UK, Norway seeing record spending as operators continue focus on optimizing recovery, maximizing smaller-prize discoveries

By Katherine Scott, associate editor

Despite its perception as a mature market, Europe continues to yield valuable finds for those prepared to invest in new technologies and have a knack for capitalizing on smaller-prize discoveries. In the UK, supermajors continue to be supplanted by smaller operators who take advantage of new tax breaks and inject life into mature fields. Rising investment levels are not limited to the UK. Norway is also expected to see a record NOK 198.7 billion (US $32.7 billion) in oil and gas spending this year. Contractors, too, recognize the opportunities and are building and bringing in rigs with advanced capabilities and higher efficiencies that operators demand in this high-cost market. In return, they are enjoying near-full rig utilization and rising dayrates.

Below, Maersk Drilling, KCA Deutag, Aker Solutions, Maersk Oil, Bentec and market intelligence provider Hannon Westwood share with Drilling Contractor the current trends and challenges in one of the industry’s most established markets.

United Kingdom

According to a February 2013 survey by Oil & Gas UK, investment in the UK North Sea oil and gas industry is at an all-time high due to a series of tax breaks, such as the Brown Field Allowances, passed in September 2012. These tax changes spare the income of older fields from paying full duty, allowing them to be fully exploited. “Following the introduction of tax changes designed to encourage growth in the UK oil and gas sector, the industry has responded with the highest investment for more than 30 years,” the survey stated.

Investment in offshore oil and gas projects is forecast to rise to a record level of at least £13 billion (US $19.6 billion) this year, up from £11.4 billion (US $17.3 billion) last year. “As a result, thousands of jobs are now being created across Britain, and the production of UK oil and gas and resulting tax revenues can now confidently be expected to rise over the coming years,” the survey stated. The recent surge in investments is also expected to lead to a significant upturn in production over the next three to four years, rising to approximately 2 million bbls of oil equivalent/day by 2017.

“Just when you think (the UK) is done, you find something that somebody else missed,” said Simon Robertshaw, senior intelligence analyst for Hannon Westwood. In the UK, it’s smaller operators, like Nexen, Apache, EnQuest and TAQA, that are investing in the region, he said, adding that 99.5% of operators in the UK are not majors anymore. “There is evidence that, without a doubt, the days of the big dominant players have shifted somewhat in the UK. The size of the player sometimes reflects an expected size of the prize, and I think when your dollars are competing for different sectors of the world, you tend to look elsewhere.”

While not all majors have left the UK, most of those remaining, like Chevron and BP, now target the deepwater Atlantic margin, West of Shetland and HPHT plays, Mr Robertshaw said. The rest of the UK market is instead dominated by independent companies able to identify smaller opportunities in more mature areas. This means a strong focus on optimizing recovery, Mr Robertshaw said. “Companies that have expertise elsewhere in the world recognize that they can optimize something that a previous operator, typically a major, didn’t have the ability to do. You’ve seen a lot of activity from these companies going back into pre-existing significant fields that are probably past their best but are now attracting attention of those who have the ability to rework them and effectively inject a new lease on life.”

According to Hannon Westwood data, there were 39 contracted rigs in the UK sector as of April, with 19 semisubmersibles, 19 jackups and one drillship – the Stena Carron is working on a BP well in the West of Shetland. Over half of these rigs are conducting drilling activities: 11 are doing exploration and appraisal, 17 are on development and production drilling. The remaining 10 mobile units are either preparing to commence their contracts or conducting non-drilling operations, such as abandonments or workovers. One semisubmersible is coldstacked.

With jackup utilization sitting at 100% and semisubmersible utilization pushing 95%, Mr Robertshaw said, dayrates have certainly firmed up. Two or three years ago, jackups were available for $80,000/day, but they’ve now gone above $100,000. “Rates are on the ascendancy without a doubt, but where that goes in the future, I don’t know, but I don’t see it dropping. At the very least, I think it will stabilize, although it’s more likely to continue on an upward trend.”

One factor boosting such demand may be a growing preference for mobile drilling units over platform drilling for field development. As of April, out of 21 development and production wells in the UK, all but seven are using mobile units, Mr Robertshaw noted. “We’ve just got seven platform-based drilling operations ongoing, and that is a significant change.” In 2010, 30 development and production wells were drilled with platforms versus 40 drilled by mobile rigs; in 2011, it was 24 versus 44, and in 2012, the number continued to decrease to 23 platform wells versus 53 mobile rig wells.

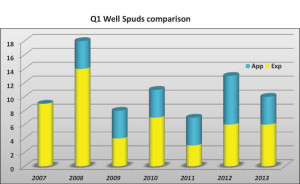

He added that six operators are currently engaged in development drilling in the UK gas basin, which he called a “healthy” proportion. In contrast, exploration and appraisal for gas is “almost dead at this moment in time. The truth of the matter is that the UK gas space in exploration and appraisal drilling has been appalling recently.” So far this year, there has been no exploration and appraisal drilling in the historically strong southern gas sector. “The trend of recent years has been pretty poor. In 2008, there were 18 exploration and appraisal wells, which dropped to six in 2009. There were 14 overall in 2010, seven in 2011, two in 2012 and so far none this year. We generally look at it as not a healthy trend. It’s still a major gas production area and probably about half a dozen or so fields still under development by a number of operators, but E&A has much diminished.”

As technology develops, the West of Shetland region has become more accessible, which has resulted in a growing market and increased focus on subsea production, according to Matt Corbin, managing director of Aker Solutions’ UK subsea business. In March, BP awarded Aker Solutions a subsea controls contract worth approximately US $110 million as part of a project to redevelop the Schiehallion and Loyal fields, located approximately 100 miles west of the Shetland Islands. “The existing subsea system has already been extended over the past 18 years, meaning that it was nearing its capacity,” Mr Corbin said. The two fields have yielded nearly 400 million bbls of oil since production started in 1998, and an estimated 450 million bbls of resources are believed to be still available.

Under the contract, Aker Solutions will manufacture and supply subsea control equipment for the Quad 204 project, including equipment for subsea trees, manifolds and subsea safety isolation valves, as well as controls distribution assemblies. The topside subsea control equipment will also be replaced. Overall, the efforts will allow for a phased upgrade of equipment on the fields and provide a framework for future expansion.

Further, additional investment by BP of approximately $4.6 billion to redevelop the fields will include replacing the Schiehallion FPSO with a new FPSO and other contracts in upgrading and replacing subsea facilities, including 15 flow lines and 21 risers; and 14 new wells in addition to the 52 existing wells. BP has a 36.3% ownership interest in the new FPSO, with partners Shell, Hess, Statoil, OMV and Murphy Petroleum. The investments are expected to push production from Schiehallion and Loyal to 2035 and possibly beyond.

“Quad 204 is the first redevelopment project of its kind in the West of Shetland. However, in the broader North Sea market, both the UK and Norwegian sectors, our clients are looking for ways to extend and enhance oil recovery from mature fields,” Mr Corbin said.

Norway

According to Statistics Norway, the country’s statistics bureau, 2013 is expected to be a record-breaking year on the Norwegian Continental Shelf, both in terms of oil and gas activity and spending. Investments in the oil and gas sector are forecast to reach a record NOK 198.7 billion (US $32.7 billion), an increase of 15% from the NOK 172.5 billion (US $28.5 billion) invested in 2012. Out of the 2013 total, exploration spending is forecast to take up 16.5%, or NOK 32.8 billion (US $ 5.4 billion); that would be up 21% from 2012.

“In the Norwegian market, there’s quite a focus on arresting the decline in production of oil and gas and various initiatives to help the way for operators to drill wells. It’s quite clear that the authorities have come to the realization that more wells need to be drilled. It’s as simple as that to keep up,” Erik Schou, Maersk Drilling’s senior director for the Norwegian market, said.

Maersk Drilling sees a definite need for newer rigs with higher capabilities in the Norwegian North Sea, and it’s currently building three new jackups, referred to as XLE 1, 2 and 3, which have all been contracted for work in Norway. Based on the same design as the Maersk Innovator and the Maersk Inspirer, the new rigs will feature a larger drilling envelope, including a 2.1 million-lb hookload, dual mud systems and accommodations for 150 personnel. An XY cantilever that is integrated with the derrick and drill floor also allows up to 1,400 metric tons in transfers and skidding. “We also focus a lot on material handling to reduce the crane lifts and thereby improve the safety,” Mr Schou said.

Identical in design and outfitted with the same equipment, the three rigs can operate in up to 490 ft of water and drill wells up to 40,000 ft deep. Upon completion at the Keppel FELS yard in Singapore in 2014 to 2015, the XLE rigs will each commence four- to five-year contracts with TOTAL, Det norske or Statoil in the Martin Linge, the Ivar Aasen and the Gina Krog (previously the Dagny) fields.

Martin Linge, in the northern North Sea, is estimated to hold recoverable reserves of 190 million bbls of oil equivalent. TOTAL submitted the Plan for Development and Operation in January 2012, and the field is planned to come onstream in Q4 2016. Also in the northern North Sea is Ivar Aasen, which is estimated to hold reserves of about 150 million bbls of oil equivalent. Three discoveries – Ivar Aasen, West Cable and Hanz – comprise Det norske’s phased field development. According to Det norske, the anticipated economic life of Ivar Aasen is 20 years.

The Gina Krog field, discovered in 1974 and located about 30 km northwest of Sleipner Vest field in the Norwegian North Sea, was originally a minor gas discovery, according to Statoil. It is estimated to hold 225 million bbls of oil and gas and is situated in a water depth of 390 ft.

Although Norway has traditionally been a strong market for semisubmersibles – and demand for semis continues to be promising in the Norwegian Sea, Mr Schou said – the market has become more balanced with jackups in recent years. There are 24 semis and 10 jackups operating in Norway today. “There’s no doubt that it’s never been that close before, and it’s probably getting even more so in the years to come.”

This jackup niche has grown in recent years as new contractors have entered the tough Norwegian market and as industry has introduced jackups that can work in up to 150 meters of water. “Jackups have not really been on the minds of some of our clients in Norway until recently. It’s been more like a southern North Sea kind of equipment,” he said. “Operators in Norway have been reevaluating their cost strategies and have started to realize that there’s a very strong alternative to semis up to the 150-meter water depths, and they have finally embraced that.”

He added that although jackup dayrates are trending upward, they are still lower than the going rates for a semisubmersible, “so it makes sense for operators to use a jackup when the water depths allow.”

In Norway, Maersk Drilling has six jackups with water depths ranging between 70 meters and 120 meters working for ConocoPhillips, Statoil, Dong E&P Norway, Lundin and BP. “We’ve got full utilization of our rigs in Norway, and the market is quite strong so our rigs that can work in Norway are working,” Mr Schou said.

Denmark

In Denmark, as in neighboring waters, there’s also a focus on optimizing recovery. “It is becoming more challenging to make some of these mature field operations economically viable,” Axel Christensen, vice president and head of corporate drilling in Maersk Oil, said. “Especially in our Danish operations, we are focused on EOR activities and into being a second-to-none mature field operator. We are into chasing the last bells, so to speak. There are still lots of new activities going on, but it is a lot to do with mature field operators.

“Being a mature field operator from a drilling perspective in essence means that you have to thoroughly evaluate your currently producing reservoirs and you have to be certain that your reservoir models are up-to-date and accurate, all in order to achieve a cost-effective drilling operation.”

Additionally, he said, the long horizontal wells that are being drilled in Danish waters – ranging from 5,000 ft to 15,000 ft with total depths of up to 22,000 ft – hold large pressure differentials (>3,000 psi). This has caused Maersk Oil to occasionally design the wells differently than it used to.

“We have been down the path of managed pressure drilling as one possible solution, and we are constantly looking at improved drilling fluids to also better handle these different pressures,” he said.

Rig-wise, Maersk Oil has just released the ENSCO 101 jackup but still has Noble’s Ton van Langeveld semi working offshore the UK and Ocean Rig’s Leiv Eriksson prepping for a 2014 exploration well in Norway. Both markets continue to remain important for Maersk Oil, with recently acquired acreage in Norway and a stable portfolio in the UK. In Denmark, it currently has four jackups on contract: Ensco’s ENSCO 71 and 72, Transocean’s GSF Monarch and Northern Offshore’s Energy Enhancer.

Maersk Oil, which has some 400 wells in Denmark, some of them 20 to 25 years old, is also part of the Danish Underground Consortium (DUC) with Shell, Chevron and the Danish North Sea Fund. Established in 1962, the DUC is a joint venture for initial exploration and possible development and production activities in Denmark, where Maersk Oil is the operator. As of April, the DUC has produced 19.5 million barrels of oil.

In April, the DUC approved the construction of a new unmanned platform in the Danish North Sea as part of an $800 million investment to expand the Tyra Southeast development, where the platform will be placed to produce a mixture of oil and gas. The investment also includes pipelines and drilling 12 horizontal wells, each about 6 km long, from 2015 to 2017, and is expected to add reserves and resources of 50 million barrels of oil equivalent over the next 30 years to Danish production.

As activity levels pick up across the European offshore market, demand for qualified personnel is also soaring. KCA Deutag, for example, expects to double its operations in the UK over the next 12 months. “We are presently carrying out O&M operations on the TOTAL North Alwyn, CNR Tiffany, EnQuest Thistle and TAQA North Cormorant platforms, and we are presently preparing to start O&M operations on the TOTAL Dunbar, Nexen Scott, CNRI Ninian North and Murchison platforms,” Gavin Sutherland, UK country manager, said. “The challenge is to find the experienced personnel to work on our platforms.” The company has 15 platform rigs in the UK and 10 in Norway.

Similarly, crew availability in their Norwegian operations is tight, and the two weeks on/four weeks off schedule for this sector adds to the challenge of staffing rigs. “I need an additional 10% crew to fill up the rig when I’m recruiting, and coverage in the market for the next two years is about 4,000 drilling personnel to cover the demand in Norway,” Paul Horne, KCA Deutag’s Norway country manager, said.

In June, KCA Deutag was awarded several contracts for drilling operations and maintenance work, all in the UK North Sea. This includes contracts with TOTAL E&P UK to provide drilling operations and maintenance services on the Alwyn North and Dunbar platforms that have already commenced; there is a firm two-year commitment with options for an extension of up to two years. EnQuest has also signed a contract with KCA Deutag for a four-year extension of its drilling operations and maintenance contract for the Heather and Thistle platforms. Additionally, a five-year extension was awarded by CNRI that incorporates drilling and completion services contracts for the Ninian North platform, South and Central platforms, the Murchison platform and the Tiffany platform.

For the Norwegian Continental Shelf, KCA Deutag also was awarded a contract with Statoil for the management, operation and maintenance of two Category J jackups. The contract adopts an innovative approach where the licenses own the rigs instead of the drilling contractor. The contract is for eight years, with the option to extend by four periods of three years, giving potential for the contract to last up to 20 years. The contract value is NOK 5.2 billion (US $900 million) for the initial period and NOK 12.8 billion (US $2.2 billion), including options. Operations are expected to start in 2016 to 2017.

Land

When it comes to European drilling, the offshore segment has for decades tipped the scales. In the past couple of years, however, onshore drilling has emerged as a potentially significant market for the coming decade. “Shale gas is still the question mark,” Dirk Schulze, CEO of Bentec, said. “Assuming that shale gas development will develop in central Europe and we will move into the next phase, there is definitely a demand for fast-moving, walking, skiddable rigs.”

Carsten Freyer, vice president of Bentec’s business development, noted that shale resources in Eastern Europe tend to be located deeper subsurface than in North America. Bentec believes this means different rig concepts and different rigs will be needed. “A big difference, if you compare the US market with the European market, is the land owner in Europe will not get any production money. There’s no incentive for land owners to put more rigs into it and try to promote having rigs on their land. Everything is dependent on the operators and the politicians.”

Bentec said it is currently in discussions with major operators in Europe for new rig designs that address shale gas development. “Because central Europe is a highly densely populated area, visual and emission footprint is a critical issue for all rigs that will come into operation for the future. It should disappear in the landscape, because nobody wants to have their rig sticking out and visible,” Mr Freyer said. “We also have to shrink down the height of the rig without compromising the performance, the speed limits and the general features of a rig.” In addition, he said that truckloads would need to be minimized for rig mobilizations.

For now, however, the company has seen a rise in demand for rigs with heavier hookloads allowing for deeper drilling. “Most of the rigs that we are selling are in the area of 350-450 ton plus,” Mr Freyer said. “There’s a need for heavier rigs capable to operate 450 tons from the capacity point of view because there is a tendency for deeper drilling down to 6,500-meter measured depth on both ends, on the conventional side and some on large geothermal projects that are under discussions in central Europe. It would be ideal to shrink down the size of the rig but still provide a higher hookload and drilling capability.”