Eyes on the long term in US Gulf of Mexico

Utilization, dayrates both sharply down, though floaters are seeing more insulation due to longer-term contracts

By Kelli Ainsworth, Editorial Coordinator

Major deepwater exploration successes made 2014 a banner year for the US Gulf of Mexico (GOM). These include Chevron’s Anchor and Guadalupe discoveries in the Green Canyon and Keathley Canyon areas of the Lower Tertiary trend; Shell’s Rydberg in the Mississippi Canyon in the Jurassic play; and Repsol’s Leon well, also in the Keathley Canyon’s Lower Tertiary. It will be years before any of these discoveries yield commercial-level production, but already they’ve laid a solid foundation for GOM drilling demand for the coming years. “Due to the nature of the GOM, it can take seven years or even longer for a discovery to be turned into a producing field,” Wood Mackenzie Upstream Analyst Thomas Shattuck said. He cited as examples the Jack and St. Malo fields, which came on-stream in late 2014, nearly 10 years after their initial discoveries.

Major deepwater exploration successes made 2014 a banner year for the US Gulf of Mexico (GOM). These include Chevron’s Anchor and Guadalupe discoveries in the Green Canyon and Keathley Canyon areas of the Lower Tertiary trend; Shell’s Rydberg in the Mississippi Canyon in the Jurassic play; and Repsol’s Leon well, also in the Keathley Canyon’s Lower Tertiary. It will be years before any of these discoveries yield commercial-level production, but already they’ve laid a solid foundation for GOM drilling demand for the coming years. “Due to the nature of the GOM, it can take seven years or even longer for a discovery to be turned into a producing field,” Wood Mackenzie Upstream Analyst Thomas Shattuck said. He cited as examples the Jack and St. Malo fields, which came on-stream in late 2014, nearly 10 years after their initial discoveries.

In downturns such as the one the industry is currently going through, this “delayed gratification” aspect of the GOM can actually provide companies with a point of stability in an otherwise volatile market. “The GOM is a long-term game,” Mr Shattuck said. “Ultimately, it’s not about this year’s oil prices or next year’s oil prices. You’re looking at what it does over time and what it looks like over the life of a project, which could be decades in some cases.”

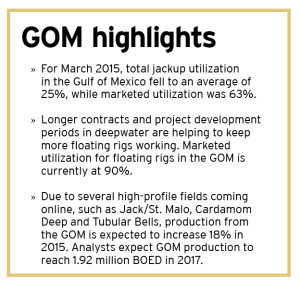

In the deepwater segment, especially, long-term rig contracts are common and do appear to be offering drilling contractors a degree of insulation in terms of declining dayrates and fleet utilization. Many of the rig contracts being worked today in the deepwater Gulf were locked in when oil prices were at or close to $100/bbl. “That being said, you do expect a pretty sharp drop for rigs that are coming up for renewal,” Mr Shattuck said, estimating that operators are knocking 15-20% off of dayrates.

At the other end of the market, the GOM’s shallow-water industry has been much harder hit. “Shallow water in the US Gulf is definitely in a worse position than the deepwater floater market,” Cinnamon Odell, IHS Senior Offshore Rig Analyst, said. For March 2015, total utilization averaged only 25%, she said. “So three-quarters of them were not working… The jackup market is pretty stagnant except for rigs that are being retired from the fleet.”

Oversaturation makes for competitive market

The IHS rig count issued on 10 April showed that the total supply of drilling rigs in the US Gulf stood at 112, and 74 of those were being marketed. Of those, 62 were listed as contracted, making for an 83.8% marketed utilization rate. A year ago, there were also 112 total rigs in the market, 86 marketed and 81 contracted, making for a 94.2% utilization, the report showed.

Looking specifically at floating rigs, Wood Mackenzie estimates there are roughly 45 contracted MODUs in the GOM. The number peaked some time in late 2014 or early 2015, Mr Shattuck said, adding that there have been several announcements of operators terminating contracts early. “So at the moment we’re more or less at an all-time high of available drillships and semisubs, but there has been a slight decrease in the number contracted,” he said.

In fact, Mr Shattuck said, his research shows that the number of drillships in the Gulf more than doubled between 2012 and 2015. Although this was partially offset by a decrease in the number of semisubmersibles in the region, it has nevertheless created a very competitive market. The current downturn has only exacerbated that competitiveness, Imran Khan, Senior Research Analyst at Wood Mackenzie, said. “There are plenty of rigs out there. The market is not tight anymore like it was a couple of years ago,” Mr Khan remarked.

Rig dayrates also reflect the market saturation. Wood Mackenzie noted that GOM dayrates began trending downward early in 2014, well before oil prices began their slide mid-year. “It started out as a supply-demand story, but then you add the oil price on top of that, and it pushed the market down even more,” Mr Shattuck said.

Significant rate drops can be seen across the board in all rig categories. In the floater market, ultra-deepwater semis that were working for $375,000/day are now down to $320,000-$350,000, Ms Odell said. Drillships are currently going for approximately $400,000/day, down from $555,000/day just six months ago. And a typical 250-ft independent cantilever jackup has a current market rate of $75,000/day while a half-year ago it was $126,000/day. “That’s not quite half, so quite a big drop there,” she commented.

Looking ahead to the next six months, Ms Odell said there is more room for rates to drop. However, it’s more likely that those rigs will not get contracts at all than to get lower-rate contracts, she said. “There’s a whole lot (of rigs) sitting idle that just aren’t getting any kind of contract. For sure, rig contractors would be willing to go down a little bit more for a job, but operators aren’t biting right now. So, in 2015, any rig that rolls off a contract is in danger of not getting another job without at least some sort of gap between programs.”

Contractors seek win-win solutions

From the perspective of drilling contractors, the competition for contracts in the GOM is fierce – perhaps more so than in other markets around the world. “The US Gulf of Mexico is experiencing jackup utilization levels that are lower than other markets at this point,” Rowan Companies CEO Dr Thomas Burke said. “However, we’re also seeing weaknesses in other markets where excess supply exists, such as in Southeast Asia.”

Rowan will have three ultra-deepwater drillships in the US GOM by mid-year. These latest-generation drillships are on long-term contracts and have better backlog visibility than jackups. The Rowan Reliance and the Rowan Resolute both have contracts locked in at the $600,000s – the former with Cobalt International that will last into 2018 and the latter with Anadarko that will keep the rig busy until October 2017. A third drillship – the 12,000-ft rated Rowan Relentless – was recently delivered from the Hyundai Heavy Industries shipyard in South Korea, set to commence a two-year contract with Freeport-McMoRan in the US GOM by mid-summer.

Compared with these floaters, backlog visibility for jackups has been more difficult. “We, like all our peers and customers, are seeing significantly reduced activity on the US GOM shelf, driven down by the commodity price,” Dr Burke said. As of mid-March, Rowan had four jackups in the area. Contracts for the Rowan Gorilla IV and the Cecil Provine are expected to end before mid-year, and the Rowan EXL III is being actively marketed. The Rowan Joe Douglas came off contract in March but is set to move to Trinidad for a contract with BHP Billiton starting in September. Three other slot-type jackups – the Rowan Juneau, Rowan Alaska and Rowan Louisiana – are currently cold-stacked.

Dr Burke points to the prevalence of short-duration wells on the GOM shelf as a major factor that is exacerbating jackup challenges. “Most industry analysts believe that jackup utilization will continue to decline if operators reduce spending in the US GOM,” Dr Burke said. “In this environment, any rigs that are capable of obtaining international longer-term opportunities will likely leave the US GOM in order to have improved and more stable earnings.”

Operators’ cost-cutting programs are reflected in the Gulf not just through drilling activities but also through rig sublets, a strategy that some companies have turned to in order to reduce CAPEX. Mark Mey, Executive Vice President and CFO of Atwood Oceanics, noted that subletting began in mid-2014 but has recently slowed as contracts have been completed. “We’ve seen announcements whereby many of our customers have come out and said they’re going to be cutting their spending by anywhere from 10-40%,” he said. “That means revenue in the GOM that drilling contractors could earn will be significantly reduced in the next year or so.”

Atwood currently has two ultra-deepwater drillships in the GOM. The 12,000-ft rated Atwood Advantage is contracted to Noble Energy into 2017, and the 10,000-ft rated Atwood Condor will work for Shell until late 2016. Both dayrates are in the $500,000s.

Although there have been reports in the industry of rig contract terminations, on the whole, contractors like Mr Mey believe that the sanctity of contracts will be upheld. Atwood’s contracts, for example, require operators to pay the full remaining contract value or the total remaining cash margins if the operator elects to cancel a contract.

The area for bigger worry is newbuilds that will be entering service this year. Atwood has two ultra-deepwater drillships under construction in South Korea. The Atwood Admiral is scheduled for completion in September 2015 and the Atwood Archer by June 2016. However, the contractor has the option to delay these rig deliveries by one year each.

Contractors are fully aware that operators are looking for contract renegotiations. Yet, it’s not a matter of us versus them, Mr Mey said, but rather a process of collaboration to create a win-win situation. This can be achieved, for example, by offering operators lower dayrates in exchange for longer contract terms. “The impact to the drilling contractor is more security with the increased duration of the contract, and the benefit to the customer is that they get a lower rate, which makes it easier for them to be able to work with their partners in drilling wells and sharing the dayrate on these rigs,” he said.

The upside during this volatile time is that contractors are already on the tail end of “a major renewal of the global fleet, both on the floater and jackup sides,” Mr Mey said. So while oil prices and the resulting low dayrates may make it difficult for contractors to justify building new rigs, many already have several new rigs they can rely on to satisfy demand, he explained.

A ready supply of modern and capable rigs allowed Noble Drilling to retire three older semisubmersibles earlier this year – the Noble Paul Wolff and the Noble Jim Thompson, both originally built in the 1980s, and the Noble Driller, built in 1976. The decision to retire these rigs was made after considering their technical capabilities, the investments required to maintain them and their remaining useful life, John Breed, Noble’s Director of Investor Relations and Corporate Communication, said.

He stressed that the decision was not motivated by current oil prices but rather the overall benefit to the company. In Noble’s February earnings call, the company stated that these rig retirements will save an estimated $85 million in operating costs for 2015. Further, due to careful planning of the retirements, Noble was able to mobilize the Noble Paul Romano semisubmersible from the Mediterranean to fulfill the Noble Paul Wolff’s four-year contract with Hess. The contract, originally set to begin in June, was delayed to September to accommodate the mobilization.

With the most recent retirements, more than half of Noble’s GOM fleet is now under five-years-old, Mr Breed said. As of 9 April, the company had three semis and six drillships working in the US Gulf, as well as the Noble Paul Romano and the Noble Discoverer on the way. End dates for these contracts range from mid-2015 all the way to mid-2022, and most dayrates are in the $400,000 to $600,000 range. Many of these contracts were negotiated one to three years ago, providing a solid $10.1 billion backlog, the company stated in its most recent earnings call. Floating rigs contribute $8 billion to the backlog, while jackups contribute $2.1 billion, the company stated.

Continued focus on safety, efficiency

Perhaps now more than ever, contractors are focusing on safety and performance in order to improve efficiency and reduce nonproductive time. “We’re in the business of providing safe and efficient operations on offshore drilling rigs to our customers,” Mr Mey said. “It’s no different than what we would have done last year or two years ago. It’s just a heightened urgency right now because the focus is on the low oil price, which means lower revenue for our customers.”

Wood Mackenzie agrees that efficient operations and cutting-edge technologies will be necessary to make future GOM wells economic. As newer wells get deeper, more challenging and more expensive – especially those in the Lower Tertiary – success in the GOM will hinge on operators’ ability to drill efficiently, Mr Khan said. Wood Mackenzie estimates that the average Lower Tertiary well can cost $300 million to drill and complete.

Statoil, which is a major deepwater acreage holder in the Gulf, has sharpened its focus on improving efficiency in the region, Jim Schwartz, Statoil spokesman said. While the company has consistently sought to improve efficiency in its drilling operations, it’s now setting specific goals that consider well depth and complexity. “We have a solid plan to improve drilling efficiency,” he said, adding that top-tier drilling efficiency has already been achieved with the most recently drilled prospects – the Perseus and Martin in the Mississippi Canyon and De Soto Canyon, respectively.

Statoil has also begun using a new controlled mud level system for managing bottomhole pressure. The ECD Management system, already deployed on select GOM prospects, is helping Statoil to address challenges associated with drilling narrow-margin wells and increasing the efficiency of those wells.

More production on the horizon

Production is projected to increase in the GOM this year, despite the downturn, Wood Mackenzie’s Mr Khan said. In 2014, production from the GOM totaled 1.3 million BOED, and a total production of 1.6 million BOED is expected this year. That amounts to an increase of approximately 18%.

The major reason for the increase in production is due to several high-profile discoveries finally coming online, Mr Shattuck said. According to the US Energy Information Administration (EIA), the Jack/St. Malo, Tubular Bells, Cardamom Deep, Dalmatian and Cardona projects all began production in late 2014. Jack and St. Malo alone are expected to produce 94,000 bbl/day of oil and 21 million cu ft/day of natural gas; Tubular Bells’ anticipated daily production is 50,000 bbl/day. In addition to those projects, Lucius, situated in the Keathley Canyon area, also came on stream earlier this year. The field holds an estimated 300 million BOE of recoverable resources, according to the EIA.

The agency’s data also shows that seven fields are expected to start production in the remainder of 2015, including Big Foot in Walker Ridge, as well as Big Bend, Troubadour and West Boreas in the Mississippi Canyon. In 2016, another seven fields are anticipated to begin producing, including Heidelberg and Tahiti 2 in the Green Canyon, and Marmalard, Dantzler and Gunflint in the Mississippi Canyon.

The redevelopment of the Mars and Na Kika fields will contribute to a further increase in production, according to EIA data.

However, although GOM production is expected to increase throughout 2015 and 2016, Mr Shattuck said, it will temporarily plateau at 1.92 million BOED before starting to fall in 2017. By 2020, production is expected to decline to an estimated 1.73 million BOED. “What you’ll see is, essentially, a bit of a wall at the end of the decade,” he said.

While 15 developments will have come online between 2014-2017, only eight are expected to come online between 2017-2020. In addition, by the end of the decade, large fields such as Mad Dog will have been producing for 15-20 years and should begin to see production levels decline.

However, around 2021, production is expected to rebound when new discoveries such as Anchor, Gila and Guadalupe begin producing. Mr Khan also expects any unsanctioned projects that were deferred as a result of the current downturn to be brought back on track, “as long as oil prices return to a higher level. If they remain at these levels, Lower Tertiary projects won’t be sanctioned because they need a price north of $60 Brent,” Mr Khan said.

Despite the expense of operating in deepwater, the GOM remains an attractive prospect for operators. Statoil, for example, considers the GOM one of its core offshore clusters globally and a major part of the company’s goal to produce more than 100,000 bbl/day by volume by 2020, Mr Schwartz said. In addition to Jack/St. Malo, Caesar Tonga and Tahiti producing fields, Statoil is a partner in the Stampede, Big Foot and Heidelberg future production projects, all of which have already been sanctioned. “We’re positive about the GOM’s future, and there is still a large yet-to-find and good fiscal terms,” Mr Schwartz said. “We are in the GOM for the long term,” he said.

While rig counts and dayrates are down for now, interest in the GOM is not. It is, after all, a long-term game. “If commodity prices stay low, then activity will remain low, and older rigs will likely be cold-stacked or stacked,” Rowan’s Dr Burke said. “But if commodity prices improve, the market balance in the US GOM may improve quickly; likely more quickly than might be expected as supply will have been taken out of the market.”