Devon COO: Still prioritizing free cash flow generation over production growth

By Stephen Whitfield, Associate Editor

Devon Energy’s merger with WPX Energy, which was finalized in January, created one of the largest unconventional oil producers in the US. The combined company now boasts approximately 277,000 bbl/day of oil production and holds 400,000 net acres in the Delaware Basin. However, despite that strong position, Devon is not expecting to chase after much production growth in the immediate future, opting instead to focus on generating free cash flow.

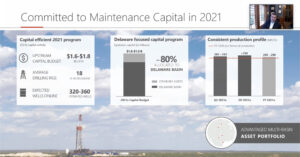

Speaking at the virtually held 2021 IADC Drilling Onshore Conference on 20 May, Clay Gaspar, Executive VP and COO of Devon, said the company is committed to maintenance CAPEX in 2021. This means that it will prioritize spending on assets that are necessary for the company to continue operating in its current form.

Devon estimates its 2021 upstream capital budget to be between $1.6 billion and $1.8 billion, with 80% of that capital allocated to the Delaware Basin. The company will run an average of 18 rigs this year – 13 of those in the Delaware – and bring between 320 and 360 operated wells online. Only a 5% growth in oil production is projected, and efforts to grow margins will be focused on operational and corporate cost reductions. This prioritization of free cash flow will help Devon attract outside investment, which in turn will help the company maintain strong financial footing during future downturns, Mr Gaspar said.

“It’s not negotiable. We cannot lever up in this business because there is an inevitability of a down cycle,” he commented. “I don’t know when, but I know it will happen again, and so we’re making sure that we are financially prepared to weather the storm. It’s an absolute fundamental.”

To achieve that targeted 5% production growth, Devon estimates it would need to add 100,000 bbl/day of new oil production. Moreover, he did not rule out the possibility of further production growth if global energy demand picks up.

“We’re putting a stake in the ground at 5%, but that’s a lot of activity. That’s a healthy organization,” he said. “But things evolve. I think, as there is a cry for more energy, I think there could be a ‘supercycle’ in the other direction where all of a sudden there’s not enough energy on the market, and there would be a demand for us to increase supply. We’re trying to watch not just today’s commodity price but the shape of the curve when you look out 12, 18, 24 months. What is the market telling us?”

Part of Devon’s plan to accelerate cash returns to its shareholders was its decision to switch to a fixed-plus-variable dividend framework starting in 4Q 2020. The framework is designed to pay a sustainable fixed dividend through a given cycle and evaluate a variable dividend on a quarterly basis. After the fixed dividend is funded, up to 50% of the remaining excess free cash flow in each quarter will be distributed to shareholders through the variable dividend.

Based on its 1Q 2021 financial performance, Devon announced a fixed-plus-variable dividend of $0.34 per share, a 13% increase in payout compared to the $0.30 dividend declared in 4Q 2020 and more than triple the $0.11 dividend declared in 3Q 2020.

“With the free cash flow that we’re generating, we have to figure out how we can best pay that to shareholders. With the variable dividend, over time, it will go up and it will go down, but we can ride that rollercoaster and reward shareholders with the progress that we’re making,” Mr Gaspar said.

Another area of priority for Devon is ESG, with efforts already paying off. In 2019, the company reduced its methane intensity rate to 0.28%, six years ahead of its target date of 2025. The company also reported a 300% increase in water recycling from 2017 to 2019, and it lowered greenhouse gas emissions 19% year over year from 2018 to 2019. The greenhouse gas emissions reduction was achieved partly due to the company’s shift away from diesel motors on its rigs. In 2019, nearly 60% of its wells were drilled with rigs running on dual-fuel or electric motors, which accounted for an estimated savings of 19,000 tonnes of CO2 emissions.

Further, ESG performance, including safety and emissions metrics, have been incorporated into Devon’s employee compensation structure.

The company’s board of directors will meet in early June to further discuss its ESG strategy in the wake of the WPX merger. “It’s been a really rich and vibrant discussion between the experts from both companies,” Mr Gaspar said. “We’re going to really talk through some guiding principles on who we are and what we aspire to be in the ESG world. What does being a leader really mean? Are we going to be setting the tone in certain areas, and if so, which areas would those be? How would we capitalize on this and use this as a strategic advantage?”