Euro-shales: Opposition mounts

Government, community concerns slow shale development in key European markets

By Jeremy Cresswell, contributing editor

A year ago, an article in the July/August 2011 issue of Drilling Contractor stated that the journey to achieving commercial shale gas production in Europe would be a slow one. Over the past 12 months or so, that journey has arguably gotten even slower, with at least two countries imposing bans on hydraulic fracturing since the publication of that article.

By comparison to the US, natural gas in Europe is expensive, and there is heavy and growing dependency on Russia for supplies. However, such pressures have so far been insufficient to, in some locales, shift public opposition to prospecting for, let alone extracting, gas from shales.

Europe is densely populated; land and water resources were already under pressure prior to the advent of shale-gas exploration. Various “green” movements have successfully capitalized on the fears that have grown around the perceived potential impacts of fracturing operations on water resources; primarily water table depletion and pollution.

This in turn has driven the bans imposed in Bulgaria and France, pending the outcome of further studies. The possibility also remains that other European Union member states – such as Romania – may follow a similar route.

The European Commission also has shale gas under study, and various reservations have been expressed.

However, it is early days, and the Commission’s approach has been pragmatic. It has not placed obstacles in the way of more progressive players such as Poland and the UK.

Indeed, in the UK, the government was quick to respond to public concerns that grew out of Cuadrilla Resources’ hunt for shale gas in the Bowland Basin near the famous holiday resort of Blackpool that resulted in localized mini-earthquakes last year that were attributed to hydraulic fracturing.

The UK Department of Energy and Climate Change (DECC) called in a group of consultants to review the situation, including representatives of the British Geological Survey.

According to Penelope Warne, head of energy at prominent European law firm CMS Cameron McKenna, the consultants recommended several specific measures to DECC to mitigate the risk of future earthquakes in relation to Cuadrilla’s operations in the Bowland Basin, working with a Drillmec rig.

Mrs Warne said, “In respect of future shale gas operations elsewhere in the UK, the experts recommended that seismic hazards should be assessed in advance of operations by conducting baseline seismic monitoring to establish background seismicity in the area of interest, using all available geological and geophysical data to determine any possible active faults in the region and using ground motion prediction models to assess the potential impact of any induced earthquakes.

“The consultation period on this report has just closed, and DECC is expected in the next few months to issue its own conclusions as to how it will assess future applications for consent to shale gas exploration drilling.”

That will not necessarily ease concerns in the UK or outright opposition to future projects, especially since there is no political priority being placed on unconventionals like shale gas as the resource is judged to be modest.

Contrast this with Poland, where the resource is considered very large and where there is strong political support. A series of exploration licensing rounds has attracted a sizable number of IOCs and independents, including ExxonMobil, Chevron, Eni, Talisman and Marathon – buying up drilling rights, either directly or through joint ventures. The Polish national oil and gas company, PGNiG, still holds the most licenses, however.

More than 100 exploration licenses, most of which are five-year terms, have been issued so far, covering most of the prospective shale gas areas. However, early exploration results have cast a damper on initial hopes for a rapid take-off in production.

According to the International Energy Agency (IEA), since PGNiG completed Poland’s first shale well in 2009, 18 exploration wells have been drilled, with a further 14 under way and 39 planned as of March 2012.

By one measure, Polish resources may be as high as 5.3 trillion cu meters, although this may prove overly optimistic as exploration results so far, including those from ExxonMobil, have been disappointing. Indeed, in mid-June, the supermajor announced its withdrawal from shale gas exploration in Poland.

Compare this with France, where the resource may be equally considerable but where the recently unseated government led by President Nicolas Sarkozy imposed a ban on hydraulic fracturing (though not drilling, per se) and revoked some licenses, including for TOTAL.

Jean-Claude Bourdon, founder and executive VP of French well engineering and drilling solutions contractor DIETSWELL said of the situation in his home country that “it is going to take time before any change might be considered.”

However, he indicated that the French oil and gas industry was not just sitting passively by.

“There is a huge mobilization from our industry on this project. Here in France, there is a coordinated effort being driven by our professional association. A team of experts has been put together to examine prospects for shale gas exploitation,” Mr Bourdon said.

“That team is looking at issues to do with hydraulic fracking … what’s good or not good; what the risks are and how these can be reduced; the volumes of water required and the impact this might have on the water table. And they are looking at the impact of drilling activity in heavily populated countries such as France.”

He highlighted that a key part of the industry’s approach would be a sustained communications campaign.

“There are many locations in France where it should be possible to produce gas from our own shales, and it would be a pity not to produce it. The only thing we have to do is make sure that we produce it in the best possible way, technically speaking. We should be able to produce gas at 3-4 euros per million cu ft instead of buying it in at 10-12 euros from the Russians, for example,” Mr Bourdon added.

Bulgaria imposed a ban on hydraulic fracturing at the start of this year, plus it withdrew a license issued to Chevron after hundreds of protesters marched in the city of Sofia to oppose the technique, fearing it would pollute the water and soil in the nation’s most fertile farm region of Dobrudja, which is where the company had intended to explore.

Regarding this setback, Pamela Low, Chevron Upstream Europe’s manager of policy, government and public affairs, told Drilling Contractor: “Chevron is continuing to work closely with the government of Bulgaria to provide the necessary assurances to the government and the public that hydrocarbons from shale can be developed safely and responsibly.”

The Czech Environment Ministry has also been mulling a ban on new shale gas exploration pending changes to its licensing regime, plus a legal review.

It has emerged that Romania, too, is looking at imposing a shale-gas moratorium, at least until after elections later this year. However, Prime Minister Victor Ponta said in early June that he wanted to “seriously discuss this issue next year.” If that happens, then again Chevron will be affected as it hopes to drill the EV-2 Barlad concession toward the end of this year.

In Austria too, there is uncertainty. OMV has halted its shale gas program and declined to discuss the issue beyond issuing the following statement:

“OMV takes the concerns and uncertainty of the community with regard to an evaluation of shale gas potential in Austria very seriously. The company has been a reliable partner of residents in Weinviertel for 60 years, and this will continue to be the case in future.

“In order to take account of the many concerns, we are waiting for the results of the comprehensive environmental and social studies by the Federal Environmental Agency and TÜV Austria.  For the time being, we will not submit any project application to the relevant authorities.

For the time being, we will not submit any project application to the relevant authorities.

“The objective of OMV is, and will be, to take an environmentally friendly, Austrian approach to shale-gas exploration in order to further secure Austria’s energy sources.”

The IEA warns in its just-published Golden Rules for Golden Age of Gas that, other than fracturing, the most significant factor that unconventional gas players face is the high population density in many of the prospective areas.

“This increases the likelihood of opposition from local communities, especially in areas with no tradition of oil and gas drilling. State ownership of oil and gas rights can also reduce the incentives for communities to accept development of local unconventional gas resources, compared with parts of the US where these rights are held by private land-owners.”

These points are clearly being recognized by operators and contractors alike, and it is influencing their behavior and strategic planning. The earlier reference to OMV’s decision to put everything on hold is an example.

In Germany, where ExxonMobil has a long-established presence extracting conventional natural gas but where its shale gas adventure has just started, a major effort is being made to assure communities that a thoroughly responsible approach is being taken. This has included advertising slots on TV.

So, is the foregoing cocktail of bans, partial bans and future potential bans not offputting to the IOCs especially? Apparently not.

As Ms Low from Chevron put it: “Development of natural gas from shale could be a ‘game changer’ for Eastern Europe, as it has been for the United States, and this energy source could provide significant benefits to the countries of Eastern Europe and their citizens.

“It could increase economic development; create additional revenues and jobs for local communities; supply flexibility and energy security; make energy costs more affordable; and help the EU meet its emissions goals through the use of clean-burning natural gas.”

In any case, setbacks are commonplace, and the IOCs are experts at playing the long game. For small independents, the foregoing issues could, in some cases, prove a major problem and even threaten their viability.

On the other hand, many such minnows have surprisingly diverse portfolios and can live with it. Dart Energy of Australia, for example, is very active conventional gas whilst maintaining a watching brief over its shale concessions, with no exploration currently planned.

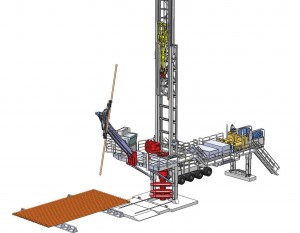

A key issue to emerge during the research for this article is rig design. In short, Joep Beijer, senior VP Europe, Russia, Kazakhstan of KCA DEUTAG, and Dirk Schulze, CEO of KCA DEUTAG unit Bentec; together with Joachim Buechner, MD of ITAG; Mr Bourdon; and Tom Pickering, independent unconventional consultant, were in solid agreement that the putative European shale gas industry would be best-served by rigs that are Euro-compliant at the outset, compact, quiet, easily transportable and as environmentally responsible as possible.

Such rigs already exist and are operating; however, the need for ongoing development of the both the rigs and their ancillaries remains.

Indeed, Mr Bourdon went so far as to suggest that the conventional descriptions of rigs be altered as part of the process of changing public perceptions. “We have been carrying out work on a new design at DIETSWELL. What is needed is something that can drill those wells near cities. I don’t want to use the terms of rigs or derricks anymore.

“We need to leave the classical images of the oil industry behind. We are looking at a new generation of drilling rigs that look more like civil works equipment. This would be much more acceptable to the public, I think.”

Mr Schulze and Mr Beijer said that KCA DEUTAG/Bentec are already in a good position, with two “strings” active in Poland and a growing reputation as Europe’s market leader for rig and drill systems design and build. They particularly highlighted the group’s successful Euro Rig family designs, of which a number have been built and are operational, including for KCA DEUTAG and various competitors.

“We’re negotiating with other companies, particularly with regard to the European shale gas market,” Mr Schulze said. “We hope that Euro Rig will become the preferred type for the European shale gas market.

“In Europe alone, I’d say we could put 30 to 40 rigs into this market over the next three years. However, we do not see demand exceeding this level in the short run. We also know that taking and modifying US rigs is fraught because of EU certification and environmental compliance issues that knocks this out as an option.

“I’d like to think that operators will team up with local providers, in particular Bentec, to work with rigs designed and built for the European market. I can’t see that there would be an influx of rigs from overseas and that additional units will be locally sourced.”

Mr Beijer pointed out that, thus far, the shale gas effort in Europe has been centered around exploration.

“Don’t forget, we’re still in the exploration phase with shale gas. When the move to development starts, a different type of rig will be required,” he said.

“With the experience that KCA DEUTAG and Bentec have gained with production drilling, particularly in Russia, we as a combination are well-equipped to provide the fast-moving, environmentally friendly and compact units that will be required.

“There are currently no production rigs working the shale gas market in Europe. Therefore, there is no tangible production as yet. However, in Poland, the Polish government is pushing the operators of its concessions to get to production as soon as is possible. But this is not envisaged before 2013-14.

“We’re positioned for growth, ready to build the systems and ready to support the industry with the rigs and crews that will be required.”

Also keen to secure market share, ITAG’s Mr Buechner said that six of the company’s eight rigs are effectively shale market-ready, the other two being smaller workover units.

Moreover, he said that the group, which is celebrating its centenary year and designs its own units (build is contracted out), would construct at least one new unit should shale-related demand kick in.

“Our eight rigs have a lifting capacity from 100 tons to 700 tons. Our largest is a 3,000-hp Ideco rig,” Mr Buechner said. “In recent years, we have been operating in Western Europe. We have three rigs almost permanently working in Austria, one in France for seven years so far, and we operate very often in the Netherlands.

“We mostly drill oil and gas wells, gas storage wells and geothermal wells. One of one of our rigs will move to Switzerland at the end of this year to execute a geothermal project in St Gallen, with planned depths of 5,000-plus meters.”

As for the future need for compact drilling units, Mr Buechner said that ITAG is prepared: “Due to the fact that we are mainly working in Western Europe in areas of high population, most of our rigs already have a small footprint.”

He added that the ITAG Group has minority interests in joint ventures with major exploration and production companies in Germany.

Last but not least, Mr Pickering’s view is that, among the factors that will drive the development of land rigs for shale-gas applications in Europe, it is highway infrastructure that may in fact call the shots.

“The issue in Europe is a lot about the road infrastructure and its ability to handle the tonnage of the main rig unit load,” said Mr Pickering, who is a former director of the gas-focused independent Composite Energy, also Geometric. “That can mean a 60-ton weight in just one load with, say, 14 tons per axle, which makes it a special load in Europe.

“There’s a crossover point between how do you achieve the strength of mast needed for a 300-ton pull to enable you to get down to the 8,000- to 10,000-ft mark that some operators want to get to, and particularly if they want to step out horizontally.

“But then, if you’re stripping back the main rig unit to enable it to be road transportable, that means an increase in the number of ancillary equipment loads to enable a rig to be built up from the stripped-back unit and then operated.”