The Arctic: Confronting the cold, hard truths about the last frontier

Possibilities of untapped resources entice, but barriers to E&P in this remote, harsh frontier remain significant

By Katie Mazerov, contributing editor

The bounty of resources that lie beneath the icy region known as the Arctic holds great promise but also poses some of the greatest risks and challenges the oil and gas industry has ever encountered.

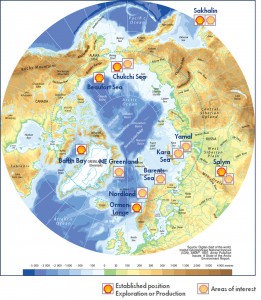

Although the significant amount of conventional oil and gas believed to exist in the Arctic has become increasingly attractive to operators, political, environmental and technological issues continue to present significant obstacles for development. Covering roughly 6% of the Earth’s surface, the Arctic comes under the jurisdiction of multiple nations with recoverable resources – the US, Canada, Greenland (Denmark), Norway and Russia. Harsh weather, with a limited window for drilling, requires extensive planning, risk management provisions and new equipment and technologies that can provide greater efficiency and withstand temperatures below -50°F.

According to the US Geological Survey (USGS), as of 2007, more than 400 Arctic oil and gas fields had been discovered. Those developments include 40 billion bbls of oil, 1,136 trillion cubic feet (Tcf) of natural gas and 8 billion bbls of natural gas liquids, most of it onshore in Western Siberia and on the North Slope of Alaska.

A 2008 USGS study, the Circum-Arctic Resource Appraisal (CARA), estimated that about 30% of the world’s undiscovered conventional gas and 13% of the world’s yet-to-find conventional oil may be located north of the Arctic Circle, above the 66.56° parallel, most of it along the shelf, in water depths of 500 meters or less.

The Arctic continental shelves are one of the world’s largely untested prospective hydrocarbon areas, said research geologist Dr Donald L Gautier, principal investigator for CARA and project chief of the USGS World Petroleum Project. While the bulk of the resources are offshore, most of the production has been onshore. “Offshore production in the Arctic is technically challenging and expensive and can be difficult politically,” Dr Gautier noted.

CARA used a probabilistic methodology to evaluate 49 geologically defined assessment units (AUs), the most significant for oil being the Alaska Platform, the Canning-Mackenzie area in western Canada, the North Barents Sea, the Yenisey-Khatanga Basin in Siberia, the Northwest Greenland Rifted Margin and the northeast Greenland shelf.

Undiscovered natural gas in the Arctic is three times more plentiful than oil, with the bulk located in Russia. Yet-to-find gas resources could range anywhere from 770 Tcf to 2,990 Tcf, with two-thirds located in four AUs – the South Kara Sea in the West Siberian Basin, the South Barents Basin, the North Barents Basin and the Alaska Platform.

“The best places for deepwater resources are along the continental margins,” Dr Gautier said. The geology indicates that the deep ocean basins, such as the Canada Basin and the AmerAsian Basin, may not have the same potential as the shallower continental shelf. “It’s not about the depth as much as it is about the geology of the deep basins.

“From a strictly geological standpoint, I believe the most prospective region for oil in the entire Arctic is offshore northern Alaska and northwestern Canada across the Beaufort Sea and the Chukchi Sea. But that area is challenging from a political standpoint,” Dr Gautier said.

Related Articles:

Norwegian minister: Climate change, greater access, Russia driving Arctic development

MECO delivers water purification system for arctic conditions

Real and Perceived Issues

Political forces have made doing business in the region a complicated undertaking. “The Arctic can be defined in a number of ways beyond geography and temperature,” said Mitchell Winkler, principal technical expert for Arctic engineering for Shell. “The region has always been challenging from the standpoint of ice, seasonality, harsh weather and darkness that pose technical challenges, but there are also many social, political and environmental challenges, both real and perceived.

“There is a lot of discussion over who owns the Arctic,” Mr Winkler continued. “We know there are vast oil and gas resources in the region, and we expect most of those resources to lie within the jurisdictional limits of the Arctic coastal nations. While there are ownership issues for the Arctic beyond these jurisdictional limits, oil and gas exploration should not be expected in these areas any time soon due to resource prospects and ice conditions.”

Shell has been active onshore and offshore Alaska and Canada for nearly 50 years and previously drilled several wells in the Beaufort and Chukchi seas off the North Slope of Alaska before moving out of the region in 1998. Shell re-acquired many of those leases in 2005 and 2008 and was successful with 19 blocks in the Beaufort Sea in December; the company hopes to begin drilling again this year, Mr Winkler said. Shell also holds two leases in Baffin Bay in a consortium with Statoil, GDFSuez and Nunaoil, the national oil company of Greenland, off the northwest coast of Greenland.

The company was the original developer of the prolific Sakhalin-2 field in far east Russia, over which the Russian national oil company Gazprom has taken control. Russian provisions mandate that all resources on the country’s continental shelf be developed by nationalized operators, Mr Winkler noted.

“Technology plays a big role in the Arctic because it allows us to do more, with increased safety, in a severe operating environment,” he continued. “But working in the Arctic is about risk management and developing the required operational practices and procedures to ensure safety and reduce the environmental impact of our operations,” he noted.

“It is critical that we understand and quantify hazards and have shut-down plans in place where hazards exceed the operating parameters.”

For example, Shell and other major operators rely on satellite and synthetic aperture radar to detect and observe ice hazards and movement patterns. Synthetic aperture allows visibility through the clouds.

“By using unmanned aircraft, or drones, which dramatically reduce the emissions footprint, we can do close-in surveillance to take people out of harm’s way,” Mr Winkler said.

Shell also is considering using autonomous underwater vehicles as an alternative to towing a sonar device, for shallow seafloor surveys. “Such technology would allow us to reduce the intensity of exploration activities during the precious open-water season, where operations may interfere with marine mammals – such as the Bowhead whale – and their migration,” he pointed out.

Technology is being used as a way of reducing the environmental footprint in terms of air, sound, emissions and improving oil spill response. “First and foremost, our focus is preventing oil spills,” Mr Winkler said.

“It starts with well design and includes blowout preventers (BOP) with redundant shear rams and real-time operation centers where data on the rig can be transmitted by telemetry to a remote center where experts can monitor the data and provide support to the personnel on the rig. The focus is on the prevention side, but we still need to have a robust spill-response plan.”

Long-term, the Arctic will be a driver for developing technology, Mr Winkler believes.

“We need to look beyond conventional solutions and paradigms,” he said. “Drilling is one example where speed is more than ever a driver, given the short open-water season. In the case of logistics, we need to look beyond conventional methods that often lead to larger vessels and more horsepower, and look for ways to reduce design requirements, which would have the added benefit of reducing both required personnel and the size and scale of the needed emergency response systems.”

Challenges Offshore

In the offshore Arctic arena, the risks and technical barriers on all fronts are particularly daunting, said Gavin Humphreys, new business and technology manager for Aberdeen-based Stena Drilling. The company is not currently operating in the Arctic but in 2010 provided a sixth-generation drillship and a semisubmersible for an Arctic summer drilling campaign in West Greenland. The company currently has two rigs, the Stena Don and Stena Carron, working in the harsh winter environment of the Norwegian North Sea and west of the Shetland Islands.

“The development of oil and gas in the Arctic is going to be complex, especially when one considers the challenges of transferring the lessons of oil or gas production from land locations to the Arctic offshore,” Mr Humphreys said, noting that in addition to planning and risk management, hydrocarbon production in these new regions needs to be seen as providing long-term growth opportunities for regional communities.

“Drilling contractors and service providers also need to consider a multitude of practical issues, not the least of which is the remote operating environment, where ice management, logistics, supplies, crew change, among other factors, are currently structurally non-existent but require substantial investment to create a true oil and gas development environment,” he continued.

Water depths across the prospective Arctic regions range from very shallow up to 1,000 meters, and dictate whether the rig needs to be equipped with dynamic positioning capability, anchors or both. The rig mobilization and de-mobilization philosophy of the operator is an issue that is especially relevant to the US/Canadian Beaufort Sea, Mr Humphreys said.

Operator requirements with respect to the drilling season, such as ice cycle and management, and the impact on rig design, also must be considered. “Finally, there are environmental demands, such as the need for relief well drilling, from regulators and local communities,” he noted.

In addition, more sophisticated techniques for acquiring seismic data are required for exploration wells. “While subsurface geological risks can be dramatically reduced through well design and appropriate BOP provisions, the well construction process that has been well-defined for offshore drilling needs to be further developed in terms of effectiveness, environmental compliance and contingency planning, for offshore production,” Mr Humphreys said. “This would be most relevant for the designs and functional specification of drillships or semisubmersible rigs permanently assigned to work in the Arctic.”

The increasing complexity of well designs also may mean that it will take up to two seasons to drill, complete and test an exploration well.

“On discovering a movable hydrocarbon that requires testing for evaluation purposes, conventional testing techniques may not be appropriate, primarily for environmental reasons, and as such, an alternative needs to be developed,” he continued. “Due consideration needs to take place with respect to the health, safety and environmental aspects of suspended wells, such as whether there will be requirements to have the wellhead below seabed to avoid damage through ice scouring, and determinations of the most appropriate technology to build the glory holes to accommodate the wellheads and BOPs.”

While drilling rigs may be able to carry on board all the necessary materials – wellheads, casing and bulks, etc – for drilling a single well, in remote areas there will be a requirement for helicopters that can travel extended distances, mainly in the dark during the Arctic winter, fully loaded and in extremely cold weather for crew changes and medical evacuation, Mr Humphreys added.

“The single most complex issue for the Arctic when it goes into development mode is not the technologies related to permanent production platforms, floating production storage and offloading units, or subsea field development system design, or even how the oil or gas is evacuated. Because while the engineering and technology are complex, the technical issues can be resolved at a cost.

“The whole development scenario hinges on having an integrated logistics and supplies infrastructure that can support the drilling rigs, production facilities and export routes in the heart of the remote and hostile Arctic environment,” he said.

Harsh Climate Solutions

While significant barriers remain for near-term offshore development, new equipment and methods are being introduced and tested for the onshore market to withstand the lowest temperatures of the Arctic permafrost.

Weatherford International has achieved success with its drilling-with-casing (DwC) technology in the gas-rich Yamal Province of Western Siberia. The technology, which uses casing strings instead of drill pipes, enables the permafrost layer to be drilled in a single trip, eliminating nonproductive time (NPT) and improving drilling efficiency by minimizing cement and reducing trips to run drill and bottomhole assembly (BHA) components into the well, said Mike Sutherland, drilling optimization services manager.

Since November 2009, the DwC technology has been used to drill close to 20 onshore gas wells for three major Russian national operators. At the 2010 “Tools and Equipment for the Oil and Gas Industry in Russia” forum, Weatherford received an Oilfield Services award for the DwC technology and its impact on drilling in Russia following its success on several test wells. It is now being used as the primary method for drilling upper-hole sections in two fields. The technology has been shown to save up to three days of rig time and to reduce fluid loss and mud and cement costs.

The DwC equipment uses steel grade rated from 30°F to -40°F to accommodate the wide range of climate conditions that can impact drilling operations and transportation in the region. “The size of the country and the weather mean planning needs to be well-controlled and organized, very much like a military operation,” Mr Sutherland said. “From the end of November through March, the roads become usable when the marsh freezes over. Then we wait for the thaw and use the river systems. Mid-August through November is a transitional season, when the ground is very soft and difficult to operate in,” he said.

“Typically, the onshore Arctic has a permafrost formation which runs from 0 to 350 meters deep,” Mr Sutherland continued. “We set the casing depth around 450 meters, which gives us 100 meters into the clay stones beneath the permafrost. This gives us a firm casing seat prior to drilling the next section. DwC is usually deployed from the subsurface, anywhere from 20 to 40 meters up to 400 to 700 meters.”

The system uses a drillable casing bit from the Defyer series that is attached to the first joint of casing. The casing is rotated in the same way drill pipe rotates in a conventional operation that uses the Overdrive casing, running and drilling system.

“As one of the biggest producers of gas in the world, Russia is a developing market, and there is huge potential here for the DwC technology,” Mr Sutherland said. “The bulk of the production is onshore, but the major operators are beginning to look at more offshore development, which will likely increase over the next five to six years.”

Redesigned Drill Pipe

VAM Drilling manufactures a line of harsh-climate tubulars from the rig floor to the BHA, including drill string, drill collars, accessories and valves. The company recently introduced a new drill pipe, VM-135 DP LT, that maintains full ductility at temperatures as low as -60°C, according to marketing and technical managers Philippe Machecourt and Kamal El Bachiri. The first delivery of the product was for Gazprom. It has not yet been deployed.

“Operators and drilling contractors are looking for the same tools in terms of performance as are usually used, but which are also suitable for very cold temperatures,” Mr Machecourt said. “Extremely low temperatures change the behavior of the steel. The underlying issues are not uniquely related to the service temperature of the equipment, but rather to the high risks associated with susceptible damage during ground transportation and surface handling, especially in arctic fields.

“The drilling operating parameters are no different between wells in the arctic and non-arctic conditions,” he added. “The shock of the extreme conditions on the steel dramatically increases the risk of equipment failure, leading to a higher scrapping ratio for the product and a huge potential increase of NPT.”

A key goal in developing the technology was overcoming a problem that occurs with steel: the higher the yield strength of the steel, the lower the toughness. VAM Drilling’s customized low-temperature steel grades combine new steel-making technologies and a controlled manufacturing method designed to achieve both yield strength and toughness, Mr El Bachiri said. The process includes high-quality steel, advanced rolling-process technology, fit-for-purpose chemical composition, and an improved heat treatment process.

“The drill pipe presents a better stability and consistency because we use higher quality with, in particular, all the micro-alloy benefits,” he said.

In one case, VAM Drilling provided high-strength drill pipe that also featured a very thin wall pipe body for an ultra extended-reach well on the North Slope of Alaska for a

major operator. Because of the environmental sensitivity of the area, the rig could not be placed directly over the wells, so drilling commenced more than six miles from the reservoir. “Had we used regular steel, the drill pipe would have needed to be a certain wall thickness to perform,” Mr El Bachiri explained. “But by using higher-strength steel on the drill pipe, the wall thickness was thinner, so the pipe weighed less and the operator was able to better drill this extremely extended-reach well.”

Methane Hydrate Prospects

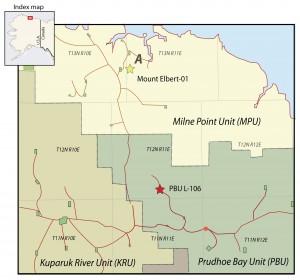

The Arctic also is believed to hold considerable unconventional resources, including coalbed methane, oil shales, heavy and viscous oil and tar sands and methane hydrates. This year, the US Department of Energy (DOE), ConocoPhillips and the Japan Oil, Gas and Metals National Corp will embark on a project to test a technology for developing methane gas from hydrate deposits on Alaska’s North Slope. The test is taking place on the onshore Ignik Sikumi gas hydrate test well that was drilled in the Prudhoe Bay area by ConocoPhillips and the Office of Fossil Energy’s National Energy Technology Laboratory (NETL) in 2011.

“The USGS has reported an estimated 85 Tcf of technically recoverable methane in gas hydrates across the Alaska North Slope,” said Dr Ray Boswell, technology manager, methane hydrates for NETL. Methane hydrate consists of molecules of natural gas trapped in a framework of water molecules in sediments in and below thick Arctic permafrost and in the subsurface of most continental waters that are 1,500 ft or more deep, Dr Boswell explained.

The test, which is being conducted from an ice pad during the 2012 winter drilling season (January to April), will involve injecting carbon dioxide (CO2) into methane hydrate-bearing sandstone formations. It is hoped that the CO2 will exchange with the methane (CH4) molecules in the hydrate structure, resulting in the release of methane gas and permanent storage of the CO2 in the formation. The DOE has invested $14 million in the project, including the prior Ignik Sikumi well installation and the upcoming testing program.

Other gas hydrate field programs, such as Japanese-Canadian “Mallik” testing in Arctic Canada in 2007-2008 and the DOE-USGS “Mount Elbert” program with BP Alaska in 2007, have focused on reservoir depressurization as the preferred means to produce gas hydrates. In this method, fluids are pumped out of the borehole to reduce pressure in the well, resulting in dissociation of methane hydrate into methane gas and liquid water, Dr Boswell explained.

“The exchange test is targeting an application that has a very different focus. We want to understand the basic potential of the CO2 injection technology,” he said. “This will be the first step down the road to determine the potential for recovering methane hydrates with a process that also permanently stores CO2. If this test is positive, there would certainly be a need for tests at larger scales.

“A major challenge,” he continued, “is conducting what is basically a science program, which requires non-standard oilfield equipment, within an active operating area without interfering with the operator’s core business.”

The final stage of the exchange tests will include reservoir depressurization to capture the released methane and then to recapture the injected CO2. “This phase of the testing will assist in the evaluation of reservoir response to depressurization,” he said.

DwC and Defyer are trademarked terms of Weatherford International Ltd.

Great atrcile! I completely agree with the last paragraph, it’s time for us as energy producers to better educate the public on fracking and what can be done to prevent spills or other accidents involving .