crew transfers.

So far, the company has only had four confirmed cases of COVID-19 among its personnel, so there has not been a significant impact on Enterprise’s operations.

“I think there’s probably not a higher risk industry anywhere, except maybe the cruise ship business. Having so few cases is a testament to our good thinking and our experience. Even with the cases we had, everybody went home, got better and came back to work,” Mr James said.

While logistical challenges stemming from the pandemic have been fairly manageable, other issues spawned by the market downturn have been much more difficult to manage. As a contractor working exclusively in the US Gulf of Mexico (GOM), Enterprise has had to navigate choppy waters: Only one of its four marketed jackups is currently working. Mr James said the GOM shallow-water market – which is Enterprise’s main focus – is “on life support.” As the major operators focus on deepwater projects, shallow-water contractors have had to work with a small client base of independent operators. However, these companies face difficulty in accessing capital. Low commodity prices have curtailed available cash flow, the private equity market is non-existent, and banks are only offering limited lending capacity.

Mr James said that adjusting to this economic reality has been difficult, but Enterprise has tried to “focus on the things we can control,” primarily cost. Enterprise has focused on cost reduction through execution and performance. “We need to eliminate incidents and reduce issues with well control. With a good plan, if you can reduce your issues, you’re reducing your costs over time. Cost control is very important. We need to deliver better-than-expected well costs to our clients.”

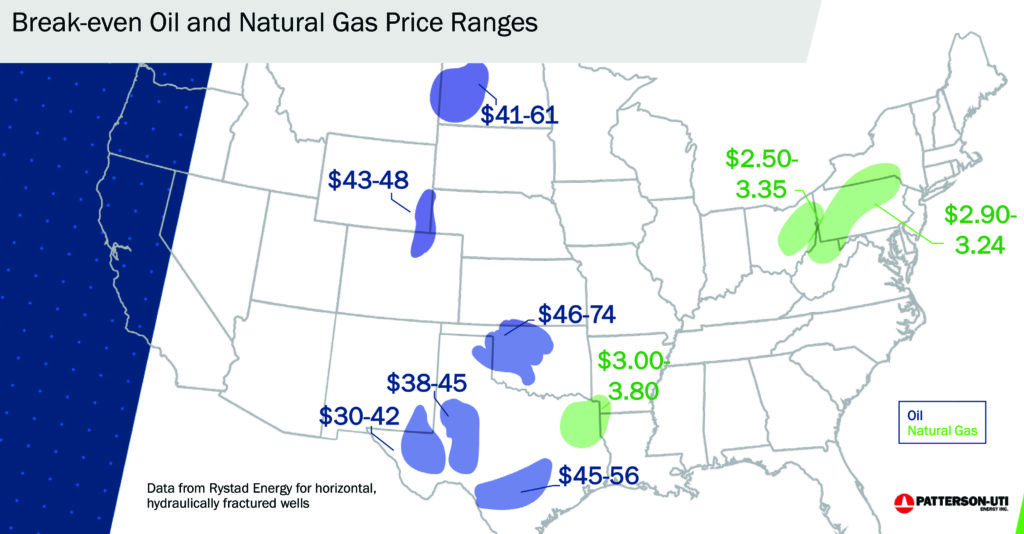

In the US onshore market, there have been some signs of optimism despite low oil prices. Mr Hendricks noted that a number of basins, including the Delaware and Midland, have breakeven prices in the $30s and low $40s. This means that operators can still stay profitable even in the current environment. However, like with offshore, any significant recovery for onshore drillers is contingent on a recovery in the global economy. Mr Hendricks said the prospect of further lockdowns in Europe and elsewhere may complicate that recovery.

“We’re going to have to wait and get through this pandemic,” he said. “At some point, the economies have to open up. We need more cars on the road. We need more jets flying. We need the demand for fuels to increase.”

Patterson-UTI currently has 61 active rigs in the onshore US, including 30 in West Texas. Mr Hendricks said he anticipates a slight increase in drilling activity in early 2021, with high-spec and super-spec rigs being the first to go back to work. Additionally, he anticipates a greater focus on initiatives to reduce carbon emissions as activity picks up.

“We talk to operators every week about reducing emissions at the wellsite,” Mr Hendricks said. “There’s going to be more technologies out there like natural gas engines or lithium battery energy storage that can help reduce emissions in various basins across the US. That’s going to take on even greater importance in 2021 as we start to pick up more rigs.”