Environment, Social and Governance

Analysis: CCS-EOR may better support energy transition than CCS-Storage

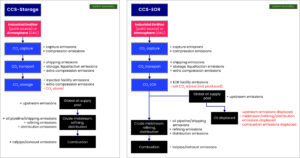

Captured CO2 for enhanced oil recovery (CCS-EOR) has fallen out of favor in recent years and been supplanted by captured CO2 to dedicated sequestration (CCS-Storage). However, new analysis by Wood Mackenzie shows that CCS-EOR will often deliver lower emissions and may better support the energy transition.

“CCS-EOR has its detractors, most of whom center their opposition to the practice around the notion that CCS-EOR continues incremental global hydrocarbon production,” said Peter Findlay, Director, CCUS Economics for Wood Mackenzie. “However, as new oil supply must be developed in the decades to come, even in the most aggressive decarbonization scenarios, CCS-EOR is not necessarily more likely than any other competing supply sources – whether from producing, discovered or to-be discovered fields – to increase global oil demand.”

According to Wood Mackenzie, the world will need 30 million barrels per day of global oil supply by 2050 in its most aggressive scenario. In its “Enhanced oil recovery with captured CO2“ report, the firm notes that CCS-EOR would displace nearly all volumes it produces from the global market and not have a material effect on global oil demand and concomitant emissions.

“Yet, although we believe CCS-EOR can deliver lower net emissions in many global plays due to its relatively low incremental emissions and lighter oil production, we acknowledge that there are some cases where CCS-Storage will deliver a lower net impact to global emissions,” Mr Findlay said. “It all depends on the project, the geology, and the oil and carbon markets.”

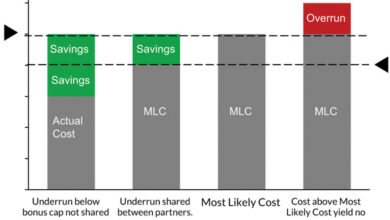

According to the report, subsidizing CCS-EOR on a per-ton basis at commercial scale less than CCS-Storage, and even carbon capture and utilization (CCU), will ultimately result in less CO2 captured globally and less overall decarbonization for the economic burden imposed. It points Canada and the US currently having lower levels of subsidization for EOR.

“By subsidizing CCS-EOR less than CCS-Storage, governments are effectively, if indirectly, subsidizing other sources of oil supply, many of which are higher emitting and outside of their jurisdiction. This can weaken a country’s energy security and diminish geostrategic advantages drawn from domestic production.”

As firms look to maximize shareholder returns, decarbonize portfolios and maintain supply, leveraging CCS-EOR could offer a pragmatic solution for the energy transition that could yield a lower carbon footprint than traditional oil and gas operations, Mr Findlay said.

According to Wood Mackenzie analysis, CCS-EOR becomes an energy transition solution only when the CO2 used in EOR operations derives from anthropogenic sources extracted from industrial point sources or directly from the air. CCS-EOR also allows producers to vary production between EOR and non-EOR wells depending on markets conditions.

“Some CCS-EOR operators like Denbury and Occidental Petroleum have looked at pushing the capture benefit into the product value chain to create a net zero oil,” Mr Findlay said. “Maximizing injection of this CO2 into depleted oil and gas reservoirs and storing more CO2 than the lifecycle emissions of the incremental oil and gas produced are the second and third steps to create an effective net zero oil. But the devil is in the details: the accounting and demarcation details as to what is included in the net zero oil calculation. And assuming net zero oil is credible, it is in most cases not yet economically viable for producers to pursue without increased market demand.”

The report concludes that, like many other decarbonization initiatives, growing CCS-EOR to meaningful scale requires more certainty in either future subsidization schemes or carbon price – a clear incentive to decarbonize.

NSTA reports improvement in licensee ESG disclosure

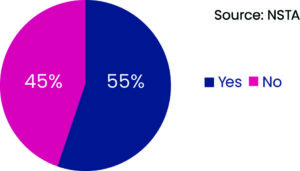

More than half of the 29 licensees analyzed by the North Sea Transition Authority (NSTA) now link executives’ variable pay with key ESG performance indicators, such as emissions reduction, according to the NSTA’s 2023 ESG Disclosure Report. This is an effective tool for hitting targets and should be adopted even more widely, the agency noted.

The majority (62%) are publishing ESG data in easy-to-find, central locations on their websites. The use of “data centers,” one of the key recommendations in the NSTA’s inaugural ESG Disclosure Report in 2022, promotes consistency and makes it easier to compare companies’ performance.

New regulatory standards issued by the International Sustainability Standards Board and requirements under the Corporate Sustainability Reporting Directive are also helping to drive up the consistency and transparency of licensees’ ESG reports.

Overall, the report found that licensee disclosure has improved, with 52% of licensees having an overall score above 50%.

The new ESG Disclosure Report also contains a series of recommendations to ensure progress continues, including fostering closer links between ESG teams and management and providing greater transparency on energy transition investments.

ESG experts generally agree that environmental considerations form the bedrock of the sector’s ESG reporting.

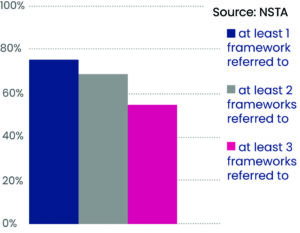

While a number of companies are identifying climate-related risks, some still do not use internationally recognized frameworks – for example, those provided by the Task Force on Climate-related Financial Disclosures and Carbon Disclosure Project – to guide their work and ensure they are sharing enough of the right information.

On social matters, licensees performed well on HR-related areas, such as diversity and inclusion, health and safety and training. Operators submit data about supply chain engagements, including payment terms and local content, to the NSTA confidentially, but companies were encouraged to proactively put this information in the public domain, as well.

Disclosure was strong across well-established, governance-related themes, such as business ethics and risk management, though the report noted that payments to governments and political donations could be more transparent.

“ESG reporting is no longer a ‘nice to have’ extra, it is crucial to attracting and maintaining investment,” said Joanne Edgeler, Head of Licensee Governance and ESG. “The principle of ‘No ESG disclosure, no access to finance’ is truer now than ever before. Industry is getting there, but there is room for improvement and the NSTA will continue to work with licensees to build on this.”

Click here to access the new ESG Disclosure report from the NSTA.

CO2 capture technology for hard-to-abate industries validated by DNV

DNV has validated the methodology developed and used by Carbon8, which specializes in helping hard-to-abate industries, including cement, reduce carbon emissions and landfilling of thermal residues. Carbon8’s patented technology, which permanently captures CO2 at source, has been verified by DNV to satisfy the ISO 14064 Part 2 standard. The technology also diverts landfill-bound ashes and residues, transforming them into material that can be used within quality construction products and transforming the built environment into a carbon sink.

The ISO 14064 Part 2 requirements specifically relate to quantifying, monitoring and reporting activities, techniques and processes that can reduce carbon/greenhouse gas emissions.

DNV validated that the methodology designed and used by Carbon8:

- Provides accurate reporting, eliminating the risk of double counting or inclusion of unsupported removals.

- Measures emissions reduction/removal accurately, accounting for equipment manufacture, operation and disposal emissions.

- Establishes stringent, transparent and repeatable monitoring procedures.

Regarding the technology, Jamie Burrows, Head of CCUS, Energy Systems at DNV, commented: “Some utilization techniques, such as that developed by Carbon8, can capture and store CO2 with a high level of permanence. Such techniques will become increasingly important in the coming years and can be particularly beneficial in locations where CCS might not be an option due to a lack of supportive policy or infrastructure. In addition to producing materials that can be used in established value chains, coupled with biogenic sources of CO2, such techniques can generate carbon dioxide removals with a high level of permanence.”

Cementing is one part of the well construction process that holds significant potential for improved emissions efficiency, as the production of cement is an emissions-intensive process.