What drives drilling contractor decisions on tech investments?

Cost is important, but contractors also weigh technology’s scalability, value to customers and – increasingly – influence on ESG performance

By Stephen Forrester, Contributor

In today’s market, effectively managing costs and investing in the right technologies – be that through internal product development or mergers and acquisitions (M&A) – are make-or-break tasks for drilling contractors. As a company works through the process of determining whether and how to make an investment, myriad criteria must be assessed from an operational and a financial standpoint. When those investments pay off, however, significant value is unlocked.

In this article, leaders from Parker Wellbore and Helmerich & Payne (H&P) weigh in on how their companies look at technology investments and what they see for the future of the sector.

Integrating equipment and technology

Parker Wellbore, said Director of Technology Chris Stewart, takes a very process-driven approach to technology investment. “We use an agile stage gate methodology that starts with an ideation phase, where we take ideas from employees, vendors and customers to understand what their needs are,” he explained. “After we evaluate the ideas to see if they align with the company’s strategy and tactical plans, the idea goes to what we call our ‘innovation council,’ and they either give us the OK or determine that we don’t want to move forward.”

After the idea is evaluated and approved by the engineering, market intelligence, risk and legal groups, it eventually gets to the point where development can begin. At this point, the concept is turned into something that can be prototyped, tested and validated, commercialized and, ultimately, launched and marketed to customers. “Of course, this process isn’t linear,” Mr Stewart clarified. “There’s an incredible amount of interface between the teams as a potential technology is moving through this process.”

Once Parker makes an investment in a technology and it is cleared for commercial deployment in the field, the company determines whether it is successful based on two main sets of criteria: financial benefit and operational impact. “To be a successful drilling contractor, you have to create value for all of your stakeholders,” Mr Stewart explained. “That includes vendors, employees and, most importantly, your customers.” Metrics are tracked over time to determine how the technology performs versus what Parker Wellbore initially thought it would accomplish.

On the financial side, the company looks at standard evaluation criteria, including net present value, return on investment and payback period, to determine if the technology investment has achieved its objectives from a revenue standpoint.

When it comes to performance-based criteria, there are quite a few additional ways to determine if an investment is successful. “Some criteria are based on environmental impact, like fuel efficiency and emissions reductions on our rigs,” Mr Stewart said. “For safety, we look at reductions in the number of lost-time incidents. And for drilling optimization, we evaluate metrics and key performance indicators around average connection times, days-versus-depth curves, rate of penetration and flat time.” Mr Stewart noted that such improvements provide value to both drilling contractor and operator, validating the investment.

When looking at some of the recent technologies in which Parker Wellbore has invested, Mr Stewart said that the company’s focus is on four specific areas: mechanization, automation, big data and energy transition. With mechanization, the company finds itself sometimes acting not only as a drilling contractor but also as an OEM. One of the company’s latest innovations is a super compact casing-running tool (SC-CRT), designed to enable safer handling and more efficient running of casing strings in the fast-paced unconventional market.

“We recently completed validation testing of the new SC-CRT, which we developed and manufactured completely in-house,” Mr Stewart said. “With this tool, we identified our customers’ challenges and determined a solution that would improve operational efficiency and safety.”

The SC-CRT is currently undergoing a field trial in West Texas, where it is being evaluated against specific success criteria based on the design of the technology. The field trial acts as a continuation of the validation testing, which helps confirm the design is fit-for-use in a particular application. “We may require more than one field trial,” he explained. “Most of this testing depends on cooperation with our customers, as they control the well plan. After completion of each field trial, the results are evaluated by the team. If all the critical criteria for success are met, the technology is moved to the next stage.”

Based on the benefits of the tool and early results from the project, Parker Wellbore expects the SC-CRT to surpass initial expectations.

Another new technology is the Data-Driven Drilling Optimization system, D3O. This digital monitoring system provides real-time visibility of drilling conditions using data collected by rig sensors on block position, standpipe pressure, bit depth and hookload. The data is presented to Parker and its customers in a web-based platform, enabling better decision making and improved resource efficiency, whether that be with how wells are drilled or how power is consumed on the rig. The D3O system is in the pilot testing phase as part of Parker Wellbore’s technology development process.

A related system, RAPID, is a rig assessment tool that allows rapid inspection of tool, equipment and system condition on the rig. This includes identifying required maintenance and repairs for every critical element.

In all cases, Parker Wellbore evaluates existing options prior to making an investment decision. When technologies are available that fit what the company is looking for, the benefits of internal product development versus partnering with other companies or potential M&A are assessed.

While Parker Wellbore works extensively with its customers on any new technology development, it rarely receives direct funding from external partners. Instead, Mr Stewart said, the company receives value indirectly, mostly through rig or service contracts. For example, “we worked with a customer in Alaska to design Rig 272 and Rig 273 specifically for the North Slope, implementing winterization elements and a drilling automation package,” he explained. “In turn, we received a multiyear contract. We also built specialized rigs that were designed for an operator’s ERD wells in the harsh environment on Sakhalin Island. On all of these projects, we provided our customers with technologically advanced rigs that enabled them to have very successful and, in some cases, world-record-setting drilling campaigns.”

In the cost-constrained environment of today’s oil field, it’s critical for Parker Wellbore to clearly show customers how a technology meets their needs, Mr Stewart said. “While engineers often have incredible ideas, not everything can become a commercial product,” he explained. “The key is to correctly interpret what your customer tells you and collaborate with them during the development process to ensure you’re aligned on objectives for the technology.”

D3O, for example, will incorporate applications focusing on drilling optimization, condition-based maintenance, augmented reality and tubular-running services analytics, all of which are connected to Parker Wellbore’s real-time operations center in Houston. In doing so, the system helps operators achieve their efficiency and safety goals.

The future for Parker Wellbore, Mr Stewart noted, is going to be increasingly based on digital and energy transition technologies, although he believes there will still be opportunities for OEMs to work with drilling contractors, especially in capital-light partnerships.

The company is also focused on what he called “technology stacking.” “What I mean is that you develop multiple technologies that are stacked together on a given rig to maximize overall value. For example, some of our current energy transition technology – like a high-voltage-power switchgear that eliminates the need for diesel generator sets except as an emergency power source – can be combined with the D3O system to optimize the drilling process, enhance safety and reduce emissions.”

Parker Wellbore is also working on a proprietary drilling-with-casing technology, which Mr Stewart expects will be commercialized in 2022.

Drilling automation and engineering services

When H&P looks at making a technology investment, the company first considers the needs of its customers. “We look at whether the technology will create value for our customers, either independently or when paired with other pieces from our product roadmap or portfolio,” Trey Adams, Senior Vice President at H&P, said. “We can look at if the technology is differentiated and how differentiated it is, and then we can look at it from a cost perspective to see if we can scale it effectively.”

H&P is increasingly focused on standardizing its rigs and rig offerings, Mr Adams noted, so that control systems and rig componentry can be used across the fleet in a plug-and-play fashion. “We look at technology solutions and digital tools in the same way,” he explained. “We want to be able to add them to our rig fleet and scale them across the fleet with ease. That’s very important to us.”

The other piece of the puzzle when looking at technology investment is the impact on internal stakeholders. “We really want to look at a potential investment to see how it affects our employees, especially in the field,” Mr Adams said. “When we roll out a new technology or tool, we have to understand how to communicate that to field staff, and what kind of value they can expect to see long term from a change management perspective.”

The field staff needs to understand the value of the technology and how it integrates and interacts with them at a personal level. Whether the technology is an automation solution or an engineering service, H&P dedicates significant resources to make sure this happens.

Any new technology also has to meet various other criteria before an investment decision is reached. This includes whether it improves a process to make something more cost effective or efficient; whether it can be added to the existing portfolio as a bolt-on to improve technologies H&P already has; and, perhaps most importantly, whether it is truly a transformative or new idea that can change the way the company operates.

“After we look at those things in the early stages of the investment process, the technology goes through a very extensive product management roadmap, including examining financial impact – internal rate of return and ROI, for example – legal constraints, operational messaging for sales, and how to commercialize and market the product,” Mr Adams explained.

H&P sees its 2019 acquisition of DrillScan as an example of good investment. The wellbore engineering firm had developed its own proprietary software for drillstring mechanics, drilling hydraulics, directional drilling and well planning. “The value of DrillScan to us was truly multifaceted,” Mr Adams said. “When putting together their drilling engineering analysis with some of the autonomous offerings we’re trying to achieve, it creates a really compelling value proposition.”

The other item to consider is the human capital element, as the acquisition provided H&P with experience and expertise that would have been difficult to find otherwise.

“There are incredible people in our DrillScan business that make it different from what you’d typically see at a drilling contractor,” he continued. “The whole team provides a level of skill in engineering that allows us to work with clients outside of the technology piece and digital offerings. So, you can’t look at an investment just from a technology perspective. You also have to look at it from an overall services and solutions perspective. We’re just scratching the surface with what we can achieve with DrillScan.”

H&P is also recognizing a fundamental shift in the role of the drilling contractor. Part of why the company invests in new technology is to move away from simply providing a rig at a set dayrate, Mr Adams said. Through earlier growth cycles to the market’s decline and relative stagnation since 2015, the industry has changed dramatically. To move forward, companies must rethink how they work together and align on goals and outcomes, he said.

“Twenty years ago, we would have brought out iron and people, and waited to be told what to do,” he said. “Now, we want to be an outcome provider, not just a drilling contractor. We need to align with our customers’ goals – in a technical sense, a commercial sense, and a rig equipment, hardware and people sense. We want to organize around their objectives and desired outcomes, whether it’s in our compensation model, or what technologies we apply, or what solutions and engineering we deliver.”

In one example, Mr Adams pointed to how H&P purchased strings of wired drill pipe in 2018 in anticipation of the industry’s push for drilling automation. The company saw an opportunity to own an enabling technology that could be used in the future. “We did this from a customer standpoint,” he said. “We wanted to be able to offer wired pipe to solve problems and provide greater certainty in the data. We also did it to improve surface automation suites, and there was a benefit to us organizationally to know what was going on downhole, correlating downhole WOB to surface WOB to improve the way our autodriller responded to different downhole dynamics.”

Looking forward, Mr Adams notes two additional priorities for H&P when it comes to investing in technology. “We want to continue to advance our suite of apps and focus on emissions and engine management,” he said. “When you think about the suite of apps and tools that we have, we look at how we ensure we’re drilling consistently and how our apps and automation offerings are sequenced appropriately and working together.”

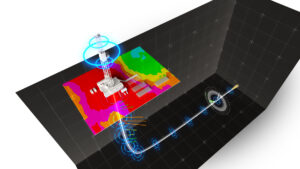

On any given H&P rig, there is a variety of apps interfacing not only with one another but also with the various pieces of surface and downhole equipment to achieve optimized drilling performance. The desired outcomes include improving ROP, helping to consistently land the curve in the right formation, and maximizing reservoir access in the target geological zone. Operating as part of H&P’s FlexRig platform, new apps can be scaled quickly and easily.

By using H&P’s process controller and apps to automate some drilling functions – like getting the drill bit back to bottom, rotating or sliding, and steering – the driller can focus on safety, performance and more critical operations. In this approach, the driller acts as a process manager instead of a button-pusher. It reimagines roles on the rig to take people out of harm’s way and more effectively use their skills elsewhere.

“There’s a lot for us to be proud of and excited for,” Mr Adams concluded. “As the industry has recovered over the last 14 months, we have seen higher levels of rig activity, as well as a 20% increase in adoption of our advanced apps and automation solutions versus pre-pandemic levels. Implementing these improved solutions allows us to truly tether technology advancement to our safety focus, with rig automation enabling our drillers and teams to focus on what matters most: controlling and removing exposures.” DC