As industry seeks cheaper ways to boost production, horizontal refractures gain prominence

Results so far vary significantly, and lack of control means refracs will likely remain niche market for foreseeable future

By Alex Endress, Editorial Coordinator

The convergence of reduced operator CAPEX, advances in fracturing technologies and know-how, and diminishing production from vintage shale wells is shining a spotlight on well refracs. Particularly with lower oil prices rendering some new drilling projects uneconomical, operators are increasingly looking to refracturing as a low-cost method of boosting production. “It’s a perfect storm,” said Tim Leshchyshyn, FracKnowledge President and Completions Advisor for Korean National Oil Company. “It is not going to be as good as when we were drilling all those (new) wells each year, but it is an area of great potential.”

Refracturing isn’t new, however. It also isn’t suitable for every well, and returns on a refrac can vary significantly. The most common method for refrac, for example, is what’s been coined as the “pump and pray” technique. In this method, diverting agents are pumped down the well to block off old perforations and allow the frac fluid to reach new areas of the well. It is indeed low cost, but it also doesn’t provide much control – there’s no way to determine exactly where those diverting agents will travel inside the wellbore.

“Much of the refrac push is hype and hope for a cheaper way to get more production,” said George King, a consultant who specializes in unconventional resources. He has worked at several major operators throughout his career and is currently employed by Apache. “The bottom line is that some refracs work very well, and many do not. Trying a refrac on a pump and pray approach may not have a high degree of returns – either from an economic or production basis.”

When refracturing is effective, operators can benefit substantially – potentially recovering 100% of a well’s IP and adding five years or more to a well’s life. “The goal is to hit the initial well IP or even higher, but there’s still some work to do to get there,” Encana Completions Engineer Will Hunter said.

In the foreseeable future, refracturing is most likely to remain a niche technology, at least until the industry learns to exert more control and achieve more reliability in refrac operations. IHS projects refracturing will remain a small segment of the US horizontal shale market and that up to 11% of total horizontal fracs in 2020 will be refractures.

Only 600 refracs

From an economic perspective, the main driver for operators to consider refracturing old wells is the current lack of available capital to drill and complete new wells. Refracturing allows for a potential production boost with a more modest capital investment. “Refracturing does not incur the drilling costs and some of the extra facilities costs of drilling and completing a brand-new well. So if the production increase is sufficiently high, then it can make sense,” IHS Energy Senior Consultant James Coan said.

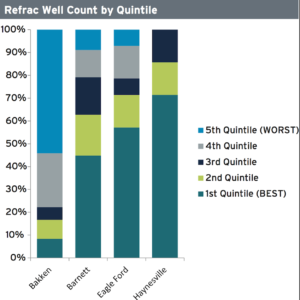

Only 600 horizontal wells out of approximately 89,000 in the US have been refractured since 2000, according to the IHS Energy Insight Report, “To Frac or Refrac: Prospects for Refracturing in the United States,” released in July. The report shows that the greatest number of refracture operations has taken place in the Bakken, followed by refracs in the Barnett and Marcellus. In these 600 wells, the average decline rate over a 12-month period was 56%. That’s slightly better than their decline rates after the original completion, which averaged 64%.

In terms of post-refrac IP, IHS did find some success. Refractured wells in the Bakken had IP rates higher than their original IP rates. The report called these wells anomalies, however, noting that most refractured wells have lower IP rates than their original IPs. IHS attributed the Bakken anomaly to the fact that this shale was one of the early testing grounds for horizontal drilling and fracturing technologies that have since been significantly improved. Due to these Bakken wells, as well as some wells that IHS called “over-performers” in the Eagle Ford, the overall average refractured well IP was 98% of the original well IP.

The main obstacle for current refracturing technology is lack of control, as operators can’t effectively target specific understimulated areas of a well. This lack of control is a product of the way most wells were originally completed – using the plug and perf method. With plug and perf, specific stages of the well are perforated with explosive charges. Then, the rock accessed by the perforations is fractured via high-pressure proppant-laden frac fluid. Once a stage has been completed, a frac plug blocks this area of the well, and the process is repeated on the next stage.

While effective upon initial use, this method makes refracture operations difficult because the existing fractures compete with the new fractures for the frac fluid. “It is possible just to (refrac) a few existing perforations, but then you are not targeting the entire mile-long length of the wellbore,” Mr Coan said. “If there are a few perforations that are taking up most of the fluid (upon refracture), then the additional production won’t be very high.”

Operators must try to reduce competition from existing perforations, which can be difficult when there are anywhere between 100 and even 1,000 of these inside the wellbore. The pump and pray is the most common technique because it offers the lowest cost, according to IHS. “E&Ps are still working on the optimal way of doing this and what are the best diverting agents out there for refracturing in different plays,” Mr Coan said. According to the IHS report, operators have also experimented with straddle fracturing via coiled tubing, as well as mechanical isolation with sliding sleeves. Although these techniques offer better control, they also come with higher costs.

For more operators to embrace refracturing, the industry must find a way to gain more control over the refracture process while keeping costs down at the same time. “If oil prices get higher, some E&Ps may go immediately back to their old ways and get back on the new well treadmill,” he said. “(It) will depend on just how advanced the technology gets in this low oil price environment and then having a few leading operators to really chase the refrac opportunity.”

Choosing the right wells

Appropriate well selection can increase the success rate of a refrac operation. The parameters most often considered are initial well performance, wellbore integrity and upside potential, according to i-Stimulation Solutions President Ibrahim Abou-Sayed. After the operator has selected the initial high producers and confirmed wellbore integrity is sufficient to withstand new frac pressure, the most important indicator is upside potential, or how much incremental production the well stands to gain, he said.

In ranking a well’s upside potential, the first aspect to consider is its proximity to other wells. “There is a unique feature that happens in shale plays much more strongly than any other reservoir types: When you frac a well, the offset wells sometimes respond positively and sometimes negatively,” Dr Abou-Sayed said. Wells that are too close in proximity may have less upside potential than wells that are farther apart, he explained, because wells that are closer together may be competing for the same resource. On the other hand, wells that are completely isolated could have the most to gain because there are no other contenders around.

If multiple offset wells in an area are located far enough apart to gain production from different rock, then these surrounding wells could actually see a positive jump from a single, central refractured well. Dr Abou-Sayed calls this “passive restimulation” and said it happens when pressures are transmitted to surrounding wells via natural fractures in the rock, among other possibilities. “This interference or interaction between wells is sometimes seen as far as a mile or two away,” he said.

Another aspect of upside potential is the age of the well. Dr Abou-Sayed indicated it takes between two and five years for production in US horizontal shale wells to decrease to a level where refracturing should be considered. The time variability in which a well’s production decreases is strongly tied to the initial downhole pressure used on the well to produce it, or drawdown. US operators have typically used high drawdown pressures during a well’s initial completion in order to have the highest possible IP. However, operators later discovered that the shale wells produced with the highest drawdown have experienced the quickest drops in production.

Dr Abou-Sayed said one of the main parameters that causes this sharp decline is the “creep” phenomenon. Too often, creep is not considered in initial shale completions. “Creep is the continuous material deformation under pressure… so it is a time-dependent process,” he said, noting that it is common in shales due to the high total organic content (TOC) and a high clay percentage found in North American shale formations.

“It is important to realize that not all shales creep the same,” he said. “Depending on the mineralogy, shale plays vary in their creep response.” As such, creep is more commonly exhibited in shale plays with higher clay content and TOC. Creep also is affected by the drawdown. “The higher the drawdown, the faster the creep. The lower the drawdown, the slower the creep,” he said. “Creep could close the fracture completely… This formation damage is non-reversible without taking action. For you to recover, you actually have to refrac the well.”

Blocking old fractures, creating new perforations

As operator interest in refracturing grows, so do service companies’ R&D dollars in associated technologies. In July, Halliburton launched ACTIVATE, a full refracture service. The four-step process – well screening, refracture design, execution and refracture diagnosis – is a formal grouping of workflows that Halliburton already had in place for fracture and refracture services.

During the well screening phase, Halliburton focuses on wells located within core acreage positions of the formation and then evaluates how strongly the original completion technique connected the well to the reservoir. “In all these plays across North America, we know that the stimulation on most of these older wells is inadequate compared to today’s standards,” Neil Modeland, Halliburton Southeast Area Business Development Technology Manager, said.

For example, many original horizontal shale completions used stage spacing that was too wide and not enough proppant to fully optimize the fractures, resulting in understimulation. “What we’re really looking at is how far you have come from when it was (originally) stimulated. There could be a lot more meat on the bone production-wise when something has been understimulated several years ago.”

In the design phase, the company looks at multiple variables, such as how a well was initially drilled and completed, well production and well density. These elements then help to customize the refrac design, including number of diversion cycles to pump, how many more perforations might be necessary, and what the stage spacing should be in order to contact new rock. This customization helps Halliburton make an estimation of where the diverting agents might preferentially seat once inside the wellbore using the company’s AccessFrac service diversion method.

“We can know where the fluid is going to go preferentially, and it is not so much steering the diversion as knowing where you’re most probable of placing the diversion,” Mr Modeland said. The company’s diversion process uses a wide-ranging particle size distribution to allow the diverting agents to flow into each existing fracture and block these openings from receiving new frac fluid.

“The product is going to be taken down with the fluid, moved into the path of least resistance – whatever cluster or fracture is taking it – and somewhere along that fracture, it is going to become width-restricted to where that largest particle size is going to bridge off,” he explained. Smaller and smaller particles then flow into the fracture and temporarily block it from receiving any new fluid, forcing pressures elsewhere down the wellbore. “Once all the exposed previous fracs have been diverted from, you are now breaking down new rock.” The biodegradable diverting agents degrade over time after being exposed to high temperatures inside the wellbore.

After execution, the diagnosis phase allows wells that were not initially completed with fiber optics on the backside of casing to evaluate the effectiveness of the refracture. The process utilizes the company’s FiberCoil technology, which is fiber optic-equipped coiled tubing, to sense the well’s temperature distribution. “Areas that took the most proppant and fluid are going to take the longest to warm back up to reservoir temperature because they have cooler fluid. Areas that heat up very quickly – those were not stimulated or were stimulated less during that refrac treatment,” Mr Modeland said.

Fiber optics can help the operator compare a well’s pre- and post-refrac production. It may also help determine well interference to see how production was affected in offset wells after the refracture by dipping the coiled tubing in surrounding wells.

Recovering production in vintage wells

Consol Energy, an independent producer with assets in the Marcellus and the Utica, initiated efforts to boost production from its existing wells in 2014. The operator, which prefers the term “recompletion” to describe operations where high-pressure frac fluid is used to create new perforations in an existing well, identified seven gas wells out of 200 vintage wells from Pennsylvania’s Marcellus Shale for this project. Key selection criteria were convenient pipeline infrastructure, accessible pad location and the wells’ core geological location in Greene County.

The wells were originally completed in 2011 and 2012 with 300- to 500-ft stages and 60 ft separating each stage. The company currently utilizes shorter 150- to 250-ft stages to enhance access to untouched rock. “You want to add additional stages so that you can improve the overall return on investment,” Consol VP of Pennsylvania Operations Andrea Passman said. “In a recompletion, the well may be still producing very well. You just want to get it to produce even better.”

In order to estimate the possible production increase that could be gained, Consol compared the seven wells’ production to newer wells that were completed more recently with updated completion techniques. Halliburton’s AccessFrac service diversion technique was selected to divert frac fluid away from old fractures before creating additional perforations for new fractures in the wellbore. The full process took one month to finish.

When completed, staging length in each well was decreased to 150 ft, with 30 ft separating each stage. Post-recompletion IP for the seven wells averaged 137% of the original IP, according to Consol. The recompleted wells showed an average 2.70 Bcf incremental estimated ultimate recovery (EUR) increase, which is 125% of the original EUR projected for a 30-year period of the well’s life. At $3/BTU, the average days to payout on the recompleted wells was 613 days, the company stated.

Ms Passman said the project was an economic win because it allowed Consol to quickly achieve set production targets for the year. Further, the operator does not consider recompletions a competitor to drilling but views it as simply another part of the company’s portfolio management, including new drilling and infill drilling.

“We’re a cash flow-oriented company, being more independent. When we do a recompletion, we look at it in our portfolio based on cash flow.”

Encana is another operator that has tried refracturing. Last year, the operator refracked nine vintage Haynesville wells that were reaching the end of their initial EURs based on original plug-and-perf completion methods. The wells had been completed from 2008 to early 2010. “Our perforations spacing was a little wider in most cases than what we currently do. Also, the fluid and proppant volumes were quite a bit lower than our current standard,” Mr Hunter of Encana said.

The company selected these nine wells because they are located in the “sweet spot” of Encana’s Haynesville play, he said. The company also chose wells with shorter laterals to reduce cost and limit risk of damaging the well. “Any time you are reentering the well, you always have the risk of almost losing the wellbore… (and) designing on a shorter lateral allows you to reduce cost from the get-go.”

The operator executed these refracs using diversion to block depleted perforations and stimulate new ones. “(You) essentially stimulate from the heel and try to divert your way down to the toe. On the Haynesville wells, we went through and shot new perfs to get closer to our current spacing,” Mr Hunter said. “We’re definitely still working on optimization that needs to occur on the diversion technique.”

Upon refracture, the company decreased perforation spacing by as much as 50% and pumped volumes by 100% or higher – compared with the initial completion – of fluid and proppant into the nine wells. Originally producing at a choked rate of about 15 MMcfd, Mr Hunter said, the wells produced at approximately 30% of the IP after refracturing. He said these wells reached near virgin flowing casing pressures, indicating new rock was stimulated with the refractures. “When we bring new wells on, the flowing casing pressure will be at a certain amount, and then that declines along with (production) rates, so we found it somewhat interesting that after the refracs, we are reaching what the initial flowing casing pressures were,” he explained.

Encana is applying knowledge learned through the Haynesville application to current and future refracturing operations in the Eagle Ford. “The main learning is we can do this, and we can do this successfully,” Mr Hunter said.

Future for refracture

While it may be necessary for the industry to gain more control over refracture technologies before they become widespread, interest is likely to grow if the price of oil remains low, Mr Leshchyshyn of FracKnowledge said. “(If) you are not drilling new wells because they are too expensive at the low price of oil, you have to refrac. It is the only thing that might happen.”

Requiring only about 20%-35% of what it would cost to drill and complete a new well, refracturing provides quick and easy incremental production and reserves, even if slight, he said. “You don’t have to have 100% of your production come back. Getting 25%, 50% or 75% of your production will still make the economics successful for you on a refrac.” Initial production rates are often achieved at a lower decline rate, although increased decline rates have also been observed after refracture, depending on the circumstances of the well and the initial completions method.

Mr Leshchyshyn points out that refracturing has gained more attention recently but is not a new technology as vertical wells have been refractured for decades. “We will have to wait to see if it is overhyped or underutilized, but (horizontal refractures) are happening , and hundreds of refracs have already happened,” he said, adding that waves of interest in refracture typically come in five-year cycles after wells have reached four- to five-year depletions.

Whether refracturing in US shale becomes widespread or not, he expects that the lessons companies are learning while refracturing will help operators to improve their original completion techniques. “When the price of oil comes back a little bit more and people start drilling new wells, you’ll find that people will retain some of their knowledge they got on refracs.” DC