New systems take holistic approach to optimize frac efficiency, well performance

Real-time fluid tracking, expanded sensor technology and predictive system among innovations aiming for greater efficiencies at frac sites

By Stephen Whitfield, Associate Editor

As US shale plows through a period of uncertainty in the midst of a global pandemic, the search for efficiencies at the margins has become even more critical for companies active in hydraulic fracturing operations.

- Need to maximize well performance has led to a focus on completions as a much more critical part of the well construction process, with new technologies allowing for better data analytics.

- Frac optimization technologies have incorporated different methods to get around latency issues, including hard-wiring servers on the frac site.

- Tech developers are aiming for simplified interfaces with greater ease of use.

“Given everything we’re seeing right now, with the price of oil dropping and Russia and Saudi Arabia going at it to the point of trying to ruin US shale, operators have to be clamoring for everything they can do to save every dollar,” said David Moore, President and CEO of Deep Imaging. “We’re still going to have to frac. It’s not like fracking is just going to stop. There’s too much money invested in the market. There’s too much potential. It has to continue, but it’s got to be more efficient. Now, more than ever, we’ve got to generate more of that free cash flow for our investors.”

Deep Imaging is one of several companies with new technologies aimed at optimizing completions, with a fluid-tracking system that it claims can help operators avoid costly setbacks. These systems leverage different capabilities to achieve similar goals, and the advantages they aim to provide may prove valuable for companies looking to get the most out of their frac jobs.

The holistic view

One challenge for operators seeking to maximize the performance of their wells is how to organize the streams of data coming from various sources during their drilling and completions campaigns. This question has spawned new technologies that help operators look at completions as a much more critical part of the well construction process, not as an afterthought at the end of a drilling campaign. This was a key motivation behind Cold Bore Technology’s SmartPAD, a completions application that allows operators to digitize and monitor all of their frac sites simultaneously and remotely.

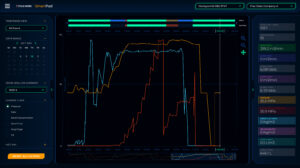

The system uses a combination of valve positioning and pressure monitoring sensors and Cold Bore’s in-house software to digitize completions operations, according to Brett Chell, President of Cold Bore. He referred to the technology as a “completions operating system,” in that it combines the information generated from different service companies during a completions campaign into a single dataset, enabling the operator to effectively view completions as its own operation.

“If I’m a frac company, I’m tracking my pump rates and fractures, and that’s digitized. But when it comes to tracking the operation with time stamps, that’s completely manual. The operator tracks it all by writing stuff on paper. They get those digital inputs from five or six different services on location, just fed into them by e-mail. Then they e-mail that to the head office, and someone tries to make sense of it. There’s no digital completions operating system,” Mr Chell said.

Commercialized in 2018, the SmartPAD system utilizes Industrial Internet of Things (IIOT) sensor-driven software to present service company data on a single screen, overlapping data sets with one another to produce unique analytical categories based on an operator’s needs.

Mr Chell said his company’s system differs from other analytic systems in that it involves the installation of an edge server on location. Edge servers provide entry points into a network, placed strategically between a private network and public internet in a way that reduces the workload on origin servers and reduces latency for users. SmartPAD requires one server per pad and can be operated on a cellular connection.

He added that connectivity is not a challenge for deployment because, in cases where the cellular service is weak, signal boosters and a satellite backup can be used.

This automation of collecting the time-stamped operational data vastly increases accuracy and drastically reduces workload, according to the company. It also creates a standard format for all data coming from the site.

Bolted to wellheads, sensors provide critical path workflow tracking, and since the system is hard-lined into other services on location, other service data can be tied in and married to the critical path via time stamp. “Essentially, we can track that operational data, bring in all the service data, stitch it through a common time task and put one clean dataset out,” Mr Chell said.

Industry interest in SmartPAD has grown significantly over the past year, he believes. According to Cold Bore, its system is currently being deployed with operators in western Canada, the Bakken and the Permian.

In January, a Canadian operator in the Duvernay shale play in Alberta used the software to identify the root cause of premature permanent frac plug settings. Real-time monitoring showed that a wireline crew was operating outside of the plug supplier’s rate-to-line speed operating window, due to a miscalculation by the wireline supervisor. Mr Chell said the operator was able to adjust its speeds accordingly, averting an average cost of $50,000 for each coil run by avoiding future premature frac plug settings.

In addition, Cold Bore is working with a Bakken operator with wireline issues. In this case, a lack of visibility of the frac tree valves had led to miscommunication among the site supervisor, wireline and the frac tree provider. This miscommunication led to two instances of wireline being cut and left downhole due to the wrong valve being shut in, costing the operator around $400,000 per incident, along with more than $100,000 in coiled-tubing fishing services and frac standby costs. By installing SmartPAD panels at the accumulator, valve positions can now be confirmed, along with the operation happening on each well.

Cold Bore is also working with wellhead providers, including Cameron and TechnipFMC, to provide fully digitized frac trees and accumulators that tie into wireline units already connected to an edge server to prevent cutting wireline all together.

Like Cold Bore, Deep Imaging’s fluid-tracking technology seeks to provide operators with a greater overall picture of their completion jobs. It allows companies to better identify potential problems that could lead to underperforming wells, such as frac hits, plug failures, bad cement and open zippers.

The technology involves laying out an electrical array over the lateral. This array does not go downhole, nor does it attach to the casing. Rather, it injects current into the ground. As a frac operation commences and fluid and proppant are pushed into the formation, that electrical current is perturbed and measured at the surface. The system tracks fluid as it travels through the wellbore and out to the fracture tips during a completion.

As a result, upstream companies can validate models and successful stages while identifying, fixing or avoiding problem stages as they occur.

Mr Moore with Deep Imaging said the setup of the electrical array and receivers depends on the operator’s needs, such as the size of the area it thinks need to be treated. Having sensors over the lateral provides operational advantages, he added.

“Our view is that monitoring can’t be something you do on 3% of your pads, where you get a view of what you think is happening subsurface that you can apply to the whole section. It has to be an operational tool. Not all operators are there yet, but there are a few who have embraced this and realized it,” Mr Moore said.

Launched in July 2019, Deep Imaging’s technology has been used in the Permian Basin and the Anadarko Basin. In the latter, the technology helped Jones Energy to discover significant lateral interaction between each of its 24 stages on a frac site, with fluid from neighboring stages bleeding into each other.

“We believe that you have to be able to monitor what’s going on, the fluid and placement, in near real time,” Mr Moore said. “As you’re fracking these stages that are anywhere between an hour-and-a-half and two hours long, if you see that you have a plug failure, or you see that there’s bad cement, or you see that you’re getting close to being out of the bounds of where you think your frac should be, you can handle all these different operational things that the operator needs to handle in order to be more efficient. We view our tool completely as an operational tool.”

Ease of use

Any new software application, regardless of the target industry, will likely tout its ease of use, or the intuitive nature of its interface, as a selling point. This is no different when it comes to optimizing frac jobs.

FracGeo’s DrillPredictor, available both as a cloud-based and a desktop application, uses standard surface drilling data to compute corrected mechanical specific energy (CMSE), the energy being used at the drill bit after accounting for frictional losses along the wellbore for any type of drilling equipment, including rotary steerable systems and mud motors, and the well profile.

Ron Dirksen, COO of FracGeo, said the program was developed to help operators fill data gaps. Launched in early 2019, the platform computes rock strength, pore pressure, geomechanical stresses, natural fracture density and rock elastic properties along the wellbore, using only surface drilling data. The data is then used during or immediately after drilling the well to provide multiple completion optimization strategies, by optimizing the cluster efficiency within frac stages.

Mr Dirksen said the company aimed to create a user experience that almost anyone could understand, recognizing the variety of personnel who need to access surface drilling data. Further, FracGeo works with operators to develop the optimal methods for them to optimize their data gathering and analysis, based on specific needs.

“We work with the operators, the drilling contractors and the people that collect the data on a rigorous process to make sure the data that’s being collected is as good as can possibly be,” Mr Dirksen said. “Quite often, we have people who use this software who are geophysicists, geologists or reservoir engineers. They’re not drilling experts. If we don’t get the drilling people involved right away, sometimes people make assumptions about the data or corrections to the data that may or may not be accurate, and then our calculations are wrong.”

For Cold Bore, Mr Chell also said SmartPAD’s original user interface was too complex for its customers, primarily because the company tried to develop the software as a multi-vendor platform with add-on features like digitizing the frac trees and real-time data tracking. However, the company decided to simplify its interface as it continued to add capabilities to incorporate wireline, coil and pump data.

“When we started, we initially wanted to solve a little problem. Let’s just focus on frac trees and tracking time,” Mr Chell said. “And then we realized the operators aren’t going to hire separate companies to track time, separate companies to do wireline, and so on. The multi-vendor problems became apparent very quickly. It’s too complicated, too expensive, requires too much infrastructure and you can’t have separate companies doing separate things.”

Addressing latency

SmartPad, DrillPredictor and Deep Imaging’s fluid-tracking system all claim to either have some form of real-time capabilities or to be in the process of developing real-time capabilities. Real time can be an appealing term to drillers and operators, but it is not always accurate as the term can be used to refer to “pseudo” real time. Such a system generates a small delay that may be an improvement over what existed before but still may not fully optimize the operation at hand.

Mr Chell said that, depending on the function for which an operator is seeking a solution, it may or may not be critical to have real-time data processing. But for users of SmartPAD, even a miniscule lag time can have a major impact.

Mr Chell said that, depending on the function for which an operator is seeking a solution, it may or may not be critical to have real-time data processing. But for users of SmartPAD, even a miniscule lag time can have a major impact.

“Our product is an operating system,” he said. “It is not an analytic system. It’s not just pulling empirical data and showing it to you in a better way. People use this on the fly to understand, for instance, let’s get our time between fracs dialed in down to the minute and keep them there, are those valves on that frac tree open? Is there a potential danger to a specific location? Should people be approaching that location? We automate a lot of that, so you can’t have a system that’s 1 second, 8 seconds, 10 seconds or a minute behind, because somebody might make a decision in that time that could have an impact on safety or operations.”

SmartPAD gets around latency issues by hard-wiring an edge server on the frac site.

“There’s a lot built into our program and our software that checks and double-checks to make sure everything is running safely, but the key to it is that edge server. We have that computing capability on the premises. Wireless is somewhat attractive in some instances, but it’s not as reliable. When you’ve got mission-critical tasks, you need to have that hard-wired connection,” Mr Chell said.

Mr Dirksen said FracGeo has mostly worked out latency issues with DrillPredictor, other than for situations where a user is processing data from wells already drilled. He said the system’s ability to work near to real time – it processes data within seconds of a well’s completion – allows operators to validate and plan its completion design as they drill the well, or immediately thereafter.

“A lot of the system and a lot of the connections are automated. You can pull data directly off any rig data collection system. As soon as it gets on those machines, it can get onto ours, so there’s no significant lag,” Mr Dirksen said.

Deep Imaging is working to add a real-time element to its fluid-tracking system, which currently delivers surface data and a full analytics package to operators approximately 20 days after a frac. On 1 March, the company introduced an imaging system that allows on-site personnel to view fluid movement within a frac on a three-hour delay. The conventional product will still deliver a full analytics package to operators within 20 days.

Having access to the fluid imagery in a three-hour time frame, Mr Moore said, will allow operators to make critical decisions on the fly. “It is our first real-time product,” he explained. “With our conventional product, you get images, you get analytics, you get the full data package that you can apply to your workflow, but being able to see where you’re placing fluid and proppant in a three-hour window adds that extra dimension. You can make those operational decisions.”

Ultimately, Mr Moore said he hopes to reduce latency of the imaging system even further.

“Right now, when you look at it, everybody else delivers in weeks. When you’re within three hours of that stage, and you’ve got 100 stages on the two-well zipper that you have, that’s enough time for you to make decisions as you’re going down the well and you’re seeing where you’re placing fluid and proppant. That’s got to get faster. We don’t want to get ahead of our schemes. Within the next few months, we have a clear roadmap to get to a 30-minute delay. If you get to below 30 minutes, you’re really watching that in real time.” DC