Wood Mackenzie: Japan’s E&P players face structural change

In a new report, Wood Mackenzie analyzes the upstream strategies of Japanese E&Ps and weighs up the future options in the face of dramatic industry change.

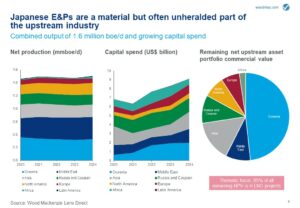

Japanese E&Ps are a material, but often unheralded, part of the upstream industry, collectively producing around 1.6 million BOE/d.

Today, they find themselves at a crossroads, as domestic drivers to develop international resources are weakening and the energy transition has forced a review of upstream strategies.

At the same time, relative to their industry peers, most Japanese E&Ps lack exposure to high-impact exploration and growth themes such as deepwater. Combined with a lack of portfolio renewal since the 2014 downturn through exploration and M&A, many upstream players must look to new investment to maintain growth.

“M&A activity by Japanese firms has dropped significantly since the last downturn,” Angus Rodger, Wood Mackenzie Research Director, said. “Between 2010 and 2014, they spent over $16 billion acquiring upstream assets. From 2015 to 2019 they spent less than $5 billion. This lack of activity has in part been due to uncertainties over the impact and speed of the energy transition.”

“M&A activity by Japanese firms has dropped significantly since the last downturn,” Angus Rodger, Wood Mackenzie Research Director, said. “Between 2010 and 2014, they spent over $16 billion acquiring upstream assets. From 2015 to 2019 they spent less than $5 billion. This lack of activity has in part been due to uncertainties over the impact and speed of the energy transition.”

“In the short term, many portfolios are in reasonably good shape,” Mr Rodger added. “But longer term, the growth options are limited. Current market conditions are chaotic due to falling oil prices, uncertain demand and a lack of buyers. But overall, if prices stay at current levels, we will see more companies across the global upstream industry look to free up capital through asset sales, and the Japanese E&Ps are well-placed to screen the opportunities that will come to light.”

Wood Mackenzie has identified four broad groups of Japanese E&Ps, each with their own individual upstream strategies and portfolio challenges:

- Trading houses: Most are reacting to the energy transition, societal concerns and changing demographics by rethinking long-term investment strategies. For some, upstream investment will continue to struggle for capital, and Wood Mackenzie sees them exiting the sector. Firms such as Sojitz have already signaled that this is their strategic direction. Others, such as Mitsui, will continue to grow their upstream capabilities, and future investment is likely to be in key growth themes such as deepwater.

- Integrated players have a greater focus on increasing clean energy and downstream profitability but are limited by low margins in the domestic market. Upstream can play a key role in offering the cash flow to expand and diversify business portfolios, but it will require continued investment to do so.

- Upstream focus: Players such as INPEX and JAPEX are less diversified than many of their Japanese peers and are far more reliant on upstream to provide company revenues and growth. As such, we expect continued investments and acquisitions to build portfolios and asset diversification. A merger between the two could also be a quick route to hitting ambitious production targets, and the creation of a national upstream champion.

- LNG players: Recent US shale gas purchases by Osaka Gas and Tokyo Gas hint at the likelihood of more countercyclical buys in US unconventional gas.

“Portfolios need clarity,” Zixin Goh, Wood Mackenzie Research Associate, said. “Bigger players such as INPEX and Mitsui can leverage balance sheets to acquire undervalued upstream assets and diversify their growth themes and options. Small and mid-sized players need to be nimble, leverage their strengths and target specialized capabilities or niches. An example of this is JXTG’s stated focus on acquiring new CO2/EOR opportunities. Either way, we see significant structural change ahead as companies are forced to decide whether they want to be involved in the upstream sector or exit.”