Despite industry ups and downs, TotalEnergies keeps its eyes on building a sustainable future

The operator will continue investing in oil/gas but calls for more innovation, collaboration on low-carbon solutions, workforce development

By Stephen Whitfield, Associate Editor

Despite TotalEnergies’ increasing invest-ments in solar and wind energy, as well as low-carbon systems such as carbon capture and storage (CCS), the operator recognizes that oil and gas will remain a critical part of its portfolio. Even in 2050, hydrocarbons (mainly gas) will still represent 25% of the energy mix produced by TotalEnergies. This means that, in order to achieve its goal of net-zero emissions by 2050, the operator will have to prioritize development of the more sustainable/less emissive wells.

For emissions, the operator is targeting wells with a greenhouse gas emissions intensity that is lower than the current average of its portfolio (19 kgCO2e/BOE). However, the term “sustainability” goes beyond simply meeting an emissions target, said Thomas Gautherot, VP – Drilling & Wells at TotalEnergies. Financial sustainability will also be important, he stressed.

In a one-on-one sit-down interview with DC at the 2023 IADC World Drilling Conference in London, Mr Gautherot noted that the operator is restricting its E&P investments to projects with a combined CAPEX and OPEX of less than $20/BOE, or an after-tax breakeven of $30/BOE. By prioritizing low-cost, low-emissions barrels, TotalEnergies hopes to create a path to a sustainable future.

“It can be difficult to take a long-term view in this industry because the market is always going up and down, but we need to try to take a sustainable view of our future, which means focusing on low-cost and low-emission wells with sustainable returns for operators and contractors,” he said.

In recent years, onshore oil and gas projects in the Middle East and Africa have provided TotalEnergies with ample new opportunities for E&P developments that are sustainable in terms of both emissions and cost. Mr Gautherot cited the Gas Growth Integration Project (GGIP) in the Basra region of Iraq as an example. GGIP is the umbrella title for a collection of projects in the region, including the development of installations to recover flared gas from three fields, as well as the construction of a gas-gathering network and treatment units to supply the flared gas to local power stations.

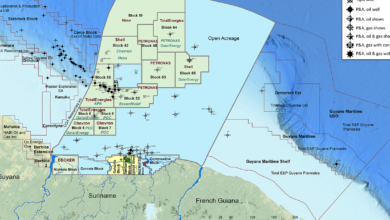

While the onshore space has been promising for TotalEnergies lately, the operator will look to maintain a balance of capital allocation between onshore and offshore projects in the long-term future. For instance, in February it announced that it had begun a multi-well appraisal and exploration drilling program offshore Namibia, following the Venus light oil discovery in the Orange Basin. It also plans to drill an exploration well in Block 9 offshore Lebanon in Q3 2023.

“To us, it’s not a matter of choosing between onshore and offshore,” Mr Gautherot said. “We take on challenging projects both onshore and offshore. It’s more a matter of utilizing our success in exploration and our capacity to develop.”

Another key cog in the operator’s sustainability strategy is investing in low-carbon systems that will help offset the emissions from its E&P activity. CCS will play a major role here, Mr Gautherot said. TotalEnergies is one of several partners, along with Equinor and Shell, in the Northern Lights project, which aims to store 1.5 million tonnes/year of CO2 upon startup in 2024. Additionally, on 27 June, the company signed an agreement with Petronas and Mitsui to collaborate on the development of a CCS hub in Malaysia. The agreement, which covers all aspects of CCS development, follows a memorandum of understanding signed by the companies in 2022.

Mr Gautherot described CCS as a “new frame of activities” for TotalEnergies, different from its conventional E&P activity. While the mechanics of drilling an injection well for CO2 are similar to drilling a hydrocarbon well, traditional well control procedures are not necessarily applicable in CCS wells.

It will be important for TotalEnergies to work with drilling contractors in better understanding how the CO2 impacts safety.

“We’re going to have to learn what well control means when the well has 100% CO2 in it,” he said. “That’s where the drilling contractor will play a key role. How does the mud behave with CO2? How do you recognize a kick of CO2 versus a kick of water or a kick of gas? These are the kinds of new things on which we concentrate our R&D and innovation efforts. CCS is not an industrial revolution, but it is an important evolution because you will use new equipment and you have to assess the capacity of the wells.”

Another key component to building a sustainable future involves investments in the workforce. This will require overcoming negative perceptions about the oil and gas industry amongst young people and showing them why its work is vital to a low-carbon future.

To that end, in 2021 TotalEnergies launched OneTech, an entity/segment designed, among other objectives, to transfer the technical and scientific expertise acquired in oil and gas into low-carbon activities. OneTech also includes a graduate program for students at engineering colleges and universities. It allows students to gain a diversity of experience by spending two years working in three sectors of TotalEnergies’ business – not just oil and gas but also various renewable sectors like solar, wind, hydrogen and biogas.

“We have to promote what we’re offering for younger workers, including the career paths available to them and the fact that they can travel the world while working on fantastic projects. We also have to show them that, as a company, we’re fully involved in the energy transition and investing massively in net zero. By joining us, they can contribute to this transition by being a part of the solution,” Mr Gautherot said.

Advancing the industry’s technical capabilities is also critical to attracting the next generation of workers, he added, including deploying digital tools to accelerate personnel training and competency.

“The digital tools we have available today to build competency are much more powerful than what was available when I was just coming into the industry,” Mr Gautherot said. “We have a wealth of knowledge and the capacity to teach it, so it’s up to organizations to figure out ways to make those learnings more accessible. It’s critical that we can accelerate competency development and transfer knowledge to the new people entering our industry.” DC