Falling rig demand and oil prices dim near-term outlook as operators re-evaluate portfolios

By Joanne Liou, Associate Editor

The ingredients for a troubled deepwater market – flattening rig demand, increasing costs and falling oil prices – have been brewing in the past year. A number of deepwater projects have been postponed, and the industry is treading cautiously, re-evaluating portfolios and reducing capital expenditures.

“(Industry) had a long period – four to five years – where the deepwater market had really been booming,” Michael Mortensen, Senior Director of Deepwater, Commercial Department for Maersk Drilling, said. “There was an immense and intense pressure on the industry to deliver. It had driven a lot of costs, a lot of demand for both people and equipment. The capital discipline that has hit now is an outcome of pressure in industry, where costs have gone up dramatically. At the same time, oil price has stopped rising.” As of 22 October, the price of WTI crude oil had fallen to $80.39, down from $101.15 a year prior.

Despite signs of a challenging year ahead, industry analyses suggest an upturn will come about by the later part of 2016, induced by capital discipline to manage major projects. “We still see a lot of deepwater prospects in many parts of the world,” Mr Mortensen said. “Timing is the big question as to when each of these will actually take off. The latter part of 2016 could be a turnaround.”

Rig supply, demand

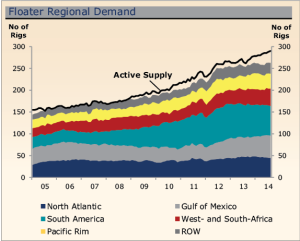

After years of increasing demand for deepwater rigs, the past 12 to 18 months have reflected a lot more flatness. Along with newbuilds that are still leaving shipyards and entering the market, rigs that were built three to four years ago are starting to come off initial contracts. This availability is creating more competition for a limited number of projects. With approximately 100 deepwater units coming into the market through 2020, including 28 from Brazilian yards, “the supply side is increasing quite fast,” Sven Ziegler, Senior Analyst and Partner at RS Platou, said. “This is a classic cycle. You have investment when times are good. Then when demand starts coming down, the units are coming into the markets.”

After years of increasing demand for deepwater rigs, the past 12 to 18 months have reflected a lot more flatness. Along with newbuilds that are still leaving shipyards and entering the market, rigs that were built three to four years ago are starting to come off initial contracts. This availability is creating more competition for a limited number of projects. With approximately 100 deepwater units coming into the market through 2020, including 28 from Brazilian yards, “the supply side is increasing quite fast,” Sven Ziegler, Senior Analyst and Partner at RS Platou, said. “This is a classic cycle. You have investment when times are good. Then when demand starts coming down, the units are coming into the markets.”

More newbuilds are also entering the global fleet without firm contracts, as a result of new companies ordering rigs on a speculative basis. “The shift to turnkey newbuild construction in the last build cycle – whilst dramatically improving project delivery outcomes – did have an unfortunate effect in the current environment of decoupling supply and demand,” Simon Johnson, SVP Marketing and Contracts for Noble Corp, said. “The shipyards took a much greater responsibility for the construction of the rigs. In the process of doing so, they developed new marketplaces and discovered new customers,” Mr Johnson said at an investor briefing in September.

Dayrates and utilization

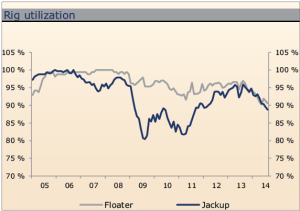

The greater supply and softening demand for deepwater rigs is, in turn, shifting dayrates and utilization rates. “In recent months, pricing power has clearly shifted from the drilling contractors to the oil and gas companies. We are also increasingly seeing gaps between contracts, whereas continuous utilization was previously the norm,” Mr Johnson stated. In some cases, he noted, drilling contractors are not just competing with other drilling contractors but also with customers who are offering rig sublets.

Over the past year, deepwater rig dayrates have fallen dramatically. “We’ve seen some contracts being fixed close to $300,000 for quite short contracts,” Mr Ziegler stated. “Compare that to one year ago, when contracts were fixed at $600,000-plus and the duration of the contracts were three years-plus.” For 2015, units will likely be fixed in the range of $350,000-$450,000 for ultra-deepwater, he said. “More importantly, dayrates are likely to be 25-30% below the levels fixed this year, which have also dropped compared to the previous year.”

Dayrates are clearly trending downward compared with 2013, Mr Mortensen of Maersk Drilling said. “The rates announced in 2014 in the high $500,000s are rates negotiated last year and does not reflect the current market picture. We now see fixtures in the range of $400,000-$500,000 with probably some cases also in the high $300,000 depending on duration and location.”

In the Gulf of Mexico (GOM), the Noble Danny Adkins semisubmersible will begin a minimum 200-day program in mid-November with Deep Gulf Energy (DGE). The semi, which was built in 1999, is rated to 12,000-ft water depth. While the rig’s previous dayrate with Shell in the GOM was $498,000, the dayrate with DGE is $317,000. Noble has said that the fixture is a tactical response to current market conditions and not an indication of the rig’s earning potential. The company also noted that the relatively short term of the assignment corresponds to the potential for improving marketing opportunities next year.

Noble also noted the $10 billion it has in contract backlog as a tool for managing the current lull in new fixtures. In early September, Noble delivered the Noble Tom Madden from South Korea to the GOM. The ultra-deepwater drillship is rated to 10,000-ft water depth and 40,000-ft drilling depth. The drillship will begin its three-year contract with Freeport-McMoran at $610,000/day in mid-December, a full month ahead of schedule.

In October, Cabinda Gulf Oil Co, a Chevron subsidiary in Angola, extended its current contract for the Mærsk Deliverer ultra-deepwater semisubmersible. The estimated contract value is $387 million for the two-year extension. The rig was built in 2010 and is rated to 10,000-ft water depth. Since 2012, the Mærsk Deliverer has been working for Chevron and its partners on the Tombua Landana field offshore Angola. The extension keeps the rig on contract until June 2017. Maersk Drilling also has two drillships – Maersk Viking and Maersk Valiant – operating in the deepwater GOM. Both were delivered in 2014 and are rated to 12,000-ft water depth. Both are on three-year contracts – the Maersk Viking with ExxonMobil and the Maersk Valiant with ConocoPhillips/Marathon Oil.

Weak deepwater dayrates are expected to continue in 2015. “We actually see good parts of 2016 being the same, but the latter part of that year could be a turnaround,” Mr Mortensen of Maersk Drilling said. “We currently see intensified competition amongst rig contractors especially in 2014 and 2015, which leads to lower dayrates and utilization. Despite these short-term challenges, we maintain our positive outlook of the ultra-deepwater market returning to a more balanced supply/demand over the next years.”

Prospects for newbuild orders in the next couple of years will depend on industry confidence in the market, Mr Mortensen said. “There are still 50 to 60 ultra-deepwater rigs being delivered over the next few years. Until that order book is down again and expectations to visible demand has gained more confidence, I don’t think you will see any new orders. I don’t think you will see it pick up until 2016 at the earliest.”

While the floater rig utilization rate has remained at nearly 100% in recent years, “this is the first time we’re starting to see some availability, even in the ultra-deepwater market,” Mr Ziegler said. Utilization of the ultra-deepwater fleet – units capable of drilling in 7,500 ft of water or greater – was 98% in Q4 2013. In Q3 2014, the rate was 96%. Utilization of the deepwater fleet – units capable of drilling in 3,000-7,500-ft of water – was 90% in Q4 2013 and had fallen to 85% in Q3 this year. Mr Ziegler projects utilization to continue to decrease, especially in 2016, as rigs come off contracts. “We are currently projecting that floater utilization can drop to approximately 80% in 2016.”

Change in plans

Because oil prices have been flat but CAPEX has been moving up, Mr Ziegler explained, cash flows are being tightened. “(Operators have) elected to continue dividends and share buybacks, while the brakes have been put on new investment or E&P spending,” he said. This has led operators to postpone major development programs, with some being postponed to 2018.

Maersk Drilling is also seeing delays in operators’ drilling programs. One example is Shell’s subsidiary in Nigeria, SNEPCo, which had a tender for two to three deepwater floaters to operate in that country. These rigs were due to start in early 2015, but “we are probably now seeing that into end 2015, early 2016 at the earliest,” Mr Mortensen said. Another example is TOTAL’s Brazil campaign, originally slated to start next year. “That is now being postponed to 2017, as well… We’ve seen a lot of prospects that were actually to be delivered and be drilled in ’14 that we’ve had to move back. These have been postponed to ’15 or some even to ’16,” Mr Mortensen said.

TOTAL’s ultra-deepwater Kaombo project offshore Angola was delayed for more than a year before the operator was able to finalize development plans. “Following an intensive optimization exercise, the project’s capital expenditure to reach full capacity was reduced by $4 billion to $16 billion, with an expected start-up in 2017,” the company announced on 14 April.

“TOTAL has significantly optimized the project’s design and contracting strategy in recent months,” Yves-Louis Darricarrère, President of TOTAL Upstream, stated. “Kaombo illustrates both the group’s capital discipline and objective to reduce CAPEX.” In the current climate, industry should expect to see more examples of operators exercising such capital discipline.

Costs and investments

A big demand on resources, particularly human resources, has resulted in higher costs in recent years. “The demand for qualified and competent personnel has significantly increased,” Mr Mortensen explained. Increasingly stringent regulations, local content rules and a growing HSE focus have also driven modifications to rigs and company management systems. This has further stretched resources and driven up costs. For operators, in particular, costs have risen through their operational chain, “from ordering their platforms when doing the FEED development to their personnel within their own operations,” he added.

It’s no surprise then that operators are re-evaluating investments and portfolios, including redirecting cash from deepwater to shallow-water and shale resources. Shale oil, in particular, continues to be a strong competitor for operator spending. In recent years, technology advances have led to higher productivity in resource plays. “The brakes on ultra-deepwater is also a function of the higher return of onshore projects – the shale oil, shale gas, where terms can be much better,” Mr Ziegler said. “If you take all the new investments, then a larger portion of that is moving to onshore rather than offshore.”

Long-term horizon

The deepwater Golden Triangle is expected to continue to reign the deepwater market in the foreseeable future. “If we look at the long-term horizon, there is definitely a lot of work still in US waters that will require deepwater rigs,” Mr Mortensen said. The same is true of Africa, with strong deepwater prospects in Angola, Nigeria and Ghana, as well as further north with Libya, Egypt and Israel. “These are all traditional markets you still have to consider with great potential. Also, India will be somewhat active, as well, along with East Africa and Southeast Asia.

“There has generally been good activity in South America with Petrobras,” Mr Mortensen continued. “And Mexico is, of course, an interesting market. There is no doubt Mexico has significant (oil and gas) prospects as well in the deepwater space.” He expects the opening of that market over the next few years to absorb some of the deepwater rig supply. Noble’s Mr Johnson shared the same sentiment, noting his confidence in the Mexican market. “Admittedly, that’s probably not going to gather pace until 2017 or 2018,” he stated.

Mr Johnson said also he believes that, in the long term, deepwater will remain an attractive option for oil companies and will lure back companies that may have turned their focus to unconventionals for now. “Only in the offshore and, in particular, in the deepwater arena can the IOCs achieve material improvement in their reserve replacement rates.”