WoodMac: $210 billion in new upstream spend on the firing line as companies target cuts

The recent oil price crash has hit the upstream sector hard, and according to global natural resources consultancy Wood Mackenzie, the deep cuts industry has undergone in the past month will have a dramatic effect on the project pipeline.

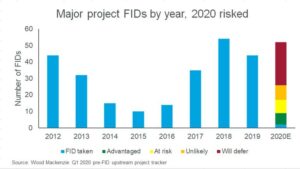

Wood Mackenzie estimates that almost all pre-FID projects will be deferred and, of the more than 50 projects it identified with potential to go ahead this year, only 10 have a chance of proceeding. This equates to around $110 billion of deferred investment with an additional $100 billion at risk.

Rob Morris, an analyst at Wood Mackenzie’s upstream research team, said that new committed investment could be as low as $22 billion if only the most advanced projects progress.

“Corporate balance sheet strength and strategic drivers are much more important than project economics,” Mr Morris said. “Only those with the strongest balance sheets will even contemplate major project FIDs. The majors and certain NOCs will take the lead, while projects with financially stretched partners and at the higher end of the cost curve will struggle.”

Mr Morris said that advantaged deepwater oil projects in places like Guyana and Brazil, along with niche LNG projects, will likely progress in 2020.

“Some project sanctions will be delated to 2021 and beyond,” he said. “Some will be completely reworked or even put on hold permanently. These include projects with weaker strategic drivers, high breakevens, and/or financially distressed operators.”