Offshore Europe: E&P revival drives rig demand

New discoveries, new acreage renew exploration potential in this ‘mature’ market

By Katherine Scott, editorial coordinator

Despite the financial hardships rippling through the European economy, operators and drilling contractors continue to thrive in a reinvigorated offshore European drilling market that is supported by continued high oil prices and buoyed by new discoveries on old fields, as well as emerging opportunities on new acreage. In essence, business is good.

“The market is quite active. … This year, the (rig) market is already sold out,” Pankaj Khanna, chief marketing officer for Ocean Rig, said. “There’s quite a lot of demand and very little supply available to meet that demand.” Ocean Rig is getting ready to mobilize the Leiv Eiriksson, a fifth-generation semisubmersible, to Norway for a three-year contract with a consortium of operators this fall after the rig completes a well in the Falkland Islands for Borders & Southern. “Europe, you cannot look at it in isolation. It is part of the global market. The global market is tight, and Europe is tight as well. If you look at Europe and you talk specifically Norway, the market is extremely tight,” he said.

Part of the driving force behind the rising demand is operators’ renewed interest in so-called mature fields, particularly in Norway, where major new discoveries are breathing new life into drilling programs. “A refocus on the North Sea and the new discoveries based on some new reservoir models has really encouraged operators to take a new look and to refocus on the old territory that has revitalized the Norwegian part of the North Sea,” said Bjornar Iversen, executive vice president corporate business development for Odfjell Drilling. “The market has been really good these days. It’s a nice place to be in the drilling business now.”

The Johan Sverdrup discovery (formerly named Aldous/Avaldsnes), located 87 miles (140 km) west of Stavanger in the Norwegian North Sea, is a prominent example of the renewed interest. “It was found in an area where people thought, ‘We’ve been looking everywhere.’ It just reinforced exploration activity,” Ivar Simensen, vice president-communications for Aker Solutions, said.

Industry also appears to be optimistic that even more discoveries will further encourage E&P in the area. Trond Robstad, senior vice president business development for Aker Solutions’ drilling technologies business, points to places in the northern part of Norway that remain undeveloped, as well as pockets in the south that could still produce big finds. “It’s not that many years ago they said, ‘There’s no point; we’ve found everything in the south.’ Then, two years later, there was a large discovery just where they had been producing for years,” he said.

In the UK as well, a North Sea licensing round earlier this year attracted 224 applications covering 418 blocks of the UK Continental Shelf. The UK Department of Energy and Climate believes it was the largest licensing round they have seen since beginning offshore licensing in 1964. Players include both majors and an increasing percentage of smaller independents doing the exploration work.

But it’s not just mature fields that are driving increased activity. Newer acreage also is providing significant opportunities. An agreement implemented on 7 July 2011 between Russia and Norway resolved a 40-year dispute in the Barents Sea and released more than 68,000 sq miles to oil and gas exploration. “That opens up acreage for new drilling area, which is basically the same size as the North Sea,” Mr Iversen said. “There are some positive trends there. That will open up a new oil province for us again.”

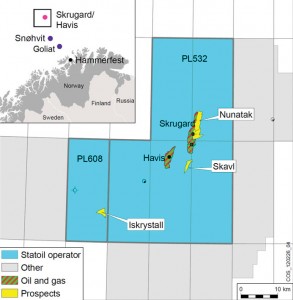

Statoil has been particularly successful recently in the Barents Sea, specifically with the Havis discovery, which was found only about 4 miles (7 km) southwest of Skrugard in January this year. “Our ambitions in regards to the Barents Sea have been given another momentum, hence our successful appraisals and discovery also of Havis,” said Torgeir Loland, head of rig strategy and procurement for Statoil. He added that the company will return to the Barents Sea this fall with Seadrill’s West Hercules, a sixth-generation ultra-deepwater semisubmersible that has a maximum water depth of 10,000 ft and a drilling depth of 35,000 ft. The rig, which is currently in China operating for Husky Oil China, will mobilize to Europe for a four-year contract with Statoil.

In the UK, it’s believed that a significant share of the country’s remaining oil and gas reserves lie in the West of Shetland, where BP is bringing Odfjell Drilling’s sixth-generation newbuild semi, the Deepsea Aberdeen, in May 2014. Another active player in the area, DONG Energy holds more than 20 licenses in the West of Shetland and, in 2009, the first well they drilled as operator made a gas discovery in the Glenlivet license. The company has had additional recent exploration successes in the West of Shetland’s Edradour, Tormore and Tornado discoveries. DONG will bring Seadrill’s West Navigator drillship to the area to drill two exploration wells from mid-September to the end of the year.

DONG is also active in Denmark and Norway. In the former, the company has had recent successes in the Solsort and Sara discoveries, said Henrik Elholm, senior manager of strategy and portfolio systems for DONG Energy. Across the entire portfolio, medium-term plans are to drill five to 10 exploration wells a year to build on the recent discoveries, he added.

Eigil Hannestad, senior director of well construction for DONG Energy, also noted that the company continues to improve efficiency by using jackups for their subsea wells, a practice driven by low availability of semis that can work in only 60-70 meters of water. Using Maersk Drilling’s Maersk Giant jackup from August 2010 to June 2012, the company drilled five such wells in Norway – two on the Trym field and three on Oselvar.

Influx of Newbuilds

In all, activities point to a tight supply/demand picture for rigs in the offshore European market. “Going forward, we expect the positive trend to continue,” said Martin Fruergaard, chief commercial officer for Maersk Drilling. “The jackup market in Norway is sold out until Q2 2014, and even though we are adding three newbuild, high-specification jackups in 2014 to 2015, we expect the market to remain tight since a lot of drilling is needed to develop production from Norwegian fields. Also, for the rest of the North Sea, we experience utilization not seen since early 2009, and also here the dayrates have established at a healthy level. It’s a very positive outlook at the moment.”

In particular, the new provinces demand high-spec, harsh-environment units that can operate in extreme conditions such as those seen in the West of Shetland and Barents Sea. Ocean Rig’s ultra-deepwater, harsh-environment semi Leiv Eiriksson, for example, which is moving to Norway from the Falkland Islands this fall, can be winterized to work in temperatures as low as -100°C.

Maersk has concentrated on the jackup market in Europe, with nine currently in operation that includes five ultra-harsh environment and four high-efficiency units – six in Norway, one in Holland, one in Denmark and one in the UK. “At least in Norway, historically, it’s the jackups that we’ve been focusing on. … We do follow what’s happening on the semi side, and should an opportunity arise, we could also be there,” Mr Fruergaard said.

The company also has three ultra-harsh environment jackups under construction that are slated for the Norwegian market upon delivery in 2014. The Maersk XL Enhanced I and the Maersk XL Enhanced II have been contracted for three years each to TOTAL and Det Norske, respectively. A third new ultra-harsh environment jackup, the Maersk XL Enhanced III, won’t be delivered until 2015, but its construction is backed by a four-year contract with Statoil for work in Norway that will last through 2019, further illustrating demand for high-spec units in the region.

Odfjell also has three semisubmersibles on the NCS, as well as manages the Songa Trym and Songa Delta semisubmersibles on behalf of Songa Offshore, who bought the rigs in 2007 and 2008, respectively. The rigs were already on contract at the time of purchase, so Odfjell will remain managers until the contracts expire. “You can move a rig that is operating in Norway to basically all segments of the world, but it’s very hard to move a rig that’s not classified and built for the region and take it to Norway,” Odfjell’s Mr Iversen said.

Aside from the increasing need for high-spec jackups, another emerging trend in the offshore European market is operators taking a more proactive stance toward rig designs. Statoil, for example, has developed several rig “categories” to tailor-fit the vessels for specific purposes, such as the Cat B rig for well interventions using wireline and coiled-tubing operations and the Cat J jackup for harsh-environment operations for both surface and subsea wells in the NCS shallow water. The efforts are all about being strategic and looking for efficiencies, said Mr Robstad. His company, Aker Solutions, is among vendors working collaboratively with Statoil in developing and building Cat B and Cat D rigs.

“The key is that they’re not building them as single-purpose vessels; they are building them as multipurpose vessels to make them more flexible,” said Glenn Ellis, senior vice president and head of Aker Solutions’ drilling technologies business in the US. “They’re not trying to be all things to all customers, but they are trying to provide equipment that gives them the ability to bundle certain services that have synergies in the customer base.”

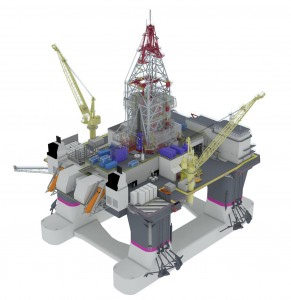

The Cat D semisubmersible was designed to increase oil recovery in mature fields on the NCS. “You have to come up with tools, rigs or smaller rigs, that can come in and assist you in these increased oil recovery operations, and that’s where the initiative started off, recognizing that for us to achieve what we hoped for when it comes to oil recovery, we need efficient tools,” Statoil’s Mr Loland said.

The Cat D rig is designed for operations in water depths up to 1,300 meters (4,265 ft) and to drill wells up to 8,500 meters (27,887 ft). It can be converted for work in deepwater, as well as HPHT and arctic operations. “We also believe that this particular rig will hold a 20% efficiency gain, not because it will drill much quicker, but it has been set up so when you reach the various stages in a drilling operation, the equipment that is supposed to go down the well is already there,” Mr Loland added. Songa Offshore is building four new Cat D semis at the DSME shipyard in South Korea, with deliveries scheduled between Q1 2014 and Q2 2015. Statoil has contracted each rig for an eight-year firm period and four three-year options.

Downhole too, Statoil is taking a proactive stance on advanced monitoring of drilling operations, recently awarding Sekal AS a framework agreement to provide a picture of the well status in real time, as well as model well behavior using Sekal’s DrillScene software. The software has shown success in early detection of symptoms of potential critical situations, such as the influx of oil and gas into the well, loss of fluids to the formation and poor cuttings transport. This early detection can reduce nonproductive time and increase safety and efficiency. The contract will run for two years and has two options for two years each.

Price of Increased Activity

One symptom of increased drilling activity has been an increase in costs. “Building the rig has become more expensive, all other supplies to the rig have become more expensive, and the crew has become more expensive, so you see a general ongoing increase, which is linked to the activity of drilling on a global scale and in the North Sea,” Mr Fruergaard said.

From an operator’s perspective, they’ve certainly noticed the costs increases, though they haven’t been high enough to cause cuts in drilling. “We have not come to a point where we haven’t as such said yes or no to wells yet. Of course, cost is a major part of that every time, and there’s a fine line there. It could happen,” Mr Hannestad said.

Further, the boom in Norway means that the availability of personnel will continue to be a constraint on how much drilling can actually be done.

As a way to ensure the competency of personnel onboard, several companies have invested in training centers in the region. Maersk’s training center in Denmark is developing a highly advanced drilling simulator that can reproduce actual scenarios seen on the individual rig designs. “We have spent more time on the training of our crew to make absolutely sure that people could operate the advanced rigs that we have. I think our focus has been on developing the skills set of the people we have,” Mr Fruergaard said. Statoil and Aker Solutions, likewise, have established drilling simulators at training centers in Stavanger.

Overall, industry continues to focus on safety, efficiency and performance in its rigs. “I think the general trend we are seeing is an obviously continued, maybe even revved up, focus on HSE, in addition to efficiency and performance,” Mr Ellis said.

Whether it’s new discoveries in mature fields or the expansion of drilling and exploration into new areas like the Barents Sea and West of Shetland, the European drilling market has stimulated significant drilling activities and rig demand. “The easy oil is gone, so the only way to get more oil out is to drill more. We have an underlying push for that,” Mr Iversen said. “I think we see some good years ahead of us.”

DrillScene is a trademark of Sekal AS.