UT study puts Barnett total recoverable reserves at 44 trillion cu ft

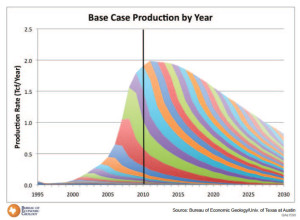

A comprehensive study of the Barnett Shale has put total recoverable reserves in the basin at 44 trillion cu ft in the base case, more than three times the cumulative production of 13 trillion cu ft to date, with production slowly declining through 2030 and beyond. The assessment was conducted by the Bureau of Economic Geology (BEG) at the University of Texas and suggests a bright future for US shale gas production.

“The Barnett is one of the oldest shale gas plays while the much bigger Marcellus is on an early uptick,” said Dr Scott Tinker, BEG director and co-principal investigator of the study. “When we aggregate those together, we can see a reasonable, multidecadal shale gas future for the US, rising, plateauing and slowly declining over several decades.” The BEG is conducting similar analyses of the Fayetteville, Haynesville and Marcellus plays and plans to release results by the end of the year.

“What makes this analysis quite different from other studies is that we were able to look at every single well in the field,” Dr Tinker said. “This is really a bottoms-up look at every single well – its decline, economics and aggregation – that allows us to determine what has been drained and what is still available to drill.”

The Barnett study, which integrates engineering, geology and economics in a numerical model, makes a base case on conservative assumptions of $4 natural gas prices, higher for liquids, and other components such as well life, cost per well and technology advances. It shows that production has plateaued to around 2 trillion cu ft per year and will decline slowly to 900 billion cu ft (bcf) per year in 2030. “The number of wells being drilled each year will continue to decrease but will be drilled in higher-quality reservoirs and some of the liquids-rich areas of the field,” Dr Tinker said. “Drilling in the better rock won’t last forever, but there are still a few more years of development in the better rock-quality areas.”

10 Productivity Tiers

The study also identifies 10 productivity tiers to more accurately forecast future production. “In Tier 1, we see the best recovery rates on the order of 50% from a given well’s drainage volume,” Dr Tinker explained. “That decreases substantially down to Tier 10, which is the worst, where recovery rates are less than 5%. But there is a lot of variability within each tier.”

Data in the model stop at the end of 2010, after some 15,000 wells had been drilled in the Barnett Shale. The study predicts an additional 13,000 wells will be drilled through 2030, including the 2,900 wells that were drilled in 2011 and 2012. The model also shows a correlation between price and production, indicating that while porosity and payzone affect the reserves, price is the dominant factor.

The BEG hopes to eventually assess shale gas plays in other regions worldwide but will also push to analyze some of the major oil shale basins in the US, such as the Bakken, including the Three Forks and Lodgepole fields, and Eagle Ford, which holds a mix of dry gas, mixed hydrocarbons and liquids.

Before issuing the report, 100 professionals from government, academia and industry, including representatives from Devon Energy and ExxonMobil, provided critical feedback on the methodology. The Barnett study included a team of 12 scientists and was funded by the Alfred P. Sloan Foundation.