Offshore likely to remain a waiting game until expected uptick in 2027

Dayrates and utilization to remain mostly stagnant next year after seeing declines this year, though analysts say long term is positive

By Stephen Whitfield, Senior Editor

Looking at the offshore market heading into 2026, the sentiment among analysts could best be described as cautiously optimistic – with the rig count likely to stay flat next year after falling this year.

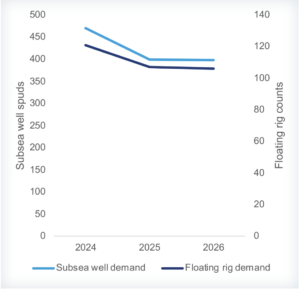

Wood Mackenzie, for instance, estimates that 2025 will see an average marketed floating rig demand of 107 globally, although by year-end the floater market could fall to just 100 rigs. These numbers exclude China, Russia and Turkey, which Wood Mackenzie does not track. That 107-rig average for 2025 would be a 14-rig drop from 2024’s average of 121, while floater rig demand is expected to reach 106 in 2026. In terms of utilization, ultra-deepwater benign floaters will move from 83% in 2025 to 81% in 2026, while harsh-environment semis will rise from 77% in 2025 to 80% in 2026.

Subsea wells should also stay relatively flat next year after seeing a year-on-year drop: The well count averaged 470 in 2024 and will fall to 400 in 2025, then 398 in 2026.

Not much change is expected with commodity and rig pricing either, with Wood Mackenzie estimating Brent prices to average in the mid-$60s next year, similar to the $65 average this year. Dayrates for ultra-deepwater benign floaters are expected to fall slightly, from $425,000 this year to $415,000 next year. For harsh-environment semis, average dayrates will rise slightly, from $395,000 in 2025 to $400,000 in 2026.

However, 2026 may be the bottom of a mini-slump. Wood Mackenzie estimates that rig demand will go up by 8.5% year-on-year in 2027, then see a slightly lower rate of growth in 2028 and 2029 of around 2.5% per year. By 2029, floating rig demand could be back at 2024 levels.

This uptick will be driven by operators that had pulled back on high-impact exploration activity in recent years due to their focus on capital discipline, said Leslie Cook, Principal Analyst – Upstream Supply Chain at Wood Mackenzie. Now, however, those companies are starting to take another look at boosting their upstream portfolios, encouraged by the successes seen in emerging basins like Guyana and Namibia. Other areas of note include the ultra-deepwater basins offshore West Africa and Brazil.

“There’s going to be an increasing amount of demand from deepwater, driven by some long-trajectory, giant developments. We think that deepwater is the area in upstream that has that continued growth potential as we come toward the end of the decade,” Ms Cook said.

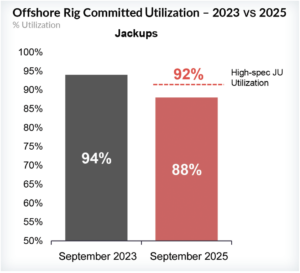

On the jackup side, the story is pretty similar to the floaters – a flat market potentially portending an upcycle toward the end of the 2020s. However, since market fundamentals do not support extensive newbuild programs, rig counts are unlikely to increase much. Westwood Global Energy Group forecasts the global marketed jackup supply will stay roughly the same year-on-year – 395 rigs in 2025, 405 rigs in 2026 – while the utilization rate will also remain in the same range – 89% in 2025, 90% in 2026.

The market in Saudi Arabia will be the main driver of jackup activity, where actions by Saudi Aramco will dictate the extent of any global market uptick. The wave of jackup contract suspensions that Saudi Aramco announced in 2024 sent shockwaves throughout the market.

Additionally, Pemex suspended at least 12 jackups in Mexico this and last year, although the government has said it hopes to bring those rigs back to operation by the end of 2025. However, from a financial perspective, it looks unlikely that a return to operations will happen on that scale.

“When you look at the jackup market, I think we’re seeing some light improvement this year in terms of increased award activity versus last year, which was pretty tough,” said Teresa Wilkie, Director of RigLogix at Westwood. “There’s been a lot of competition trying to get those suspended assets back out to work. Utilization is still going to be pretty flat in 2026, but when you look at 2027 onwards, we’ll see more improvement.”

West Africa

One of the top areas of interest in the near-term future is West Africa, even if the year-on-year forecast figures don’t necessarily support this. Wood Mackenzie estimates floating rig demand in the region to drop from 12 in 2025 to 10 in 2026, while well counts will drop from 65 to 50. However, there are indicators that the region is poised to ramp back up, Ms Cook noted.

Massive new finds in Namibia’s Orange Basin by TotalEnergies and Shell in 2022, along with a 2024 discovery by GALP, abound in low-cost, low-carbon barrels. These discoveries have sparked a frenzy of activity among operators looking to repeat those successes.

In April, BP, Eni and Rhino Resources all confirmed preliminary results of the Capricornus 1-X well, which was spudded in February in Block 2914A. The companies are planning to drill an additional three wells in the Orange Basin, starting in December. Chevron is also considering acreage in Namibia’s Walvis Basin, just north of the Orange Basin.

Next year, TotalEnergies, along with partner Qatar Energy, will test the extension of the proven Cretaceous fan play in Namibia into South African waters with the Volstruis-1X and Nayla-1X wells. TotalEnergies will also drill Olympe, southwest of its giant Venus discovery.

“The operators are going after those advantaged barrels, and they’re getting better and better at targeting drilling areas where they feel they can get the most bang for their buck. That means some exciting areas are going to come up soon. Namibia is finally starting to get on its feet,” Ms Cook said.

Outside of Namibia, other countries in West Africa are looking to breathe life into their more mature basins, with Nigeria and Angola enacting incentives to stimulate investment. In 2024, Angola introduced new production terms designed to make smaller infill and tieback projects economically viable, lowering royalties and taxes.

This response has generated a positive response from E&Ps, with ExxonMobil extending its license for Block 15 offshore Angola up to 2027 and planning to kick off a second phase of drilling in the block in the near future.

Nigeria is offering a broad suite of incentives under its Petroleum Industry Act, providing substantial tax credits that Wood Mackenzie said were decisive for Shell to move forward with the Bonga North project, the operator’s first major deepwater FID in the country in over a decade. In October 2025, Shell also took FID on the HI gas project offshore Nigeria, which will supply gas to Nigeria LNG for exports to global markets.

US Gulf

Wood Mackenzie does not see much movement in the US Gulf between this year and next, due to the lack of new projects on the immediate horizon. Rig demand in the region was at 22 in 2024 but will drop to 20 in 2025, then down to 18 in 2026. The number of wells drilled will see a similar drop, from 67 in 2024 to 54 this year to 52 next year.

“I think when you look at the Gulf specifically, you’ve got your supermajors who have priorities all over the world, and some of those companies are ramping up in other parts of the world. They’ve got priorities elsewhere, and they know where they’re spending their money,” Ms Cook said.

One constraint that may be limiting operator appetite for further exploration in the US Gulf is the high dayrate environment. Floater dayrates in the region typically were in the $450,000 range throughout 2023 and 2024. However, those rates are starting to fall, with Wood Mackenzie forecasting an average of $425,000 for 2025 and a similar average in the low $400,000s for 2026.

“The Gulf, from a rig standpoint, is the highest-priced market in the world,” Ms Cook said. “Those are the rigs that have been pushing up the dayrates in the ultra-deepwater space. But when we look at what we saw in 2024, when utilization was in the low- to mid-90s (percentile), dayrates should have been $600,000 or more. We should have seen dayrates way higher than they were, but they weren’t that high because of the capital discipline among the operators. They’re really holding firm on that.”

One of the only new projects moving ahead in the US Gulf is BP’s Tiber-Guadalupe, with FID announced on 29 September. The operator is set to deploy 20,000-psi equipment to help drill and complete the high-pressure, high-temperature wells required for this project, with startup of production anticipated in 2030. It will include six wells in the Tiber field and a two-well tieback from the Guadalupe field.

Outside of this development, the region is unlikely to see any new activity in the next year or two, Ms Cook added. “What our team will tell you is that they’re having trouble seeing where the growth is going to come from, period,” she said. “The only project left to get going is the BP 20k stuff. Every other project has been started and is under way.”

Latin America

Wood Mackenzie is also projecting a negligible increase in the number of rigs and wells in Latin America for next year – 40 floating rigs in 2025 rising to 42 in 2026, and 139 wells drilled in 2025 increasing to 142 wells in 2026.

The bulk of that activity will occur in Brazil: Wood Mackenzie estimates there will be 33 rigs in the country this year and 35 next year. In August, Petrobras announced that its production from the Búzios field had surpassed 900,000 barrels per day (bpd), setting a record for the operator. Additionally, operators including Petrobras, ExxonMobil, Shell and Chevron were awarded multiple blocks in the country’s most recent bid round on 17 June.

That was followed in early August by a major discovery announced by BP at exploration well 1-BP-13-SPS at the Bumerangue block, located in the Santos Basin. The well reached a total depth of 5,855 m and sits within a high-quality pre-salt carbonate reservoir spanning more than 300 sq km. The operator called this its largest discovery in 25 years.

While the Bumerangue discovery could motivate other operators to bid more aggressively in Brazil’s next licensing round, Ms Cook said she does not anticipate any significant increases in the country’s rig count in the near term. This is primarily because there will be a number of rigs coming off of contract there next year.

“There will be plenty of activity in Brazil, but I can’t imagine Petrobras would continue to pay to bring in rigs when they’ve already got a lot in-country. They have some tenders out right now, but our assumption is that they will just use the rigs they already have in-country to fill whatever tenders they have. There could be a few more rigs that come into Brazil for the IOCs, but that’s it. There are a number of IOCs with planned wells in Brazil over the next two years,” Ms Cook said.

Suriname is another high-interest area in Latin America. At least five exploration wells were planned to be drilled there in 2025, including TotalEnergies’ Macaw-1 exploration well in Block 64. Petronas is also planning to drill Caiman-1 and Kiskadee-1 in Block 52 in the second half of 2025. Also scheduled to be drilled in late 2025 are the Chevron-operated Koriori-1 well in Block 5 and the Shell-operated Araku Deep-1 in Block 65. The two operators have said they are considering conducting further exploration activity next year.

“I think the attitude with Suriname is, let’s see what happens,” Ms Cook said. “Right now, it’s only a little more exploration than what we’ve seen, but we’ll see.”

Middle East

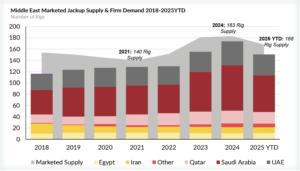

The Middle East saw a significant decline in its offshore rig count in the wake of Saudi Aramco’s 2024 jackup contract suspensions. In 2025, the marketed offshore rig supply for the region dropped to 168, down from 183 rigs in 2024, with those rigs almost entirely coming from the six Gulf Cooperation Council (GCC) countries – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE.

For next year, not much change is expected, with Westwood forecasting an average of 169 marketed rigs. Committed utilization – which Westwood defines as the percentage of rigs in the region that are either contracted now or committed to working in the region in the future – dropped from 97% in 2024 to 91% in 2025, and should fall further to 89% in 2026.

The utilization figures in the Middle East are indicative of the waiting game in which drillers find themselves heading into next year, particularly in Saudi Arabia. Of the 37 rigs whose contracts were suspended by Saudi Aramco in 2024, 22 have either been mobilized out of the country or contracted to be mobilized out of the country – four to other nearby countries (Egypt, the UAE), seven to West Africa, two to South America, one to Mexico, two to China and six to Southeast Asia.

However, Ms Wilkie said there is evidence of a potential shift in activity. One of those 37 suspended rigs has resumed work with Saudi Aramco, while three other rigs have been awarded 10-year extensions with the NOC, even though they have not resumed work yet. In addition, Saudi Aramco sent letters to drilling contractors with suspended rigs in September 2025, inquiring about the availability of the suspended rigs, as well as indicative pricing.

Ms Wilkie noted that some of the rigs expected to move out of Saudi Arabia do not have firm contracts lined up yet and have been moved out speculatively or for stacking elsewhere. While it is still too early to say, utilization in the region could see an increase heading into 2027 if Saudi Aramco decides to ramp up its jackup demand again.

“Even though there are rigs that have been moved, you still have some that are sitting there idle,” Ms Wilkie said. “The three that have been given 10-year extensions with Saudi Aramco, they’re sitting there waiting to return to work. You have four units that were on bareboat charters but have now been returned to their owners, mostly shipyards, but we believe the majority of these are under discussions to be sold. You have an additional seven units that are just sitting idle in both Saudi Arabia and the UAE. However, I’d say there’s more optimism in that market than there was last year, because you have these three rigs already awarded extensions, as well as talks that Aramco may be interested in bringing a few more of those suspended rigs back.”

Before that activity increase is realized, however, dayrates will remain weaker in the GCC countries. They averaged $108,484 in 2023 before falling to $91,735 in 2024, then to $89,865 in 2025. Dayrates could fall further in 2026 but are likely to remain in the low- to high-$80,000s.

These lower rates will likely contribute to a more favorable environment for Saudi Aramco to bring back suspended rigs if it should require them, however. Ms Wilkie indicated that the operator is seeking to renegotiate lower rates should it bring those rigs back to work.

“They’re not going to take back all of those suspended rigs, but there have been some conversations with the drilling contractors, and I think there’s some optimism that this might actually come to fruition,” she said.

Asia Pacific

Southeast Asia has picked up six of the jackups that had been suspended in Saudi Arabia, although two of them, expected to move to Singapore in late October 2025, will be stacked as they don’t yet have work in place.

PTTEP contracted the other four for work offshore Thailand: the ADES Admarine 502 was awarded an 18-month contract with a nine-month option, the ADES Admarine 503 was awarded a five-year contract plus a three-year option, and the COSLGift and COSLSeeker jackups were contracted from COSL.

Of the two jackups that mobilized to China, CNOOC contracted COSL’s Lovansing, while the SinoOcean Wisdom went to an undisclosed operator.

“You’ve got a very strong jackup market already in Asia, and we’re definitely seeing that area as a growth market over the next few years,” Ms Wilkie said. “They’ve soaked up quite a few of the suspended Saudi jackups.”

Westwood expects rig count to increase moderately year-on-year in Asia Pacific, moving from 50 in 2025 to 57 in 2026, while utilization will move from 81% in 2025 to 89% in 2026. While much of that activity will come from jackups, Ms Wilkie noted that floater activity in the area will likely pick up, as well. DC