Countries reassess climate, energy policies amid geopolitical tensions, market uncertainties

Oil and gas industry stands to benefit from renewed focus on energy security, although long-term impact remains to be seen

By Stephen Whitfield, Senior Editor

The oil and gas industry may be in the midst of a sea change, with recent elections in the US and elsewhere installing new administrations that have signaled changing attitudes toward both climate policy and oil and gas E&P.

While oil and gas was always going to be a part of the energy mix – even in the most aggressive net-zero scenarios – recent geopolitical developments have placed an added emphasis on the need for energy security and independence. Around the world, governments appear to be recognizing that bolstering oil and gas E&P is critical to achieving those aims.

This shift has been especially pronounced in the US, with the Trump Administration signaling its aim to strengthen oil and gas production. Besides supporting an increase in onshore and offshore lease sales of federal lands, it is also crafting a more favorable tax regime to encourage E&P companies to invest in new developments.

However, whether those actions will actually lead to increased oil and gas activity remains to be seen. Greg Matlock, Americas Oil & Gas and Chemicals Tax Leader at Ernst & Young (EY), noted that recent changes on trade policy, particularly steel tariffs, as well as foreign content restrictions in recent US legislation, have introduced cost uncertainties that impact investment decisions. However, they also provide opportunities for supply chain planning.

“It’s been a couple of months since the tariffs were increased, and I think folks have had an opportunity to look at the different sensitivities from a cost structure perspective, see how that impacts project economics and CAPEX investments. I think they’ve been able to adapt, but it certainly changes some of the planning,” Mr Matlock said.

Amidst this uncertainty, the industrywide focus on capital discipline that has been present since the COVID-era oil price downturn may prove to be a benefit. Since E&Ps already have their spending reined in, they can more easily adjust to market fluctuations.

“The industry knows the game plan,” said Matthew Bernstein, VP North America Oil & Gas at Rystad Energy. “Companies have already been operating in this capital discipline mode for five or six years now. It’s a lot easier to adjust to things when you’re just having to defend your dividend. Even if the oil price falls and costs rise, you’re reassessing the business model, but it’s still feasible to continue operating and paying out a certain degree of shareholder returns.”

Impact of the steel tariffs

Geopolitical developments – such as military confrontations in the Middle East and unexpected production increases from OPEC+ – have led many E&Ps to heavily revise their long-term strategic plans. Even more concerning have been the ongoing high tensions around recent increases in US tariffs, particularly steel tariffs. On 4 June, President Trump doubled US tariffs on steel and aluminum imports from almost all US trade partners to 50%, up from the 25% that had been maintained since 2018. The UK is the only trade partner still operating under the previous 25% tariff. Then, on 19 August, the US Department of Commerce announced the addition of 407 product categories to be covered under these tariffs, including mobile cranes, bulldozers, compressors and pumps.

These tariffs have had effects around the world. For example, on 7 October, the European Union proposed a 50% tariff on steel above a lowered annual import limit (18.3 million tonnes) in an effort to blunt the impact of US tariffs on EU steel exports. Currently, the EU enacts a 25% tariff on all imports above a 40-million-tonne quota. That proposal is still subject to approval by EU member countries and the European Parliament.

The aggressive approach to trade policy by the US was, according to the Trump Administration, intended to bolster domestic manufacturing. Yet, it has impacted oil and gas costs in certain instances and affected economic projections, Mr Matlock said. Corporate planners are now faced with changes and uncertainty in the short term while also needing to reassess long-term strategies and capital allocation based on adjusted economic expectations, he noted.

“There are going to be challenges and opportunities in figuring out what is going to be your appropriate cost structure,” Mr Matlock explained. “The impact of that uncertainty will differ depending on the location of the investments, as well as the size of the E&P company. Smaller companies working in low-margin plays are going to be more susceptible to increased costs and economic vulnerability.”

In the three months since the US first announced its plans for steel tariffs, however, E&Ps appear to have demonstrated resilience, Mr Matlock said. He attributed this to organizations’ focus on capital discipline, which continues to place limits on CAPEX expansion and keep priority on investments with shorter payouts that are less susceptible to cost shocks. This means most E&Ps have made low-risk resources central to their long-term planning, and those resources will continue to be valuable even as costs rise.

Still, Mr Matlock said companies will likely redouble their efforts to cut costs and seek opportunities to drive synergies through mergers and acquisitions (M&As), a trend that has defined the oil and gas industry in recent years. In its 2025 Oil and Gas Reserves, Production and ESG Benchmarking Study, EY registered $206.6 billion in E&P M&A activity in the US in 2024, a 331% increase from 2023. This was driven by five megadeals with a combined value of more than $10 billion.

Maintaining that pace of M&A activity may be challenging in the near-term future, however. The EY study noted that, despite falling commodity prices and expected synergies from M&As – two factors that typically help keep production costs down – costs per barrel of oil equivalent (boe) still unexpectedly ticked up by 1% in 2024. The rise in steel tariffs, if continued, will likely lead to further increases, which will have to be built into any future deals, Mr Matlock said.

“M&A creates immediate value on the things that you would typically look for in any deal – reserves, access to transportation, access to markets that you know,” he noted. “Do you have geographically synergistic assets when you’re looking at value creation? That’s something that’s more of a short-term focus, and tariffs play a role in that, to a certain extent. If a company involved in an M&A deal has a large-CAPEX project, you’re going to factor those costs in.”

The OBBBA provisions

The US re-pivoted its energy policy with the passage and signing of H.R. 1, otherwise known as the “One Big Beautiful Bill Act” (OBBBA). The legislation is set to transform supply chains, redirect investment flows and solidify the US government’s support of fossil fuels. It includes various cost-cutting measures that directly reverse key provisions of the Biden-era Inflation Reduction Act (IRA) and could reshape commodity markets.

“The OBBBA will be very beneficial to the industry,” Mr Bernstein said. “It’s going to create additional cash flow in their balance sheets. You can deal with less red tape.”

The final budget reconciliation legislation, which was signed into law on 4 July, contains several provisions that impact oil and gas production. One of the more noteworthy provisions is that it restores the pre-IRA rates on oil and gas leases, cutting it from 16.6% to 12.5%, and repeals the IRA-codified royalty imposed on methane produced from oil and gas leases on federal lands and waters.

The bill also establishes a permanent 100% bonus depreciation rate, reversing the phased-down rates created under the 2017 Tax Cuts and Jobs act. This means that, instead of spreading the cost of a capital asset (like machinery or equipment on a drilling rig) over the course of its recovery period (typically between five and seven years), businesses can write off the entire purchase price within a year of the asset being put to use. Accelerating depreciation means that businesses can reduce their taxable income and tax liability in the year the asset goes into service.

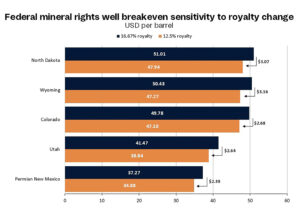

The new tax regime brought on by H.R. 1 will lead to immediate cost savings for E&P companies, Mr Bernstein said. Although the exact amount of those savings remains to be seen, he estimated that the reduction in royalty rates could create as much as a $3/bbl difference in breakeven prices for E&Ps in the Lower 48.

US shale companies with the most exposure to federal land with mineral rights stand to benefit the most from the royalty rate cuts and tax incentives ushered in through H.R. 1. Although the bill may not spur a new era of high growth from all US shale plays – Mr Bernstein said the industry is “not crying out for more land to drill necessarily” – the lower rates could help to reduce the marginal supply cost needed in the long term for new incremental sources of gas.

“The E&Ps are basically saying that these royalty rates are just going to be baked into the costs at future auctions,” he said. “A $3 difference in breakevens translates to significant dollars back in your pocket, especially in a commercial region like the Permian. In places that are more marginal, like North Dakota, that have a lot of federal land, that $3 difference could potentially be enough to incentivize a company to take on more leads. Maybe we see more activity in those regions. Maybe they put an additional rig there.”

Another key provision in H.R. 1 is the increased federal leasing requirements. The bill requires the US Department of the Interior to hold at least four quarterly onshore lease sales per year in states with eligible lands, and at least two offshore lease sales per year in the US Gulf through 2039.

It also allows companies to pay an optional fee to receive expedited environmental reviews for projects requiring documentation under the National Environmental Policy Act. That fee equates to 125% of the anticipated costs for an environmental impact statement.

These changes to federal leasing, when combined with lower breakevens to the tax regime, could also potentially goose E&Ps into bidding on marginal areas that they would not have considered previously, Mr Bernstein said. This could be particularly advantageous for gas-heavy basins with significant amounts of unleased federal land, such as the Haynesville, although he noted that structural issues with drilling into the highly variable interbedded formations in the basin may limit growth. He also cited the Rocky Mountains – particularly the Denver-Julesburg Basin in Colorado and the Greater Green River Basin in Wyoming – as a potential beneficiary.

“If you look at the areas with potential for gas production, there’s a lot of potential in areas that also have a high concentration of activity on federal land,” he said. “Perhaps less of that land has been leased up compared to other basins. So, operators might actually want to take advantage of that new leasing that’s become available, along with these improved royalty rates. That could be an area where operators are incentivized to grow production.”

A change in attitudes?

H.R. 1 is just one indicator of a shifting regulatory and financial environment that favors oil and gas production. The US has also paused a planned implementation of climate disclosure rules issued by the US Securities and Exchange Commission in 2024. The rules would have required publicly listed companies to provide comprehensive disclosures of greenhouse gas emissions and other climate-related activities.

A similar shift is ongoing in Canada. Since taking over in March 2025, the government of Prime Minister Mark Carney has made sweeping changes to the country’s climate policy, including a repeal of the carbon tax. This comes at the same time as the country is planning to expand its liquefied natural gas production; LNG Canada, in Kitimat, British Columbia, shipped its first LNG export cargo in June 2025.

In New Zealand, the parliament passed legislation on 31 July to reopen the country for offshore oil and gas exploration, reversing a ban imposed by the government of former Prime Minister Jacinda Ardern in 2018. The Crown Minerals Amendments Act, which went into effect on 5 August, allowed companies to apply for petroleum exploration permits beyond onshore Taranaki, on the country’s North Island, starting in September.

The act also changed language from the original Crown Minerals Act of 1991, now charging the government with promoting, rather than simply managing, the country’s E&P activities.

Over in Norway, Energy Minister Terje Aasland said in a social media post on 7 August that the country is preparing to launch a new oil and gas licensing round on the Norwegian Continental Shelf. This would be the country’s first offer of new drilling permits in unexplored regions in four years. It is not yet known when the awards would be made. The Norwegian government had previously agreed in 2021 to a four-year moratorium on frontier exploration.

Mr Matlock cautioned against making a sweeping statement about what moves like these say about global attitudes toward E&P or climate change. Countries are likely revising their climate goals or E&P policies primarily because of capital requirements, he said.

“For some countries, they’re taking the strategy of boosting hydrocarbon output while remaining flexible to accommodate an evolution of the energy mix. Let’s unlock what we have, because that’s going to be the cheapest, fastest way to be able to meet those growing energy demands. I don’t think that’s necessarily to the exclusion of other energy sources, but it definitely is a benefit to E&P,” he said.

This trend of reassessing energy policy will likely continue in the near-term future, he added, with more countries having a “more positive outlook” toward oil and gas. However, that doesn’t mean that governments’ focus on ESG will go away, and the oil and gas industry will have to continue to play a significant role in decarbonization efforts.

“The industry has spent an inordinate amount of money on technologies related to decarbonization. When you look at oil and gas, they’ve been the market leader in capital investment on these types of technologies. I don’t think you’re going to see that change. Obviously, it has to make money, but you’ll see that focus continue.”

Although the US has paused its rules requiring climate disclosure, other countries and organizations are still pressing ahead with sustainability reporting. In November 2024, the International Standard on Sustainability Assurance 5000 was released by the International Auditing and Assurance Standards Board (IAASB). It is the first international standard for providing limited and reasonable assurance of sustainability-related disclosures. It applies to sustainability disclosures across all topics and accommodates any suitable reporting framework, such as the European Sustainability Reporting Standards and the Global Reporting Initiative. In January 2025, Australia became the first country to formally adopt the standard.

Also, more than 35 jurisdictions worldwide have adopted, or are in the process of adopting, sustainability reporting standards based on the IFRS Sustainability Disclosure Standards developed by the International Sustainability Standards Board (ISSB).

IAASB and ISSB standards are industry agnostic and could apply to any company engaging in oil and gas-related activity in countries that adopt them. The standards are also indicative of the continued stakeholder and regulatory demand for ESG information.

The industry has responded to this demand: In its benchmarking study, EY noted that E&Ps have enhanced their voluntary ESG disclosures through sustainability reports and information in recent years. In 2024, 88% of the companies analyzed in the study reported their Scope 1 and Scope 2 greenhouse gas (GHG) emissions, up from 73% in 2021. Additionally, the percentage of companies that obtained external assurance over their emissions numbers increased from 35% in 2021 to 50% in 2024. Disclosures of climate-related targets and goals also saw a marginal increase in 2024 to 78%, compared with 73% in 2022 and 2023.

However, the percentage of companies disclosing other metrics remained unchanged from 2023 to 2024. Moreover, there was a noticeable split in reporting depending on the type of company. The study showed that 100% of large independents – defined in the report as companies that do not have oil refining and marketing capabilities and whose worldwide reserves exceeded 1 billion boe at the end of 2024 – reported their Scope 1 and Scope 2 GHG emissions and a climate-related target or goal. In comparison, only 76% of smaller independents disclosed GHG emissions, and just 57% of them reported a climate-related target or goal.

“You have these two different levers that dictate the implementation of ESG goals. One, what’s your focus? Is it a short-term focus or a long-term focus? Two, what’s the size of your business? If I had a small company that was very short-term focused, I’d have a much different outlook on decarbonization versus a large company with a long-term focus,” Mr Matlock said.

“The smaller companies are moving because they’re focused on what happens this week, this month, this quarter. With larger companies that have longer-term outlooks, you’ve seen them make statements on maybe a change in pace with ESG and decarbonization goals, but they’re not walking away from them.” DC