Deepwater drives Petrobras future production

The company’s first deepwater technological program, PROCAP, ran from 1986-1991 and enabled production feasibility up to 1,000 m of water depth. From 1992-1999, PROCAP 2000 enabled production feasibility up to 2,000 m of water. Further technological developments have now enabled PROCAP 3000, which extends the operational scenario to 3,000 m water depth.

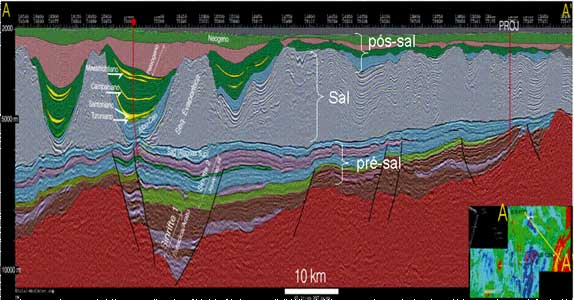

The discovery of the Tupi oil bed, off the southeastern coast of Brazil, represented a technological leap: It was made 7,000 m below the water surface and crossed a 2km-thick salt barrier. Petrobras is about to dive into a series of major challenges to explore what could be one of the world’s largest oil fields, Mr Figueira said.

The company’s first deepwater technological program, PROCAP, ran from 1986-1991 and enabled production feasibility up to 1,000 m of water depth. From 1992-1999, PROCAP 2000 enabled production feasibility up to 2,000 m of water. Further technological developments have now enabled PROCAP 3000, which extends the operational scenario to 3,000 m water depth.

The discovery of the Tupi oil bed, off the southeastern coast of Brazil, represented a technological leap: It was made 7,000 m below the water surface and crossed a 2km-thick salt barrier. Petrobras is about to dive into a series of major challenges to explore what could be one of the world’s largest oil fields, Mr Figueira said.

One big challenge is the 300-km distance between Tupi and the Santos coast, and Petrobras is investigating options for transporting natural gas from Tupi to shore, including the possibility of installing a thermoelectric plant at high sea.

Probably the bigger challenge, however, is the 5 km to 7 km from the water surface to the reservoir — considering that the reserves Petrobras currently explores are just over 2 km deep. “The evolution in Petrobras’ well depth is noteworthy,” he said.

Outside of Brazil, Petrobras has also been expanding operations in areas it has identified with major E&P potential “and where operating technical and technological skills represent a competitive differential,” he said. Areas where Petrobras has increased exploration in recent years include Colombia, Argentina, Nigeria, Angola, Tanzania, Libya, Turkey and Portugal.

However, its biggest area of international investment is the US Gulf of Mexico — of the US$15 billion that Petrobras expects to invest outside Brazil from 2008-2012, US$4.9 billion of that will be in the US.

As recently as 2001, Petrobras was a small player with “a shy position” in the US GOM, mostly in shallow waters. It saw no room for growth, he said. Then the company realized that if it moved to the deepwater, there was suddenly “lots of room for growth.”

“Despite the presence of risks, Petrobras made a strategic decision to become a leading player in the GOM with large reserves and operating on new frontiers,” he said, “and the way to do that was through innovation and technology.” In 2006, Petrobras invested US$740 million in new technologies and in 2007 it invested US$800 million. The company sees that as a means to achieve results, Mr Figueira noted.

He said that rig availability is recognized as a challenge, but the company already has plans to bring two new generation-5 rigs into the GOM on long-term contracts.

One of its biggest GOM projects is the Cascade/Chinook development in 2,500 m (8,200 ft) of water depth. Mr Figueira said that Petrobras will be bringing in the first FPSO to the Gulf of Mexico, approved by US regulators. It will also bring in new technologies — the FPSO will be equipped with a disconnectable turret buoy that will allow the vessel to move off-site during hurricanes. The project will developed over three phases, and the first phase is currently under way.